The Labor Market: Worker Perception and Economic Health

Both of these can be true: The labor market is currently healthy, and many workers are feeling stuck.

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

Workers and economists interact with the labor market in quite different ways. This contrast can lead to misunderstandings, at best, and distrust of the data at worst. Neither macroeconomic evaluations nor personal experiences are without merit, however.

The labor market at the start of 2025 is healthy by macroeconomic standards. But individual experiences don’t always reflect those aggregate figures. Individuals base their opinions of the economy in large part on their personal experiences. Understanding the interplay between overall economic health and worker experiences provides insight that can drive more effective communication, coverage and policy.

Right now, many Americans feel stuck in their current jobs, in what’s been called the Great Stay. And relative to just a few years ago, during the Great Reshuffling, their interactions with the labor market today may feel quite different, and even potentially bad.

This analysis examines how individuals might interpret the economy through the labor market, how that differs from economic analysis of the same topic and why those perspectives matter.

On this page

Why it matters - Our relationship with work

Though it’s likely safe to say that many of us work primarily in order to pay the bills, the sheer amount of time we spend working is reason enough to attach more meaning to it. Many of us spend the majority of our waking hours at work, most days of the week, for years on end.

In addition, research that controls for pay has found that there are psychosocial benefits to work beyond those conferred by being able to cover your bills or achieve a higher standard of living . Our work can give us a sense of purpose, help us form social relationships and be an outlet for creativity. These are just a few reasons why many people, myself included, would likely continue to work for at least a portion of their time, even if they became wildly wealthy.

Nearly nine in 10 (88%) employed Americans say their job satisfaction is an important part of their overall life satisfaction, according to a NerdWallet jobs survey conducted online by The Harris Poll, January 2-6, 2025. But this sentiment may be a luxury — younger workers and those with lower household incomes are less likely to hold job satisfaction in similar high regard.

Our work affords us our lifestyle; it allows us to put a roof over our heads and food on the table. And for many of us, our career is an indelible part of how we define ourselves. For these reasons, and more, we attach importance and feelings to our work. The labor market statistics however are devoid of emotion, by design.

Labor market health, as measured by economists

Work in the form of time and effort spent on jobs is what we trade in the labor market. Workers (who supply the labor) exchange their time and effort for pay and other benefits from employers (who demand the labor). Ideally, these things — the supply of and demand for labor — are in balance. Economists look for signs of this balance, or imbalance, in macroeconomic data.

Currently, we have a labor market where supply and demand are fairly well-balanced. But it wasn’t that way in recent years, and this difference can make current conditions feel bad for workers, in particular.

From roughly 2021 to 2022, we saw the impact of labor demand outweighing supply, where opportunities to leave a current job and land in a better one were prevalent. The result: a period referred to as the Great Reshuffling, as workers were able to reap the benefits of employers competing for their attention. Unfortunately, a “hot” labor market like this is unsustainable — employers increase wages to attract and keep talent, and this wage growth drives inflation. So getting inflation down to a reasonable level after running high will necessarily involve pumping the breaks on workers’ upper hand over employers.

“ Now, labor supply and demand are in far better balance — the labor market has gotten cooler without sliding into recession. ”

Since that period, the labor market has moderated as the Federal Reserve began raising interest rates in 2022 to temper inflationary pressures. Higher borrowing costs for employers helped lessen labor demand at a time when an influx of immigrants increased labor supply . Now, labor supply and demand are in far better balance — the labor market has gotten cooler without sliding into recession. Evidence of this balance includes:

Unemployment rate: The unemployment rate has been 4% or slightly higher since May 2024, up from 3.5% on average between mid-2022 and mid-2023 . Lower unemployment indicates a tighter market, or demand outpacing supply.

Hiring and quits: These two measures, which indicate worker mobility or “shuffling” when high, have decreased. Put differently, worker churn, or turnover, has slowed. The hiring rate has moderated to 3.4% as of December, after running at 4% or higher for nearly two years until January 2023. And the quits rate, which reached a series high 3% on three occasions in late 2021 to early 2022, has since moderated to 2% .

But cooling doesn’t mean cold. In fact, despite the overall slowing, wage growth has remained healthy — growing at roughly 4% annually — without producing additional inflationary pressures . Solid growth in labor productivity has enabled this . The labor market continues to hum.

Jobs added: Decreased hiring indicates employers are pulling back a bit on labor investments compared to where they were prior. However, the economy is still adding jobs. In 2024, an average of 166,000 nonfarm jobs were added to the economy each month, down from 216,000, on average, in 2023; 380,000 jobs in 2022, and 603,000 in 2021 . For context, an economy in recession is typically characterized by shedding jobs.

Layoffs: If economic conditions deteriorate (rather than just slow down), one expects to see layoffs across industries. But the layoff rate has remained subdued since 2020 .

Despite this overall moderation — in unemployment, hiring and quits, jobs added and layoffs — from a macroeconomic perspective, the labor market may feel less well from a worker perspective, particularly when you consider it relative to the worker-benefitting rush it recently had.

As the labor market cools, and even if it remains within healthy territory, people will find it more difficult to find jobs. Evidence: Jobs are more scarce; there are currently 0.9 unemployed workers per open job, compared with 0.5 in 2022 . And if you parse the data a bit, looking at industry specifics, you’ll find some workers will have a tougher experience than others. For instance, though hiring rates have fallen across most industries over the five year period beginning just before the pandemic, they’ve fallen furthest in construction, professional and business services, information and leisure and hospitality industries.

Labor market sentiment, from a consumer perspective

Labor market sentiment can be thought of as consumer feeling about the labor market at large and/or their feelings about their place within it. In either case, it is currently just fine, though perhaps a bit bleaker than in prior years.

Labor market outlook: Pessimism about jobs has largely driven declines in overall consumer sentiment recently. Views on current labor market conditions and pessimism about future employment both fell in February, according to The Conference Board .

The likelihood of losing one’s job has been slowly climbing over the past few years, reaching just over 14% in January 2025, according to data from the New York Fed. However, this is relatively on par with where this measure was before the pandemic .

However, even if you lack job security, feeling good about your prospects should you lose your job can make the uncertainty bearable. Currently, Americans believe they have a 52% chance of finding another job in three months, should they lose their job today, according to the NY Fed . This is down from 56% in 2023, on average, and 57% in 2022.

Job satisfaction: In any given quarter of the past five years, a majority of workers are satisfied with their current wages (59%, on average) and nonwage benefits (62%), and few (11%) anticipate making a job change in the next four months . These measures, from the NY Fed, don’t generally change much from month to month, but one can surmise it’s not the same individuals holding the same sentiment. Instead, as personal experiences shift, some people feel better and some feel worse, with much of the change coming out in the wash.

Good or bad, the sentiment isn’t just vibes — it’s likely many of these people have had direct or indirect exposure to the slowing labor market as of late, which is influencing their outlook.

Interactions with current labor market - Current and potential jobs

Pay satisfaction

While many of us attach some meaning to our work beyond money, most people work primarily in order to afford the things they need, and hopefully some they want. Whether that pay is enough doesn’t only depend on the salary or wages you’re offered at a new job, but also on whether changes in that payment is comparable to changes in the costs of those needs and wants.

Measuring how well pay and benefits have kept up with inflation isn’t straightforward, because the conclusion you reach depends on how you’re measuring changes in both categories. Overall, however, most widely used measurements for income growth indicate pay has outpaced price increases since 2019 . When you look a bit deeper, you find pay gains have been particularly strongest for lower wage and services industries, like leisure and hospitality, during this period.

»CHART: Wage growth by industry

About half (51%) of employed Americans say their pay increases over the past five years have kept up with inflation, according to the NerdWallet jobs survey. This is a sentiment more likely to be held among younger workers — 56% of both Gen Z (ages 18-28) and millennials (ages 29-44) say this, compared to 45% of Gen X (ages 45-60) and 44% of baby boomers (ages 61-79). One possible explanation: Younger generations may be more likely to be at a stage in their working life where wages rise more quickly, and because they’re earlier in their careers, more likely to work in lower wage industries that have benefited more greatly in wage increases in recent years.

Being able to afford the same things as prices rise is a solid sign that your wages are tracking inflation, but many Americans may have even bigger expectations when it comes to pay increases. And if your expectations are greater than reality, you could ultimately be disappointed.

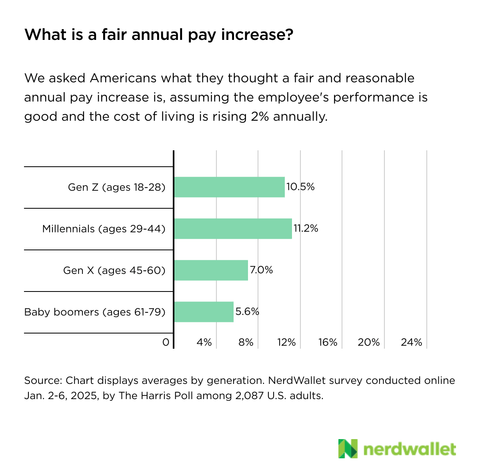

On average, Americans believe a fair and reasonable annual pay increase is 8.2% — the median is slightly lower, at 5%, according to the NerdWallet survey. Wages have grown 4.1% over the past year, on average .

Job searches

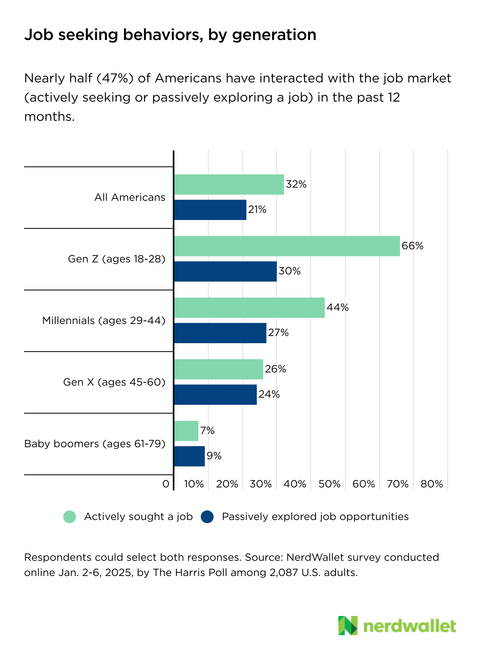

Personally interacting with the job market gives workers some direct experience. Nearly half (47%) of Americans say they’ve either actively or passively sought a job in the past 12 months, according to that recent NerdWallet survey. The youngest Americans are most likely to be interacting with the labor market as such job seekers — 81% of Gen Z, 63% of millennials, 45% of Gen X and 16% of baby boomers.

Because the labor market has cooled, these job seekers are likely running into a more difficult time, and people who are unemployed, specifically, may be having a harder time finding work again. The typical number of weeks someone remains unemployed has been rising since mid-2022 and now stands at about 10.4 . And the number of workers labeled as “discouraged” has similarly been rising. This measure looks at people who want a job but are only marginally attached to the labor force — most likely, they’ve stopped actively looking for work .

Some discouragement could be from increased competition for roles, but some could also be attributed to a (bad) job search or interview experience.

Some 27% of active job seekers say they were ghosted by a potential employer in the past 12 months, according to the NerdWallet survey. That is, the hiring manager or representative simply stopped responding to them. This experience is more common among women — 32% of active job-seeking women were ghosted versus 22% of men.

But some applicants don’t even make it to the communication phase — 41% of active job seekers say they applied for at least one role where they never received a response in the past 12 months.

How it’s all changed in recent decades

It doesn’t seem that long ago that job searches involved toting around a stack of printed resumes and visiting local businesses. But with the proliferation of technology, and later, the ability to work remotely for many jobs, job searching has changed. One might think these changes would make job searching more efficient, but as internet use increased, the time spent job searching actually increased, too, according to data from the Bureau of Labor Statistics . This could suggest the ease of applying and increased volume of applicants has contributed to making job searching more difficult (and less fruitful) than carrying your resume from business to business.

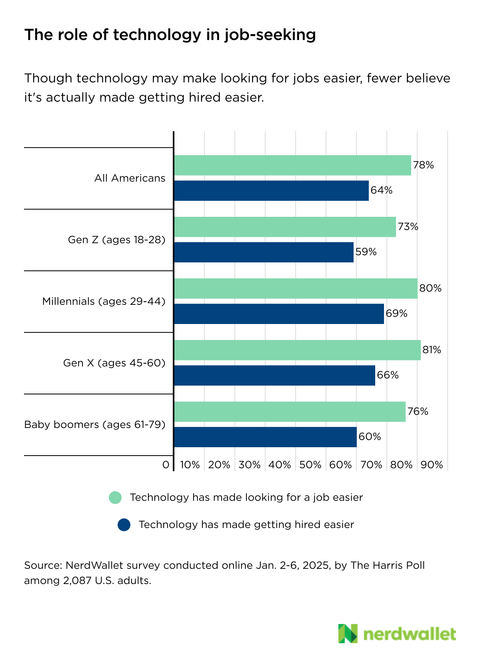

One can surmise that the easier the application process is, the more applications that will come in. By making online applications more detailed and time consuming, employers hope to use technology to improve matching — pairing job seekers with jobs they’re likely to get and be successful at. But the complexities of the application and interview processes could cause frustration for job seekers.Indeed, while 78% of Americans say technology has made looking for a job easier, in contrast 64% say it has made getting hired easier, according to the NerdWallet survey.

An increased reliance on contingent workers could also play a role in job-seeking dissatisfaction. These workers are less likely to receive robust benefits when compared to employees, and are likely to feel less job security. From 2017 to 2023, the share of workers whose sole or main job was contingent rose from 3.8% to 4.3%, and about 45% of these contingent workers would have preferred a permanent job instead, according to the Bureau of Labor Statistics .

Looking ahead

Because such an array of individual experiences exists across demographics, industries and worker characteristics, there’s no doubt there will always be some disparity between how the labor market is doing, on the aggregate, and how it feels. For example, the current “low” unemployment rate of 4% represents nearly 7 million jobless people looking for work. And for these would-be workers, hearing the labor market is doing well could be jarring.

Most recently, the share of people who report that jobs are difficult to get has fallen for the past three months, to just shy of 14.8% in December, versus 18.6% in September, according to the Conference Board . This could reflect stabilization in the labor market, or that the active cooling has stopped. There is other evidence that the cooling has slowed — hiring and quits rates appear to have leveled off, for example.

But much about the near future remains uncertain. Proposed federal policies under the new administration stand to impact the economy in a multitude of ways — some inflationary, some potentially weakening economic growth and some directly impacting the labor supply (through immigration) or demand (through credit constraints or layoffs).

Much of what comes next is outside of the control of individual workers. Despite this, keeping your network strong and your resume updated can make it easier to stay competitive no matter the health of the labor market. And putting together a plan in case of job loss can provide better resilience if the worst happens, as well as a sense of security when things are going well.

METHODOLOGY

The NerdWallet survey was conducted online within the United States by The Harris Poll on behalf of NerdWallet from January 2-6, 2025, among 2,087 U.S. adults ages 18 and older. The sampling precision of Harris online polls is measured by using a Bayesian credible interval. For this study, the sample data is accurate to within +/- 2.5 percentage points using a 95% confidence level. This credible interval will be wider among subsets of the surveyed population of interest. For complete survey methodology, including weighting variables and subgroup sample sizes, please contact [email protected].

Disclaimer

NerdWallet disclaims, expressly and impliedly, all warranties of any kind, including those of merchantability and fitness for a particular purpose or whether the article’s information is accurate, reliable or free of errors. Use or reliance on this information is at your own risk, and its completeness and accuracy are not guaranteed. The contents in this article should not be relied upon or associated with the future performance of NerdWallet or any of its affiliates or subsidiaries. Statements that are not historical facts are forward-looking statements that involve risks and uncertainties as indicated by words such as “believes,” “expects,” “estimates,” “may,” “will,” “should” or “anticipates” or similar expressions. These forward-looking statements may materially differ from NerdWallet’s presentation of information to analysts and its actual operational and financial results.

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

- 1. Hussam, R., Kelley, E., Lane, G., Zahra, F. . The Psychosocial Value of Employment: Evidence from a Refugee Camp - American Economic Review . Accessed Feb 11, 2025.

- 2. Orrenius, P., Pranger, A., Zavodny, M., Dhillon, I. . Unprecedented U.S. immigration surge boosts job growth, output - Dallas Fed. Accessed Feb 11, 2025.

- 3. U.S. Bureau of Labor Statistics. Unemployment Rate, retrieved from FRED, Federal Reserve Bank of St. Louis. Accessed Feb 11, 2025.

- 4. U.S. Bureau of Labor Statistics. Quits Rate, retrieved from FRED, Federal Reserve Bank of St. Louis . Accessed Feb 11, 2025.

- 5. U.S. Bureau of Labor Statistics. Average Hourly Earnings of All Workers, retrieved from FRED, Federal Reserve Bank of St. Louis. Accessed Feb 11, 2025.

- 6. U.S. Bureau of Labor Statistics. Productivity and Costs. Accessed Feb 11, 2025.

- 7. U.S. Bureau of Labor Statistics. Total Nonfarm Employees, retrieved from FRED, Federal Reserve Bank of St. Louis.

- 8. U.S. Bureau of Labor Statistics. Layoffs and Discharges, retrieved from FRED, Federal Reserve Bank of St. Louis. Accessed Feb 11, 2025.

- 9. U.S. Bureau of Labor Statistics. Unemployed Persons Per Job Opening. Accessed Feb 11, 2025.

- 10. Conference Board. U.S. Consumer Confidence. Accessed Feb 25, 2025.

- 11. Federal Reserve Bank of New York. Survey of Consumer Expectations. Accessed Feb 11, 2025.

- 11. Federal Reserve Bank of New York. Survey of Consumer Expectations. Accessed Feb 12, 2025.

- 11. Federal Reserve Bank of New York. Survey of Consumer Expectations. Accessed Feb 11, 2025.

- 14. East, C., Edelberg, W., Steinmetz-Silber, N. Have Workers Gotten a Raise? Hamilton Project. Accessed Feb 11, 2025.

- 5. U.S. Bureau of Labor Statistics. Average Hourly Earnings of All Workers, retrieved from FRED, Federal Reserve Bank of St. Louis. Accessed Feb 11, 2025.

- 16. U.S. Bureau of Labor Statistics. Median Weeks Unemployed, Retrieved from FRED, Federal Reserve Bank of St. Louis. Accessed Feb 11, 2025.

- 17. U.S. Bureau of Labor Statistics. Marginally Attached to the Labor Force - Discouraged Workers, retrieved from FRED, Federal Reserve Bank of St. Louis. Accessed Feb 11, 2025.

- 18. U.S. Bureau of Labor Statistics. American Time Use Survey.

- 19. U.S. Bureau of Labor Statistics. Contingent and Alternative Employment Arrangements Summary. Accessed Feb 11, 2025.

- 20. Conference Board. Employment Trends Index. Accessed Feb 11, 2025.

Related articles