Form 3800 Instructions: How to Fill out the General Business Credit Form

Here are step-by-step instructions for IRS Form 3800, for entrupeneurs claiming small-business tax credits.

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

There are two main ways for entrepreneurs to save on their small-business taxes. One way is to claim tax deductions, and the other is to take advantage of small-business tax credits. Tax credits directly decrease your tax bill, reducing what you owe to the IRS.

If you claim multiple small-business tax credits, you’ll need to submit Form 3800, General Business Credit to the IRS, along with your tax return. Our Form 3800 guide provides step-by-step instructions for completing this complex form, including all required calculations.

Who needs to fill out IRS Form 3800?

Form 3800 lets you calculate the total amount of business tax credits you’re eligible to claim in a single tax year, including credits that you’ve carried back or carried forward from other tax years. The general business credit is actually a collection of several different small-business tax credits. On Form 3800, you’ll add up the value of all these different credits, ensuring that you don’t exceed the dollar limit on credits that the government allows.

You’ll need to complete IRS Form 3800 if you’re claiming more than one of the following credits:

- Investment credit (Form 3468).

- Qualifying therapeutic discovery project credit.

- Work opportunity credit (Form 5884).

- Biofuel producer credit (Form 6478).

- Credit for increasing research activities (Form 6765).

- Disabled access credit (Form 8826).

- Renewable electricity, refined coal and Indian coal production credit (Form 8835).

- Empowerment zone employment credit (Form 8844).

- Indian employment credit (Form 8845).

- Credit for employer Social Security and Medicare taxes paid on certain employee tips (Form 8846).

- New markets credit (Form 8874).

- Credit for small employer pension plan startup costs (Form 8881).

- Credit for employer-provided child care facilities and services (Form 8882).

- Qualified railroad track maintenance credit (Form 8900).

- Biodiesel and renewable diesel fuels credit (Form 8864).

- Alternative motor vehicle credit (Form 8910).

- Alternative fuel vehicle refueling property credit (Form 8911).

- Credit for employer differential wage payments (Form 8932).

- Qualified plug-in electric drive motor vehicle credit (Form 8936).

- Qualified plug-in electric vehicle credit.

- Small-business health care tax credit (Form 8941).

- Employee retention credit (Form 5884-A).

- Employer credit for paid family and medical leave (Form 8994).

- General credits from an electing large partnership (Schedule K-1, Form 1065-B).

The credits shown above are a partial list. Consult the IRS instructions for a complete list of general business credits. The list updates from year to year as Congress adds new credits, or existing credits expire or get repealed.

Each tax credit has its own individual tax form, noted in parentheses above, called the source form. If you’re claiming just one credit, you only need to submit the source form for that credit. If you’re claiming more than one tax credit, then you’ll need to fill out the source form for each credit, plus Form 3800.

Logan Allec, certified public accountant and owner of Money Done Right, explains that partners in pass-through entities, such as partnerships and S corporations, don’t have to fill out the source form. “Let’s say that ABC Chemicals LLC is taxed as a partnership and generated $10,000 of research and development credits during the year. ABC Chemicals LLC would have to complete the source form (Form 6765) for the research and development credit, but the partners of the firm wouldn’t. If ABC Chemicals LLC is owned equally four ways, each partner could simply report $2,500 of R&D credit on their Form 3800; they would not each have to complete a separate Form 6765 because it was already completed at the partnership level.” Sole proprietors have to complete the source form.

Form 3800 also regulates the carryforward or carryback of tax credits. If you don’t claim a tax credit for a particular tax year, you can sometimes apply the credit to the preceding tax year (carryback) or to future tax years (carryforward).

AD

Boost Your Credit for a Strong Future

Better credit¹ can open up new financial opportunities for your business.

Start building faster¹

On average, users with starting credit under 600 saw +84² points in 1 year with on-time payments.

The power of tri-bureau reporting

Kikoff reports to Equifax, Experian, & TransUnion monthly.

Fast and easy

No credit check. No interest. No hidden fees.

IRS Form 3800 instructions: A step-by-step guide

Form 3800 can be a complicated tax form to fill out for small-business owners, so we recommend using a tax professional to complete this one. Instead of filling out the form in a linear fashion, you’ll end up jumping back and forth between different parts of the form.

Here are the basic instructions for completing IRS Form 3800:

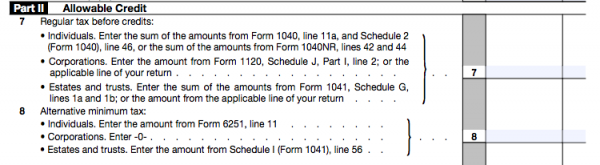

1. Calculate your regular tax liability

Before you can calculate your general business credit, you need to determine your regular tax liability. This figure goes in Part II, Line 7 of Form 3800. To figure out your regular tax liability, you’ll need to know your business income and any deductions that you’re eligible for. In general, keep in mind that you can’t claim both a deduction and a credit for the same business expense.

A shortcut to find your regular tax liability is to refer to the appropriate tax form for your business entity type. That’s Schedule C for a sole proprietor, Form 1065 for a partnership or limited liability company, Form 1120 for a C corporation and Form 1120S for an S corporation.

2. Calculate your alternative minimum tax

General business tax credits cannot offset your alternative minimum tax, or AMT. The AMT was created to ensure that high-income earners pay their fair share of taxes. It primarily affects individuals who report $200,000 or more of gross income.

If you’re a high-income earner, then you’ll essentially need to calculate your tax liability in two ways: once under regular tax rules and again under AMT rules. Then, you’ll need to pay whichever tax bill is higher. The AMT tax rules are stricter because you can’t claim the standard deduction or certain popular itemized deductions.

Calculating AMT is complicated because you’ll need to add some deductions and adjustments back into your income. We recommend asking a tax professional to help you with this calculation. You can understand more about AMT on IRS Form 6251. For purposes of the general business credit form, all income earners should calculate their AMT.

At this point, you’ll need to calculate two other numbers that will be important as you fill out Form 3800. The first is net income tax, which is your regular tax liability plus AMT. The second is tentative minimum tax, which is the AMT minus the foreign tax credit. The foreign tax credit is only available to individuals or businesses that pay taxes to a foreign government.

Source: IRS

3. Calculate your allowable general business credit

Once you have your regular tax liability and alternative minimum tax, you can apply a formula to find out your dollar limit for the general business tax credit.

Your general business tax credit can’t exceed your net income tax, minus the greater of one of the following:

- Your tentative minimum tax.

- 25% of your net regular tax liability that is more than $25,000 ($12,500 if married filing separately).

Net regular tax is the regular tax liability minus certain nonrefundable tax credits (usually personal tax credits). Let’s take an example, assuming that your net income tax is $48,000, tentative minimum tax is $40,000, net regular tax liability is $45,000 — 25% of the net regular tax liability would be 25% times $20,000, or $5,000. Since the tentative minimum tax is greater, that is the limit you should use. The general business tax credit can’t exceed $48,000 minus the $40,000 tentative minimum tax, or $8,000.

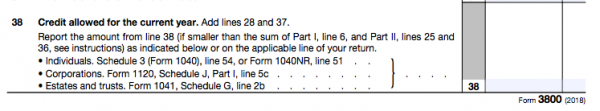

Source: IRS

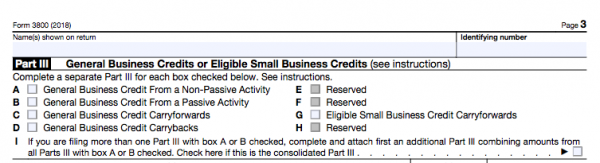

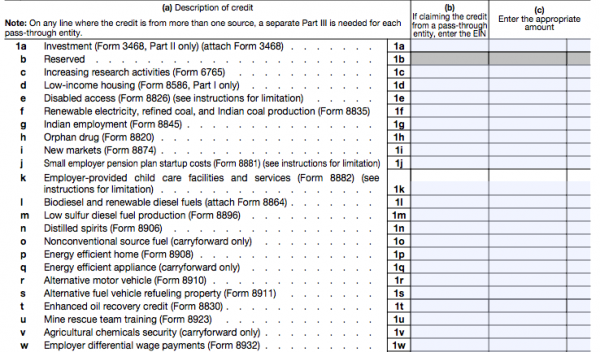

4. Carry over individual business tax credits

The most important step is to properly carry over all the individual tax credits you’re claiming onto Part III of Form 3800. There, you’ll enter the amount of the credit, plus the employer identification number, or EIN, if the credit is sourced from a pass-through entity. You’ll also identify different types of credits that you’re claiming. For instance, carryforward credits are supported separately from carryback credits and passive income credits. Passive income is any income that’s derived from a business in which you don’t actively participate.

Source: IRS

The order in which you claim credits, says Dawn Delia, managing attorney at Delia Law, is important because “credits are applied on a first-in, first-out basis. This means offsetting the earliest-earned credits first. In any given tax year, the earliest carryforwards should be claimed first. Then, you would claim the general business credits earned in that year. Finally, you claim the carryback to that year.”

Claim your credits in the following order:

- Carryforwards to this year, the earliest ones first.

- The general business credit earned this year.

- Any carrybacks to this year.

General business credits should be claimed in the order listed earlier in “Who Needs to Fill Out IRS Form 3800?” starting with the investment credit. For credits not shown on that list, consult the official IRS instructions. Any personal tax credits or foreign tax credits should be carried over before the general business tax credit.

The total general business credit consists of all the credits you’re claiming for this tax year, plus any carryforward or carryback credits for this tax year. You’ll report this total general business credit on line 38 of Part II, and subtract the amount from your final tax bill.

Source: IRS

5. Claim carryforwards and carrybacks

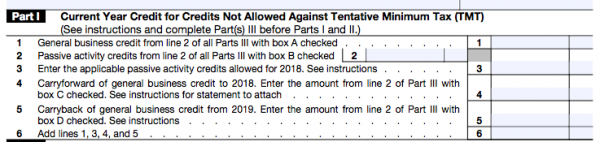

In Part III, you’ll specify if you’re claiming any carryforward or carryback credits. If you check off the carryback or carryforward box in Part III, you’ll need to fill out a separate Part III for the carrybacks and a separate one for the carryforwards. Carrybacks and carryforwards also get reported in Part I, lines 4 and 5, along with other types of credits.

Source: IRS

Carryforwards and carrybacks are used if you can’t claim a specific tax credit in the current tax year. For example, the credit might exceed your allowable limit because you operated at a loss. In that case, you won’t be eligible to claim the credit this year.

The IRS says that general business tax credits can be carried back one year, as long as that credit was available and you were eligible for it in the preceding year. If you carry back a tax credit, your tax bill for the previous year will decrease. In most instances, you will need to amend that year’s tax return to claim a carryback credit. As a faster alternative, you can sometimes claim a tentative tax refund from the government.

General business credits can be carried forward for 20 years. Some credits, such as the qualifying therapeutic discovery project credit and the qualified plug-in electric vehicle credit, are carryforward only. You can’t claim these credits in the current tax year, but must apply them to future tax years until they are used up.

The final thing to remember is that the general business tax credit is nonrefundable. This means that the credit cannot reduce your tax liability below zero. In contrast, certain personal tax credits, such as the earned income credit and the education credit, are refundable tax credits. In those cases, if your tax liability goes below zero, the government will actually send you a check for the difference.

A version of this article was first published on Fundera, a subsidiary of NerdWallet.

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

Related articles