50/30/20 Budget Calculator

Enter your monthly income after taxes into this free budget calculator to create a budget that accounts for your needs, wants and savings goals.

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

Use the budget calculator to see how to divide your take-home pay with the 50/30/20 rule.

Just enter your net income (the money you get after taxes and deductions) to see how your budget breaks down.

What is the 50/30/20 rule?

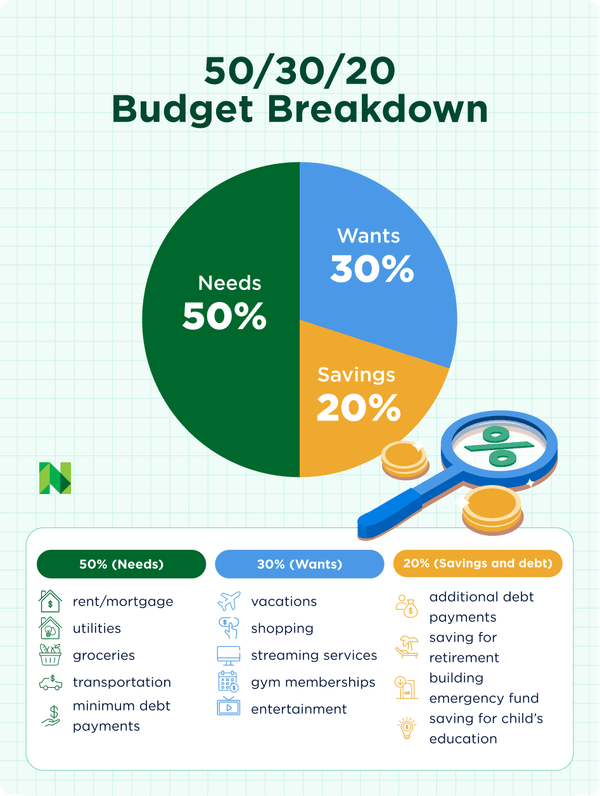

The 50/30/20 rule is a simple way to plan your budget. It suggests using 50% of your take-home pay for needs, 30% for wants, and 20% for savings and paying off debt.

Typical needs include housing, transportation, insurance, childcare, utilities and groceries. Everyone’s “wants” are different, but dining out, concerts, streaming services and kids’ sports and activities likely fall into this category. The savings and debt paydown category includes retirement savings in a 401(k) or similar account, 529 educational savings and investments alongside credit card, student loan and other debt payments.

Think of this budget as a helpful guide, not something you have to follow perfectly. It can help you cover the basics, enjoy some fun spending, and still put money aside for saving and future goals.

Here’s how each category works and what might fit into each one:

The percentages in the 50/30/20 budget can be changed to fit your financial needs at a given moment. If saving or paying down debt is a priority, for example, it’s OK to shrink your wants bucket and increase the savings and debt bucket.

Next steps checklist

Now that you know how much of your income to put toward necessities, wants and savings and debt repayment, it’s time to stack that up against your actual spending.

✅ Step 1: Look at your last one to three months of spending

Pull out your bank and credit card statements and add up your spending. Total up your needs, wants and savings/debt repayment numbers. How do they compare with the results from the calculator above? Which categories differ most?

Highlight a few categories you want to adjust first. Dining out, food delivery and subscriptions are good places to start. Finding ways to save on groceries by swapping for store brands or shopping at discount grocers like Aldi or Grocery Outlet could also offer valuable savings.

✅ Step 2: Make one small change this week

It’s time to take action. Pause or cancel that subscription you’re not using. Make a grocery list and stick to it. Move $25 into your savings account. Focusing on one quick win can build momentum, especially as you start to see savings stack up.

✅ Step 3: Automate as much as you can

Setting up automatic payments for credit cards, debt and savings and investments can takes some of the stress out of money management. Automating payments adds consistency to your money routine and can help you stay on track.

Choose realistic amounts for savings. Set aside a specific amount for your emergency fund. Consider how much you want to save for other things, such as vacations, holiday gifts and other big purchases. Then evaluate how much you can put toward other goals like a wedding, home or car purchase. If you have debt, schedule automatic payments above the minimums, if possible, to chip away at your debt.

Alternative budgeting methods

While the 50/30/20 method can be a good place to start, it might not always fit your needs or circumstances. For example, if you live in a high cost of living area, or have high childcare costs, the 60/30/10 budget might work better during this season of life.

If you want to curb impulse purchases and feel more emotionally connected to your money, the envelope system might be a good way to start.

Zero-based budgeting is another method, geared toward people who want to assign a “job” to every dollar they have coming in until they have zero dollars left at the end of the month.

If your goal is to prioritize savings, reverse budgeting might be for you. In this method, you put money toward savings and retirement first, before paying fixed and variable expenses like rent and groceries. This method requires careful planning, so you don’t overdraft or come up short for your other bills.

» Read more about how to choose the right budgeting system

Dive deeper with your monthly budget

For more budgeting advice, including how to prioritize your savings and debt repayment, review our tips for how to budget.

Not sure how to start budgeting? A pen and paper is a free and low stakes way to list your expenses. If you want something more automated, download a budget app.

Stress less. Track more.

See the full picture: savings, debt, investments and more. Smarter money moves start in our app.

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

Related articles