The Guide to AmEx Purchase Protection on Travel Cards

AmEx purchase protection generally covers theft, loss and damage to eligible items within 90 days of purchase.

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

From porch pirates to Murphy's law, a lot can go awry between the time you buy an item and make use of that purchase. Thankfully, many credit cards offer so-called "purchase protection" that covers theft, damage and loss within a set time after purchase. For example, if you have an American Express card, the chances are that card provides AmEx purchase protection.

However, not all purchases and losses are covered by AmEx purchase protection. Let's look at how Amex purchase protection works, which AmEx cards feature it and the limitations and exclusions of this coverage.

How does AmEx purchase protection work?

AmEx purchase protection covers lost, stolen or damaged items within the first 90 days after purchase.

This coverage is complimentary on most AmEx cards — including some debit, prepaid and reloadable AmEx cards. All you need to do to get this coverage is to use your eligible AmEx card to make a covered purchase of a tangible item.

If that item is lost, stolen or damaged within the first 90 days, file a Notice of Claim within 30 days to start the claims process. Here, you'll need to provide a copy of the purchase receipt and proof of loss.

That proof of loss depends on the circumstances.

- If a loss is due to theft, you may need to provide a copy of the police report.

- In the case of a damage claim, you may need to send in the broken item.

Get the 'Cheat Codes' to Cheaper Travel

Unlocking the secret to saving a ton on travel is easier than you think. 📤 Our free newsletter shows you how in 5 min. or less.

Which cards have AmEx purchase protection?

Dozens of AmEx cards offer purchase protection benefits.

Personal cards with purchase protections from AmEx include:

AmEx personal cards with purchase protection

- Amex EveryDay® Credit Card (no longer available to new applicants).

- The Amex EveryDay® Preferred Credit Card from American Express (no longer available to new applicants).

Terms apply.

Meanwhile, here's the list of small business cards from AmEx with this benefit:

AmEx small business cards with purchase protection

Terms apply.

However, the purchase protection coverage amounts and limitations vary between AmEx cards. Plus, AmEx can change the coverage at any time. So, checking the terms for your AmEx card when you need coverage is essential. Terms apply.

» Learn more: The best travel credit cards right now

Limitations and exclusions on AmEx cards

As with any insurance or coverage product, AmEx purchase protection comes with limitations and exclusions. Let's take a look at the current coverage on the American Express Platinum Card® as an example. Terms apply.

At the time of writing, the American Express Platinum Card® holders are covered for up to 90 days from the date of a covered purchase of an eligible item (see rates and fees). Big spenders should note that the purchase protection on the American Express Platinum Card® only covers up to $10,000 per covered purchase. Each eligible AmEx card is covered for up to $50,000 in claims per year. Terms apply.

» Learn more: The best credit cards for travel insurance benefits

Unfortunately, if you're affected by a natural disaster, AmEx purchase protection only covers a maximum of $500 in claims per event.

AmEx purchase protection excludes a long list of types of purchases, including:

- Animals or living plants.

- Antiques, artwork and previously used items.

- Cash and cash-like items — including gift certificates, stamps and coins.

- Intangible items — such as software.

- Land, buildings, or permanent fixtures.

- Medical or dental devices.

- Motorized vehicles.

Terms apply.

Plus, not all damage and losses are covered. For example, AmEx won't approve a claim for damage to an item "purchased for play." So, you can't claim purchase protection if your baseball bat or hockey stick breaks. AmEx purchase protection also doesn't cover losses when the item isn't "reasonably safeguarded" — such as leaving it in an unlocked car or publicly unattended. Terms apply.

How to file an AmEx purchase protection claim

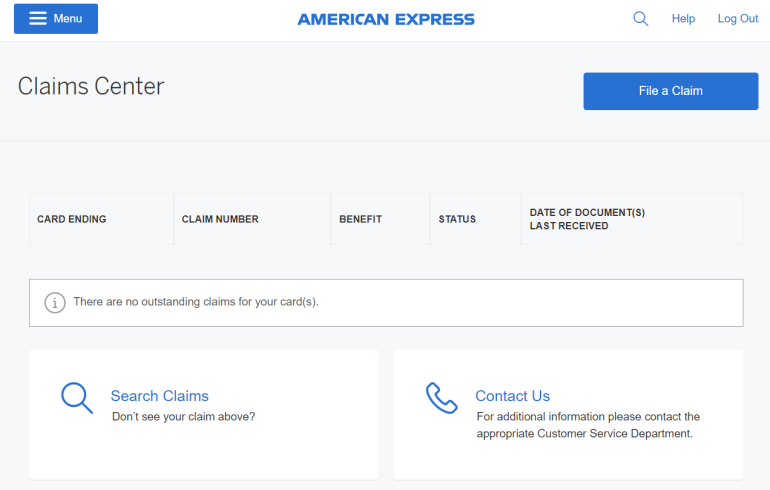

AmEx makes it easy to file a purchase protection claim on its website. To start the process, log into your AmEx account and go to the claims center page.

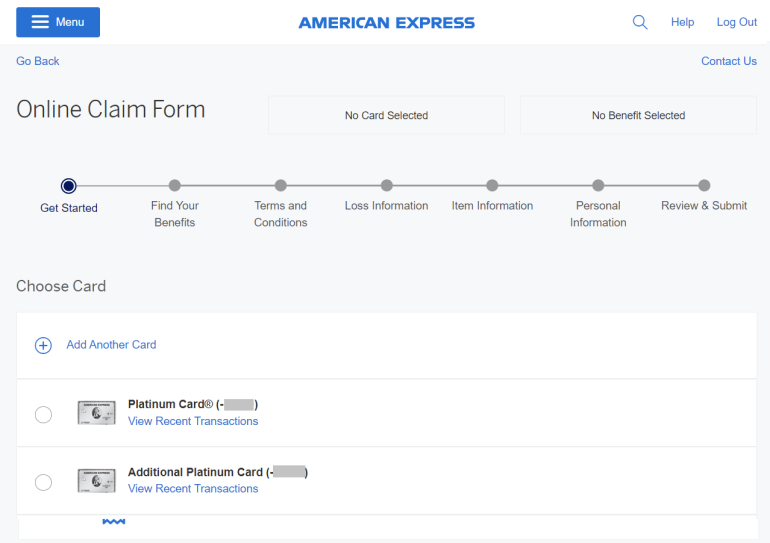

Click "file a claim" and select the card for which you're filing a claim, enter your date of purchase and click "continue."

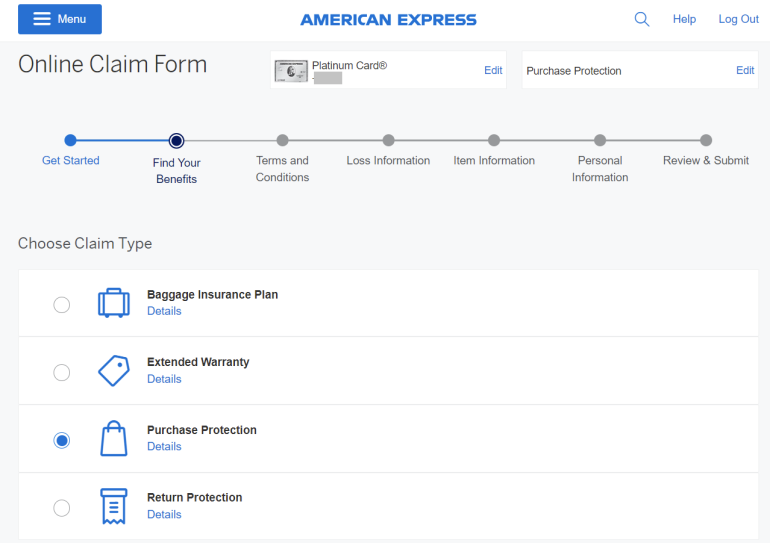

Select "purchase protection" on the next page and continue the process.

Frequently Asked Questions

Does the Gold card have purchase protection?

Yes, cardmembers of the American Express® Gold Card are covered by AmEx's purchase protection coverage. However, this card is so packed with benefits that this coverage doesn't make the card's highlights on the AmEx website. Instead, check the benefits guide to see the card's purchase protection coverage.

In short, covered purchases are covered for up to 90 days from the date of purchase for up to $10,000 per covered purchase and up to $50,000 per eligible card per calendar year. Terms apply.

Does AmEx purchase protection cover lost items?

In addition to stolen and damaged items, AmEx purchase protection also covers items lost within the coverage period. Just make sure to file a notice of claim within 30 days of the loss. Also, note that some losses are excluded — such as if you left the item in an unlocked car.

Can I file an AmEx purchase protection claim if I redeemed points?

Eligible AmEx cardmembers can still file a purchase protection claim for a covered loss even if you've redeemed Membership Rewards points for all or part of that purchase — including Pay With Points redemptions.

AmEx purchase protection review

AmEx purchase protection is complimentary coverage provided on most AmEx cards that covers theft, loss and damage to eligible items within the first 90 days of purchase. Terms apply.

Like insurance, purchase protection is one of those things that you hope you never have to use. Check the details of your card's coverage to see if your incident is covered. Remember you need to provide a copy of the purchase receipt and file a Notice of Claim within 30 days of the loss or damage. Terms apply.

All information about Amex EveryDay® Credit Card has been collected independently by NerdWallet . Amex EveryDay® Credit Card is no longer available through NerdWallet.

All information about The Amex EveryDay® Preferred Credit Card from American Express has been collected independently by NerdWallet. The Amex EveryDay® Preferred Credit Card from American Express is no longer available through NerdWallet.

All information about Hilton Honors American Express Aspire Card has been collected independently by NerdWallet. Hilton Honors American Express Aspire Card is no longer available through NerdWallet.

American Express Insurance Benefit: Purchase Protection

- Purchase Protection is an embedded benefit of your Card Membership and requires no enrollment. It can help protect Covered Purchases made on your Eligible Card when they’re accidentally damaged, stolen, or lost, for up to 90 days from the Covered Purchase date. The coverage is limited up to $10,000 per occurrence, up to $50,000 per Card Member account per calendar year. Coverage Limits Apply.

- Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply.

- Please visit americanexpress.com/benefitsguide for more details.

- Underwritten by AMEX Assurance Company.

American Express Insurance Benefit: Purchase Protection

- When an American Express® Card Member charges a Covered Purchase with their Eligible Card, Purchase Protection can help protect their Covered Purchases for up to 90 days from the Covered Purchase date if it is stolen or accidentally damaged. The coverage is limited up to $1,000 per occurrence, up to $50,000 per Card Member account per calendar year.

- Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply.

- Please visit americanexpress.com/benefitsguide for more details.

- Underwritten by AMEX Assurance Company.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2026:

- Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

- No annual fee: Wells Fargo Autograph® Card

- Flat-rate travel rewards: Capital One Venture Rewards Credit Card

- Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

- Luxury perks: American Express Platinum Card®

- Business travelers: Ink Business Preferred® Credit Card

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

Limited Time Only: Earn $1,000 Toward Travel!

Capital One Venture Rewards Credit Card

Travel

For a limited time, the

Capital One Venture Rewards Credit Card is offering new cardholders an especially rich bonus: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel!

More like this

Related articles