What Is IRS Form 720? How to Calculate and Pay Excise Taxes

Small businesses that sell goods or services that incur excise taxes need to file IRS Form 720 quarterly.

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

If your small business deals in goods and services subject to excise tax — such as air transportation, fishing equipment or gasoline — then you may have to file IRS Form 720 on a quarterly basis to report and pay your federal excise tax.

Here's what you need to know about Form 720, including a step-by-step guide to completing it.

What is a 720 form?

IRS Form 720, the Quarterly Federal Excise Tax Return, is a tax form for businesses that sell goods or services subject to excise tax to report and pay those taxes.

IRS Form 720 consists of three parts, as well as Schedule A, Schedule T and Schedule C sections and a payment voucher (called Form 720-V). If your business is responsible for completing Form 720, you must do so quarterly and can file electronically or by mail. Payments for excise taxes, however, are required semimonthly (twice a month) and should be made by electronic funds transfer.

What is an excise tax?

An excise tax is a tax the federal government imposes on specific services or goods manufactured in or imported into the United States. Excise taxes are often included in the price of products such as gasoline or alcohol. Here’s more information about excise taxes.

Who files Form 720?

Your business needs to fill out IRS Form 720 if you sell goods or services that incur excise taxes. These products and services can include, but are not limited to:

- Telephone communications.

- Air transportation.

- Gasoline.

- Passenger ship transportation.

- Coal.

- Fishing equipment.

- Indoor tanning services.

- Bows and arrows.

- Tires.

- Vaccines.

Form 720 lists all of the products and services that incur excise taxes. If your business does not deal with any of these products or services, you do not have to fill out this tax form.

Two other conditions determine whether you need to complete Form 720, per the instructions from the IRS:

- “You were liable for, or responsible for collecting, any of the federal excise taxes listed on Form 720, Parts I and II, for a prior quarter and you haven’t filed a final return.

- “You were liable for, or responsible for collecting, any of the federal excise taxes listed on Form 720, Parts I and II, for the current quarter.”

Although alcohol, tobacco and firearms require excise taxes, they're not covered under IRS Form 720. These products are regulated by the Alcohol and Tobacco Tax and Trade Bureau, and taxes must be filed using the return form on its website.

When to fill out Form 720

Businesses file IRS Form 720 quarterly. Here are the deadlines:

| Quarter covered | Due by |

|---|---|

| First quarter: January, February, March. | April 30. |

| Second quarter: April, May, June. | July 31. |

| Third quarter: July, August, September. | Oct. 31. |

| Fourth quarter: October, November, December. | Jan. 31. |

If the due date for filing Form 720 falls on a weekend or legal holiday, you can file by the next business day.

Paying your excise taxes

You must pay excise taxes semimonthly. The IRS considers a semimonthly period as the first 15 days of the month (first semimonthly period) or the 16th through the last day of the month (second semimonthly period).

- If your business is paying excise taxes for communications or air transportation, you have the option to pay according to an alternative schedule as dictated by the Form 720 instructions.

- Excise tax deposits must be made to the IRS by electronic transfer (aka an ACH deposit) and submitted at least one day before the date the deposit is due. If the due date is Jan. 15, the payment must be submitted by Jan. 14.

- If a payment due date falls on a weekend or legal holiday, the previous business day becomes the de facto deadline.

Where to find Form 720

IRS Form 720 and its instructions are on the IRS website.

- You can print and mail a completed form to the IRS.

- You can file electronically by working with a tax pro who participates in the IRS e-file program for excise taxes. The IRS has a database of participating preparers if you want to find one in your area.

Form 720 instructions: A step-by-step guide

Now that you've got the basics, let’s dive deeper into the specific parts of the form and how to fill them out.

1. Gather accounting documents and fill out your business information

Your accounting software can generate reports to help you calculate your excise taxes for Form 720. Depending on your specific business, your excise taxes are either a percentage of total sales or a percentage of units sold.

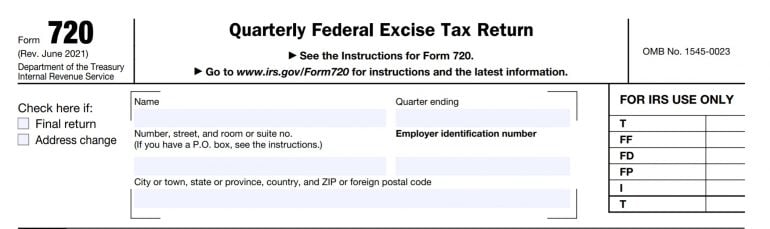

The first part of IRS Form 720 asks for basic business information such as your name, address, end date of the respective quarter and your employer identification number, or EIN.

2a. Calculate the appropriate excise taxes and fill out Form 720 Part I

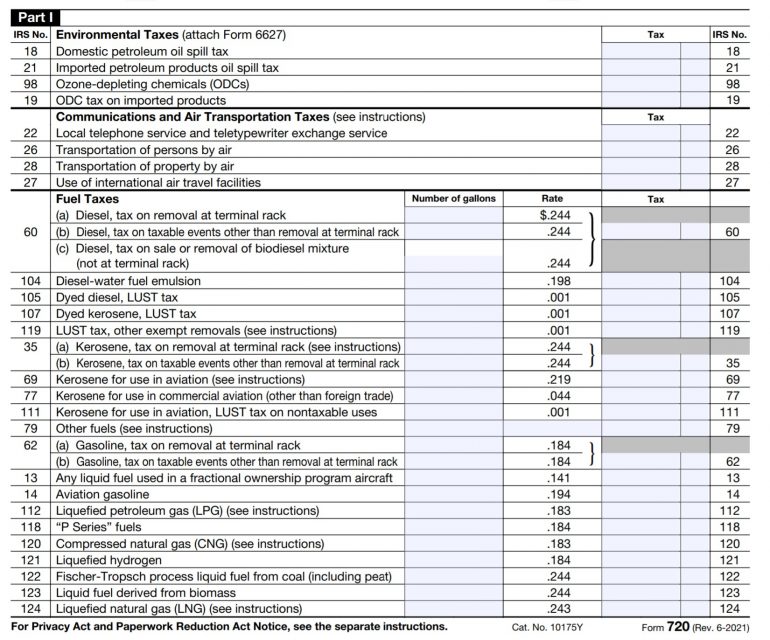

Complete Part I of Form 720 if your business needs to pay the following taxes:

- Environmental taxes: petroleum oil spills, imported petroleum products, ozone-depleting chemicals (if you must pay these environmental taxes, you’ll also have to complete IRS Form 6627).

- Communication and air transportation taxes: phone service or air transportation.

- Fuel taxes: diesel, kerosene, gasoline, natural gas, biomass.

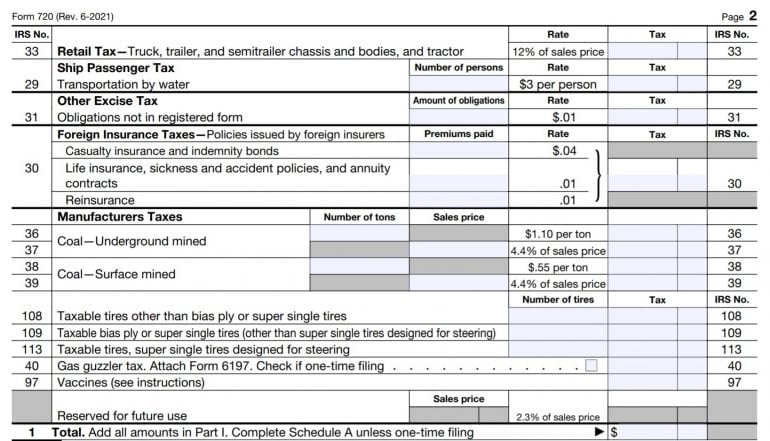

- Retail taxes: trucks, trailers, tractors.

- Ship passenger tax.

- Foreign insurance taxes: insurance policies issued by foreign insurers.

- Manufacturers taxes: coal, tires, “gas guzzlers,” vaccines.

Part I (as well as the IRS Form 720 instructions) details specifically what products fall into this section. If your business qualifies, use the respective rate in the “Rate” column to calculate the taxes your business is responsible for.

Based on your total sales/units sold and the respective rate, fill in your business’s tax responsibility in the “Tax” column. At the bottom of Part I, add up all of the taxes and fill in the total.

If none of the excise taxes in Part I apply to your business, go to Part II. However, if your business has any tax liability in Part I, complete the Schedule A section of IRS Form 720.

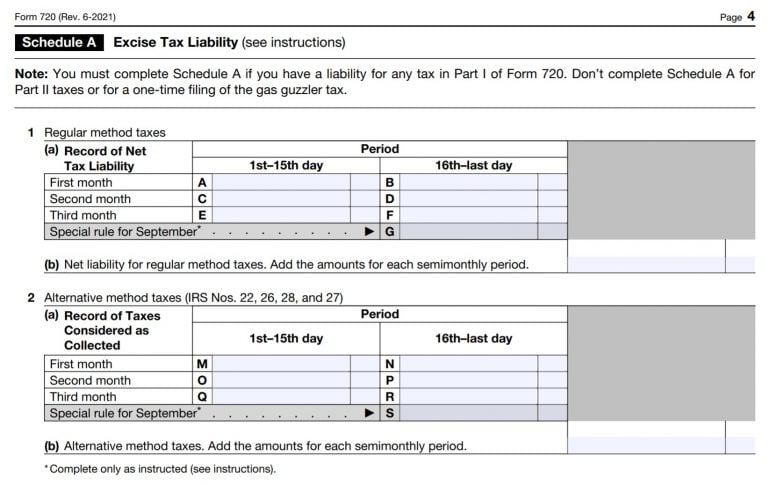

2b. Calculate the net tax liabilities and fill out Form 720 Schedule A

The Schedule A section of IRS Form 720 is for businesses that have a tax liability in Part I. If you don’t have liability from Part I but do have liability for Part II, you do not need to fill out Schedule A.

Schedule A reports your business’s net tax liability. In Schedule A, add the net tax liability for each tax for each semimonthly period and enter the total in the applicable box.

Complete No. 1 of Schedule A unless you are liable for any of the alternative-method taxes, as indicated by the appropriate IRS numbers (22, 26, 28 or 27 — which correspond to Part I). If your business is responsible for any of those taxes, complete No. 2 of Schedule A.

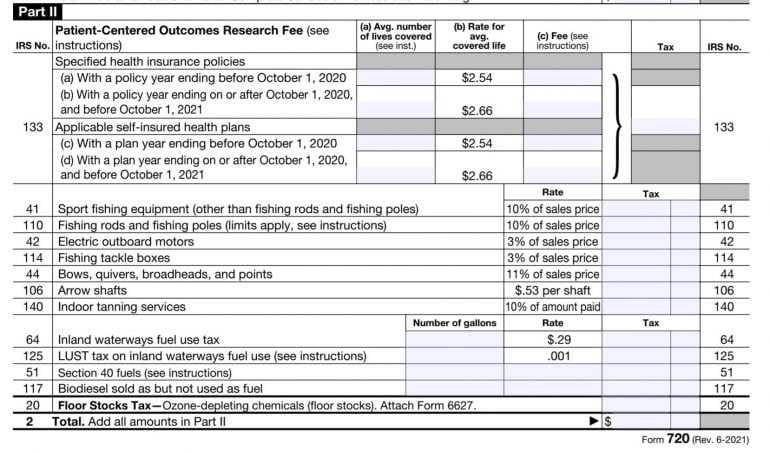

3. Calculate the appropriate excise taxes and fill out Form 720 Part II

Complete Part II of Form 720 if your business provides any of the following products or services:

- Specified health insurance policies.

- Fishing equipment.

- Electric outboard motors.

- Bows and arrows.

- Indoor tanning services.

- Waterways fuel.

- Biodiesel sold as fuel but not used as fuel.

Complete Part II the same way as you would Part I. If your business qualifies for any of the goods or services in Part II, calculate your tax using appropriate documents and the rate in the “Rate” column. Fill in the calculated tax in the “Tax” column and add up the total at the bottom of Part II.

The tax for health insurance is calculated differently than the other categories. It uses the average number of lives covered, as opposed to units sold or total sales.

4. Determine if you need to fill out Schedule T or Schedule C and complete these sections of Form 720

Before moving to Part III, determine if you need to fill out Schedule T or Schedule C of IRS Form 720. Both Schedule T and Schedule C are related to businesses that deal with fuel.

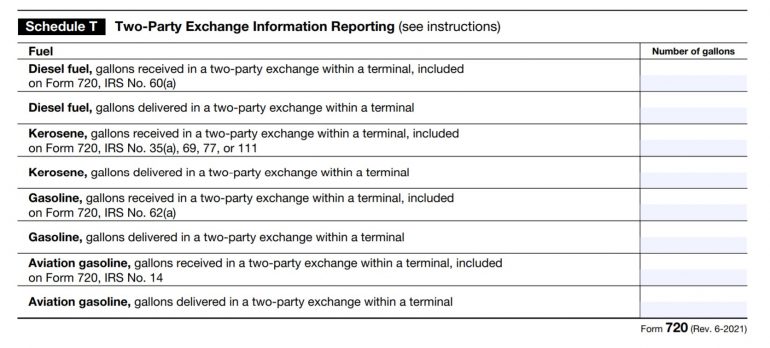

Schedule T

You need to complete the Schedule T section of Form 720 only if your business produces or sells diesel fuel, kerosene, gasoline or aviation gasoline. Schedule T reports the total taxable fuel gallons received or delivered in a two-party exchange within a terminal.

In a two-party exchange, the person receiving the fuel, not the person delivering it, is liable for the tax imposed on the removal of taxable fuel from the terminal. If your business deals with any of these fuel types according to the IRS definition of a two-party exchange, complete Schedule T.

Schedule C

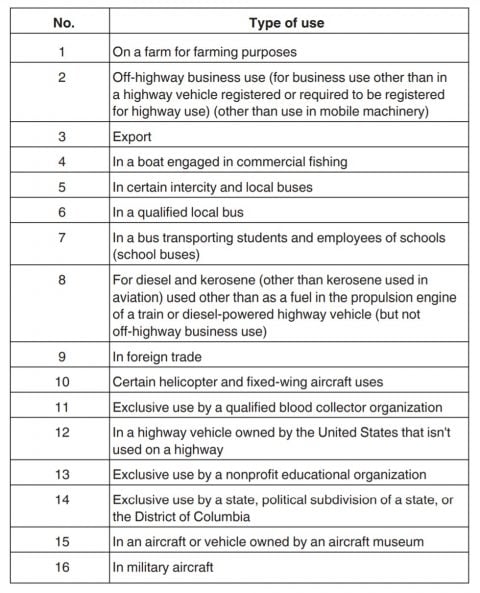

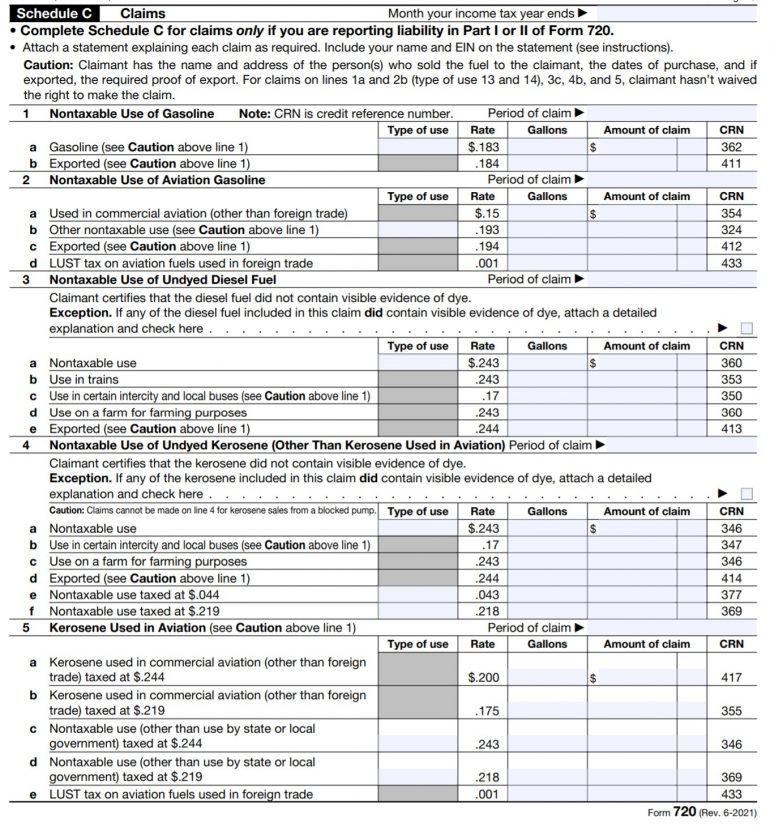

Like Schedule T, Schedule C applies to businesses that deal with one of the fuel types (and a few tire types) indicated in Parts I and II of IRS Form 720.

If you're liable for taxes on Part I or Part II, you may be able to cut your tax bill by filing a claim on Schedule C. However, only certain types of fuel and use cases qualify for a Schedule C claim. The IRS indicates the use types that can qualify for a Schedule C:

If your fuel business falls under one of the use cases in this chart, you can fill in Schedule C by indicating the use case number, the tax rate, gallons amount and the total dollar amount of your claim.

Once you’ve completed any appropriate columns in Schedule C, add up your final total on the last Schedule C page and enter it on line 15. Use this total to complete Part III of IRS Form 720.

5. Fill out Part III of Form 720

On Part III of IRS Form 720, you’ll calculate your total taxes by adding the totals from Part I and Part II and putting the sum in box 3.

If you completed Schedule C, add your total claims amount in box 4.

In box 5, enter your excise tax deposits made for the quarter. If you overpaid in previous quarters, write this amount in box 6 and box 7. Box 8 is the total of boxes 5 and 6, and box 9 is the total of boxes 4 and 8. If your total tax in box 3 is greater than box 9, enter the difference, which is your balance due, in box 10. You will have to pay this amount with your return filing of Form 720.

On the other hand, if box 9 is greater than box 3, you can indicate what you wish to do with the overpayment. You can apply the amount to your next return or have it refunded to you.

Finally, sign and date IRS Form 720. If you're going to designate a third party, such as your accountant, to discuss your return with the IRS, indicate this in the “third party designee” section. Additionally, if your accountant or other tax professional prepared Form 720 for you, they fill in their information in the “paid preparer use only” section.

6. File Form 720 and pay your balance due, if necessary

File Form 720 before the specified due date. There are two ways to file:

- Mail Form 720 directly to the IRS.

- File electronically if you’re completing the form through the IRS e-file program.

When you file Form 720, you must also pay your balance due (from box 10 of Part III).

- You can pay your balance with a direct debit, check or money order.

- If you’re filing electronically, you must pay with a direct debit.

- If you’re filing physically, you can complete Form 720-V; this payment voucher form will accompany your check or money order to pay your balance due. You will then send Form 720-V in with your completed Form 720 when you file to the IRS.

Before you file Form 720, make copies of your completed form for your records.

IRS Form 720: Tips for completing the form

To help streamline completing IRS Form 720, here are some tips to keep in mind:

- Prepare ahead of time. One of the best ways to avoid errors and stress when completing tax forms such as Form 720 is to stay organized. Keep track of your inventory, sales and other important financial metrics using good accounting software or an accountant. This way, when it’s time to fill out Form 720, all of your information will be up to date, organized and complete. Additionally, keep up with the semimonthly excise tax payments and quarterly filing deadlines for Form 720. If you’re unprepared, you’re more likely to make mistakes on the form or even file late, which may trigger penalties.

- File electronically. You may be able to save yourself time, paper, stamps and hassle by using the IRS’s e-file program. Plus, you won’t be relying on the mail system to meet your deadline. In addition, filling out Form 720 electronically can make it easier to look up information in your accounting software, refer to the IRS filing instructions, and check for recent IRS updates.

- Use a tax professional. If you hire a tax advisor to complete, or help you complete, Form 720, you’ll have access to someone with years of experience. A good tax professional should be able to complete the form quickly and accurately, and if issues arise after you file Form 720, your tax pro will be able to address them. Also, a tax pro may be able to represent you before the IRS.

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

Related articles