Data: Retail Therapy is Common — How to Curb It

Three in 10 (30%) Americans say they’ve spent money on items to improve their mood in the past 12 months.

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

Having a tough week? Have you considered spending some money on yourself? You’d be in good company.

Three in 10 (30%) Americans say they’ve spent money on items to improve their mood in the past 12 months, according to a recent NerdWallet survey, conducted online by The Harris Poll. Some research indicates it may be effective — buying stuff you don’t need can make you feel better, providing a distraction, escape or sense of control.

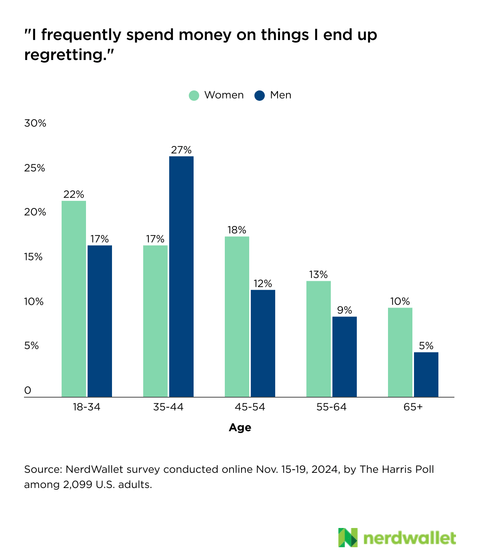

But those benefits may come with negative attachments, like regret or even debt. According to the survey, 15% of Americans frequently spend money on things they end up regretting. And 41% of Americans say shopping — such as for “luxuries” or clothing beyond the basics — contributed to their current credit card debt.

“While a little retail therapy can be harmless and provide a much-needed mood boost, it’s worth first checking in on your overall budget and giving yourself a limit to minimize the potential negative impact of a splurge,” says Kimberly Palmer, a personal finance expert at NerdWallet.

We get it. It’s rough out there, and there are days when you just need to treat yourself. But you don’t need to sacrifice long-term financial stability for a shopping spree’s short-term high.

Retail therapy among women and men

A third of women (33%) report having shopped to improve their mood in the last 12 months, compared to about one in four men (26%), according to the NerdWallet survey.

This tracks with what we know about American shopping habits. Women shop more: They’re more likely to report shopping on any given day, according to the American Time Use Survey from the Bureau of Labor Statistics. Of course, much of that shopping may be done for the household — their families and children.

Over-shopping is certainly not just a “girl” thing. A quarter of men making purchases to soothe their mood is still notable, and men of a certain age seem unusually susceptible to buyer’s remorse: Men ages 35-44 are actually the group most likely to say that they frequently regret their purchases.

Find some replacement highs

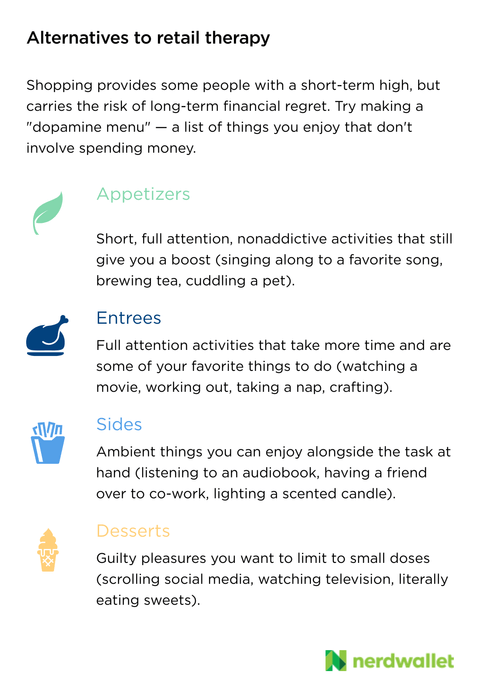

If you’re among those filled with regret after retail therapy, or frequently find yourself overextending your budget, it may be time to rethink your coping mechanism. Research suggests that the high people get out of shopping is related to the feel-good neurotransmitter dopamine. The good news is that there are many other affordable, and even healthy, things that can trigger the release of the same chemical.

Try making a “dopamine menu,” a concept popularized online largely by the ADHD community. This tool is essentially a list of things you enjoy, arranged by how time and attention-intensive they are, as well as how satisfying, with the goal of having alternatives to retail therapy.

Print out your menu and put it somewhere prominent, or save it as your phone’s wallpaper. The idea is to have a list of convenient pick-me-ups handy, instead of reaching for the most familiar thing (shopping) the next time you’re feeling depleted or stressed.

Become a more mindful shopper

Breaking a bad habit can be hard, and sometimes the alternatives available won’t scratch that itch. Learn to identify when you’re spending money only to feel better. This could mean using an expense tracking app, or recording transactions in a notebook or a phone notes app whenever you buy something.

At the end of the day or week, go through your list to reflect on any purchases you might regret. You might ask yourself the following questions:

- Did I see an advertisement that sucked me in?

- What was happening and how was I feeling before I made the purchase?

- How did I feel afterwards?

- Was it important to me that the item was on sale?

- Was I alone or with people?

- Were there moments when I could have decided not to click “buy”?

This level of reflection might be uncomfortable. But if you can cut through the feelings of shame and remorse, you can start to identify triggers and come up with tactical steps to manage your shopping. Consider:

- Deleting your credit card from favorite retail websites so you’re forced to enter it manually every time.

- Carpooling with a non-shopaholic colleague, if swinging by Target on the way home from a stressful work day is tempting.

- Muting the social media account of a retailer or influencer that always manages to entice you at the wrong time.

- Using a wishlist: Instead of hitting “buy” every time you find something you want, add it to a wishlist to revisit at a set time. This way you still get the rush of choosing something new, and the opportunity to review that decision with a clearer mind before actually making the purchase.

Retail therapy can still play a useful role during stressful times, but overdoing it can lead to more stress.

METHODOLOGY

This survey was conducted online within the United States by The Harris Poll on behalf of NerdWallet from Nov. 15-19, 2024, among 2,099 U.S. adults ages 18 and older. The sampling precision of Harris online polls is measured by using a Bayesian credible interval. For this study, the sample data is accurate to within +/- 2.5 percentage points using a 95% confidence level. This credible interval will be wider among subsets of the surveyed population of interest. For complete survey methodology, including weighting variables and subgroup sample sizes, please contact [email protected].

Disclaimer

NerdWallet disclaims, expressly and impliedly, all warranties of any kind, including those of merchantability and fitness for a particular purpose or whether the article’s information is accurate, reliable or free of errors. Use or reliance on this information is at your own risk, and its completeness and accuracy are not guaranteed. The contents in this article should not be relied upon or associated with the future performance of NerdWallet or any of its affiliates or subsidiaries. Statements that are not historical facts are forward-looking statements that involve risks and uncertainties as indicated by words such as “believes,” “expects,” “estimates,” “may,” “will,” “should” or “anticipates” or similar expressions. These forward-looking statements may materially differ from NerdWallet’s presentation of information to analysts and its actual operational and financial results.

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

Related articles