How Much Does a Home Warranty Cost?

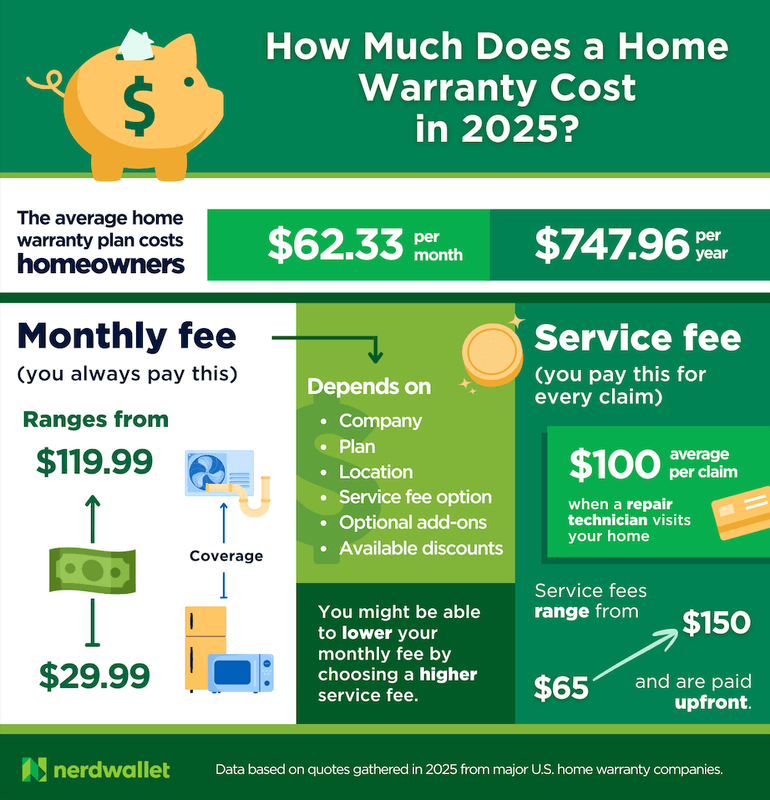

A home warranty plan costs $62.33 per month on average in 2025, but you can save with discounts or might pay more for a better plan.

Some or all of the mortgage lenders featured on our site are advertising partners of NerdWallet, but this does not influence our evaluations, lender star ratings or the order in which lenders are listed on the page. Our opinions are our own. Here is a list of our partners.

You'll pay $50 to $75 a month for a home warranty plan, but the price you'll actually pay depends on several factors, including your location and the coverage you choose.

Home warranty costs

A homeowner warranty plan usually comes with a monthly premium and several potential fees.

- Premium. A premium is a monthly or annual fee that depends on several factors such as where you live and the coverage you choose. If you pay monthly, the premium is usually the same each month, and you’ll pay it even if you don’t need an item repaired during that month. You’ll pay monthly premiums throughout the term of your home warranty service agreement.

- Service fee. Most home warranty companies require customers to pay a service fee, sometimes called a trade fee, every time a technician visits your house in response to a claim. Customers usually have to pay service fees even if they can’t choose their own technicians, the technician can’t repair the item during that visit or the claim is denied because of the technician’s diagnosis.

- Additional coverage fees. If you want coverage that isn't part of a plan, such as for roof leaks, some homeowner warranty companies will let you add coverage for an additional monthly fee. This fee is usually added to your monthly premium.

See an infographic that summarizes this article

How much is a home warranty?

The average monthly premium for a home warranty plan is $62.33, which comes out to $747.96 a year.

Costs will vary between companies and coverage options with each company. Below is a summary of our cost research for major home warranty companies.

| Company | Monthly premiums | Service fees per call |

|---|---|---|

| 2-10 Home Buyers Warranty | $35.00-$69.00. | $100 or less. |

| AFC Home Warranty | $61.08-$111.50. | $75 or $125. |

| American Home Shield | $29.99-$119.99. | $100 or $125. |

| Choice Home Warranty | $49.16-$57.50. | $100. |

| Cinch Home Services | $30.99-$66.99. | $100, $125 or $150. |

| First American Home Warranty | $42.00-$97.00. | $100 or $125. |

| First Premier Home Warranty | $64.99-$71.99. | $75. |

| Home Service Club | $56.67-$69.17. | $65, $95 or $125. |

| Home Warranty of America | $48.33-$60.84. | $75 and up. |

| Liberty Home Guard | $49.99-$69.99. | $75-$125. |

| Old Republic Home Protection | $45.00-$85.00. | $100 or $125. |

| Select Home Warranty | $60.42-$66.25. | $75-$100. |

During our research we requested quotes from several companies using different ZIP codes in three states, each of which represented a different cost of living. Here are a few key numbers we found in our research:

- The cheapest quote was $29.99 per month.

- The most expensive quote was $119.99 per month.

- The average cost of the cheapest plans was $49.92 per month ($599.04 annually).

- The average cost of the most expensive plans was $74.74 per month ($896.89 annually).

Service fees

Service fees may be somewhere in the $65-$150 range.

Some companies have set service fees that every customer pays; others allow you to select the service fee amount when you buy the plan. Generally, the higher the service fee, the lower the monthly premium.

A reputable home warranty provider will tell you what your service fee will be before you purchase a plan, and most of them state the fee in your service agreement.

» MORE: Are home warranties worth it?

Advertisement

Factors affecting home warranty cost

Several factors go into the final price of your home warranty premium, including your location, the plan you choose, your service fee and more.

Location

Some plans charge different prices in different areas. This can vary by state, city and even ZIP code. For example, American Home Shield charges different rates for the same coverage in different ZIP codes within the same city.

| Location | ShieldSilver quote with $100 service fee | ShieldPlatinum quote with $100 service fee |

|---|---|---|

| Dallas, Texas (75230) | $69.99. | $119.99. |

| Dallas, Texas (75211) | $39.99. | $89.99. |

| Fort Worth, Texas (76107) | $69.99. | $119.99. |

| Fort Worth, Texas (76110) | $39.99. | $89.99. |

| Lubbock, Texas (79423) | $69.99. | $119.99. |

| Lubbock, Texas (79413) | $39.99. | $89.99. |

Plan coverage

The plan you choose will also affect your monthly premium. Generally, the better the coverage, the more expensive the plan. This is true for most home warranty providers.

Provider

Some providers offer cheaper plans all around, while others are known for more expensive premiums. The provider you decide to go with will determine the rate you pay. For example, among the quotes that we gathered for Tulsa, Oklahoma, American Home Shield offered the cheapest basic plan, and Cinch Home Services offered the cheapest premium plan.

» MORE: What does a home warranty cover?

Add-on coverage

Adding coverage outside of a plan’s items will increase your premium as well. Optional coverage is often available for things such as pools and spas, water softeners, additional refrigerators, septic systems, well pumps and roof leak repairs. How much each additional item increases your premium depends on the provider.

Service fee

If you have the option to choose your service fee, your selection will affect your monthly premium. Usually plans with higher service fees cost less per month and vice versa.

Square footage

Most home warranty plans typically cover primary structures that are 5,000 square feet or fewer. If a plan allows you to cover a house that is larger than its standard size, you might pay more for the additional coverage.

Most home warranty plans have coverage limits. The coverage limit is the maximum total amount the provider will pay to repair or replace a covered item. If a repair or replacement costs more than the coverage limit, you’ll have to pay the difference. So if you’re thinking of getting a home warranty plan, estimate how much you can afford to pay out of pocket if your plan doesn’t cover the full cost of a repair.

How to get a home warranty quote

Home warranty companies generally provide quotes online, but many of them require you to submit your personal contact information. You’ll likely need to provide:

- Your name.

- The address of the residence for which you want coverage.

- The square footage of the home if it’s more than 5,000 square feet.

- Which plan you prefer, though some companies provide quotes for all of their plans at once.

- Any additional coverage you want, such as for a pool.

Once you provide this information, the home warranty company’s website usually shows you the monthly or annual price of your plan. If you want to go ahead with a contract, you can usually sign up for one at that time.

How to save money on home warranties

Although home warranty providers set their own prices, there are three things you can do to save money on your plan.

- Only get the coverage you need. Some home warranty providers have plans that are comprehensive and cover a mix of appliances and home system, such as air conditioners. Others have appliance-only and system-only plans. Pay attention to what’s covered to avoid paying for more coverage than you’ll use.

- Ask for discounts. Some home warranty providers offer discounts for certain groups, such as older adults or veterans. When talking with a representative, ask what discounts are available and compare them to other companies' discounts.

- Get multiple quotes. Research companies and ask for quotes from several of them to compare your options. Don’t be afraid to be honest with a provider’s representative if you call for a quote — tell them you’re shopping around and want the best price. They might be able to get you a bit more of a discount than you planned.

What to know before buying a home warranty

Reading the coverage and exclusions information in your contract is one of the most impactful things you can do to avoid costly misunderstandings in the future. You have a right to read your contract before purchasing a plan, and it’s important to understand that home warranties:

- Always have exclusions to coverage, no matter what their sales pitches say. Read your contract carefully before purchasing a plan — especially anything listed as an exclusion or limit of liability. For example, a company might cover air conditioning systems but exclude certain parts or components, such as coils. Other companies cover plumbing repairs but won’t pay to clear all plumbing stoppages or repair certain types of leaks.

- Are not a type of insurance. Even though some companies call their service fees deductibles, home warranties do not work the same way as insurance policies. They differ in what they cover and how they pay for repairs or replacements. A home warranty is not a supplement for homeowners insurance.

- Limit how much they pay. If the cost of a repair or replacement goes beyond a limit stated in your contract, you’ll have to pay the difference. For example, if the bill for a repair is $2,000 and the limit is $1,500, you’re required to cover $500. This is in addition to your monthly premium and service fee.

- Can deny your claim for several reasons. Examples include if you had work performed on a covered item without approval or you modified the system or appliance.

- May not pay enough to cover the full cost of replacing a covered item. Home warranties often depreciate the value of items as they age, so you’ll likely have to pay at least some money to replace an item, even if it’s covered by the contract.

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

More like this

Related articles

AD

50% OFF Select Plans — Limited Time Only

Call American Home Shield

REDEEM NOW

on American Home Shield's website

AD

50% OFF Select Plans — Limited Time Only

- Comprehensive Coverage from Just $29.99/Month;

- Trusted by Over 2 Million Members for 50+ Years;

- No Records or Home Inspections Required.

Call American Home Shield

REDEEM NOW

on American Home Shield's website

AD

Protect Your Home for as little as $1 / Day

Call Select Home Warranty

REDEEM NOW

on Select Home Warranty's website

AD

Protect Your Home for as little as $1 / Day

- Great Home Warranty Protection with $150 off + 2 Months Free + Free Roof Coverage;

- Join the Select Benefits Program and Save up to 75% on Common Everyday purchases.

Call Select Home Warranty

REDEEM NOW

on Select Home Warranty's website