Forming an LLC in NJ: A Step-by-Step Guide

Our guide on how to set up an LLC in NJ includes everything from obtaining a business license to paying taxes.

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

One of the first decisions you’ll need to make when starting a business in NJ is to choose your business entity type. There are several different business structures to choose from, but the limited liability company (LLC) is one of the most popular.

An LLC is a hybrid between a partnership and a corporation. Like corporations, members of an LLC aren’t personally liable for business debts. But like partnerships, LLCs are relatively easy to form and maintain.

Forming an LLC in NJ

In order to create an LLC in New Jersey, you’ll need to register your LLC with the NJ Division of Revenue. This agency sets the requirements and filing fees for forming an LLC in New Jersey. This is also the agency you’ll register with if you created an LLC in another state but would like to operate in New Jersey.

Step 1: Choose a name for your NJ LLC

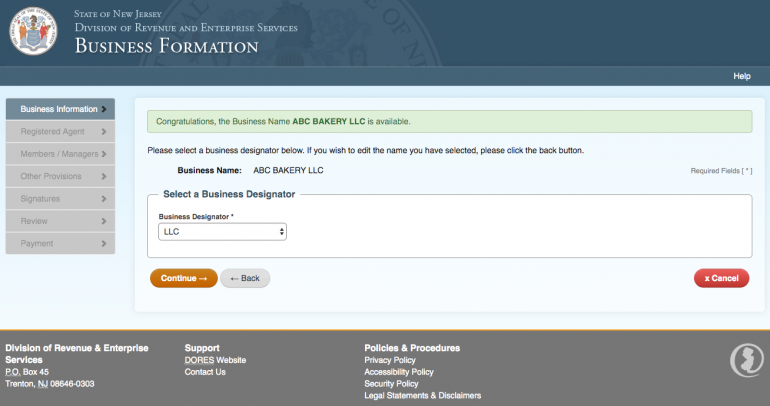

When forming an LLC in New Jersey, you’ll first need to choose a business name. Under NJ law, the name you choose has to be different from the names of other business entities that are on file with the Division of Revenue. This requirement helps ensure that customers and members of the public don’t confuse your business with another.

The name for your NJ LLC has to end with “Limited Liability Company,” “LLC” or “L.L.C.” You can use the abbreviations “Ltd.” or “Co.” The use of certain words in your business names, such as “bank” or “insurance,” requires special permission from state agencies.

In order to ensure that your LLC’s name is available, you should do a preliminary name check on NJ’s Business Name Database. If the name is available, you’ll be able to reserve it for up to 120 days using an Application for Reservation of Name. This reservation holds the name until you’re able to file your certificate of formation (see step 4). Keep in mind that the Division of Revenue doesn’t check names for trademark compliance. It’s ultimately up to you and your business attorney to ensure that your LLC’s name doesn’t infringe on any other company’s rights.

Step 2: Choose a registered agent in NJ

Every LLC that operates in New Jersey must name a registered agent that will accept legal and official mail on the LLC’s behalf. A registered agent for a New Jersey LLC can be either an individual or a company. The registered agent will be among the first to notify you if your business gets sued or receives an official notice from the government.

When forming an LLC in NJ, an individual can serve as a registered agent as long as they are a state resident. This includes a member or manager of the LLC. Alternatively, a company that’s authorized to operate in New Jersey can serve as the registered agent for a business. The registered agent of your NJ LLC must have a physical address in New Jersey (P.O. boxes are not sufficient), which is called the registered office.

Many businesses opt to use an online legal service as their registered agent, such as Incfile, which is licensed to provide registered agent services in all 50 states. If you form your LLC on Incfile, you'll also receive one year of free registered agent service.

Step 3: Obtain an NJ business license

Companies in select industries need a business license to operate in New Jersey. Most of these companies are in skilled or heavily regulated sectors, such as construction, food service and childcare. New Jersey’s Business Action Center maintains a list of industries that require licenses, so you can check if any requirements apply to your small business.

If your business uses a trade name that’s different from the company’s legal name, you must register the trade name with the Division of Revenue. New Jersey calls such trade names “alternate names.” Other states use the term “fictitious business name” or “DBA” (“doing business as” name). The fee to register an alternate name is $50, and the process can be completed online, by mail or over the counter at the Division of Revenue’s Trenton, New Jersey office.

Businesses in New Jersey that sell taxable goods or services must register to collect sales tax with the Division of Revenue. After registering, you’ll need to file quarterly returns and send in quarterly payments of the sales tax. Some high-volume sellers have to file monthly returns and make monthly payments.

Step 4: File your certificate of formation

The next step — and the most important one — when forming an LLC in New Jersey is to file your certificate of formation with the NJ Division of Revenue. The certificate of formation, sometimes referred to as the articles of organization, officially establishes your authority to operate as a New Jersey LLC. Although you can request a paper copy of the form, the quickest option is to file your certificate of formation online. The filing fee for the certificate of formation is $125.

You’ll need the following information to complete the certificate of formation:

- The LLC’s name, purpose and date of formation.

- Registered agent’s name, email and New Jersey street address (P.O. boxes are not acceptable).

- Dissolution date (if your LLC will terminate on a specific date).

- Signature of the member or authorized person completing the form.

Along with the above items of information, foreign LLCs — those that are formed in another state but want to operate in New Jersey — must include a certificate of good standing from their home state when filing their certificate of formation. Foreign LLCs pay the same filing fee of $125.

If you file your certificate of formation online, you’ll receive instant online confirmation of your filing and a printable certificate. The state will also mail a filing notification to your registered agent’s address within three to 10 business days after filing. Certificates of formation that are mailed in will take a few extra days to process.

Step 5: Draft an LLC operating agreement

Unlike the neighboring state of New York, New Jersey LLCs aren’t required to have an LLC operating agreement. That said, even though it isn’t legally required, we recommend that every LLC adopt a written operating agreement. When forming an LLC in New Jersey, the operating agreement sets the blueprint for your LLC’s day-to-day operations and prevents conflicts among co-owners.

At a minimum, the LLC operating agreement should include this information:

- The purpose of the LLC, including products or services offered.

- The names and addresses of each member (and the manager, if there is one.

- Each member’s financial contributions to the LLC.

- Each member’s ownership stake in the company, voting rights and profit share.

- The procedure for admitting new members to the LLC.

- The procedure for electing a manager if the LLC is manager-managed.

- The LLC’s meeting schedule and voting procedures.

- Dissolution procedures.

All members should be given an opportunity to review and sign the operating agreement. At that point, you can store the agreement with other business records. Should you need some extra help in drafting your operating agreement, you can also use a service like IncFile to form your LLC.

Step 6: Comply with state and federal obligations

Choose how you want your LLC to be taxed

LLCs can choose to be taxed as pass-through entities or corporations. If you opt for a pass-through entity, your LLC doesn’t pay any state or federal taxes of its own. Instead, the members report their share of the business’s income and losses on their personal tax return. If you opt to be taxed as a corporation, however, then you’ll be subject to NJ’s corporation business tax and federal corporate tax rates.

Obtain an EIN

In order to file federal taxes, your LLC might need an employer identification number (EIN). An EIN is required for LLCs with employees or multiple owners, as well as those taxed as corporations for federal tax purposes. Additionally, an EIN will be necessary when you’re opening a business bank account or credit card, as well as if you apply for financing.

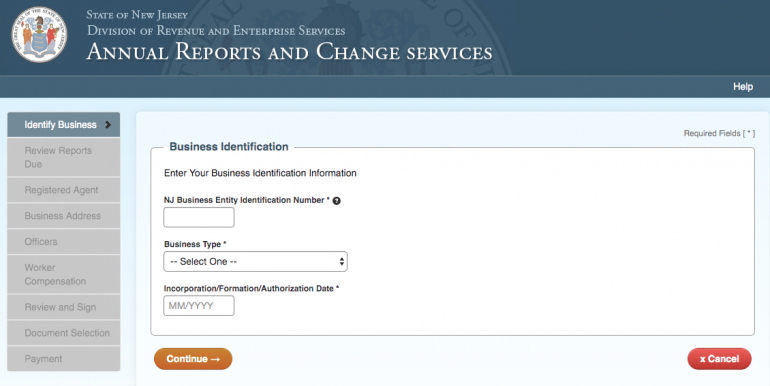

File annual reports

New Jersey LLCs also have to file an annual report, accompanied by a filing fee of $50 to $75. The report is due on the last day of the anniversary month of the business’s formation. For example, if you filed your certificate of formation on March 3, your annual report would be due by March 31 of the successive year and each following year. The annual report keeps your business’s information, such as your registered agent’s name and address, up to date with the state.

Comply with employee obligations

- Employee reporting: Under both state and federal law, employers must report new employees within 20 days of their hire date to the New Jersey New Hire Reporting Center.

- Pay unemployment taxes: In New Jersey, most employers have to start paying unemployment insurance taxes once their payroll reaches $1,000.

- Employer withholding: New Jersey employers must withhold state and federal income taxes and payroll taxes from their employees’ wages.

- Purchase workers' compensation insurance: All businesses in New Jersey with employees need to purchase adequate workers' compensation insurance. LLC members do not count as employees.

There could be additional employer obligations when you create an LLC in New Jersey, such as observing the minimum wage law. We recommend hiring a business attorney who’s experienced in New Jersey employment law to help you stay in compliance.

Pros and cons

If you’re thinking about creating an LLC in New Jersey, consider these advantages and disadvantages.

Pros

- Members of an LLC are not personally liable for business debts and lawsuits (as long as separation is maintained between business and personal finances).

- LLCs have fewer recordkeeping requirements than corporations.

- LLC members can choose their business’s tax treatment.

- By default, LLCs are pass-through entities for tax purposes and avoid the double taxation of C-corporations.

Cons

- LLC members must pay high federal self-employment taxes.

- Corporations are better suited than LLCs for raising money from outside investors.

- LLC members can’t take a salary, and all draws from the business are subject to income taxes.

A version of this article was first published on Fundera, a subsidiary of NerdWallet.

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

More like this

Related articles