How to Get Your Free Credit Reports From the Major Credit Bureaus

Use AnnualCreditReport.com to request your credit reports — you have free weekly access.

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

Federal law gives you free access to your credit reports from the three major credit bureaus: Equifax, Experian and TransUnion. Using the government-mandated AnnualCreditReport.com website is the quickest way to get them, but you can also request them by phone or mail.

Those reports — which previously had been limited to once a year — are permanently available weekly to help consumers manage their finances.

Your credit reports are a detailed record of your past use of credit — but they do not include your credit score. NerdWallet offers a free credit score and report, updated weekly using TransUnion data. Checking your score does not damage your credit.

Here’s how to use AnnualCreditReport.com.

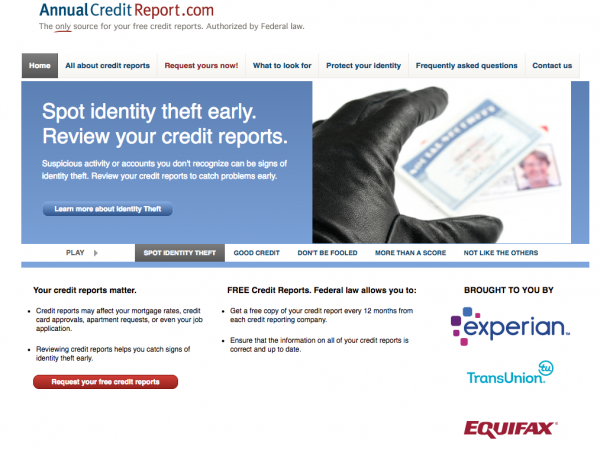

1. Go to the correct site

First, make sure you’re on the right site: AnnualCreditReport.com. Some other sites have similar-sounding names.

The one you want looks like this:

2. Enter your personal information

You'll need your name, Social Security number, address and birthdate. This, along with other personal data, will be matched against files for identification.

3. Request a credit report or reports

You can order your reports from one, two or all three of the major credit bureaus: Equifax, Experian and TransUnion.

How to get credit reports in Spanish

🤓 Nerdy Tip

You can request your credit report in Spanish directly from each of the three major credit bureaus:· TransUnion: Call 800-916-8800.

· Equifax: Visit the link or call 888-378-4329.

· Experian: Click on the link or call 888-397-3742.

🤓 Consejo Nerdy

Usted puede solicitar una copia de su informe crediticio (gratis y en español) de cada una de las tres principales agencias de crédito:

· TransUnion: Llame al 800-916-8800.

· Equifax: Visite el enlace o llame al 888-378-4329.

· Experian: Haga clic en el enlace o llame al 888-397-3742.

4. Successfully answer security questions

For each report request, you’ll be asked a few questions about your finances that presumably only you can answer — for instance, the approximate amount of your mortgage payment or who holds your auto loan and when you took it out.

Some consumers have reported difficulty using the site, particularly answering security questions about accounts that are several years old. If you can’t recall those details, you can request your reports by mail or phone; this process doesn’t require security questions.

Stress less. Track more.

See the full picture: savings, debt, investments and more. Smarter money moves start in our app.

5. Generate your credit report online

You can save reports to your desktop or print them out so you’ll have access later.

If you need to request a report or reports by mail, send a request form to:

Annual Credit Report Request Service

P.O. Box 105281

Atlanta, GA 30348-5281

P.O. Box 105281

Atlanta, GA 30348-5281

Your report or reports should be sent within 15 business days.

You can also get your credit reports by calling 877-322-8228. Visually impaired consumers can also call this number to request audio, large-print or Braille reports.

6. Read your reports and fix errors

Read your credit reports, looking for:

- Accounts that aren’t yours or you didn’t authorize.

- Incorrect, negative information.

- Negative information that’s too old to be included. Most negative information, other than one type of bankruptcy, should be excluded after seven years.

These errors have the potential to hurt your credit score, says Chi Chi Wu, a senior attorney with the National Consumer Law Center. You might see other types of errors, such as out-of-date employment information, she says, but those aren’t factored into your score.

If you find errors, dispute them. Typically, the fastest way to file a dispute is online, but you can also call the credit bureaus or send a credit dispute letter by mail. The credit bureaus will investigate and must remove information that they can’t verify.

7. Monitor your credit regularly

Monitoring your scores and reports can tip you off to problems such as an overlooked payment or identity theft. It also lets you track progress on building your credit. NerdWallet offers both a free credit report summary and a free credit score, updated weekly.

Here’s how the information you’ll get from AnnualCreditReport.com differs from what free personal finance sites may provide:

AnnualCreditReport.com provides:

- Reports (not scores)

- Data from all three major credit bureaus

- An extensive history of your credit use

Personal finance websites, including NerdWallet, provide:

- Credit scores, sometimes credit report information

- Unlimited access

- Data from one or two credit bureaus

- A recent history of your credit use

- Additional information about building and protecting your credit

Stress less. Track more.

See the full picture: savings, debt, investments and more. Smarter money moves start in our app.

Frequently Asked Questions

Is AnnualCreditReport.com safe?

AnnualCreditReport.com is authorized by federal law and safe to use — as long as you ensure you're on the correct site.

Double-check the URL when you type it, to be sure you have not made a typo. Some other sites have similar-sounding names, so check that the URL matches and the site looks as expected.

Be aware that your credit reports are free, but credit bureaus also use the AnnualCreditReport.com site to sell credit scores and promote paid services, such as credit monitoring. However, monitoring doesn’t keep your identity from being stolen; it just alerts you after the fact. For best protection, use a credit freeze.

“Just get your free credit report. Don’t get suckered by the upsell,” says Ed Mierzwinski, consumer program senior director for the U.S. Public Interest Research Group.

What do I get when I request reports?

Your creditors regularly report your account information, including payments, credit applications, the percentage of available credit you’re using and negative marks such as collections. The three bureaus build that data into the credit reports that you get from AnnualCreditReport.com.

A credit report is not the same thing as a credit score. Your credit score is derived from some of the information in your credit reports.

If you used the online portal to access your reports, we suggest saving them as PDFs or printing them out. Once you have them, read over them for mistakes.

When should I get my reports from AnnualCreditReport.com?

Get all three credit reports from AnnualCreditReport.com if you’ve never done so or it’s been at least a year since the last time.

It's also wise to check them if you've received payment modifications or other relief, such as offered during the pandemic, and need to see whether creditors are reporting those accounts correctly.

And if you’re about to apply for a large loan, such as a mortgage, you should get and check your credit reports. That gives you a chance to fix score-lowering problems before applying, giving you a better shot at approval.

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

Related articles