Mint Alternatives: NerdWallet and Other Free Budgeting Apps

Mint users have several options for a new free budgeting app. Here are a few and things to consider.

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

Since Intuit announced its plans to shut down the Mint app, many users have flocked to online discussion forums and app stores, kicking off the search for new personal finance tools to try. Intuit is integrating some of Mint’s capabilities into the Credit Karma app, which it also owns, but stripping the budgeting features.

However, Credit Karma isn’t the only option. Other apps might meet your budgeting needs and more — including NerdWallet. NerdWallet’s editorial team won’t review or rate the NerdWallet app, but this article will explain the app's features.

Here’s a look at what NerdWallet and a few other buzzworthy free apps have to offer, plus what else to consider when choosing a tool to help you manage your money.

Mint vs. NerdWallet at a glance

First things first: We want to set clear expectations for Mint users who might be considering giving us a try. NerdWallet doesn’t currently have customizable budgeting categories or spending limits, but it shares many other features with Mint and has a few unique offerings as well. Here’s how NerdWallet’s capabilities compare with Mint. If we're not what you're looking for, we'll also go into some other alternatives later in the story.

| Mint | NerdWallet | |

|---|---|---|

| Cost | Free basic version; $0.99 monthly ad-free version and $4.99 monthly premium version | Free |

| Available on | iOS, Android | iOS, Android |

| Web version | Yes | Yes |

| Account linking | Yes | Yes |

| Manual entries | Yes | Yes |

| Types of accounts supported | Cash, credit cards, investments, loans, property | Cash, credit cards, investments, loans, property |

| Automatic pull/export of transactions | Automatic pull: 90 days of transaction history when linking accounts Export: Download 10,000 transactions at a time into a spreadsheet | Automatic pull: Two full years of transaction history when linking accounts Export: No |

| Custom categories and spending limits | Yes | No |

| Goal setting | Yes | No |

| Spending and savings trends | Yes | Yes |

| 50/30/20 budget | No | Yes |

| Net worth tracking | Yes | Yes |

| Bill tracking | Yes | Yes |

| Bill negotiation | Yes | No |

| Free credit score | Yes; VantageScore 3.0 via TransUnion | Yes; VantageScore 3.0 via TransUnion |

| Free credit report | Yes (summary of report) | Yes (full report) |

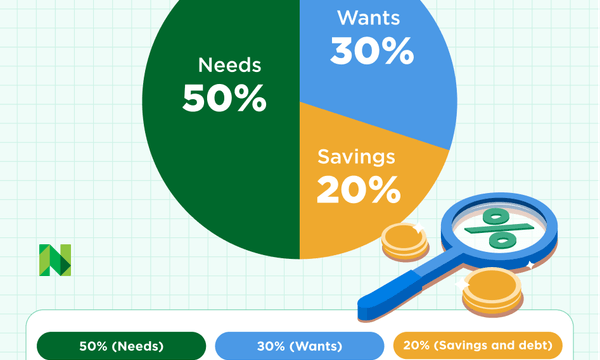

The NerdWallet app gives users a broad view of their financial picture. It connects to a wide range of financial accounts to track income, spending, net worth, home values and more. The cash flow feature shows how much money you have coming in and out, which you can compare with the previous week, month or year. It breaks down spending totals by category and uses 50/30/20 budget guidelines to show what percentage of your money is going toward needs, wants, savings and debt.

NerdWallet provides a free credit score and report. The app also includes educational resources, such as articles, insights and product reviews.

Other alternatives to Mint

You might not find a carbon copy of Mint in these contenders, but you may discover a budgeting app that gets the job done or offers something new and useful. We’re sticking with free options to make it a fair comparison. See more choices on our best budget apps list.

Stress less. Track more.

See the full picture: savings, debt, investments and more. Smarter money moves start in our app.

EveryDollar

EveryDollar has a free basic version and a premium version, which costs $17.99 per month or $79.99 annually. The app is strictly budgeting-focused, meaning it lacks Mint’s extra features like net worth and investment tracking. EveryDollar is built around the zero-based budget method, which promotes planning exactly how you spend and save each dollar of your income until you reach zero.

- Cost: Free (basic version).

- Available on: iOS, Android

- Web version: Yes.

- Account linking: No.

- Ability to import/export transaction history: No.

- Overview: EveryDollar allows users to make monthly budgets with custom categories, add payment due dates for bills and create sinking funds to help map out contributions toward special savings goals. Users can also receive a monthly newsletter featuring articles and budgeting tips. Unlike the paid version, EveryDollar’s free app does not link to bank accounts. You’ll have to manually add your income and transactions.

Credit Karma

Mint and Credit Karma are both owned by Intuit. Intuit is encouraging Mint users to switch to the Credit Karma app, promising they’ll have access to “some of Mint’s most popular features.” Custom budgets aren’t among those features, but Credit Karma does break down spending by category and compares current spending with the previous month.

- Cost: Free.

- Available on: iOS, Android.

- Web version: Yes.

- Account linking: Yes.

- Ability to import/export transaction history: Users who migrate from Mint can carry most account balances, net worth, and three years of transaction history over to Credit Karma. However, Credit Karma notes that it may take a while to transfer this data. Connecting new accounts will import transactions from the past 90 days.

- Overview: Credit Karma tracks members’ net worth, spending and cash flow. Based on that data, Credit Karma recommends certain products (such as credit cards and loans) and ways to build credit. Users can check their VantageScore 3.0 credit scores and credit reports from Equifax and TransUnion in the app. Credit Karma also provides ID and credit monitoring alerts.

Goodbudget

The Goodbudget app is a digital take on the envelope system, also known as cash stuffing. Users create “envelopes” representing different monthly budget categories and choose how much of their income to add to each one. The free version is limited to 10 envelopes. The Plus version costs $8 per month or $70 annually and includes unlimited envelopes. GoodBudget’s free plan gives you access on two devices, so you can budget with a partner.

- Cost: Free (basic version).

- Available on: iOS, Android.

- Web version: Yes.

- Account linking: No.

- Ability to import/export transaction history: GoodBudget supports transaction imports with QFX and OFX files, plus CSV files for advanced users. You can export your transaction history as a CSV file.

- Overview: Goodbudget users follow the envelope method of earmarking funds for specific spending and savings categories, such as utilities or vacations. The app also tracks debt and goals. The idea is to take a proactive approach to budgeting, not just review past spending. The free Goodbudget plan allows up to 10 envelopes. Users who need more than that can pay for unlimited envelope privileges with the Plus plan. The app doesn’t sync with bank accounts, so users must enter transaction info by hand or upload their account activity using a supported file format. The free plan restricts users to one account; Plus plan members get unlimited accounts.

Additional functionality

Careful thought should go into choosing an app, whether that ends up being NerdWallet or something else. Use these details as a starting guide:

Price

If you’re looking to get a better handle on your budget because money is tight, paying for an app isn’t ideal. Start by looking into free personal finance tools and see if the features appeal to you.

Money is precious, that’s true. But so is your time. For some folks, free budget apps simply may not cut it. Paying a monthly or annual fee might be worth it if it grants you access to handy features that can save you money or stress.

Your money management style

Some people need a hands-on way to log and categorize every transaction to make their budgets click. Others prefer something that provides a broader view of their personal finances or requires less effort. You know yourself best. Search for apps that suit your style.

Bonus features

Maybe basic income and expense tracking is all you need. Maybe you’d also benefit from getting quick access to your credit score, tracking cryptocurrency investments or seeing graphs and reports that highlight trends. Consider what your financial goals are as you shop around for apps.

Account linking

Many apps sync with financial institutions to automatically pull account balances and transaction history. While this is a must-have feature for many budgeters, others prefer to enter their information manually.

Pay attention to the types of accounts an app supports if account linking is on your wishlist. For example, it might link to checking and savings but not retirement accounts. An app that allows both account connectivity and manual entries can cover your bases.

Security

Apps that rely on manual transaction entries may make you more comfortable than those that require you to log in with your bank credentials. Either way, when you’re sharing sensitive financial information with a company, you’ll want to make sure it has measures in place to keep your data safe.

Look for apps that use encryption and partner with secure third-party companies that link accounts. A strong password goes a long way as well. Learn more about NerdWallet’s security features.

Customer support

As you research apps, note what type of support they provide. This will be important in case you run into any issues. Will you have access to a community forum or get email, chat or phone help directly from the company? Or all of the above? Will you be dealing with a chatbot or real humans?

Options sometimes vary within a service depending on whether you choose the free or paid option. For example, Goodbudget’s free version offers only community support while the paid version includes email support.

User experience

An app’s performance and design shouldn’t be understated. A tool that offers all of the ideal bells and whistles won’t make a good fit if the information is presented in a confusing way — or if it crashes constantly. Play around with apps to find one you’re comfortable using.

Reviews

Other people’s experiences are valuable too. Check out user reviews in app stores and internet forums. You can also read reviews from dependable financial websites. What are people saying? Maybe an app has a habit of miscategorizing expenses or unlinking bank accounts. That could be a deal breaker. A track record of fast customer service response on the other hand might win you over.

After deciding

Give yourself a fair chance to learn and adjust to a new app. Make use of free trial periods, when offered, before you commit to paying for a tool.

Remember that most apps evolve over time. New features get added and old ones are improved. So even if you’ve tried a particular app in the past, it could be worth revisiting to see if any updates have made the experience better.

Stress less. Track more.

See the full picture: savings, debt, investments and more. Smarter money moves start in our app.

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

Related articles