Magnificent Seven Stocks: Should You Invest?

The Magnificent Seven stocks are high performers — and you may already be invested in them.

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet, Inc. does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

What are the Magnificent 7 stocks?

The “Magnificent Seven” stocks are Alphabet (GOOG, GOOGL), Amazon (AMZN), Apple (AAPL), Meta Platforms (META), Microsoft (MSFT), Nvidia (NVDA) and Tesla (TSLA). The Magnificent Seven stocks were first identified as “monopolistic U.S. tech stocks” by Bank of America investment strategist Michael Hartnett and his team in an internal report from May 2023 .

Magnificent 7 stock list

| Ticker | Company | Performance (Year) |

|---|---|---|

| GOOG | Alphabet Inc | 70.21% |

| NVDA | NVIDIA Corp | 48.97% |

| AAPL | Apple Inc | 13.61% |

| TSLA | Tesla Inc | 5.37% |

| AMZN | Amazon.com Inc | 3.54% |

| META | Meta Platforms Inc | 2.82% |

| MSFT | Microsoft Corporation | 1.99% |

| Source: Finviz. Data is current as of February 2, 2026 and is intended for informational purposes only. | ||

The history behind the Magnificent 7

In 2013, CNBC’s Jim Cramer, along with technical analyst Bob Lang, coined the term “FANG” to refer to Facebook, Amazon, Netflix and Google. “FANG” became “FAANG” with the addition of Apple in 2017.

As time went on, Google became Alphabet and Facebook became Meta. Microsoft and Nvidia were added to the group due to their impressive performance — and what was turning into an unwieldy acronym became the “Magnificent Seven.”

| Brokerage firms | |

|---|---|

| | |

| |

Why invest in the Magnificent 7?

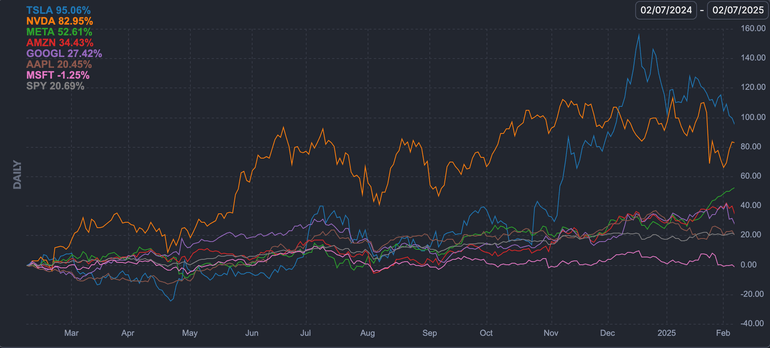

The Magnificent Seven stocks have all been identified for their outsized performance. For the last year, five out of seven outperformed the S&P 500 index. The top performer, TSLA, has returned nearly 100% in the last year, compared to the 20% return of the S&P 500 overall.

But past performance doesn’t guarantee future returns — and the individual stocks that have performed well over the last year may not perform well in the future. Tesla, for example, has underperformed the S&P 500 so far in 2025.

How to invest in the Magnificent 7

If you invest in a 401(k) through work or invest in a mutual, index or exchange-traded fund, it’s likely that you already own shares in at least some of the Magnificent Seven stocks. These stocks are robust performers that are often included in large market indexes such as the S&P 500.

If you don’t already have the Magnificent Seven in your portfolio through funds and you want to own shares in these companies, you have a couple of options for how to do it. But first, in order to buy any stock (or fund) you need to open an investment account, also known as a brokerage account. There are several types of investment accounts, and some have great tax benefits, so it’s worth investigating what kind you should get before diving in.

» Ready to compare? Check out the best online brokerages

Option 1: The first option you have for buying the Magnificent Seven stocks is to simply buy stock in each of the seven companies — Alphabet (GOOG, GOOGL), Amazon (AMZN), Apple (AAPL), Meta Platforms (META), Microsoft (MSFT), Nvidia (NVDA) and Tesla (TSLA).

» Learn how to buy stocks

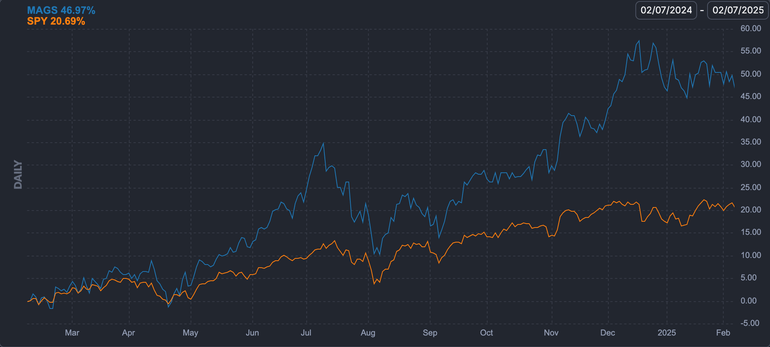

Option 2: The second option is to invest in all seven companies at once through a fund. One such fund is the Magnificent Seven exchange-traded fund (MAGS) . This fund holds all seven funds equally and has an expense ratio of 0.29%. The benefit of investing through a fund is that you don’t have to manage each individual stock. The downsides are that if one stock is performing poorly, you can’t simply drop it, and you have to pay an annual fee (the aforementioned expense ratio — individual stocks don’t charge expense ratios).

Here’s how MAGS performed against SPY over the last year.

Option 3: The last option is to simply invest through an S&P 500 index fund. A fund that tracks the S&P 500 invests in about 500 of the biggest companies in the U.S. — including all seven of the Magnificent Seven.

When looking at the chart comparing MAGS to SPY, it may seem obvious that investing in MAGS is a better option. And it’s true that the Magnificent Seven did, when combined, outperform the S&P 500 considerably over the last year. But by investing in 500 companies instead of seven, you increase your diversification, decrease your risk and safeguard against volatility in individual sectors.

» Learn how to invest in index funds

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

- 1. Bank of America Global Research. The Flow Show. Accessed Jun 20, 2024.

- 2. Roundhill Financial Inc.. MAGS Magnificent Seven ETF. Accessed Jun 20, 2024.

More like this

Related articles