Medicare Open Enrollment Guide: What You Need to Know

Medicare open enrollment runs from Oct. 15 to Dec. 7. During this time, you can change or join plans.

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

Medicare open enrollment is the period each year when you can make changes to your Medicare coverage. You can switch from Original Medicare to a Medicare Advantage plan, or vice versa. You can also change your Part D prescription drug coverage to other options.

When is Medicare open enrollment?

Medicare open enrollment happens every fall from Oct. 15 to Dec. 7. Changes you make during this time take effect the following year on Jan. 1. The deadline to make changes to your Medicare coverage for 2026 was Dec. 7, 2025.

Mark your calendar

What can you do during Medicare open enrollment?

Here's what you can do during Medicare open enrollment:

With Medicare Advantage:

Change from one Medicare Advantage plan to another.

Change from a Medicare Advantage plan without drug coverage to a plan with drug coverage, or vice versa.

Switch from Medicare Advantage to Original Medicare.

With Original Medicare:

Enroll in a Medicare Part D prescription drug plan.

Switch from one Medicare Part D plan to another.

Quit your Medicare Part D plan (but watch out for late enrollment penalties if you go back later).

Switch from Original Medicare to a Medicare Advantage plan.

Compare Medicare Advantage plans

Can I sign up for Medicare during open enrollment?

Medicare open enrollment applies to people already enrolled in Medicare. So if you don’t already have Medicare, open enrollment isn’t the time when you sign up.

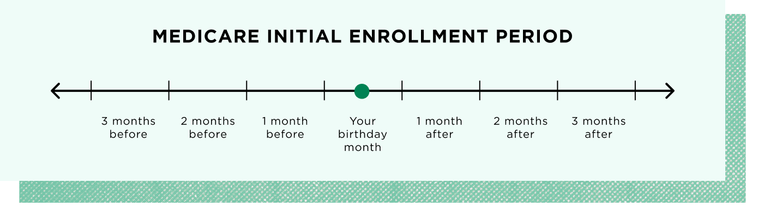

If you're new to Medicare, you can sign up during your initial enrollment period. It generally starts three months before your 65th birthday month and ends three months after.

If you miss your initial enrollment period, you might be able to sign up during a special enrollment period based on certain life events. Otherwise, you’ll need to sign up during the general enrollment period: Jan. 1 to March 31.

Your Medicare open enrollment checklist

If you’re currently enrolled in Medicare, here’s how to prepare for open enrollment:

1. Review your ANOC.

Your plan will send an Annual Notice of Change (ANOC) in the mail each fall before open enrollment starts. This document outlines any changes to coverage and cost being made to your Medicare plan for the upcoming year.

2. Check to see if your drugs are covered.

If you have prescription drug coverage, you’ll want to check your plan’s formulary, or drug list, for the upcoming year. Make sure your medications are covered at an out-of-pocket cost you can afford.

3. Make sure your providers are in network.

If you have a Medicare Advantage plan, make sure any providers you see are still in network with your plan. Otherwise, you might not be covered, or you might have to pay more to see those providers.

4. Compare your plan options during open enrollment.

Browse plans in your area to make sure your current Medicare coverage is still the best fit. You can compare plans using the Medicare plan finder tool on Medicare.gov or speak with a licensed broker or agent. If you decide to change Medicare plans, make sure to do so by the Dec. 7 deadline.

Nerdy Perspective

What if I just want to keep my current coverage?

Medicare Advantage plans can change every year. The same plan might have different benefits, in-network doctors and/or drug coverage, for example. It's a good idea to take a look to see whether your plan is still the best fit. Part D plans change from year to year, too. Watch out for changes to covered drugs, premiums and out-of-pocket costs. Plug your drugs into a plan comparison tool to find the best coverage option for you.

Can I drop my Medicare Advantage plan and go back to Original Medicare?

There are two annual periods when you can switch from Medicare Advantage to Original Medicare.

Medicare open enrollment: Oct. 15 to Dec. 7.

Medicare Advantage open enrollment: Jan. 1 to March 31.

If you go back to Original Medicare during open enrollment, you might be able to purchase a Medicare Supplement Insurance (Medigap) plan. But because you’re outside of your Medicare Supplement open enrollment period, you might pay more or be denied because of your health status. Also, you will have to enroll in a separate Medicare Part D prescription drug plan if you want drug coverage.

When can I change my Medicare Supplement Insurance plan?

In most states, you aren’t guaranteed the ability to change your Medigap plan outside of your six-month Medigap open enrollment period. This six-month window starts when you’re 65 or older and have Medicare Part B, and it only happens once.

After that, it’s up to your insurer whether you can change your Medigap plan, and you may have to pay more, unless you qualify for a special enrollment period due to certain life events.

What happens if I do nothing during Medicare open enrollment?

If you don’t do anything during Medicare open enrollment, your current coverage will automatically renew for next year in most cases. You won’t have the chance to switch plans or join a plan again until the next open enrollment period, unless you qualify for a special enrollment period.

If your current plan is discontinued, you might need to take action.

If your Medicare Advantage plan ends, you’ll be enrolled in Original Medicare unless you pick another Medicare Advantage plan.

If your Medicare Part D plan ends, you’ll lose prescription drug coverage unless you sign up for another plan. (If you have Extra Help, you’ll be automatically enrolled in a new plan unless you choose one yourself.)

If your plan has been discontinued, you’ll likely qualify for a special enrollment period that may go beyond the Dec. 7 deadline for Medicare open enrollment. If your provider sends a notice that your plan is being discontinued, read the notice to make sure you understand your options.

Shopping for Medicare Advantage plans? We have you covered.

MEDICARE ADVANTAGE is an alternative to traditional Medicare offered by private health insurers. Compare options from our Medicare Advantage roundup. | |

Best for size of network

| Best for Part B Giveback

|

Best for ratings

| Best for low-cost plan availability

|

Star ratings from CMS and on a 5-★ scale. | |

Best Medicare plans in each state

Medicare Advantage plan availability varies by location. Click on a state on the map below to see NerdWallet's picks for the best Medicare Advantage plans available in that state.

Top Medicare Advantage companies

More than half of Medicare-eligible people are in a Medicare Advantage plan. But each plan has different strengths and weaknesses. Here’s the list of Medicare Advantage plans this year that got our attention.

Best for size of network: UnitedHealthcare.

Best for ratings: Aetna.

Best for low-cost plan availability: HealthSpring (formerly Cigna).

Best for Part B Giveback: Humana.

Best startup: Devoted Health.

» Learn more in our roundup of the best Medicare Advantage plans

For additional guidance, you can reach out to your local State Health Insurance Assistance Program, or SHIP.

ON THIS PAGE

ON THIS PAGE