Buy-Sell Agreement: What Is It and Do You Need One for Your Business?

A buy-sell agreement helps prevent future problems. Here’s what you need to

know about setting one up.

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

In all of the business planning you’ve done, you might not have thought about what happens to your business if you retire, move on — or in a worst-case scenario, become incapacitated or die.

Having a buy-sell agreement establishes a clear plan to handle any of these events. Without one, a company could face major tax hassles down the road, as well as other financial and legal difficulties.

What is a buy-sell agreement?

A buy-sell agreement is essentially a document that re-allocates a business, or the part ownership of a business, when someone can no longer be an owner (or no longer wants to be an owner). Think of it as a kind of hybrid between a business prenup and a will, since it lays out exactly how a business will divide up its assets and ownership in the event of its dissolution, divestment of interest from a business partner or the death or disability of a co-owner.

Basically, a buy-sell agreement is an exit strategy for you and your business partners. The agreement spells out exactly who owns what in the event that a partner leaves the company, rather than leaving these decisions to executors or the courts. A buy-sell agreement typically spells out a reasonable sale price for a member’s interest in a company, as well as the details behind how and when a person’s share is distributed to the person designated to take over.

How does a buy-sell agreement work?

The way a buy-sell agreement works is that a clear transition for ownership of the business when each partner passes away or chooses to leave the business is decided upon. This legal agreement is most commonly used in the instances of sole proprietorships, closed corporations and partnerships.

The agreement will stipulate that the remaining business share be sold to the company or certain members of the business. In the case of partner death, their estate is legally obligated to sell.

Why do you need a buy-sell agreement?

There are several plausible scenarios that might play out if your business doesn’t have a buy-sell agreement. For instance, a former business partner’s spouse could become your co-owner, a bank might end up having a stake in your company, or your old business partner’s kids might become the newest members of your management team. You could end up with one (or several!) business partners who don’t know about your business or don’t necessarily care about its survival as much as you do. But they’ll still get a seat at the table, whether you like it or not.

But these are only a handful of potential scenarios that may occur if you don’t establish a buy-sell agreement. If you’re not convinced yet, here are a few more reasons why you should set up a buy-sell agreement for your business right off the bat:

A buy-sell agreement establishes the fair value of a person’s share in the business, which comes in handy if a partner wants to remain in the company after another partner’s exit.

This helps forestall disagreements about whether a buyout offer is fair since the agreement establishes these figures ahead of time. You’ll mitigate the risk that a now-former business partner or their next of kin, expects more money than you believe their share is actually worth.

2. You’ll develop an exit plan for business partners.

The breakup of a partnership, be it a marriage or a business, has the potential to be messy. It can become hard for former partners to agree on the terms of the split if those terms aren’t set in stone (or at least in writing).

But a buy-sell agreement spells out most of the terms and conditions that business partners have to abide by in the event that they’re no longer with the company. You’ll reduce headaches — and financial risks — by planning ahead.

3. You’ll keep business interests with the surviving owners.

Without a concrete buy-sell agreement in place, you run the risk of unexpected business partners entering the fray. Just as a will determines who gets your belongings and money after your death, a buy-sell agreement stipulates who’s entitled to your share of a business if you’re no longer able to be a part of it (or, on a less morbid note, if you plan to sell your share).

If you don’t have this agreement in place, your or your partners’ next of kin may take over your part of the company. That’s usually the kind of decision you’d rather make ahead of time, and in consultation with your co-owners. But without a buy-sell agreement, you’re leaving this decision to a lawyer. Plus, you’re leaving your partners vulnerable to disruption, or even the dissolution of your company if your heir decides to sell.

4. You’ll create a business continuity plan.

No one wants to commit an unforced error — and this isn't just baseball talk. Few would ever be in favor of unnecessary disruptions to their business operations. But that’s exactly what you risk without a buy-sell agreement.

Any unexpected death, illness or sale of a portion of the company could cause chaos for your business. With a continuity or contingency plan, you can guard against at least a few of the obstacles these challenges create. You’ll know who’s responsible for what, and how the basics of the business will carry on despite these conditions.

How to set up your buy-sell agreement

Every effective buy-sell agreement covers the same basic ground: a valuation clause, the ground rules of the agreement and provisions for heirs that help mitigate the tax burden that might result if they inherit a portion of the business. You’ll meet with your business partners, company accountant and a valuation expert (if necessary) to get your agreement ready to go.

1. Start early.

Just as you would with any other binding legal document, you’ll want to establish a buy-sell agreement as early as you can. Although you can always create this agreement later on, it’s often better to get it out of the way in the beginning.

Odds are that the process will be less emotional or combative if you’ve taken care of these details before any substantive business occurs. Plus, you can rip off the Band-Aid easier if the buy-sell agreement is just one of several contracts, documents and forms on your to-do list for kicking off business operations.

2. Set up ground rules.

It’s not enough to merely create a buy-sell agreement — you have to make sure that contract is practical and realistic for your particular business.

The company’s valuation is important, but so is spelling out to which heirs you want the business to go specifically. A buy-sell agreement can also detail which events can trigger the company’s sale, which may prevent lenders from taking control in the event of a partner’s bankruptcy.

3. Take out life insurance policies.

Most business partners take out life insurance policies against one another when they sign buy-sell agreements. This helps make sure that the other parties have access to the money necessary to buy out the deceased or disabled co-owner. You want to be absolutely positive that you have the cash to buy out your former partner (which is exactly what life insurance policies can provide the means to do).

4. Include a valuation clause.

Your buy-sell agreement’s valuation clause is critical, as it determines how you’ll calculate the value of your stake in the company if you’re no longer involved. Some businesses prefer to include their own valuation methodology within the agreement itself, whereas others state that these decisions must be made by a valuation expert at the time of the proposed sale or inheritance.

5. Pay attention to taxes.

Estate taxes can take a huge bite out of the money you’d get for selling your business. The same holds true if any of your successors sell the shares they received from you, too. You’ll want to make sure you have an honest, conservative valuation formula within your agreement. Or, you might open yourself or others up to otherwise avoidable taxes as part of a sale.

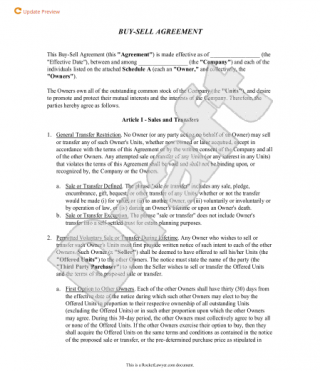

Buy-sell agreement template

For those not quite ready to hire a lawyer, there are free buy-sell agreement templates available that can help you get the ball rolling. As your business grows, it’s smart to have a lawyer draft up an agreement, but for new business owners this can be a more cost-effective way to get started. For example, Rocket Lawyer offers a free buy-sell agreement template for each state.

A version of this article was first published on Fundera, a subsidiary of NerdWallet

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

More like this

Related articles