How to Choose the Right Budget System: 4 Methods to Consider

The best system for you depends on what you’re trying to do — curb spending, pay down debt, build savings or something else.

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

Budgeting systems are designed to help you understand and evaluate your relationship with money. While all share a common goal, they often use distinct tactics to get you there.

We’ve narrowed down some options to help you find one that resonates.

4 budgeting methods to consider

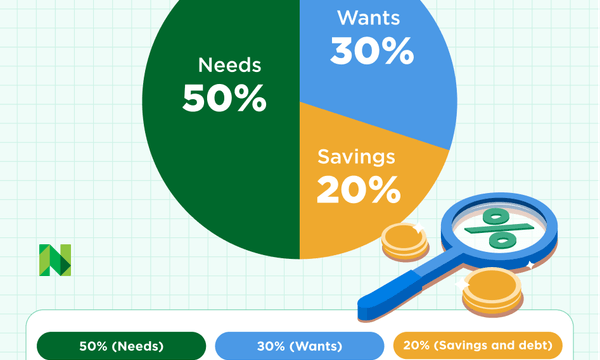

1. Get started: the 50/30/20 budget

What’s appealing about this system is that it gives you room to pay down debt, cover current costs and save for future expenses. It splits your income across three major categories: 50% goes to necessities, 30% to wants and 20% to savings and debt repayment. You can use it by itself or as a baseline for other flexible budgeting methods.

Stress less. Track more.

See the full picture: savings, debt, investments and more. Smarter money moves start in our app.

2. Curb your spending: the envelope system, or 'cash stuffing'

If you need a rigid system to help you stop spending money frivolously or stay out of debt, but don’t want to track every purchase, try this cash-based approach.

You set a spending limit for each expense category, such as groceries. Then, you fill envelopes with the allotted cash you can spend in each category (hence the "cash stuffing" nickname). Once an envelope is empty, you can’t spend any more money on that particular category for the month.

“Our brains are wired so that something tactile in front of you that you can smell and feel is more real than something on your phone or a number in your bank account,” says Daniel Chong, a certified financial planner in Irvine, California. “If you can’t seem to get a grasp on a certain spending category, then cash is king.”

The Goodbudget app is based on the envelope system, for those who like the method but don't want to deal with paper envelopes.

3. Build up your savings: Pay yourself first

This “reverse” budget puts savings before immediate expenses. It is designed to align your spending and values. With this system, you decide how much to set aside from your monthly income for savings goals, such as retirement and an emergency fund, then use the rest for bills and other costs. That way, you don’t have to crunch every number.

4. Make the most of every dollar: the zero-based budget

This budget suits overspenders and meticulous planners alike. It makes monitoring your spending clear. You take your monthly income and use every dollar in a deliberate way until there are zero dollars left.

It is similar to the envelope system, in that you categorize your spending, but without the envelopes. If you don’t strictly use cash, you’ll have to log each expense to make sure you’re on budget. Budget apps such as YNAB and EveryDollar can help you follow a zero-based budget.

How to choose the right budget system

Figure out where you are and what you value

If you don’t know which budget to choose, your present financial state and goals can give you a clue.

Perhaps you’re in debt and need a system to help you decrease spending. Or maybe you want to learn how to balance spending and saving for a house. Knowing where you stand and what you want to accomplish can help you find the right fit.

Decide how much effort you’re willing to put in

The best budget for you is the one that you will stick to. Think about how much time and maintenance a budgeting system involves. Some have strict requirements, while others are more flexible. For example, some Excel spreadsheets and the zero-based budget demand frequent and detailed expense tracking. The pay-yourself-first system and apps that sync to your financial accounts require little upkeep.

How often should you budget? There’s no set rule, so go at your own pace. If you’re confident with your financial state, you can probably get away with reviewing your information once a month or a couple of times a year. Others may want to check in weekly, or after every purchase they make.

Compare manual and digital budgeting options

Determine whether you want to take a DIY approach to budgeting or use an app or online tool. Software can be convenient if the app or program lets you automate savings or access and update your information on the go. If it doesn’t automatically input and categorize your purchases, or if it's hard to use, it might not add much value.

For some, pen and paper is best. Writing things down can help you retain information and feel connected to your budget. If you’re not comfortable linking your bank accounts to an electronic budgeting service, a physical method can save you worry, too.

» Learn more: 7 ways to track monthly expenses

Reassess if needed

You might look at your spending and expenses and decide you don't need a budget. Some experts say there’s no need to follow a specific system as long as you’re aware of important details such as your income, debts, goals and spending.

If you know that you’re on pace to reach your goals, then tracking every penny could be overkill, says Catherine Hawley, a CFP in Monterey, California.

“You don’t need to know that your electric bill was exactly $83.82 last month. You just need to know that you’re kind of within some general parameters, and I think that can actually be a relief to people,” she says.

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

Related articles