Paycom Review 2022: Pricing, Payroll and HR Features, User Reviews

Our Paycom review covers all aspects of this payroll and HR software — including features, pricing and more.

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

Paycom is a cloud-based payroll service that essentially acts as a full-service human capital management, or HCM, system — offering access to payroll and HR services in a single software. Time and labor management, HR management, talent acquisition and talent management are the broader HR features included in the platform. Paycom’s employee-driven data system automates many payroll and HR tasks and includes a self-service app that allows employees to manage their data and do their own payroll.

If you run a large organization and need an all-in-one solution that can be completely customized to your business, Paycom may very well work for you. However, if you need a straightforward payroll or HR platform to manage the essential tasks for a smaller team, you may want to explore an alternative solution.

Deciding factors

| Pricing | Quote-based pricing. |

| Plans | Single, all-inclusive software plan available. |

| Notable features | Paycom offers instant data flow across multiple systems with features that include:

|

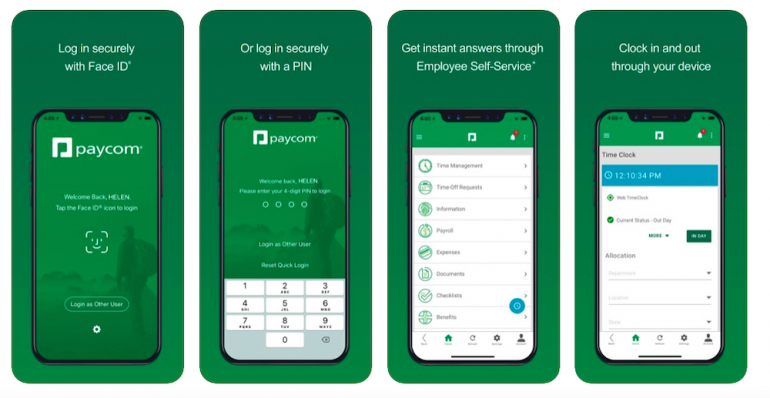

| Mobile app | Self-service app available for Android and iOS devices. |

| Integrations | Offers a few add-ons like Affordable Care Act (ACA) assistance, but doesn’t integrate with other software such as expense, accounting or time-tracking apps. |

| Live support | Customer phone support Monday through Friday, 7 a.m. to 7 p.m. Central time. Employee training offered through Paycom Learning. |

Paycom features

Payroll

Automated payroll processing: Known as Beti, this software allows employees to manage, verify and approve their own paycheck. Beti identifies any errors so employees can fix them before submission.

Paycom Pay: Issues paper checks from a Paycom bank account and manages the reconciliation process — ensuring that net payroll, taxes and fees are only deducted from your account once per payroll.

Automated payroll tax management: Handles completing, filing and paying payroll taxes.

Self-service app: Gives employees 24/7 access to their pay stubs, scheduled earnings and deductions, and more.

Report center: Use predefined reports or create customized payroll reports using data from across the Paycom system.

Garnishment administration: Reconciles payment amounts and calculations, balances deductions every pay period, and administers and sends required payments and documentation.

Expense management: Allows employees to submit photos of receipts for expenses; once approved, those expenses automatically flow to payroll for reimbursement.

Expense tracking: Expenses imported into a general ledger are automatically allocated to categories such as travel, meals, entertainment, etc.

Mileage tracking: Allow employees to track and submit their mileage from their mobile device; add the FAVR feature to calculate mileage rate based on location.

General ledger mapping: Customize and import general ledger reports into your accounting software.

Time and labor management

Time tracking app: Allow employees to submit their time using a time tracking app; edit and approve submitted time and automatically sync data to payroll.

Customize tracking options: Set rules for rounding hours, bonuses, shift and weekend differentials, and holidays worked.

Time off requests: Allows employees 24/7 access through the mobile app to review vacation and sick time accruals and submit time-off requests.

Scheduling tools: Create schedules and give employees access to view their schedules, mark availability, and swap or pick up shifts.

Time clocks: Offers self-service app and web-based time clocks to allow employees to clock in and out, as well as physical terminals for badge-swipe or biometric check-in.

Labor allocation: Assign labor costs to a particular location, department, job or other criteria when employees clock in.

Labor management reports: Get real-time reports, by department and by shifts, to see who’s clocked in and monitor labor distribution.

HR management

Document control: Archive, access and retrieve employee files and HR documents, including W-4 and I-9 forms.

Compliance tools: Remain compliant with government regulations; receive notifications of changes in legislation; generate compliance reports for Equal Opportunity, Fair Labor Standards, Family and Medical Leave; and more.

Personnel action forms: Document and approve role and compensation changes with a clear audit trail, including payroll effective dates.

Benefits administration: Set up employee benefit plans, deduction amounts, enrollment dates and waiting periods; allow employees to select benefits through self-service app; and add the Benefits Carrier tool for automatic carrier communications.

Report center: Generate reports to see and notify employees who are eligible for benefits enrollment, send reminders about enrollment, view changes to employee benefits packages, and view the benefits each employee chose.

COBRA administration: Sends required correspondence, tracks important dates, collects and remits premiums, and receives updates to changes in COBRA laws.

Enhanced ACA tool: View all of your ACA data in a single dashboard, learn about changes to the Affordable Care Act, and ensure that your business is compliant.

Manager tools: Review and approve employee requests, monitor performance, view applications, and take care of other managerial tasks through the mobile app.

“Ask Here” feature: Allows employees to use the self-service app to ask questions and get directed to the right people for answers.

Employee surveys: Use customizable templates to receive confidential feedback and view results.

401(k) reporting: Maps data to your plan provider’s requirements, creates 401(k)-specific reports, and sends reports to providers.

Direct Data Exchange: Monitor employee usage of self-service app, view costs based on employee tasks, and see opportunities for increased usage and cost savings.

Talent acquisition

Job postings: Automatically post open positions to your company website, employment sites and online job boards.

Applicant tracking: Build a customized applicant tracking system with a directory of talent profiles and searchable contact history for candidates.

Reports and analytics: View details about recruiting sites, including views, applicants, offers and hires; generate reports to monitor compliance with federal employment guidelines.

Tax credits: Automatically screen job applicants, send notifications of eligibility, administer available tax credits, and monitor the federal tax code for updates.

Background checks: Run background checks on candidates and current employees; remain in compliance with the Fair Credit Reporting Act; create pre-adverse and adverse action letters; securely store the results.

Onboarding: Create a streamlined onboarding process with new-hire paperwork and task checklists; allow employees to complete all necessary tasks online; and store documents in employees' online files.

E-Verify: Add an E-Verify task to the onboarding process to confirm employment eligibility, securely store information, and receive notification of employees who need re-verification.

Talent management

Performance management: Implement performance reviews, including self-reviews, manager reviews and 360 reviews; assign performance goals and track goals by employee.

Position management: Build a directory of positions with required skills and salary levels.

Compensation budgeting: View reports of compensation spending, create a merit matrix, set salary grades, update employee compensation, and sync system-wide.

Employee training: Assign consistent compliance training to employees and allow them to complete it through the self-service app; create business-specific training courses for employees.

Comprehensive reports: Access reports and view historical data and action items.

Pricing

Paycom doesn’t include pricing information on its website for its payroll and HR software. Instead, you can request a demo and then work with Paycom's sales team to determine what the cost of the software will be for your business.

Generally, when it comes to quote-based payroll software, much of the cost will depend on the size of your business and the number of employees on your payroll. Typically, payroll providers charge a monthly base fee, plus a monthly per-employee fee. You might also see additional fees for setup and certain tax forms, as well as for particular tools or services within the platform.

Paycom user reviews

Online Paycom payroll reviews are generally positive. Reviewers highlight the scope of functionality within the Paycom system, especially as a payroll and HR software. Additionally, many users praise Paycom’s customer service.

Although there aren’t many wholly negative reviews, some users found drawbacks to the system. A few users felt some processes were more difficult and time-consuming than expected, while others voiced concerns about the number of updates, not being notified before an update, and about the quality of updates.

Benefits of Paycom

Advanced software features

Paycom is a highly automated, detailed and advanced software solution. This platform truly is full-service, allowing you to manage the most specific parts of payroll, HR and broader HCM within a single solution.

While many payroll services provide the tools you need to automate your payroll and HR tasks, Paycom takes this optimization to the next level — in many cases, handling important and complex processes on your behalf.

Employee self-service

A particularly noteworthy aspect of Paycom’s functionality is the employee self-service app. This app contains all the necessary features of the software, allowing employees to manage their time, benefits, documents and training, and even find the right person within the company to answer their questions. This not only empowers employees, but it improves the accuracy of data and also eliminates tedious payroll and HR tasks.

Drawbacks of Paycom

Lacks pricing transparency

Paycom doesn’t provide pricing information on its website — making it difficult to determine whether it’s a viable solution for your business without talking to its sales team. Additionally, because you’ll only know the pricing Paycom offers your business, you may be paying more than other businesses for the same service. With quote-based pricing, Paycom makes it hard for you to adequately compare its service to other providers that do list pricing information.

Better suited for larger businesses

Paycom’s all-in-one package with advanced features and automation may be more than many small businesses need. If you’re a smaller business looking to optimize your payroll and HR, you may find Paycom overwhelming and confusing, especially if the tools you do need are buried amongst a variety of those you don’t.

Top alternatives

Gusto

If your business doesn’t need all of the functionality that’s included in Paycom, you might look into Gusto Payroll, another web-based payroll service that also has HR features.

Gusto PayrollGet 25% off the Plus plan for a limited time |

Gusto starts at $40 per month, plus $6 per person per month, and is available in three plan levels: Simple, Plus and Premium. Gusto also offers a contractor-only option at $6 per person with no base fee.

In addition to full-service payroll capabilities, Gusto plans include automated payroll features, employee self-service onboarding, new hire reporting, and health insurance administration. With the higher-level plans, Gusto also provides advanced onboarding tools, time tracking, surveys and more.

Zenefits

For a Paycom alternative with a greater focus on HR capabilities, you might consider Zenefits. This user-friendly, web-based solution offers core HR features, like automated onboarding, directory and organizational charts, document management, time off tracking, scheduling and more. Zenefits offers three plan levels, each with an increasing number of capabilities. With the higher-level Zenefits plans, you’ll receive access to compensation and performance management tools, as well as employee well-being features.

Zenefits’ lowest-tier plan, Essentials, starts at $8 per month per employee. If you want to add payroll capabilities to your Zenefits software, you can do so for an additional $6 per month per employee.

A version of this article was first published on Fundera, a subsidiary of NerdWallet

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

More like this

Related articles