Should I Use Affirm for Travel?

Buy now, pay later services are seldom worth it. Unless you can pay your loan off within six weeks, avoid Affirm.

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

Affirm is a "buy now, pay later service" that offers consumers the option of paying for their purchase in installments instead of requiring the whole payment upfront. It can be used for a wide range of products, from clothing to electronics, furniture, and even travel. Many travel companies, including Expedia, Priceline, Orbitz and American Airlines, use Affirm.

If you're considering using Affirm to pay for your travel, read on to learn more about the service, how it works and whether using it is a smart money move.

What is Affirm?

While you may not have heard of Affirm, the buy now, pay later or BNPL service has become quite popular, with over 12.7 million customers as of June 2022. From January to March of the same year, it extended roughly $3.9 billion of loans. BNPL services like Affirm are especially popular among younger generations — an estimated 75% of all BNPL users are either Gen Zers or millennials.

Affirm offers two types of payment plans:

- Affirm Pay in 4. This option allows you to pay in four equal installments every two weeks with no interest or impact on your credit score.

- Monthly payments. This option is a loan that allows you to pay in either three-month, six-month or 12-month installments at varying interest rates based on your credit score.

Affirm also offers a savings account and a virtual card, which can be used like a credit card (even at locations that don't accept Affirm).

Get the 'Cheat Codes' to Cheaper Travel

Unlocking the secret to saving a ton on travel is easier than you think. 📤 Our free newsletter shows you how in 5 min. or less.

Who can use Affirm?

To use Affirm, you must:

- Be a U.S. resident.

- Be at least 18 years old (or 19 years old for Alabama residents and some Nebraska residents).

- Have a Social Security number.

- Own a phone number that is registered in the U.S. and can receive SMS text messages.

In addition to the above criteria, Affirm will also consider the following when deciding if you qualify for a loan with them:

- Your credit score.

- Your credit utilization.

- Your payment history with Affirm.

- How long you've had an Affirm account.

- The number of loans you have with Affirm.

- Verification of your income and debts.

- Recent bankruptcies.

- Store policies.

Because approval is based on several factors, if you're shopping at a website that uses Affirm, we recommend having a backup plan in case you do not qualify for a loan.

» Learn more: What is a good credit score?

Where can you use Affirm to pay for travel?

Affirm has partnered with several popular travel companies. Examples of those that allow you to pay with Affirm include:

- Orbitz.

- Travelocity.

- Vacasa.

- Vrbo.

If you choose to get an Affirm virtual card, you can use it to book on other travel sites, including Hotels.com and Booking.com.

» Learn more: NerdWallet's review of Affirm buy now, pay later

How to use Affirm to pay for travel

There are two ways to use Affirm to pay for your travel:

- Book on a website that includes Affirm as a payment option.

- Use an Affirm virtual card.

Here's a closer look at both options.

Use Affirm as a payment option

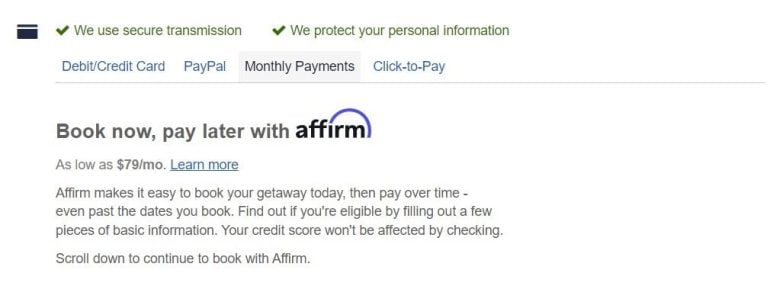

To give you an example of booking travel on a website with Affirm as a payment option, we looked at booking the Hyatt Ziva Puerto Vallarta for three nights in August on Expedia.

This stay would cost $867 total if you decided to pay for it with either a credit or debit card or PayPal, but you can also click "Monthly Payments" and you'll see an option to pay with Affirm.

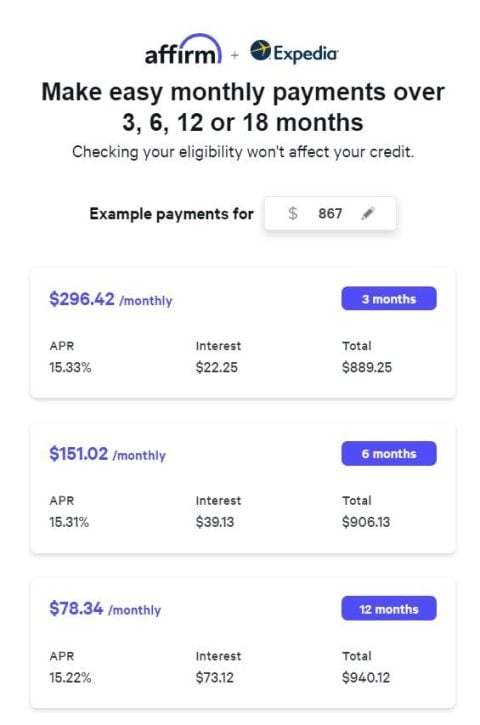

When you click "Learn more," Affirm gives you examples of what your monthly payments would look like based on whether you pay in three-month, six-month or 12-month increments, as well as your total payment amount and how much you'll pay in interest.

The monthly payment for the 12-month plan is only $78.34, as opposed to $296.42 on the three-month plan. However, keep in mind that if you choose this option, you'll pay $940 for your hotel stay instead of the $867 you'd have paid with a card or PayPal — an additional $73.

The payment options above are only examples — you'll need to apply to find out if you qualify for Affirm. You may also be asked for a down payment or be given different interest rates based on your financial situation.

If you decide you want to pay with Affirm, you'll need to provide your cellphone number and create an account with some basic personal information.

After doing so, you'll receive a real-time decision on whether your request was approved. You'll then be able to use Affirm to pay for your travel based on the payment schedule you select.

» Learn more: How to travel without a credit card

Use an Affirm virtual card

If you'd like to use Affirm, but you're not offered the option to do so when booking, you may be able to use a virtual credit card.

To get started, you'll need to download the Affirm app and choose the "Virtual Card" option. You'll then select "Pay with a one-time-use virtual card" and enter the approximate amount your purchase will cost.

You'll receive an immediate decision, and if you're approved, you'll get a virtual card you can add to your phone's wallet. Then, when you're ready to pay, enter the card details as you would with any other credit card. Keep in mind, however, that you'll need to complete your transaction within 24 hours of being approved for the virtual card.

» Learn more: Is BNPL a smart way to finance travel?

When should I use Affirm to pay for travel?

There are a couple of instances where it may make sense for you to pay for your travel with Affirm:

You're able to use Affirm Pay in 4

Since Affirm Pay in 4 allows you to pay in four installments with zero interest and no impact on your credit score, this can be a great option if you don't have the cash to pay upfront and can't wait to make your purchase.

For instance, if a flight costs $800, you’d pay four installments of $200 – the first installment due at time of purchase. Just remember to budget for these additional payments over six weeks.

You're booking essential travel but lack the funds to pay in full

As much as we love to travel, we generally don't recommend booking a trip unless you have the funds to pay for it or can pay off the charge immediately before any interest accrues.

But if there's essential travel that you need to book — for instance, a family or medical emergency — and you can't pay in full, Affirm can be a useful option if you don't have a credit card or if it offers a better interest rate than your credit card.

However, suppose you're considering using Affirm because the interest rate is lower than your credit card. In that case, we recommend calling your credit card company to see if they can provide you with a lower promotional rate.

Aside from the limited examples above, you're likely better off paying for travel on your credit or debit card or with another payment option.

» Learn more: Watch out for these buy now, pay later traps

If you're thinking of using Affirm on travel

While you may be tempted to use Affirm so that you don't need to pay for your travel in total upfront, buy now, pay later services can be detrimental to your finances if not used wisely.

Unless you can use Affirm Pay in 4 to quickly pay off your loan with no interest, Affirm charges a high interest rate that you're better off avoiding where possible. It's better used to help in a pinch, such as when you're traveling for a last-minute emergency.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2026:

- Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

- No annual fee: Wells Fargo Autograph® Card

- Flat-rate travel rewards: Capital One Venture Rewards Credit Card

- Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

- Luxury perks: American Express Platinum Card®

- Business travelers: Ink Business Preferred® Credit Card

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

Limited Time Only: Earn $1,000 Toward Travel!

Capital One Venture Rewards Credit Card

Travel

For a limited time, the

Capital One Venture Rewards Credit Card is offering new cardholders an especially rich bonus: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel!

More like this

Related articles