Bitcoin vs. Ethereum: What’s the Biggest Difference?

When it comes to Bitcoin vs. Ethereum, the main difference is that Bitcoin was designed to carry out payments, while Ethereum can support more complex software.

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet, Inc. does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

Nerdy takeaways

- Bitcoin is an investment and a payment method, and so is Ethereum — but Ethereum can support financial software, too.

- Bitcoin and Ethereum are created through very different processes — mining vs. staking — and have different environmental footprints.

- Ethereum fees have tended to be higher than those for Bitcoin.

The main difference between Ethereum and Bitcoin is that Ethereum is a network that supports a complex financial ecosystem, whereas Bitcoin was designed as a way to carry out relatively simple digital payments.

Bitcoin (BTC) and Ethereum (ETH) do have plenty in common, though. They are both cryptocurrencies, and together, they make up a large chunk of the overall crypto market.

As such, they rely on similar “blockchain” technology, and they appeal to many of the same investors. They are widely available on cryptocurrency exchanges, and many people still buy both for their perceived investment value rather than their current utility.

But within the world of digital assets, the comparison of Bitcoin versus Ethereum reveals some fundamental differences:

- Bitcoin remains the most highly valued cryptocurrency.

- Bitcoin has seen greater acceptance by traditional finance, evidenced by the approval of spot Bitcoin ETFs in 2024.

- Ethereum can support smart contracts, software programs that execute automatically when certain conditions are met. Bitcoin does not have this capability.

- Bitcoin uses an energy-intensive method of verifying transactions known as Bitcoin mining. Ethereum launched using a similar protocol but has transitioned to a process called staking, which has fewer environmental effects .

Advertisement

Fees $0per trade | Fees 2%-5.5% |

Account minimum $0 | Account minimum $1 |

Promotion Up to 4% match (up to $2M)when you open and fund an account with Webull | Promotion Noneno promotion available at this time |

Basics of Ethereum and Bitcoin

It’s essential to grasp the key details of both Ethereum and Bitcoin to understand their differences.

Bitcoin is recognized as the first cryptocurrency. Rolled out in 2009 by mysterious developer Satoshi Nakamoto , Bitcoin paved the way for thousands of other cryptocurrencies. It was developed as a secure digital payment that does not require a central arbiter such as a bank.

Though it has not achieved broad adoption as a form of payment, Bitcoin has become a popular — and volatile — investment that is now even offered in some retirement plans. Moreover, the spot Bitcoin ETFs that were approved in 2024 were issued by some of the biggest financial institutions in the world, including BlackRock, Fidelity and Invesco.

» Learn more: How to buy Bitcoin

Ethereum went live in 2015, the product of an attempt by developer Vitalik Buterin to expand on the central promise of cryptocurrency to decentralize larger swaths of the economy . The essential difference is that a developer can write programs that interact directly with the Ethereum platform, making it possible to provide services that Bitcoin could not. For example, Ethereum supports a range of lending and trading protocols, as well as games and other content.

Ethereum’s native cryptocurrency, known as Ether, can be used to pay for services or transaction fees on the network. Though its adoption in mainstream finance trails Bitcoin, many people have also used it as a speculative investment.

» Learn more: How to buy Ethereum

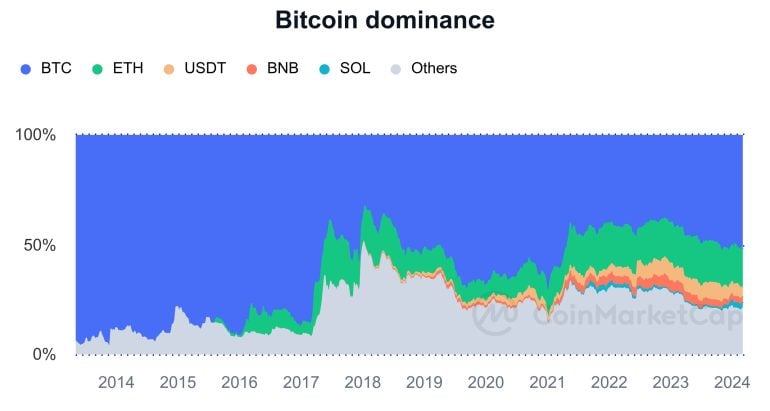

Ethereum has been taking a larger share of the market from Bitcoin over the past several years, though Bitcoin retains the industry’s largest market value. In March 2024 when Bitcoin hit a new all-time high, the global cryptocurrency market cap was over $2.3 trillion, with Bitcoin making up more than half of that at $1.3 trillion. For comparison, Ethereum's market cap stood at $420 billion .

Overall, a long-term investment in either represents the hope that their underlying technology will achieve worldwide use, increasing the demand for the limited supply of their cryptocurrency. Whether to buy either — or both — depends on your market analysis.

» Ready to invest? Here are our picks for best Ethereum and cryptocurrency exchanges.

The table below shows just how large Bitcoin's market cap is, followed by Ethereum, Tether, BNB, Solana and the rest of the market.

What can you buy with each cryptocurrency?

Ethereum and Bitcoin are both cryptocurrencies, so either could work for any transaction in which both buyer and seller are comfortable using it.

But overall, Bitcoin is intended as more of a general-purpose currency for everyday payments.

Ethereum is designed explicitly for payments on the Ethereum network. That means Ethereum cryptocurrency would be better suited than Bitcoin for carrying out a transaction that relies on an Ethereum smart contract, such as funding a loan that will be automatically paid back on a specific date.

However, one thing you can't escape with either cryptocurrency is network fees. Any time you carry out a transaction with either Ethereum or Bitcoin, you’ll be charged an amount that helps pay for the network's technology. These fees can sometimes come on top of whatever fee you might be paying to the crypto platform or payment provider you’re using.

Ethereum fees have tended to be higher than those for Bitcoin. But before you complete a trade or transaction for either, it can be good to look at the network fees to see if they’re running higher than usual. If it’s not a time-sensitive transaction, you can sometimes save money by waiting for fees to go down. There are various ways to see current fees and expected fees on a particular transaction, but two examples include Etherscan (for Ethereum transactions) and Blockchain.com for Bitcoin fees.

Mining and environmental impact of each

Bitcoin is known as a “proof-of-work” blockchain project. That means users can run programs on their computers that help verify the integrity of transactions and prevent fraud. The process is known as “mining,” and it makes it possible for participants to receive cryptocurrency rewards in exchange. Mining uses a huge amount of energy, which has led to significant criticism of cryptocurrency in general.

Ethereum has recently converted its technology into a format known as “proof-of-stake. ”

Proof-of-stake blockchains do not require mining; instead, they use a process called staking, which incentivizes people to put cryptocurrency at stake to vouch for the accuracy of transactions. Participating users get rewards akin to interest in a bank account when the system works normally.

Over time, this shift could mean that Ethereum becomes more energy efficient than Bitcoin. On the other hand, some supporters of Bitcoin argue that the process does not have to be environmentally damaging if miners use renewable energy .

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

- 1. Thomson Reuters. 5 Questions about the Environmental Impact of Crypto Mining. Accessed May 11, 2022.

- 2. Bitcoin.org. Bitcoin: A Peer-to-Peer Electronic Cash System. Accessed Mar 17, 2022.

- 3. Wired. The Uncanny Mind That Built Ethereum. Accessed May 11, 2022.

- 4. Coin Market Cap. Today's Cryptocurrency Prices by Market Cap.

- 5. Ethereum.org. The Merge. Accessed May 11, 2022.

- 6. The New York Times. Bitcoin Miners Want to Recast Themselves as Eco-Friendly. Accessed May 11, 2022.

More like this

Related articles