What Is a Marginal Tax Rate? Definition and Calculator

The tax rate you pay on the highest portion of your taxable income is known as your marginal tax rate. Here’s how to determine it.

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

One of the most common misconceptions about the federal tax system is that someone's entire income is taxed at a single rate. In reality, most people pay at least a few different tax rates on different portions of their income.

In tax speak, a marginal tax rate refers simply to someone's highest tax rate.

Marginal tax rate definition

A marginal tax rate is the rate paid on the last dollar of taxable income. It equates to your highest tax bracket.

Although you may hear someone say that they are "in the 22% tax bracket," what that really means is that 22% is the highest rate applied to their income, not that their entire income is taxed at that rate.

Marginal tax rate example

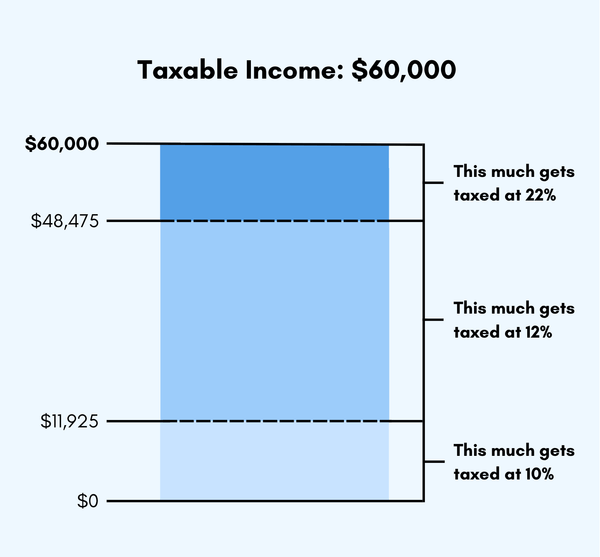

Say you’re a single taxpayer who made $60,000 in taxable income in 2025. In this scenario, parts of your income fall into three different tax brackets: 10%, 12% and 22%.

How to calculate your marginal tax rate

Figuring out your marginal tax rate is often fairly simple. Once you know how much taxable income you have, you'll just need to review the tax brackets for the current tax year. Keep in mind that filing status does come into play, as there are different tax brackets and rates for each filing status.

For example, single taxpayers who made up to $103,350 in 2025 would see a highest tax rate of 22%. Those married filing jointly, however, could have made up to $206,700 and would still fall within that 22% marginal rate.

on Anthem Tax Services' website

on Priority Tax Relief's website

Marginal vs. effective tax rate

While marginal tax rate refers to your highest tax bracket, effective tax rate is the actual percentage of your income that is taxed. This is sometimes referred to as your average tax rate.

You can determine your effective tax rate by dividing your total taxes owed (line 24 of your Form 1040) by your taxable income (line 15). You can also figure your effective tax rate using our tax calculator.

What is a flat tax?

A flat tax is when all the income you earn is taxed at the same percentage. Whether you make $100 or $1 million in taxable income during the year, each dollar is taxed the same. This differs from the federal progressive tax model but is sometimes seen in the U.S. in state-level income tax.

» Learn more: State income tax rates

How to reduce your marginal tax rate

Reducing your marginal tax rates means reducing your taxable income — and there are many strategies you can use to do so. Keep in mind that some methods require itemizing on your return, which isn’t right for everyone.

Some popular ways to reduce your marginal tax rate include:

Contributing to a 401(k) or traditional IRA.

Making charitable contributions.

Contributing to an HSA or FSA.

Deducting qualified medical expenses.

» Learn more: 12 ways to lower your tax bill