What Is a FICO Score? Here’s What You Need to Know

FICO scores are one brand of credit score. Your FICO score is calculated using the data in your credit reports.

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

Nerdy takeaways

- Your FICO score is a number, typically in the 300 to 850 range, used by lenders to determine your ability to pay back borrowed debt.

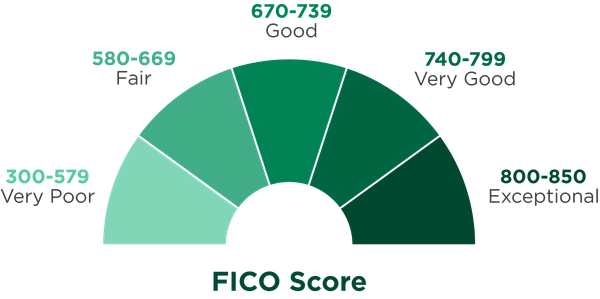

- FICO has five credit score ranges. The company defines a good credit score as anything from 670 to 739.

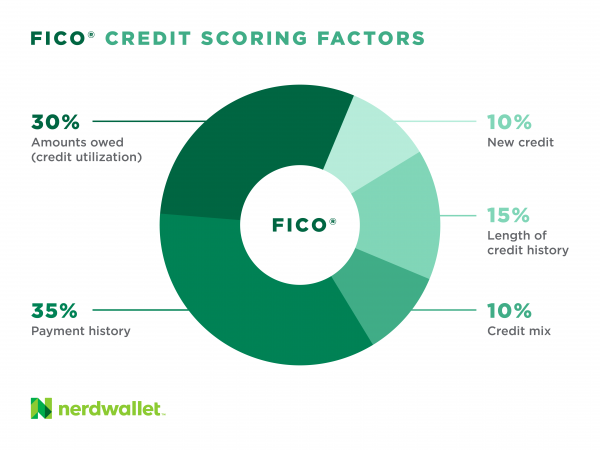

- Payment history and amounts owed are the two biggest factors that impact your FICO score.

- You have multiple FICO scores because scoring models are updated every few years, and there are industry-specific FICO scores for auto lenders and credit card products.

- Paying your bills on time, utilizing less than 30% of your available credit and having a variety of credit types will help build your FICO score.

What is a FICO score and why is it important?

A FICO score is a three-digit number between 300 and 850 that tells lenders how likely a consumer is to repay borrowed money based on their credit history. Higher scores can open the door to more financial opportunities.

Your FICO credit score is important because it determines the kinds of rates and terms you can get on financial products such as a car loan or a mortgage. For example, a score that is in the good or excellent range can give you more credit card choices and access to lower interest rates when buying a car. Your credit score may also be used by utility companies and landlords to determine your deposit or whether you'll be accepted as a tenant.

The name derives from the Fair Isaac Corp., which introduced the FICO score in 1989.

FICO score vs. credit score

The terms “credit score” and “FICO score” are often used interchangeably, but there are other brands of scores, including VantageScore, which is FICO's biggest competitor.

» Learn more about credit score ranges

Stress less. Track more.

See the full picture: savings, debt, investments and more. Smarter money moves start in our app.

What is a good FICO score?

There are five ranges that make up FICO scores. A good FICO score sits somewhere in the 670 to 739 range. Here are the other FICO score ranges:

While your score might be "good" on the FICO range, it's important to know that each lender or credit card issuer can decide what score is needed to qualify for a particular line of credit.

» Learn what's considered a "good" credit score

How is a FICO score calculated?

FICO applies a proprietary formula to the information in your credit reports to calculate a credit score. While FICO doesn’t reveal its exact scoring formula, it gives useful guidelines about the factors that matter for scores.

Paying on time and keeping balances low account for about two-thirds of your score:

- Payment history (35% of your score): Paying your bills on time is key for earning an excellent score. Late payments can really hurt your score, as can accounts in collections or a bankruptcy.

- Amounts owed (30%): Also known as credit utilization, this is how much of your available credit you are using. Try to use 30% or less of your available credit.

- Length of credit history (15%): This refers to how long you’ve had credit and the average age of your credit accounts.

- New credit (10%): A hard inquiry when you apply for new credit can ding your score for up to six months. That's why it's important to research credit card offerings and eligibility requirements before applying for one.

- Credit mix (10%): Having both installment loans (those with level payments, like a car loan or mortgage) and revolving credit (like a credit card) can help your score because it shows lender that you can manage different types of borrowing.

Why do my FICO scores vary?

The three main credit bureaus that create your credit reports — Equifax, Experian and TransUnion — have slightly different data from one another. That’s because lenders don’t always report to all three bureaus or they report data at different times. So your score may vary depending on which bureau's data was used in the calculation.

FICO also offers industry-specific scores for credit cards and car loans, which range from 250 to 900.

What is a FICO score used for?

Creditors often use FICO scores to decide whether to approve an application for a loan or a credit card. It gives them a picture of how you've handled credit in the past. They also check other information, such as your income and existing debt obligations, to see whether you have the means to repay them.

» See our picks for the best credit cards for you

FICO 8 is the most widely used among lenders

There are many versions of FICO scores, but FICO 9 is very popular among lenders. FICO 9 includes rent payments, lessens the impact of paid medical debt and excludes paid collections. Newer versions include FICO 10, which punishes missed payments more harshly than other versions.

UltraFICO is a scoring model meant for people new to credit or looking to rebuild credit. It links with your checking and savings accounts to provide a bigger picture of your financial habits.

» See our picks for the best checking accounts

FICO is the go-to for mortgage lenders

FICO says it is used by 90% of “top lenders,” and it's favored by the law in one crucial spot: home mortgages. FICO has historically been the most used score by mortgage lenders, but as of July 2025, lenders can opt to use VantageScore instead.

» Learn the credit score you need to buy a house

FICO vs. VantageScore

FICO and VantageScore are competitors in the credit scoring world. VantageScore was developed jointly by the three major credit bureaus and introduced in 2006. It is gaining traction with both consumers and lenders.

FICO and VantageScore use the same set of factors to calculate scores, but each company weights those factors differently. For example, payment history accounts for 35% of your FICO score and 40% of your VantageScore. This variation means that your FICO and VantageScores might be similar but likely not the same, even when the score is calculated using the data from the same credit report.

» Learn more about VantageScore

How do I get a FICO score?

You may already have access to a free FICO score on your credit card statement or banking app. Some credit card issuers such as Bank of America and Discover give customers free FICO scores monthly.

You can get your FICO score for free directly from FICO using its website. It costs $29.95 per month to get your FICO scores from all three credit bureaus, along with other kinds of information like your FICO automotive score and credit monitoring.

If you're preparing for a big purchase, like a car or home, it might be worth it to subscribe for one month, check your reports and then cancel. That way, you'll be walking into the lender's office without any surprises.

Many personal finance websites, including NerdWallet, offer a free credit score from VantageScore, FICO's main competitor. That gives you another option for watching your score. VantageScores tend to track similarly to FICO scores, because both weigh many of the same factors and use the same data from the credit bureaus.

Stress less. Track more.

See the full picture: savings, debt, investments and more. Smarter money moves start in our app.

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

Related articles