Starting an LLC in Michigan: The Ultimate Guide

This guide provides step-by-step instructions to launch your Michigan LLC and maintain it in good standing.

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

Whatever industry your business belongs to, the first step to forming a business in Michigan is to choose a business entity structure for your company.

The limited liability company (LLC) is among the most popular legal structures for small businesses. LLCs are a hybrid business structure, with some features of both corporations and partnerships. This guide on starting an LLC in Michigan will provide simple, step-by-step instructions to launch your Michigan LLC and maintain it in good standing.

Starting an LLC in Michigan

In order to start an LLC in Michigan, you’ll need to register your company with the Michigan Department of Licensing and Regulatory Affairs (LARA). LARA sets the requirements and fees for starting an LLC in Michigan and for operating an out-of-state LLC in Michigan.

Step 1: Choose a name for your Michigan LLC

To begin, you’ll need to make sure that your business name is available. Michigan requires your LLC to have a different name from other LLCs, corporations and limited partnerships that are operating in the state. For example, if a company called “A Delicious Restaurant, LLC” already operates in Michigan, then you can’t call your LLC “The Delicious Restaurant, LLC.” Very similar business names could cause confusion among customers and members of the public, so your business’s name must be unique.

Name availability and name reservation

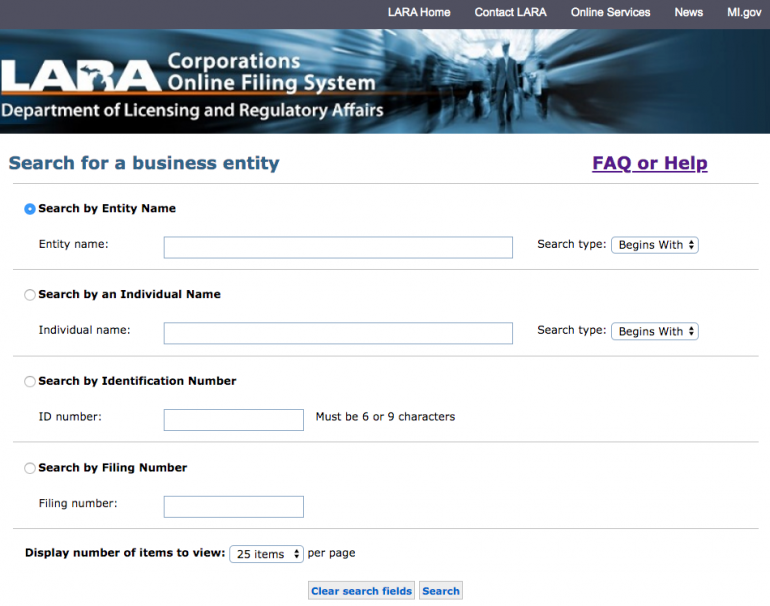

You can check the availability of your LLC’s name in Michigan’s business name database. The name of a Michigan LLC must end with the words “limited liability company” or with the abbreviations “LC” or “LLC” (with or without periods). Your LLC cannot contain the words “corporation” or “incorporate” because that might suggest to someone that your business is a corporation.

Once you find an available name that you like, you can reserve the name for up to six months by filing an Application for Reservation of Name (CSCL/CD-540). The name reservation fee is $25. You can mail the application form, file in person, or file online.

Professional LLCs in Michigan

In Michigan, members of some licensed professions must form a professional limited liability company (PLLC). This is similar to a regular LLC, but the name of a PLLC should end with one of the following words or abbreviations: “professional limited liability company,” “PLLC” or “PLC” (with or without periods). Dentists, physicians, members of the clergy and attorneys must form a PLLC in Michigan, and every member of the PLLC must have a professional license for the occupation.

Michigan LLCs with trade names

Some businesses operate under a trade name — also called an assumed name, fictitious business name, or “doing business as” (DBA) name — that’s different from the company’s legal name. For example, your business’s legal name might be “Karen Jones Marketing and Advertising Services, LLC,” but you might want to operate informally as “Karen’s Marketing.” In that case, you’ll need to ensure that the trade name “Karen’s Marketing” is available and apply for a Certificate of Assumed Name (CSCL/CD-541). The fee for filing a trade name for a Michigan LLC is $25.

Step 2: Choose a resident agent for your Michigan LLC

When starting an LLC in Michigan, you’ll need to designate a resident agent and registered office. A resident agent, also called a registered agent, is an individual or commercial entity who you appoint to receive official mail on your business’s behalf. The resident agent must maintain a physical address in Michigan (not just a P.O. box), and that address is called the registered office.

An individual can serve as your resident agent if they are at least 18 years old, and available to accept mail during normal business hours. You can serve as your own resident agent, as can a friend or family member, but keep in mind that the resident agent’s name will appear in the state’s public records.

For privacy and convenience, most small-business owners opt to use a commercial provider as their resident agent. You might try using an online legal service, like Bizee, that is licensed to provide registered agent services in all 50 states. If you form your LLC on Bizee, for example, they’ll serve as your resident agent for free for the first year, with the ability to renew after that.

Step 3: Obtain Michigan business licenses

Not every Michigan LLC needs a business license to operate, but some do. Companies in regulated industries, such as child care and construction, will need to obtain a license from the state. Those in professional occupations, such as healthcare, will need a license from the Bureau of Professional Licensing. The state government has a business license search, which you can use to check the requirements in your industry.

The Michigan city or county where your company operates might require you to obtain a business license as well. You can contact your city or county to learn more about local licensing requirements. Larger cities, like Detroit, tend to have more requirements than smaller towns.

Retail businesses must register for a sales tax license from the Michigan Department of Treasury. You’ll be required to collect sales tax from your customers and remit the tax to the state on a monthly, quarterly or annual basis. The filing frequency depends on the amount of tax you collect from customers.

Step 4: File LLC articles of organization

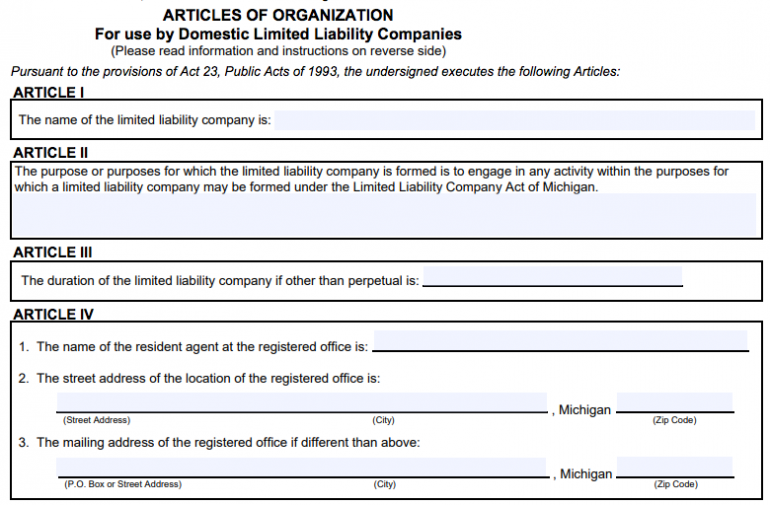

Next up is to file your LLC’s articles of organization (Form CSCL/CD-700) with LARA. You can either submit the articles by mail or file them online. The filing fee is $50. The articles of organization officially authorize your LLC to operate in the state of Michigan. Note that there’s a different set of articles — Form CSCL/CD-701 — that PLLCs need to file.

You’ll need the following information to fill out the Michigan LLC articles of organization:

- Business name.

- Name and address of the resident agent (P.O. boxes insufficient).

- Duration of the LLC if it ends on a specific date.

- Name and signature of the organizer who is filling out the form.

- Any additional information authorized by law, such as a late start date.

LARA will examine the articles of organization to make sure all the required information is provided, and then will file your business information in the state records. Your original articles will be returned to your business’s registered office address. It normally takes about one week for LARA to process your articles of organization.

Foreign LLCs operating in Michigan

Have you already established your LLC in another state and would now like to operate in Michigan? In this case, your business is considered a foreign LLC. If you have a foreign LLC that you’d like to operate in Michigan, you have to fill out an Application for Certificate of Authority to Transact Business in Michigan (CSCL/CD-760). Attach a certificate of good standing from your home state to this application. The filing fee is $50.

Step 5: Draft an LLC operating agreement

An LLC operating agreement is a document that describes the daily operations of an LLC, as well as the rights and responsibilities of each member. The state of Michigan doesn’t require LLCs to have an operating agreement, but we highly suggest that you create one.

Here’s what to include in the operating agreement for your Michigan LLC:

- Description of your LLC’s products or services.

- Whether your LLC is member-managed or manager-managed.

- Each member’s name and address.

- The manager’s name and address if the LLC is manager-managed.

- Each member’s contributions of money and property to the LLC.

- Each member’s profit share and voting rights.

- The LLC’s meeting schedule and voting procedures.

- The procedure for admitting new members to the LLC.

- The procedure for electing a manager if applicable.

- Terms, conditions and procedures for dissolving the LLC.

All members of the LLC should have the opportunity to review and sign the operating agreement, after which you can store it with other business records.

Step 6: Comply with Michigan employer obligations

If your Michigan LLC employs workers, here are additional requirements you’ll need to comply with:

- Employee reporting: Federal and state law requires employers to report new employees to the government within 20 days of their hire date. It’s easy and free to register for online reporting at the Michigan New Hires Operation Center.

- Employer withholding: Employers in Michigan must withhold federal, state and local income taxes from their employees’ wages and remit the taxes to the government.

- Paying unemployment taxes: Michigan employers must pay taxes to fund the state unemployment fund from which unemployment benefits are paid. The tax rate is based on a business’s age and history of unemployment claims. Register to pay these taxes through the Michigan Unemployment Insurance Agency.

- Purchasing workers compensation insurance: Most employers in Michigan must purchase workers compensation insurance to pay for their workers’ job-related injuries. This insurance can be purchased from a private insurer or group fund, and some companies choose to self-insure.

A business attorney who specializes in Michigan law can help you learn more about employer requirements and help you stay in compliance.

Step 7: Pay Michigan LLC taxes

By default, LLCs are pass-through entities for income tax purposes. This means the LLC itself doesn’t pay income taxes and doesn’t file a tax return. It’s the owners, or members, of the LLC who have to pay Michigan state income taxes on their share of the LLC’s income. This income is reflected on their personal tax return.

In addition to state income taxes, Michigan requires all LLCs to file an annual statement. The form is due on Feb. 15. LARA will send you an annual statement form to complete 90 days before the due date. The form will contain up-to-date information on your business and resident agent, and should be accompanied by a $25 filing fee.

The members of an LLC can choose for the business to be treated as a C-corporation for tax purposes, instead of a pass-through entity. If you elect corporation tax status for your LLC, the company will be subject to Michigan’s corporate income tax.

Don’t forget that you’ll also have to pay unemployment insurance taxes and collect sales taxes. You’ll also withhold employee income taxes and remit these to the government

Step 8: Comply with federal requirements

Your LLC must comply with Michigan law and federal law. As at the state level, LLCs are pass-through entities for federal income tax purposes. This means the LLC itself doesn’t pay a federal income tax. Every member of the LLC reports their share of the LLC’s profits on their personal income tax return.

Members can choose for their LLC to be taxed as a C-corporation at the federal level, in which case the LLC will pay a flat 21% federal corporate income tax. Business owners might choose corporation tax status because corporations are eligible to take more deductions and tax credits.

In addition to federal income taxes, LLC members must pay federal self-employment taxes to cover their Social Security and Medicare obligations. Businesses with employees must withhold federal income taxes and Social Security and Medicare taxes from their workers’ wages, and pay the employer share of Social Security and Medicare taxes. Finally, employers must a federal unemployment tax. The federal unemployment tax rate is reduced if you pay Michigan unemployment taxes in full and on time.

Before filing your federal taxes, it’s likely your LLC will need a federal employer identification number (EIN). An EIN is a must-have for LLCs with employees or multiple members, and for LLCs that choose to be taxed as a corporation.

Step 9: Maintain your Michigan LLC

After starting your Michigan LLC, you’ll need to make sure that your company remains in good standing with the state. The best way to remain in good standing is to keep your business finances separate from your personal finances. By doing so, you can ensure that the owners of the LLC aren’t personally liable for business debts. Treating business finances distinctly also makes accounting and tax time easy.

Here are some tips for keeping business and personal finances separate:

- Open a business bank account that you use exclusively for business transactions.

- Use business credit cards only for business expenses.

- Use business loans only to cover business expenses and not for personal purposes.

In addition to these steps, hold regular member meetings and document decisions in writing whenever a member or manager acts on behalf of the LLC.

Benefits and drawbacks

When launching a new business, an LLC is one of several business structures you should consider. The biggest advantage of an LLC is that, in the normal course of business, owners aren’t personally responsible for debts or obligations of the business. This means each owner’s personal assets are protected from creditors. LLCs also offer more tax options, allowing members to choose between pass-through taxation and corporate taxation.

On the negative side, LLC owners often end up paying self-employment taxes on all of the profits of the business. Compared to a sole proprietorship or general partnership, an LLC is also more expensive and challenging to start and operate. Finally, business owners who want to raise money from investors will generally need to form a corporation.

Benefits

- Owners of an LLC aren’t personally liable for business debts and lawsuits in the normal course of business.

- An LLC is easier and less expensive to start and maintain than a corporation.

- An LLC’s members can choose for the business to be taxed as a pass-through entity or corporation.

- Michigan LLC formation fees are lower than average.

- Michigan doesn’t charge an annual LLC tax.

Drawbacks

- LLCs are more difficult and expensive to start than sole proprietorships and partnerships.

- An LLC’s members must pay federal self-employment taxes on all profits, whereas corporations don’t pay self-employment taxes on dividends.

- LLCs can’t issue stock, so they are not well-suited for raising money from investors.

When evaluating the pros and cons of starting an LLC in Michigan, consider your business’s needs both now and later so that your business structure is appropriate over the long term. You can always change your business structure, but choosing wisely at the outset saves time and money down the line.

A version of this article was first published on Fundera, a subsidiary of NerdWallet.

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

More like this

Related articles