Per Stirpes: Definition and How to Use for Estate Planning

If one of your beneficiaries dies before you do, per stirpes can ensure their share of your estate goes to their kids.

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet, Inc. does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

Per stirpes, which is Latin for “by branch,” “by roots” or “by stalk,” is an estate planning method in a will or trust to specify that if one of your beneficiaries dies before you do, their share of your estate is divided equally among the deceased beneficiary's descendants.

It’s difficult to consider the possibility that your beneficiaries might die before you do, but planning for that helps ensure your assets are distributed according to your wishes, regardless of circumstances. Here’s what to know.

How per stirpes works

Per stirpes distribution means that each beneficiary’s family branch receives the share of assets specified in your will — regardless of whether each specific beneficiary is alive or dead when you die.

This designation covers as many generations as is necessary to carry out your will. It means that a share of your estate may go to a deceased beneficiary’s children, grandchildren or even great-grandchildren .

Adopted children are included in this lineal distribution and typically will inherit just as a biological child does — but unadopted stepchildren and spouses of beneficiaries typically won’t inherit under per stirpes.

» Need help from a pro? See our picks for the year's best financial advisors

🤓 Nerdy Tip

Per stirpes designations aren’t only for wills; they can also be used with other types of assets, including life insurance policies and individual retirement accounts, or IRAs. What is an example of per stirpes?

Here are a few examples of how a per stirpes distribution could play out in a will.

Example 1

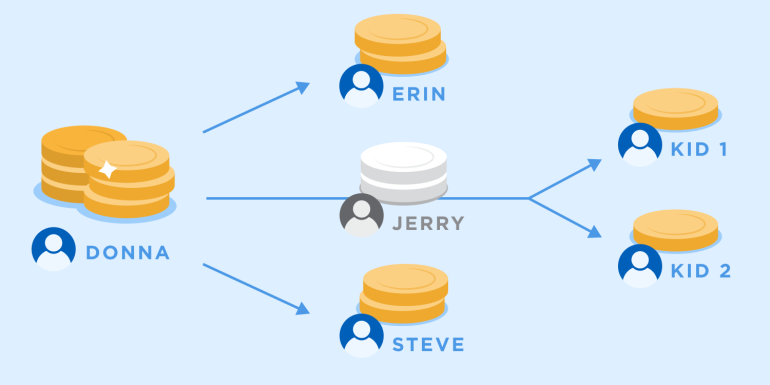

Donna is a widow who wills her assets to her three children (Erin, Jerry and Steve) to be divided in equal shares, per stirpes. Jerry dies before Donna does, so when Donna passes, Erin and Steve each receive one-third of Donna’s assets. Jerry’s share is divided equally between his two children, which means they each receive one-sixth of Donna's estate.

Example 2

Andrew has no spouse or children, so he wills his assets to be divided equally between his two closest lifelong friends, Barry and Ted, per stirpes. Ted and his children all die unexpectedly before Andrew. However, Ted has one surviving granddaughter, Lisa, who then receives Ted’s share of the inheritance when Andrew dies.

Example 3

Eric wills his entire estate to his two daughters, Ann and Bethany, to be distributed in equal shares, per stirpes. Ann dies before Eric, but she never had children. Bethany thus inherits the entirety of Eric’s estate.

Pros and cons of per stirpes

Advantages of per stirpes

- Can save time. No need to update your will when additional children or grandchildren are born to your beneficiaries or if one of your beneficiaries dies before you do.

- Gives you more control. Per stirpes allows you to keep your assets within each branch of your family, even if a beneficiary predeceases you.

- Minimizes the risk of disputes. The linear approach may reduce the chance of family conflict over distribution.

Disadvantages of per stirpes

- May create uneven inheritances. Assets could be distributed unequally if some beneficiaries have more children than others.

- May inadvertently involve other people. Someone you don’t want may end up managing some of your assets, for example, if an in-law is responsible for handling the assets of a minor child.

- May inadvertently exclude some people. Per stirpes typically doesn’t include stepchildren whom your beneficiary hasn’t legally adopted; stepchildren usually aren’t considered lineal descendants — even if your beneficiary raised their stepchildren since birth. You may need to name stepchildren of your beneficiaries in your will specifically if you want them to inherit a share in the event of your beneficiary’s death.

Per stirpes vs. per capita in a will

The main difference between per stirpes and per capita designations is who gets your assets if a beneficiary dies before you do. Although both designations are ways to name backup beneficiaries, in a will or trust with a per stirpes designation, the beneficiary's share of your estate automatically goes to their kids. In a will or trust with a per capita designation, the beneficiary's share of your estate automatically goes to your other beneficiaries .

Per capita is Latin for “by head” and involves distribution to specific individuals rather than branches of a family. This designation means each of your beneficiaries only receives a share of your estate if they’re still alive when you die. If a beneficiary dies before you do, their share is divided among the remaining living beneficiaries. The children of a deceased beneficiary wouldn’t receive anything .

It’s important to be clear about per stirpes and per capita distributions in your will because if you don’t specify which designation you prefer, the final distribution of your assets (via probate court) may not reflect your preferences.

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

- 1. Cornell Law School Legal Information Institute. Per stirpes. Accessed Oct 6, 2025.

- 2. American Bar Association. Per stirpes. Accessed Oct 6, 2025.

- 3. Cornell Law School Legal Information Institute. Per capita. Accessed Oct 6, 2025.

- 4. Consumer Financial Protection Bureau. How long does information stay on my credit report?. Accessed Feb 5, 2026.

- 5. Consumer Financial Protection Bureau. What is a debt relief program and how do I know if I should use one?. Accessed Feb 5, 2026.

- 6. Federal Trade Commission. How To Get Out of Debt. Accessed Feb 5, 2026.

- 7. Internal Revenue Service. About Form 1099-C, Cancellation of Debt. Accessed Feb 5, 2026.

Compare online will makers

Advertisement Related articles