Forming an LLC in PA: A Step-by-Step Guide

Starting a new LLC in PA or an out-of-state LLC in PA is easy and inexpensive.

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

If you’re among the 1 million entrepreneurs who operate in the Keystone State, you’ll need to choose a business entity structure for your company.

There are many business structures to choose from, and the limited liability company(LLC) is one of the most common. Whether you want to start a new LLC in PA or operate an out-of-state LLC in PA, this guide has you covered.

Forming an LLC in PA

The PA Department of State is responsible for handling LLC formations in Pennsylvania. An LLC is considered a business entity that’s legally separate from the owner, so you’ll have to register your LLC with the Department of State before you can operate. The Department sets the rules, requirements and fees to form an LLC in PA or operate an out-of-state LLC in PA.

Step 1: Choose a name for your PA LLC

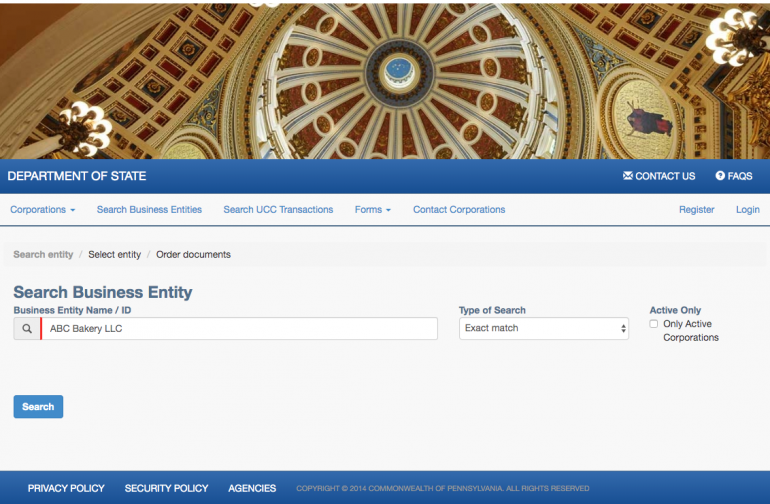

To begin, you have to choose a name for your PA LLC. Pennsylvania requires every LLC operating in the state to have a unique name. In other words, your LLC’s name must be different from the names of other active businesses on file with the Department of State. This is meant to avoid confusion among customers and members of the public.

To check if your business name is available, you can review Pennsylvania’s online business name database. The name of an LLC has to end with “Company,” “Limited,” “Limited Liability Company,” or appropriate abbreviations of these words. Certain words, like “Corporation,” cannot appear in an LLC’s name.

If you find that a name is available after checking the business database, Pennsylvania lets you reserve the name for up to 120 days. For a fee of $70, you can file a name reservation request online or submit a name reservation form by mail. Filing this form guarantees the name will be available as you go through the other steps of forming an LLC in PA.

Certain licensed professionals in PA, such as doctors, have to form a restricted professional company. Other states call this type of entity a professional limited liability company (PLLC). In PA, most of the rules for PLLCs mirror those for LLCs. You can see if your industry is considered to provide restricted professional services by looking at the list in the PA business code.

Step 2: Choose a registered agent in PA

When forming an LLC in PA, you must designate a registered office to accept legal correspondence on behalf of the business. The registered office, which most other states call a registered agent, will be your business’s main point of contact with the state. The registered office will notify you if your business is sued or receives official mail.

In Pennsylvania, a registered agent can be an individual or a company. An individual registered agent must be a PA resident and at least 18 years old. A company that’s authorized to do business in PA can also serve as the registered agent. Whether you go with an individual or a company, the registered agent must have a physical address in PA (P.O. boxes are not sufficient).

Your registered office can be your own business address or the home address of any of your LLC’s members or managers. However, for convenience, most businesses opt to use a commercial provider as their registered office. We recommend IncFile, an online legal service that is licensed to provide registered agent services in all 50 states. If you form your LLC on IncFile, it will include one year of free registered agent service.

Step 3: Obtain a Pennsylvania business license

Businesses in certain industries will need a business license to operate in PA. There are several types of licensure you might need, including:

- Local licenses from your city or county.

- Professional licenses for certain skilled occupations.

- Environmental licenses.

- Health and safety licenses.

- Zoning permits.

- Regulatory permits, such as liquor licensing.

- Sales tax permits.

As a starting point, you should file the PA-100 Business Entity Registration Form online or by mail, which will allow you to obtain most of the statewide business licenses you’ll need. Businesses that sell taxable goods or services must register for a sales tax permit using Form PA-100. You’ll be required to collect and remit sales tax to the state on a monthly, quarterly or semiannual basis depending on how much tax you collect.

One final license you might need is a fictitious business name, also called a DBA or “doing business as” name. This applies to any business that operates under a trade name that’s different from the business’s legal name. For example, if your LLC’s legal name is Larry Smith Flowers, LLC, but you market your business as “Flowers from Larry,” you would need to register the latter name as a fictitious business name with the PA Department of State.

Unlike legal names, the right to a fictitious business name isn’t unique. Another business could use the same fictitious business name. This is different from most states, which require fictitious business names to be unique.

» MORE: Best LLC business loans

Step 4: File your Certificate of Organization

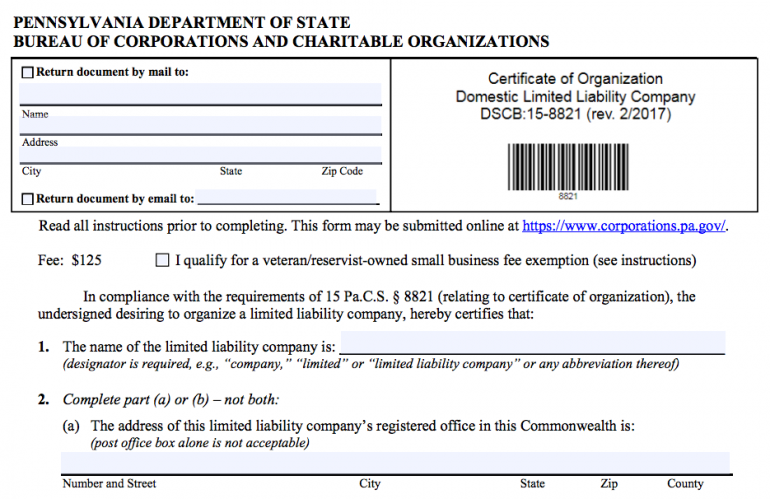

The next step in forming an LLC in PA is to file a Certificate of Organization for Limited Liability Company (DSCB: 15-8821) with the PA Department of State. In other states, the certificate of organization is called the articles of organization. The certificate of organization officially establishes your authority to operate as an LLC in PA.

The Pennsylvania certificate of organization requires the following information:

- The LLC’s name and principal place of business.

- Registered office address (P.O. boxes not acceptable).

- The name of each LLC member.

- Signature of the organizer who completes the form.

- An effective date for the LLC’s formation.

- PLLCs must indicate the business’s industry.

Along with the certificate of organization, you’ll need to include a Docketing Statement (DSCB:15-134A). The docketing statement requires you to provide your LLC’s employer identification number (EIN), fiscal year and other details. You can mail in the certificate of organization and docketing statement, but you can also file online for faster processing. The filing fee for the certificate of organization is $125.

The Department of State will usually take about one week to process your certificate of organization. If your certificate is approved, you’ll receive a copy of the filed certificate in the mail. If the state rejects your certificate for some reason, you’ll have the opportunity to make corrections and refile.

Foreign LLCs operating in Pennsylvania

Foreign LLCs are organized under the laws of another state but want to operate in Pennsylvania. You might be an LLC with multiple locations throughout the country. If this is the case, you won’t file a certificate of organization. Instead, you’ll need to file a Foreign Registration Statement (DSCB 15-412), accompanied by a $250 filing fee.

Step 5: Draft an LLC operating agreement

When forming an LLC in PA, you’re not required to have an LLC operating agreement, but it’s highly advisable to have one. Starting an LLC without an operating agreement is similar to buying a house without a floor plan. The operating agreement provides a blueprint for how your LLC will be managed and run on a day-to-day basis.

Here’s what the operating agreement for your PA LLC should include:

- A description of the LLC’s products or services.

- The members’ names and addresses.

- The manager’s name and address if the LLC is manager-managed.

- Each member’s capital contributions to the LLC.

- Each member’s ownership stake in the company, voting rights and profit shares.

- The procedure for admitting new members to the LLC.

- The procedure for electing a manager if applicable.

- The LLC’s meeting schedule and voting procedures.

- Dissolution terms and procedures.

After drafting your LLC operating agreement, all members should have an opportunity to review and sign it. At that point, you can store the agreement with other business documents. Need some help in creating your operating agreement? When you use IncFile to form your LLC, it can also draft a custom operating agreement for you.

» MORE: Business insurance for LLCs

Step 6: Comply with Pennsylvania employer obligations

In addition to the steps listed so far, Pennsylvania LLCs with employees have some additional obligations, including:

- Employee reporting: Under state and federal law, employers must report new employees within 20 days of their hire date to the Pennsylvania New Hire Reporting Program.

- Employer withholding: Pennsylvania employers are obligated to withhold state and federal income taxes from employees. Employers periodically remit payments of the withheld taxes to the state.

- Paying unemployment taxes: Pennsylvania employers are responsible for paying unemployment taxes. Every employer is assigned a tax rate based on the age of the business, industry and history of unemployment benefit claims.

- Purchasing workers compensation insurance: In Pennsylvania, a small-business owner must purchase workers compensation insurance as soon as they hire their first employee. Employers can purchase workers compensation coverage through a private carrier or the state insurance fund, or they can self-insure.

To learn about additional requirements for employers and help you stay in compliance, we suggest hiring a business attorney who specializes in Pennsylvania employment law.

Step 7: Pay Pennsylvania LLC taxes, and file a Certificate of Annual Registration

In terms of income taxes, most LLCs are pass-through entities. This means the LLC itself doesn’t pay an income tax. The owners, or members, of the LLC pay Pennsylvania state income taxes on their share of the LLC’s profits.

In some cases, the members of an LLC will elect for the LLC to be taxed as a C-corporation instead of a pass-through entity. In that event, the LLC is subject to Pennsylvania corporation taxes.

As mentioned above, PA LLCs with employees have to pay unemployment taxes and withhold taxes from their employees’ wages.

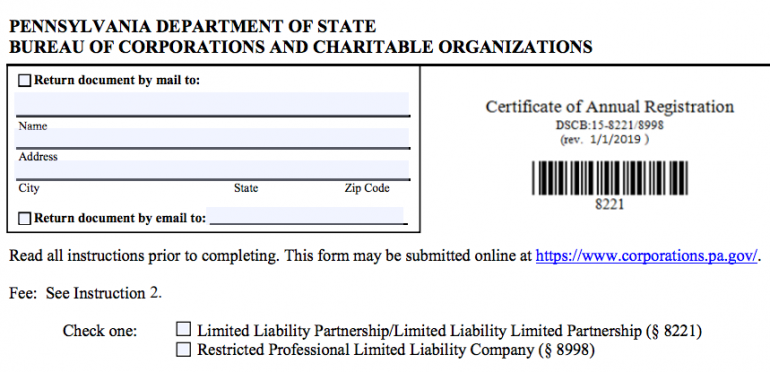

Along with income taxes and unemployment taxes, Pennsylvania requires LLCs to file a Certificate of Annual Registration (DSCB 15-8221-8998). The certificate is due to the Department of State by April 15 of each year, and must be accompanied by a filing fee that’s equal to $560 times the number of members in the LLC. You can also efile the annual registration certificate if you prefer.

Step 8: Comply with federal requirements

LLCs operating in Pennsylvania have to comply with state and federal rules. As at the state level, federal law treats most LLCs like pass-through entities. Members of the LLC report their share of LLC income on their personal income tax returns. The LLC itself doesn’t pay a federal income tax.

The members of an LLC can elect for it to be taxed as a C-corporation at the federal level, in which case the LLC will pay a flat 21% federal corporate tax.

When filing taxes, your LLC will need an employer identification number (EIN) if you have more than one member, have employees or are filing as a corporation.

Federal law also levies other taxes. For example, LLC members must pay a 15.3% federal self-employment tax to cover Social Security and Medicare obligations. If you have employees, you must withhold federal income taxes and payroll taxes from your employees and pay the employer share of payroll taxes. There’s also a federal unemployment tax.

Step 9: Maintain your PA LLC

Starting your PA LLC isn’t quite enough. You also have to make sure that you continue in good standing with the state. In this regard, the most important thing is to keep your personal and business finances separate. By doing so, you can help ensure that members of the LLC won’t be personally liable for any business debts.

To keep business finances separate, take the following steps:

- Open a business bank account that you use exclusively for business transactions.

- Charge only business expenses to your business credit card.

- Apply for a business loan if you need growth capital.

Equally important is to hold regular member meetings and document decisions in writing when a member or manager acts on behalf of the LLC.

Benefits and drawbacks of forming an LLC in PA

When starting a new business, you should evaluate whether the LLC model is right for your company. The biggest advantage of an LLC is liability protection for owners. Owners aren’t personally liable for business debts or obligations, which means their personal assets are protected. LLCs also have more tax flexibility, allowing members to choose between pass-through taxation and corporation taxation.

On the downside, LLCs are subject to high self-employment taxes, and an LLC is costlier to start than a sole proprietorship or general partnership. An LLC is also not well-suited for raising money from investors.

Benefits

- Members of an LLC aren’t personally liable for business debts.

- LLCs have fewer recordkeeping requirements than corporations.

- LLCs that are taxed as pass-through entities avoid the double taxation of C-corporations.

Drawbacks

- LLCs are costlier to start than sole proprietorships and partnerships.

- LLC members must pay high federal self-employment taxes.

- LLCs can’t issue stock, so they are not well suited for fundraising.

- LLCs in Pennsylvania, especially those with multiple members, have to pay a high annual fee.

As you evaluate the pros and cons of starting an LLC in PA, think about your business’s needs both now and later. An LLC often provides a good balance of startup ease, tax flexibility and legal protection for small-business owners.

A version of this article was first published on Fundera, a subsidiary of NerdWallet.

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

More like this

Related articles