What Is the Consumer Financial Protection Bureau?

The CFPB, created in the wake of the 2008 banking crisis, has been under steady attack in 2025.

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

Updated on July 28.

The Consumer Financial Protection Bureau has been the subject of numerous efforts to scale back its work and its staffing since President Donald Trump took office in late January.

In the latest blow, the "big, beautiful bill" signed by Trump on July 4 cut the funding cap for the Consumer Financial Protection Bureau almost in half. For now, though, the CFPB is still standing.

The watchdog agency was formed in the aftermath of the 2008 financial crisis. To date, its work has resulted in almost $20 billion in consumer relief.

The Consumer Financial Protection Bureau, or CFPB, is a government agency created to oversee the consumer finance industry, including banks, lenders and other financial institutions. As its name suggests, it’s a consumer-focused agency whose goal is to ensure people can access fair, transparent and competitive markets for financial products. It also provides consumer financial education.

What does the CFPB do?

The CFPB was established by the Dodd-Frank Wall Street Reform and Consumer Protection Act in 2010. It was seen as a chance to bring better enforcement and accountability to the consumer finance industry after the financial crisis exposed borrowers’ vulnerability in a complicated marketplace that wasn’t being held accountable for unfair, deceptive and abusive lending practices.

By creating a consumer protection agency, the federal government initiated supervision of financial product and service providers that had largely flown under the radar. It also took over responsibilities that had been divided among several government offices.

In practice, the CFPB makes rules that improve transparency, supervises financial services companies, enforces consumer laws and acts on consumer complaints.

However, under the current administration, those activities have changed considerably, according to a memo to CFPB staff dated April 16, which outlines the agency’s 2025 enforcement and supervision priorities. The memo indicates the agency will:

- Move away from efforts involving medical debt, peer-to-peer platforms and lending, student loans, remittances, consumer data, digital payments and loans for individuals with criminal records.

- Reduce supervisory “events,” with the focus being on correcting or mediating harms raised by consumer complaints.

- Focus on depository institutions, including banks, rather than nonbank financial services companies.

- Prioritize redress for consumers and not imposing penalties on companies that would be added to the agency’s penalty fund.

- Minimize duplicative enforcement by leaving matters up to states and other agencies when overlap occurs.

- The recent "big, beautiful bill" passed by Congress and signed by President Donald J. Trump on July 4 cut the funding cap for the Consumer Financial Protection Bureau almost in half.

The CFPB has released additional statements on April 30 and May 6 indicating that it is pulling back from supervision of small business lending programs and Buy Now, Pay Later providers.

The agency is led by acting director Russell Vought, who also serves as director of the Office of Budget and Management.

Previous work by the CFPB

Before the CFPB was largely dismantled, its enforcement and supervisory work netted consumers $21 billion in refunds, principal reductions, canceled debts and other consumer relief. Since its inception, it has also imposed more than $5 billion in civil penalties on companies and individuals who broke consumer protection laws.

Previous examples of the bureau’s work include:

- Penalizing banks for creating fake accounts.

- Rooting out harmful private student loan lenders and federal servicers.

- Investigating discriminatory lending practices.

- Stopping wrongful auto repossessions.

- Ordering refunds for defrauded customers.

- Supporting Department of Education efforts to cancel student debt.

- Regulating new financial products and technology.

What’s happening at the CFPB right now?

At the moment, the CFPB seems to have resumed operating but in a much different way than it did under the previous administration. However, without a permanent director and amid a lawsuit challenging documented attempts to dismantle the agency, the long-term future of the agency remains uncertain.

A new administration

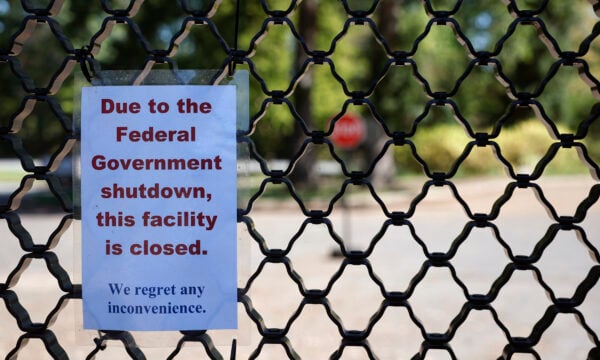

Soon after Trump took office in January, it seemed that the CFPB was targeted for possible elimination. Former director Rohit Chopra was fired on Feb. 1, and new leaders took swift steps to halt operations at the bureau, including closing its headquarters and issuing a stop-work order. Other signs of the bureau’s dismantling began to show.

- The Department of Government Efficiency, an unofficial department run by Elon Musk, became embedded in the CFPB. On Feb. 7, Musk tweeted, “CFPB RIP.”

- Acting director Vought took to social media to announce plans to cut off the agency’s funding.

- The bureau’s X account and homepage were deleted, though its research, published rules, complaints database and education material were still available.

- Also on X, Vought confirmed a new tipline was set up to give companies a place to report CFPB employees who violate his stop-work order.

- A series of layoffs affecting roughly 150 CFPB workers appeared to be just the beginning of a much larger workforce reduction. The National Treasury Employees Union filed a lawsuit on Feb 13, alleging that Vought planned to dismiss more than 95% of the agency’s staff.

Ongoing lawsuit challenges Vought’s stop-work order

The lawsuit filed by the union representing CFPB workers challenges the new administration’s efforts to dismantle the CFPB by attempting to fire nearly all its staff and halting activities that Congress says the agency is required to do. As the case proceeds through the courts, CFPB leaders have formally agreed not to follow through on plans to eliminate the agency’s staff, records or funding.

On March 28, U.S. District Judge Amy Berman Jackson granted a preliminary injunction that would stay in place while a lawsuit proceeds through the court. However, her order has been temporarily lifted by an appeals court panel of judges while it considers the CFPB’s argument that Berman Jackson’s order should be reversed. The next hearing in the case is set for April 9.

Berman Jackson’s order would prevent CFPB leaders from eliminating data or records, terminating staff, and enforcing a stop-work order issued in February. And it would require the CFPB to reinstate all staff who were fired after Feb. 10, as well as give them access to do their jobs either at an office or at home. It also would direct the agency to ensure its consumer complaint operations are functioning and to unwind its work to cancel other contracts.

“If the defendants are not enjoined, they will eliminate the agency before the Court has the opportunity to decide whether the law permits them to do it, and as the defendants’ own witness warned, the harm will be irreparable,” Berman Jackson said in her opinion.

The bureau’s work had largely halted after a Feb. 10 email from Vought directed CFPB staff to “not perform any work tasks,” according to court documents. But as Berman Jackson considered whether to grant the injunction, the CFPB had resumed some activities mandated by Congress, such as its consumer complaint program, according to testimony. The New York Times reported March 15 that the bureau’s consumer response team was working through a pile of 16,000 complaints.

Meet MoneyNerd, your weekly news decoder

So much news. So little time. NerdWallet's new weekly newsletter makes sense of the headlines that affect your wallet.

CFPB drops enforcement actions

Meanwhile, under the new Trump administration, some recent work by the CFPB has been undone.

The CFPB has dropped at least 10 lawsuits against financial services companies. Those cases were dismissed “with prejudice,” which means the CFPB forfeited the right to sue over the same claims again in the future. A few notable examples of dropped suits include:

- Allegations that the operator of Zelle and three of its owners — Bank of America, JPMorgan Chase and Wells Fargo — failed to safeguard users against fraud, leading to $870 million in losses for customers.

- Claims that Capital One cheated millions of consumers out of $2 billion in interest by hiding an opportunity for customers who had an existing 360 Savings account to open a new, similarly named savings account that offered a higher interest rate.

- Claims that student loan servicer Pennsylvania Higher Education Assistance Agency illegally collected on student debt that was discharged in bankruptcy and sent false information about borrowers to credit reporting agencies.

- Allegations that Rocket Homes gave kickbacks to mortgage brokers and agents who steered homebuyers to Rocket Mortgage.

- Allegations that Vanderbilt Mortgage & Finance failed to properly consider manufactured home buyers’ ability to repay loans.

- Claims that TransUnion — one of the three largest credit reporting agencies — and its former executive John Danaher violated a 2017 law enforcement action by continuing to use digital “dark patterns” that cause consumers to inadvertently sign up for subscriptions or buy products.

Most recently, on July 1, the CFPB moved to withdraw from a $95 million settlement reached in 2024 with Navy Federal Credit Union related to overdraft fees. Under the settlement, the credit union would have refunded $80 million to affected service members, in addition to paying a $15 million fine.

In another move, the CFPB is trying to return a $105,000 fine to Townstone Financial, which the mortgage lender paid in November 2024 to settle a lawsuit over alleged discriminatory practices. In a court document filed with Townstone on March 26, the CFPB says the original investigation was unmerited and the lawsuit violated the lender’s First Amendment rights and asks the court to vacate the final judgment and order.

Additionally, the bureau has halted several inquiries into dozens of financial services companies’ alleged wrongdoing that could have resulted in enforcement actions, according to a ProPublica investigation.

Controversial rules face scrutiny

With the change in administration, leaders stalled any new rules that were finalized under the previous administration but hadn’t yet taken effect. Some specific rules also face challenges in courts, Congress or both.

Most recently, a federal judge voided a rule that would have cut the typical credit card late fee from $32 to $8. The move was in response to a request from both the CFPB and the plaintiffs in the lawsuit, which had sued to block the rule from taking effect. New leaders at the CFPB agreed that the rule violated the CARD Act, which allows card issuers to “charge penalty fees reasonable and proportional to violations.”

Additionally, under the Congressional Review Act, Congress has power to overturn agency rules, as long as the resolution disapproving the rule is passed by both chambers and signed by the president. So far, two highly scrutinized rules have been overturned by this process.

- One would have cut overdraft fees charged by large banks and credit unions, including those with more than $10 billion in assets. The rule was slated to take effect Oct. 1 but faced strong opposition from the industry.

- The other gave the CFPB authority to supervise companies providing digital wallets like Apple Pay and peer-to-peer digital payments apps like Venmo or Zelle (or the kind Elon Musk hopes to integrate with X).

Other rules face unresolved challenges:

Medical debt removal: A judge voided a CFPB rule that went into effect on Jan. 7, 2025 andds would have removed an estimated $49 billion in unpaid medical debt from consumers’ credit reports and prevented medical bills from appearing on credit reports going forward. The rule also prohibited lenders from considering medical debt when evaluating a borrower’s ability to repay a loan.

Buy now, pay later oversight: In addition to stopping enforcement, the agency says it plans to revoke an interpretive rule that introduced new protections for users of buy now, pay later loan products, according to a March 26 court filing. The rule, which was made in May 2024, would have treated BNPL providers the same as credit card companies under lending laws. The Financial Technology Association filed a lawsuit challenging the rule in October.

What the CFPB can do for you

Here are some direct links to the CFPB’s services for consumers:

Submit a complaint: The agency takes consumer complaints about financial products and services, including credit cards, mortgages and other consumer loans, credit reporting and debt collection. Not only will the CFPB work to get you a response from the company, it also uses consumer complaints to prioritize its initiatives.

The bureau also maintains a public complaint database, which helps consumers get information about institutions or products and makes it clear which tend to cause the most trouble.

Blow the whistle: Anyone currently or previously working in the financial industry who wants to report misconduct can do so using dedicated communication channels.

» Have you submitted a complaint to the CFPB? NerdWallet reporter Taryn Phaneuf is covering ongoing changes at the agency under the new administration. Get in touch via email: [email protected].

How to reach the CFPB

The best way to make specific complaints, comments or reports is through the links above. Here are a few more ways to find out information from the CFPB or contact the agency.

CFPB website: consumerfinance.gov. Its Ask CFPB library can answer additional questions.

CFPB phone number: 855-411-2372

Mailing address for complaints:

Consumer Financial Protection Bureau

PO Box 27170

Washington, DC 20038

Mail address for all other mail:

Consumer Financial Protection Bureau

1700 G St. NW

Washington, DC 20552

Meet MoneyNerd, your weekly news decoder

So much news. So little time. NerdWallet's new weekly newsletter makes sense of the headlines that affect your wallet.

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

Related articles