Form 8829 Instructions: Claim Home Office Deduction

Learn about IRS Form 8829, including who qualifies and how to fill out this form to claim a home office deduction.

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

IRS Form 8829 is one of two ways to claim a home office deduction on your business taxes. Only self-employed people are eligible to claim this deduction. If your business qualifies for the home office deduction, you’ll file Form 8829 with your Schedule C, profit or loss from business.

There are two ways to claim the deduction: using the simplified method and reporting it directly on your Schedule C, or by filing IRS Form 8829 to calculate your total deduction.

This guide will focus on the latter option to explain what Form 8829 is, and how to file to claim your home office deduction.

What is tax Form 8829?

If you run a business out of your home or have a home office, you might be able to take a home office deduction on your tax return. One way to do this is to keep careful records and file Form 8829 with your tax return, but by doing this you can calculate and claim your home office deduction and save money on your taxes.

AD

Boost Your Credit for a Strong Future

Better credit¹ can open up new financial opportunities for your business.

Start building faster¹

On average, users with starting credit under 600 saw +84² points in 1 year with on-time payments.

The power of tri-bureau reporting

Kikoff reports to Equifax, Experian, & TransUnion monthly.

Fast and easy

No credit check. No interest. No hidden fees.

When do you file Form 8829?

If you qualify for a home office deduction, you’ll file Form 8829 along with your personal tax return. It gets filed with your Schedule C, profit or loss from business. You’ll report your total home office deduction on line 30 of your Schedule C.

Only self-employed people are able to claim a home office deduction — work-from-home employees are no longer able to deduct home office expenses, as part of the changes implemented by the Tax Cuts and Jobs Act.

Does your home office qualify for a deduction?

Just because you work from home doesn’t mean you automatically get to claim a home office deduction. The IRS is very specific about who qualifies and who doesn’t.

To qualify for the home office deduction, your home office needs to:

- Be exclusively and regularly used for business, and

- Be your principal place of business, a place where you meet clients or a place where you store inventory.

Exclusive use can be tough to meet. Having a portion of your home be exclusively used as a business means it can’t be used for anything else. So if you set up shop at your kitchen table during the day, you can’t write that space off as a home office.

There are two exceptions to the exclusivity rule: if you run a daycare out of your home or if you use part of your home for inventory storage.

Your home office will count as your principal place of business if you do your management and administrative work from there and you don’t have another fixed location to do that work. For example, a plumber who works at various houses all day but comes home and does billing and other paperwork from a home office would have the home office count as his principal place of business.

Form 8829 instructions

Form 8829 can be tricky to fill out. When in doubt, consult with a tax professional. They can help you decide what is allowed and what’s not based on your specific situation.

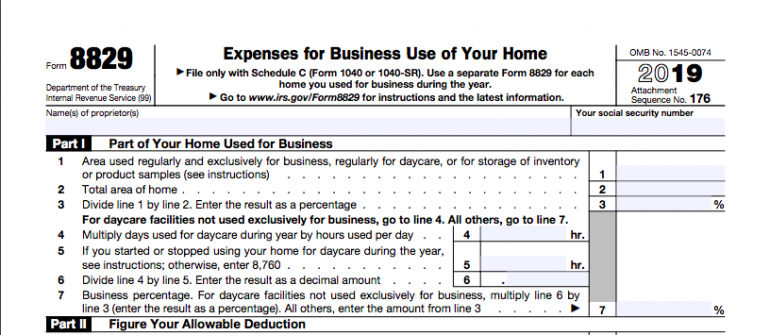

Part 1: Measure your home office

Before jumping into this form, you’ll need to measure your home office. The goal of this section is to get the percentage of your home that’s used for business. You’ll use this percentage throughout the rest of the form to divide your expenses between personal and business.

For example, if your home is 1,000 square feet and your home office is 100 square feet, you use 10% of your home as part of your business. You’ll use this percentage when it comes time to calculate how much of an indirect expense, like your rent, should be able to be taken as a deduction.

If you don’t run a daycare, lines one, two, three and seven are going to be the only lines you use in this section. You’ll take the square footage of your home office and divide that by the square footage of your whole house. That gets you the business percentage that you’ll use for the rest of the form.

Part 2: Figure your allowable deduction

This section is where you get into the expenses that you can add together to make up your deduction. This part of Form 8829 asks you to separate your direct and indirect expenses:

- Direct expenses are only related to the office portion of your home. If you need to repaint just your office, that’s a direct expense.

- Indirect expenses are expenses related to your entire home, including your home office. If you repaint your entire home, including the office, that’s an indirect expense.

To start this section, you’ll need to enter your profit from Schedule C, line 29. That’s straightforward, but it can get tricky if you have any gains or losses from the business use of your home or if you work from another location as well as your home. The IRS instructions have more details on what to include on line eight if either of those situations applies to you.

Once you have your profit entered on line eight, you’ll enter direct and indirect expenses on lines nine through 11 for:

- Casualty losses.

- Deductible mortgage interest.

- Real estate taxes.

If you take a standard deduction rather than itemizing deductions on your personal tax return (Schedule A), don’t include anything for deductible mortgage interest or real estate taxes in this section. You’ll include that below on lines 16 and 17.

Next on lines 16 through 31, you’ll be able to deduct other expenses, including:

- Excess mortgage interest paid.

- Excess real estate taxes.

- Insurance.

- Rent.

- Repairs and maintenance.

- Utilities.

- Any other operating expenses that you haven’t included.

- Depreciation (which you’ll calculate in part three).

- Excess casualty loss.

Part 3: Depreciation of your home

This part of Form 8829 can get really tricky — it’s now time to calculate the percentage of depreciation on your home you can include in your deduction calculation.

To do this, you’ll need to know the adjusted basis of your home or fair market value and enter whichever one is less on line 37. Then you’ll separate out the value of the land (line 38) and the value of the home (line 39). That’s because you only take depreciation on the building, not the land.

You’ll then enter the depreciation percentage from the instructions on line 41. Multiply that percentage by the basis (value of your home) and you’ll get your allowable depreciation deduction. You can take that amount and enter it on line 30.

Part 4: Carryover of unallowed expenses

If you have more expenses than you can claim here, you can carry over the excess and claim it next year. This is where you’ll include the excess amount that you’re carrying over.

Tips for filing IRS Form 8829

The home office deduction calculation on Form 8829 is confusing. If you’re stuck on something, it’s a good idea to get a tax professional involved to make sure you don’t miss any valuable deductions you could claim.

Whether you’re filling out Form 8829 yourself or getting professional help, there are a few things that will help make claiming your home office deduction easier:

Accurately measure your home office: As so much of this form depends on using the business percentage of your home, get accurate measurements of your space done early. Measure the part of your home that qualifies for the deduction and look up the total square footage of your home on your county records. This will make things speedier once it comes time to sit down and fill out the form.

Keep a list of direct and indirect expenses: It’s easy to forget what direct and indirect expenses you’ll want to claim when taxes roll around. Home repairs that happened in January feel like a very distant memory over a year later. Keep a list and receipts of everything, both direct and indirect expenses, that you can use when filling out the form.

Consider the simplified approach: Beginning in 2013, the IRS introduced a new way of calculating the home office deduction called the simplified method. Under the simplified method, there’s no extensive calculation to make or additional receipts to keep. You simply take a standard deduction of $5 for every square foot of office space, up to 300 square feet. So the maximum deduction you can take is $1,500.

However, you may get a larger deduction by using IRS Form 8829 — so before you make the switch, talk to your tax professional about which one is best for your situation.

A version of this article was first published on Fundera, a subsidiary of NerdWallet

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

Related articles