Excise Tax: The Ultimate Guide for Small Businesses

An excise tax is an extra tax added to certain products or services. Learn what this might mean for your business.

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

This article has been reviewed by tax expert Erica Gellerman, CPA.

An excise tax is a tax charged for items that are frequently seen either as socially harmful or as a luxury good or service. Luxury vehicles are subject to excise tax, as are alcohol, gas, airline tickets, indoor tanning and more. Excise tax is sometimes also called a “sin tax” because it’s on goods that are considered unhealthy, and it produces billions of dollars in federal and state revenue each year.

Excise tax is thought to help decrease the use of potentially harmful products and services that are taxed at a higher rate than other non-harmful products or services might be. In fact, experts concluded that an increase in excise taxes and prices of tobacco products helped reduce overall tobacco consumption, according to a study by the International Agency for Research on Cancer.

Items that incur an excise tax include (but are not limited to):

- Alcohol.

- Tobacco.

- Vaping and e-cigarettes.

- Medical marijuana.

- Recreational marijuana.

- Indoor tanning.

- Gambling.

- Sports betting.

- Fuel (including gas).

- Vehicles.

- Air transportation.

- Firearms.

- Ammunition.

Does your business have to pay excise tax?

Businesses selling certain items or services have to pay excise taxes. Depending on where you do business there are various state and local excise taxes to pay in addition to the nationwide federal excise taxes that will also apply.

Businesses that sell alcohol, tobacco and/or firearms have to register with the Alcohol and Tobacco Tax and Trade Bureau (TTB), while businesses selling other items or services subject to excise tax will deal directly with the IRS. Some products that are subject to excise tax also need to be registered before you can begin selling them.

If you fail to register these products before you start selling them, you can face a penalty of $10,000 for each initial failure, plus $1,000 for each day thereafter, according to the IRS.That fine is in addition to any other tax that is owed at the time.

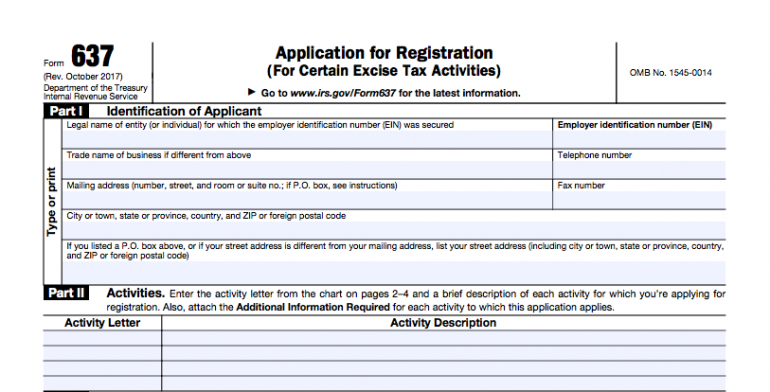

To register with the IRS you’ll need to fill out Form 637 and fax or mail a hard copy of it to the IRS. Once that application is approved you’ll get a registration letter. You can check your registration status online with the IRS. Below is an example of part of the Form 637.

How excise taxes are calculated

There are two ways an excise tax is calculated. The tax is either ad valorem or specific. Ad valorem means the tax is a set percentage, meaning as a business you have to pay a set percentage of the sale you make. An example of this is the excise tax charged to indoor tanning providers. The excise tax on indoor tanning is 10% and, according to the IRS, should be collected at the time that the purchaser of the tanning service makes their purchase. So if the tanning business plans to charge $10 for a session, the tax would be $1. If it then passes that cost to the purchaser, the customer’s total would be $11.

A specific tax, on the other hand, is a set dollar amount charged to a certain good. The federal excise tax on a pack of cigarettes for example is $1.01. Usually states also have their own excise taxes on cigarettes in addition to the federal tax. The state with the highest excise tax on a pack of cigarettes is Connecticut where the excise tax is $4.35 per pack, in addition to the federal excise tax, increasing the total by more than $5 for each pack.

How is excise tax different from sales tax?

A sales tax and an excise tax are very similar, but the main difference is that excise tax is only collected on the sale of very specific items. Sales tax on the other hand is added to nearly every item a customer buys or that you as a small-business owner sells, and it’s always a percentage of the purchase. Excise tax isn’t always a percentage of the purchase.

Do you have to tell customers they’re being charged an excise tax?

Some business owners choose to tell their customers about the excise taxes included in the price of the goods or services while others don’t disclose this information. When the tax on indoor tanning was implemented as part of the Affordable Care Act, some owners of indoor tanning businesses decided to tell customers about it as a way to explain the increase in prices at their businesses.

Many business owners don’t disclose the excise tax to their customers though, and simply include it in the cost of items when pricing their goods or services. As a business owner, it will be up to you whether you disclose this information upfront with your customers.

What are excise taxes used for?

Money collected from excise taxes is either sent to a general fund or it’s set aside for specific trust funds. It makes up a small percentage, about 3%, of the federal revenue on a yearly basis. In general, the taxes are used to raise funds for public efforts and programs that benefit people in the U.S. They’re sometimes also used to promote positive behaviors or improvements, like road repairs and maintenance.

When are excise taxes paid?

Federal excise taxes are due on a quarterly basis and they’re due a month after the end of the quarter. To file you must fill out the Form 720 and either mail it to the IRS by the due date or file it online.

The IRS accepts both paper and electronic submission of the Form 720. Filing the form online comes at whatever cost the provider determines for the service fee. Be aware that not all excise tax forms can be filed electronically; there are still some that you might be responsible for that have to be physically mailed in. Those that can be filed electronically, according to the IRS, are: Form 2290, Heavy Highway Vehicle Use Tax; Form 720, Quarterly Federal Excise Tax; and Form 8849, Claim for Refund of Excise Taxes (Schedules 1, 2, 3, 5, 6 and 8).

The state and local excise taxes are on their own schedules. They’re due at a different time in each state and not always due when the federal excise tax is due, so be sure to check the details of the excise tax your business has to pay to make sure you’re on time. In some states, like Massachusetts for example, the excise tax on your vehicle would be due annually at a rate of $25 for every $1,000 your car is considered worth or is valued at.

The excise taxes owed to the Alcohol and Tobacco Tax and Trade Bureau are on a different schedule, as well. Some businesses file on an annual basis while others file quarterly or semi-monthly, depending on what good or service you sell. For example, firearms and ammunition require quarterly federal excise tax returns, as do indoor tanning services. The full list of excise tax due dates can be found online, and how frequently you file will have to do with the specifics of your business and your business type. The tax rates for the various types of alcohol, firearms and ammunition are available from the TTB, as well.

A version of this article was first published on Fundera, a subsidiary of NerdWallet

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

Related articles