FICO 10, 10T and BNPL: How to Make Your Credit Shine

These FICO models put more weight on changes in debt level, including "trended data" over the past 24 months and Buy Now, Pay Later data.

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

The FICO 10 and 10T credit scores made a big splash when they were introduced in 2020, primarily because of the 10T version, which looks back over at least 24 months of credit activity to predict future credit behavior.

For the vast majority of people, however, any change to scores from the new scoring models is likely to amount to less than 20 points. FICO Score 10 BNPL and FICO Score 10T BNPL, to be released in the fall of 2025, represent the newest variations of FICO 10, which captures Buy Now, Pay Later data.

Here’s what to know about FICO's 10 and 10T scores.

Stress less. Track more.

See the full picture: savings, debt, investments and more. Smarter money moves start in our app.

How FICO 10 and FICO 10T are different

FICO updates its scoring models about every five years, says Dave Shellenberger, vice president of product management at FICO.

Algorithms are analyzed and updated to better predict risk. This is the first time the company has offered two versions of a general FICO score.

The score that got consumer attention is the FICO 10T — the T stands for trended data. If you think of a traditional FICO as a single photo of your finances in that moment, FICO 10T is more like a time-lapse video of your balances and payments. FICO competitor VantageScore likewise introduced a score using trended data, version 4.0, in 2017.

FICO 10 is being offered with and without trended data because that’s what lenders wanted. The FICO 10 uses the same reason codes as previous versions and can be easily adopted because it is “backward compatible,” Shellenberger said. The FICO 10T is more predictive, but it requires some new reason codes and so will take more time and money to adopt.

Are lenders using FICO 10 and 10T?

FICO 10 scores are now available for use by the three major credit bureaus. Shellenberger said adoption by lenders will take time. It can take months or “usually longer for large lenders.”

Right now, most lenders still use the FICO 8, which was introduced in 2009, for most non-mortgage lending decisions. For mortgages, FICO 2, 4 or 5 are used.

But, FICO said beginning in the fourth quarter of 2025, mortgage lenders will only have to provide the FICO 10 T.

But, FICO said beginning in the fourth quarter of 2025, mortgage lenders will only have to provide the FICO 10 T.

What is FICO 10 BNPL and FICO 10T BNPL?

As consumer credit behavior evolves, so do credit score models. According to a study Consumer Financial Protection Bureau study, one-fifth of consumers using credit obtained a BNPL loan in 2022 . FICO 10 BNPL and FICO 10T BNPL reflect these growing changes in consumer behavior.

In a June 23, 2005 FICO press release, Julie May, vice president and general manager of B2B Scores at FICO, stated the importance of BNPL in consumers’ financial lives, expounding that the FICO 10 suite more accurately evaluates credit readiness.

The exact inclusion of FICO 10 BNPL and FICO 10T BNPL in the marketplace is not yet clear, but both models are slated for release in the fall of 2025. They will be offered alongside current FICO score models.

How might FICO 10 affect your score?

Your score is most likely to drop when using the FICO 10 scoring models if:

- You took out a personal loan to consolidate credit card bills, but now your card balances are up again or it appears you have applied for additional credit.

- You are using credit cards to get by — and you just can’t seem to whittle the balances down or your balances are growing.

- You have missed a payment — the penalty for going 30 days past due will be even harsher than it is under previous FICO scoring models.

On the other hand, some people could see their scores rise by 20 points or more. Your score is most likely to rise if you have been penalized for occasional high balances. Shellenberger gave an example: If you typically vacation in July and put airline tickets, hotel and meals on a credit card — and then pay it off — the trended data won’t penalize you as much. It looks at balances over time and sees you bringing a temporarily high balance down.

Keys to a higher score on the FICO 10 and 10T

- Pay down balances on credit cards. Consistently high statement balances — or rising balances — can suggest financial difficulty. If you are paying off your bills monthly but have high statement balances, make frequent payments throughout the month. That keeps your balance low no matter when it’s reported to the credit bureaus.

- Do all you can to avoid missing a payment.

- If you don’t already have an emergency fund, start one. If you have to turn to credit cards in an emergency, your rising balances could hurt your scores.

- If you are thinking of consolidating credit card debt with a personal loan, avoid charging up the credit card balances again; FICO 10T will penalize you for it.

Stress less. Track more.

See the full picture: savings, debt, investments and more. Smarter money moves start in our app.

How to look good no matter what score lenders use

Make no mistake: Lenders want to find creditworthy applicants. They just want to minimize the risk that they’ll approve customers who won’t pay as agreed.

The ways to build credit have not changed:

- Pay every bill on time.

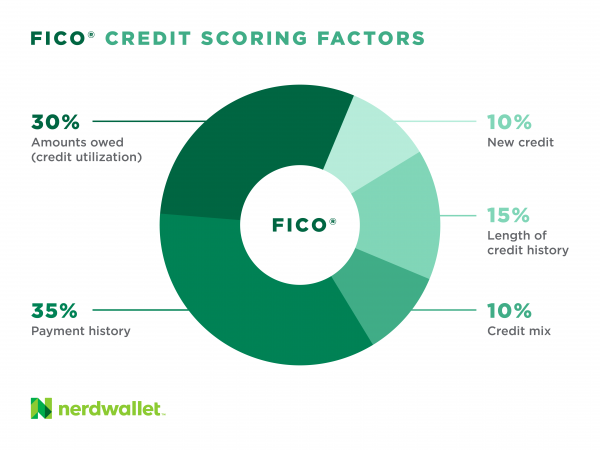

- Keep credit card balances low relative to your credit limits, which benefits a highly influential scoring factor called credit utilization.

- Be judicious about applying for new credit. A flurry of new applications can suggest financial distress.

- Keep old credit card accounts open unless you have a compelling reason to close them, such as a high annual fee. Their credit limits help your credit utilization and older cards also contribute to credit age, a minor factor in your score.

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

- 1. Consumer Financial Protection Bureau. CFPB Research Reveals Heavy Buy Now, Pay Later Use Among Borrowers with High Credit Balances and Multiple Pay-in-Four Loans. Accessed Sep 2, 2025.

Related articles