Equifax Business Credit Report: What It Is, How to Use It

Equifax’s business credit reports let you check the financial health of suppliers, competitors and other businesses.

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

Equifax business credit reports give business owners insights into the financial health of other companies. These business credit scores can help you assess competitors, acquisition targets, suppliers and potential business partners.

Want your own business credit report from Equifax? That’s only possible if you’re actively applying for a new credit line, and even then, you’ll have to jump through some hoops. You’re better off keeping an eye on your business through other commercial bureaus like Dun & Bradstreet, which offers free access to your company’s business credit report.

Keep reading to learn what goes into an Equifax business credit report, including information included and what the various scores mean.

What is an Equifax business credit report?

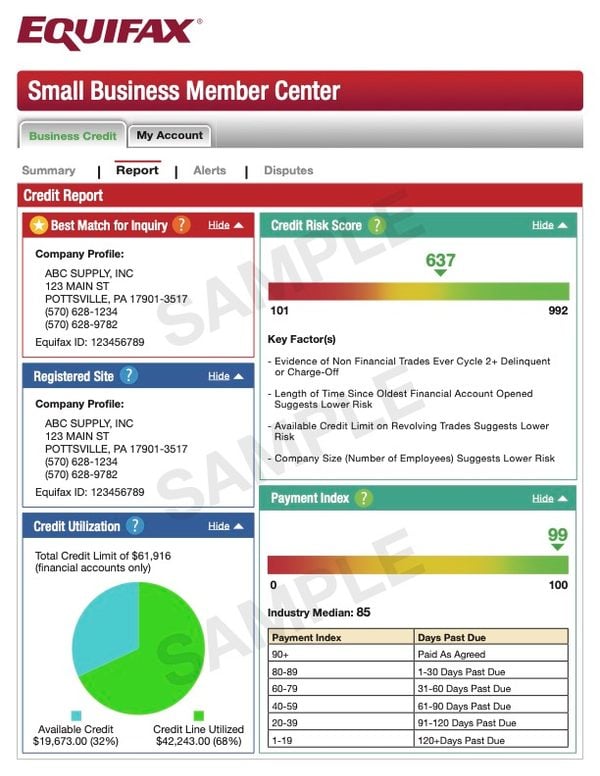

Equifax is one of three main commercial credit bureaus. Business credit reports are also available from Dun & Bradstreet and Experian, though each is set up differently. An Equifax business credit report contains a variety of information about a business, including:

- Company profile: Business name, phone numbers, addresses and alternate business names (DBAs). You will also find a Standard Industrial Classification (SIC) code, and owner and guarantor names, and number of employees.

- Credit summary: A snapshot of a business' credit accounts, such as bank loans, equipment leases, business credit cards and supplier credit lines.

- Public records: Business registration information, as well as liens, judgments, Uniform Commercial Code filings (UCC filings) and bankruptcies reported against a business.

- Payment trends: Average time a business takes to repay suppliers (over 12 months) and how it compares to industry averages.

Understanding Equifax business credit scores

Equifax business credit reports deliver multiple distinct scores that assess different aspects of a business's financial health.

Payment index score (1 to 100)

The number is based on a business’s payment history. If the company pays its bills on time, the score will be between 90 and 100. If even one bill was paid late, the score will decline depending on how far past due. A serious delinquency (more than 120 days past due) will typically result in a score between 1 and 19.

Credit risk score (101 to 992)

This score tells potential creditors how likely a business will be delinquent (pay more than 90 days late) in the next 24 months. The higher the score, the lower the credit risk.

Failure risk score (1,000 to 1,610)

This score uses commercial demographic data, credit and payment information, and company legal records to asses a business's risk for closing withing the next 12 months. A lower score indicates a higher risk of failure.

View a sample Equifax business credit report

How to get an Equifax business credit report

You can request a business credit report via the contact form on the Equifax website if you want to gain insights into the financial health of your competitors, acquisition targets or prospective suppliers and/or customers.

Equifax is very opaque with its pricing, but in the past has charged $99.95 for a single report or $399.95 for a pack of five credit reports.

You can get your company’s Equifax business credit report for free if you're actively applying for business credit, like a loan or credit card. You’ll need to contact an Equifax representative and provide proof of a business credit application. Otherwise, Equifax does not offer direct access to your own report.

Resolving errors on your Equifax business credit report

Contact Equifax directly via its customer support hotline (1-888-378-4329) if you spot any mistakes on your Equifax business report. Then, contact the organization that supplied the information to Equifax.

When you initiate a dispute, clearly identify the disputed item on your report, provide facts and information that prove an error was made, and request deletion or correction. You should also check your business credit report with other commercial credit bureaus — Dun & Bradstreet and Experian — to see if the errors persist with those bureaus.

If your report is missing key information, like trade lines or credit accounts, reach out to your creditors and ask them to supply your information to the credit bureau.

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

Related articles