Patriot Payroll Software Review 2023: Benefits, Drawbacks, Alternatives

Patriot Payroll is an affordable payroll software option with an easy setup process, but you may find it’s lacking some features.

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

Patriot Payroll is a competitively priced payroll software option for small businesses, with an easy setup process and transparent pricing. It offers unlimited payroll runs, handles businesses with more than one location and lets you pay contractors along with your employees — making it a solid choice for small businesses that handle payroll for up to 500 employees.

However, if you want Patriot to handle payroll tax filings and deposits, you’ll need the full-service plan — the more expensive of the two plans offered. And unlike some competitors, Patriot charges additional fees for certain services and doesn't offer benefits administration or customizable reports.

Patriot Payroll |

| Deciding factors | |

|---|---|

| Price | After free 30-day trial:

|

| Tax filing and payments | Yes, but only the full-service option offers federal, state and local tax filings. |

| Benefit administration add-ons | No. Limited to setting up customizable payroll deductions such as 401(k), health savings account and flexible spending account contributions on employee pay stubs. |

| Employee access to portal | Yes. Through the portal, employees can view past paychecks, edit direct deposit information, view time-off history and download W-2s. |

| Live support | Yes, by phone, chat or email, weekdays 9 a.m. to 7 p.m. Eastern time. |

| Easy to use | Yes. It has a simple, intuitive interface and easy-to-follow training materials. |

How does Patriot’s payroll software work?

Patriot offers a free demo on its website as well as a 30-day trial period of its payroll software. It has two pricing tiers: basic and full service.

After picking a service and signing up, users receive a welcome call and email, and a representative guides them through setup options. Patriot can take care of the payroll setup process for free if provided with the relevant information. It also has a tool, called the payroll startup wizard, that walks users through the process and provides instructional videos.

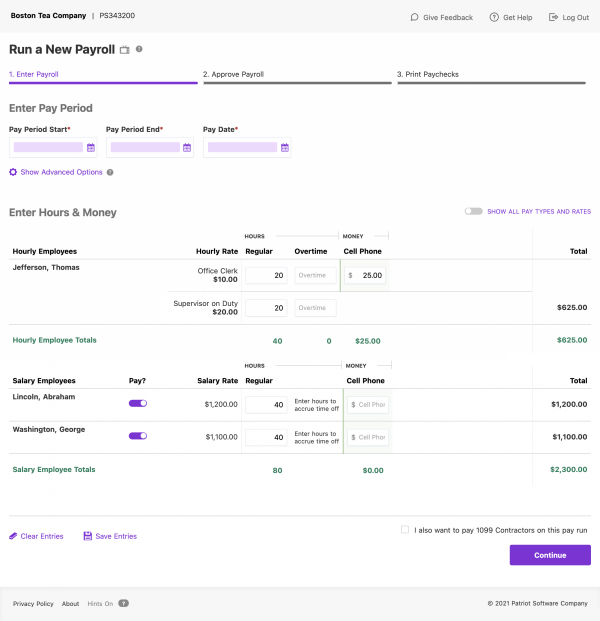

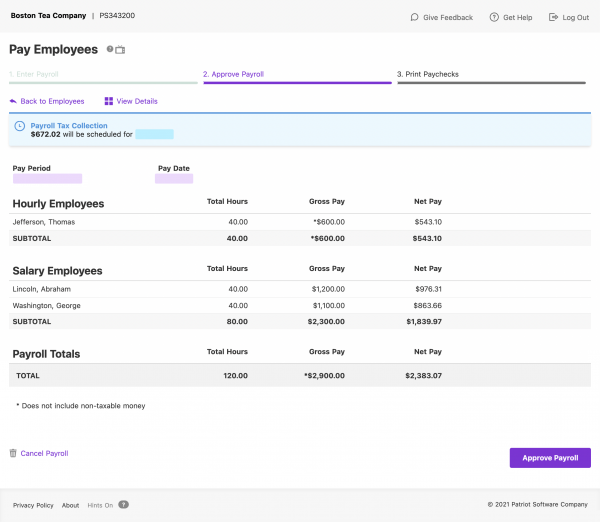

Payroll is run in three steps:

- Enter payroll information for employees and contractors.

- Approve payroll.

- Issue pay via direct deposit or print paper checks.

Payroll needs to be run four days before payday (by 8 p.m. Eastern time) when using direct deposit or two days before payday for qualifying customers.

The funds are debited from a business bank account after running payroll (Patriot doesn't allow funds to be sent from a personal account). Both basic and full-service options allow payments to employees as well as contractors on different schedules, including weekly, biweekly, semi-monthly or monthly.

Patriot Payroll pricing

Patriot has two pricing tiers:

Basic: $17/month base price; $4/month per person

- Run payroll in all 50 states.

- Paid time-off policies.

- Integrates with Patriot’s accounting software or other software, including QuickBooks Online or QuickBooks Desktop.

- Import time-tracking data from Patriot Time and Attendance software or QuickBooks Time.

- Free integration with workers’ compensation insurance through AP Intego.

- Employee portal.

- Ability to classify employee payroll by groups and generate reports on payroll costs by team.

- 1099 e-filing option comes with an additional fee: $20 for up to five contractors, $2 for every additional 1099 filing, up to 35 people.

Full service: $37/month base price; $4/month per person

- All the services from the Basic plan.

- Federal, state and local tax filings and deposits plus year-end payroll tax filings. Additional state tax filings cost $12 per month, per state.

- Tax filing accuracy guarantees to cover penalties and interest if Patriot fails to file on time.

In both the basic and full-service versions, businesses can purchase Patriot’s own time-tracking or HR software for an extra cost starting at $6 per month plus $2 per person. The company also offers accounting software starting at $20 per month.

Benefits of Patriot Payroll

Affordable and does the job

At $37 per month, Patriot’s full-service plan is one of the more affordable options that NerdWallet has reviewed. It comes with all the basic features of payroll software, such as unlimited payroll runs, the ability to pay employees and contractors across multiple states and tax-filing services. It can also support up to 500 employees, unlike some less expensive options that come with lower limits.

Transparent costs

With Patriot Payroll, costs and features are presented in a transparent manner, which isn't true for all payroll software companies. For example, ADP and Paychex only provide limited pricing details online; instead, businesses have to request quotes.

Comprehensive resources

Patriot’s demo software, articles and training videos are comprehensive and easy to follow. The payroll setup process is also relatively straightforward. The company handles the process with the free payroll setup option, or the payroll startup wizard lets you do it yourself.

Patriot Payroll |

Drawbacks of Patriot Payroll

Additional fees

With Patriot’s basic payroll software, users have to pay a fee for e-filing 1099 forms. For five or fewer contractors, it's a flat $20 fee for e-filing. For six to 35 contractors, the cost is an additional $2 for every 1099 filing; additional charges don't apply for those with 36 or more contractors. Payroll4Free, priced in the same range as Patriot, includes this feature for free.

For small businesses that file taxes in multiple states, additional state tax filings cost $12 per month, per state. OnPay and Wave Payroll (with filing options in 14 states) don't charge for multiple state tax filings.

No benefits administration or free HR services

Companies like Gusto and OnPay throw in HR services such as employee onboarding documents or offer letters with the basic versions of their payroll software. Patriot doesn't: An HR add-on has to be purchased separately. On the benefits front, Patriot doesn't handle the administration of employee benefits with external providers, such as a health insurance company or 401(k) provider.

Employee paycheck deductions and contributions can be set up using Patriot, but it cannot send money to providers on your behalf. Patriot also doesn't send payments for insurance, garnishments or child support. Gusto and OnPay, priced slightly higher than Patriot, both offer health benefit administration services through partners. Gusto also sends child support and garnishment funds to the appropriate agencies.

No customizable reports

Patriot’s basic and full-service options include a suite of built-in payroll reports, which may work fine for basic needs. For those who want the ability to generate custom reports, OnPay gives them the power to do that for no additional cost.

Alternatives to Patriot Payroll

With the basic or full-service option, Patriot carries an affordable price tag and many of the features users would want in payroll software. Roll by ADP, Payroll4Free and Wave Payroll are similarly priced options worth considering for a small business's payroll needs. Here’s how they stack up against each other:

| Software | How it's different from Patriot Payroll | Tax-filing availability |

|---|---|---|

| $29 per month and $5 per person per month and up. |

| Federal, state and local tax filing included. |

| Free. |

| Tax-filing options available for $25 per month. |

| $20 per month and $6 per person per month for self-service tax filing. |

| Tax filing available in 14 states (at a plan cost of $40 monthly plus $6 per person). |

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

Related articles