How to Use an Accounts Receivable Aging Report

Dive into accounts receivable aging, a report that can help you manage receivables and project future cash flow.

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

Aging your accounts receivable means measuring the amount of time between when unpaid invoices were issued and the current date. This information is summarized on the accounts receivable aging report, which is typically broken down in 30-day increments, with totals along the right-hand side and the bottom that show you how much money is due to you from each customer and how much is due in each 30-day period, respectively.

If you extend credit to your customers, managing your accounts receivable is one of the most important accounting functions in your business. Without proper management, your accounts receivable can get out of control, causing significant cash flow problems for your business.

The accounts receivable aging report is the go-to tool for businesses with accounts receivable to manage. A word of caution about this report: It’s only as good as the data it summarizes. Make sure the person who is in charge of creating invoices for your business follows good invoice processes. An incorrectly-entered invoice date or payment terms that are not set up correctly can skew your accounts receivable aging report, causing you to make assumptions that are not accurate and might even harm your relationships with your customers.

Don’t be afraid to rely on your accountant or bookkeeper for help managing your accounts receivable (A/R) or understanding any A/R metrics mentioned here. These professionals understand the importance of accounts receivable management, and they will be happy to help you streamline your processes to ensure you have the best information possible.

advertisement

Accounts receivable defined

Accounts receivable — sometimes called simply “receivables” or A/R — are funds due to you from customers for products or services you have already delivered to them. If your business invoices customers and allows them to pay at a later time, then you have accounts receivable. And if you have accounts receivable, you must stay on top of them in order to ensure you collect the money due to you in a timely manner and according to the payment terms you and your customer agreed upon.

Accounts receivable is an accrual basis accounting term, and the total of your accounts receivable will appear on your company’s balance sheet. Even if you are a cash basis taxpayer, if you extend credit to your customers, you should run your business’s financials on an accrual basis in order to get your company’s full financial picture. Your tax preparer can make the necessary adjustments at tax time to exclude any money you have not yet collected from your customers at year-end.

Accounts receivable aging

In a perfect world, all your customers would pay on time — or even early — and you would have no need for accounts receivable aging. However, this is very rarely the case, and from time to time even the customers with the best track record for prompt payment could fall behind.

Customers might be late paying you for any number of reasons. Maybe the invoice got lost in the mail or perhaps the customer fell upon financial hardship and isn’t able to pay you as promised. Occasionally, a customer will withhold payment because they are dissatisfied with the product or service you sold to them.

Whatever the reason for the late payment, if your customers don’t pay you in full upon receipt of the product or service and if their invoice is outstanding for any length of time at all, then you will need to age your accounts receivable.

Simply put, aging your accounts receivable means measuring the amount of time that has passed since you invoiced your customer and the current date. The number of days becomes your accounts receivable aging, and this information is summarized on the accounts receivable aging report.

Accounts receivable aging report

The accounts receivable aging report summarizes all amounts due to you in the form of unpaid customer invoices. The report is typically broken down in 30-day increments, with totals along the right-hand side and the bottom that show you how much money is due to you from each customer and how much is due in each 30-day period, respectively.

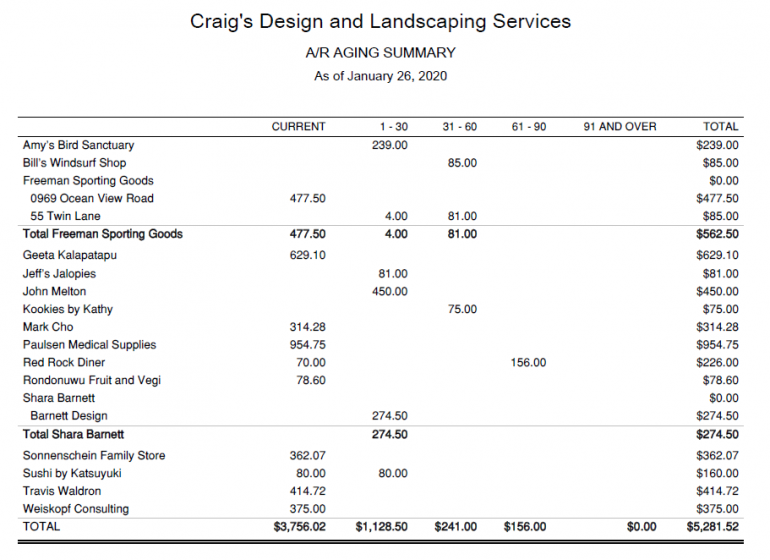

Let’s take an in-depth look at the Accounts Receivable Aging Summary report from the QuickBooks Online sample file.

You’ll notice this sample company — Craig’s Design and Landscaping Services — has amounts due from several customers. The total amount due to the company — $5,281.52 (the amount in the bottom right corner of the report) — should match the amount of accounts receivable shown on the company’s accrual-basis balance sheet as of the date of the report (January 26, 2020).

Along the left-hand side of the report is a listing of each customer that has an open balance with Craig’s Design and Landscaping. Along the right-hand side is the total amount each customer owes.

It’s important to note that this is a summary report, meaning each customer could have multiple invoices due, even if they only have one amount listed on the accounts receivable aging report. Along the top of the accounts receivable aging report are columns that break down the aging of each client’s accounts receivable balance:

Current

The first column shows balances that are not yet due according to the payment terms you have extended to your customers. Ideally, you want most of your accounts receivable balance to be in this column because it means most of your customers pay on time.

1-30

This column shows balances that were due at some point in the past 30 days, but they have not yet been paid.

Let’s say John Melton’s $450 balance is all on one invoice, and that invoice was due on January 25, 2020. Because we ran the accounts receivable aging report on January 26, 2020 — and because we haven’t received and posted John’s payment yet — his balance is appearing in the 1-30 column.

But if John’s invoice was due on December 31, 2019, it would still appear in this column. You can think of each column on the accounts receivable aging report as a “silo” of amounts due or past due for each date range. Depending on their customers’ payment history and behavior, many business owners don’t get overly concerned about amounts in the 1-30 silo. They might give the customer a friendly phone call reminder or send them a statement with a reminder, but most business owners won’t take any further collection action at this point.

31-60

This column can indicate an impending problem for your business. Amounts in this column are now over a month past due, which means you might have been waiting two months or longer for payment, depending on your payment terms.

Let’s say you extended Bill’s Windsurf Shop net 30 terms on its invoice dated 11/1/2019. That means its payment was due on 12/1/2019. Its $85 balance hung out in the 1-30 column until 12/31/2019, but it remained unpaid. Now it’s 1/26/2019 — nearly three months after you made the sale — and you still haven’t been paid. Depending on the amount due, your other sales, cash reserves and other factors, a customer who has an amount due in the 31-60 column can cause significant cash flow issues for your business.

Most businesses will get a bit more aggressive on collecting from customers with an amount in the 31-60 column. They might refuse to do additional work for the customer until the balance is paid in full, and they might refuse to extend credit to that customer in the future. Some business owners will even start mentioning the possibility of sending the amount to collections at this point.

61-90 and 91 and over

These two columns can be the most dangerous columns. At this point, the sale was made at least three months ago. The customer has derived the benefits from the product or service, and they still haven’t paid you. What’s worse, the customer might have forgotten about the benefits they derived from your product or service, making them less willing to pay. Most businesses will take more aggressive collection actions against amounts in these columns.

The total of the amounts due in each date silo is shown at the bottom of each column.

How to use the accounts receivable aging report

As demonstrated above, you can use the accounts receivable aging report to quickly determine which customers might need to be more aggressively pursued for payment. Plus, there are a couple of additional uses:

Project cash flow

Remember, accounts receivable indicates sales you have made but for which you have not yet received payment. While you wait for payment, your normal business operations continue, meaning you have expenses you must pay even though you haven’t received payment for the work you’ve done or the products you’ve delivered. If your cash position is getting tight, you can use your accounts receivable aging report to project your upcoming cash flow.

Using the above example, let’s say Craig has $1,000 in his business checking account, and he knows he has $3,000 worth of expenses coming up in the next 30 days. However, he also knows most of his customers pay their invoices on or before the due date, and the customers in the Current and 1-30 days silos have a good track record of making timely payments. Looking at his accounts receivable aging report, he can deduce he will likely have enough money to cover his upcoming expenses.

Determine credit policies and payment terms

Maybe your business has a high success rate of collecting from customers, but they take a long time to pay. At any given time, most of your accounts receivable is in the 31-60 or 61-90 column. This can indicate you need to either tighten up your credit policies or adjust your payment terms. After all, the payment terms you offer on your invoices directly influence when your customers pay you. If most of your accounts receivable balance is in the 31-60 or 61-90 column, consider tightening up your payment terms — maybe offering net 15 instead of net 30 terms — to collect payments faster. If you consistently have customers who are slower to pay than others, you might have to consider revoking their credit, at least temporarily. Don’t let “being nice” get in the way of your business’s cash flow health.

When to be concerned

Let’s say you’ve been reviewing your financial statements on a monthly basis, and you notice the accounts receivable balance on your balance sheet is creeping steadily upward. You ask your bookkeeper for your accounts receivable aging reports for the last few months, and you notice several customers have large balances in the 61-90 column.

With increasing accounts receivable balances in one of the “danger” columns, you might be tempted to think you are heading for a cash flow or collections crisis.

Before you panic, take a moment to look at your accounts receivable days to pay report. If your accounting software doesn’t provide this report, you can easily calculate the accounts receivable days to pay for yourself using this formula:

(Accounts Receivable / Annual Revenue) x 365 = A/R Days to Pay

This amount can be calculated across all your customers, but you can also calculate it for individual customers.

For example, let’s say Craig’s Design and Landscaping customer Paulsen Medical Supplies has a balance due of $12,350 in the 61-90 column. It's a long-time customer, so Craig looks back at Paulsen’s payment history over the past few years.

Craig might want to reassess their payment terms or the amount of credit he extends to them, but he probably doesn’t want to pursue collections yet. Doing so could damage his relationship with the customer since they have a history of paying within this timeframe.

If, however, Paulsen usually pays within 30 days, it would be prudent for Craig to reach out to them to determine why they are late paying now.

You can — and should — determine your accounts receivable days to pay for your entire company on a regular basis. Doing so will help you determine when customers are starting to pay more slowly, which will, in turn, help you prevent cash flow problems in your business.

A version of this article was first published on Fundera, a subsidiary of NerdWallet.

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

Best Accounting Software for Small Businesses

More like this

Related articles