How to Use the $50 Annual Ultimate Rewards Hotel Credit

Hotel elite status holders should weigh the savings of the credit against the cost and benefits of booking directly.

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

Among the many travel benefits of the Chase Sapphire Preferred® Card is a $50 annual hotel credit for bookings made through Chase's travel portal. Here's how to use the credit.

On this page

What is the Chase Sapphire Preferred® Card $50 hotel credit?

Chase Sapphire Preferred® Card holders will only receive the $50 hotel credit for hotel bookings made directly through Chase. You'll receive the credit immediately upon approval for the card.

If you want more freedom, the Chase Sapphire Reserve® comes with $300 in annual statement credits that are automatically applied to travel purchases on the card and are not limited to hotels booked in Chase's travel portal — it can apply to a variety of travel-related expenses, including hotels, airfare, train tickets and cruises.

» Learn more: Chase Sapphire Preferred vs. Sapphire Reserve

Get the 'Cheat Codes' to Cheaper Travel

Unlocking the secret to saving a ton on travel is easier than you think. 📤 Our free newsletter shows you how in 5 min. or less.

How to use the $50 annual Ultimate Rewards® hotel credit

The hotel credit can be used for any hotel available within Chase's travel portal, providing a lot of flexibility for booking. The portal also includes the ability to filter properties by star rating, amenities, hotel chain and more.

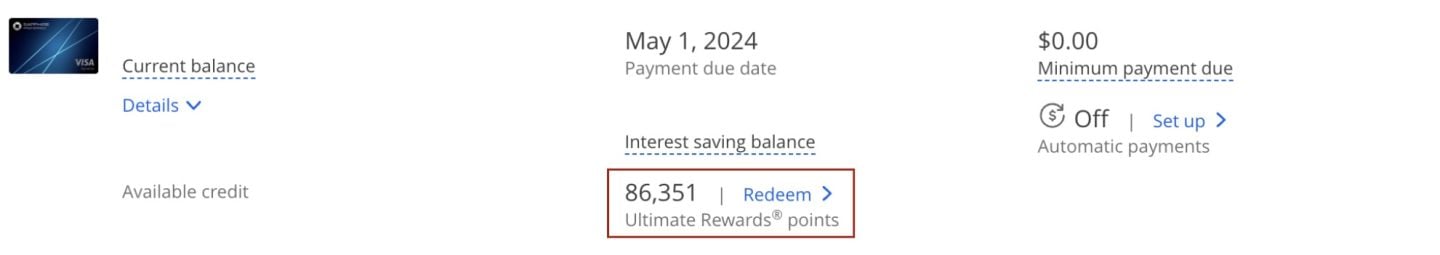

To use the credit, you'll first want to log in to your Chase Ultimate Rewards® account.

Once logged in, you’ll need to select your Chase Sapphire Preferred® Card, which will bring up the card’s detailed information. Next, select the "Redeem" link next to your rewards balance to access the Chase Ultimate Rewards® homepage.

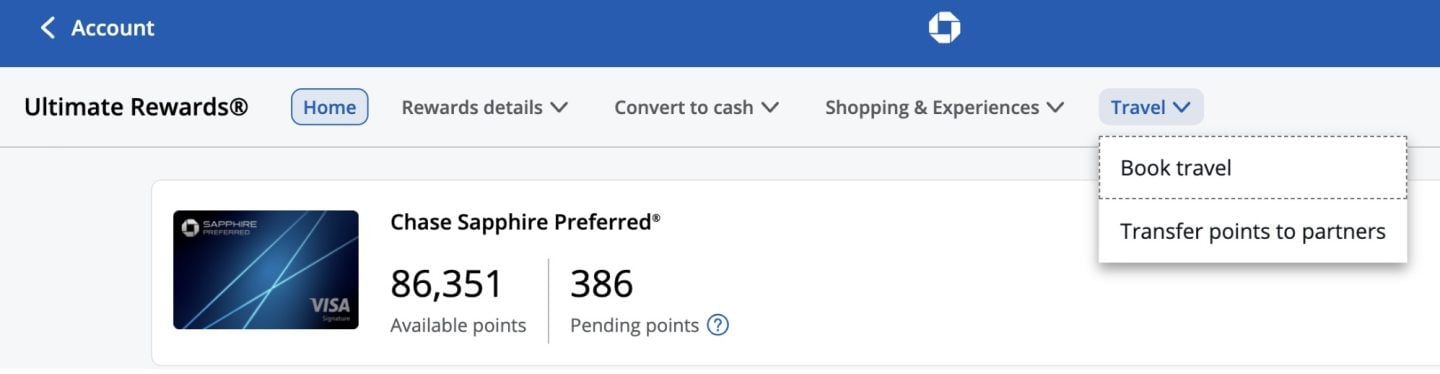

Next, select "Book travel" from the travel dropdown menu.

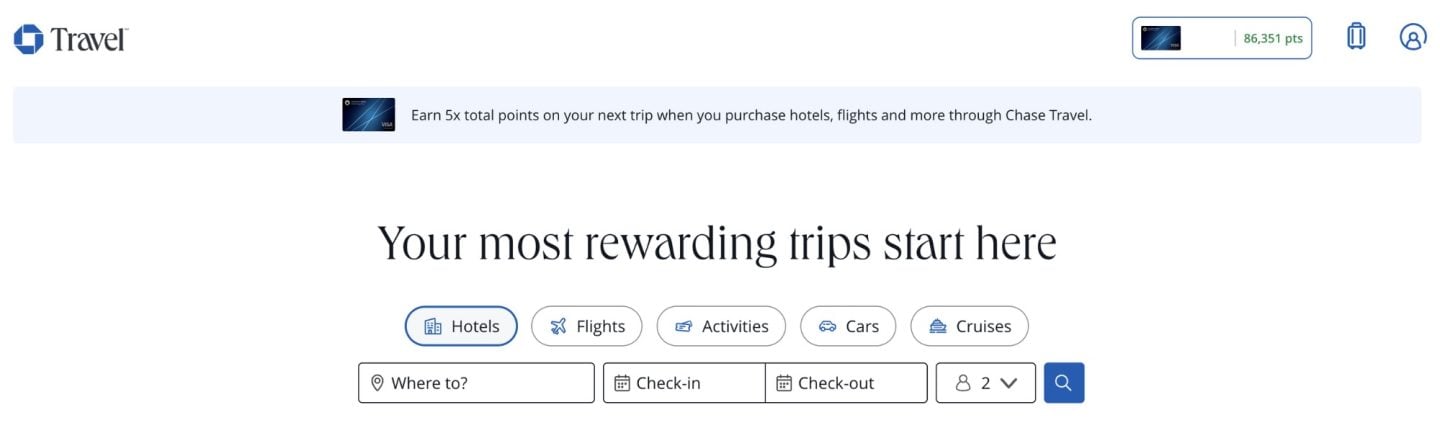

This will take you to Chase's travel portal, where you can book flights, hotels, cruises, cars and tour activities. To use the hotel credit, you'll select hotels, then input your travel details.

The hotel credit can be used with any hotel that shows up on the results page.

After choosing a hotel, you’ll be able to select your room and then navigate to the checkout page. Here, you can choose to use points for your redemption or pay with cash. To use the credit, you’ll want to use your Chase Sapphire Preferred® Card to pay. You can choose to pay with a combination of points and cash if you prefer, but you should pay at least $50 in cash to qualify for the statement credit.

You’ll be able to see the booking on your statement, and once you’ve completed your stay, the credit will be automatically applied to your account.

» Learn more: How to maximize Chase Ultimate Rewards®

When should you use the Chase Ultimate Rewards® hotel credit?

A $50 credit toward a hotel is always good to have, but you won’t always want to use it for your bookings.

When it doesn’t make sense

Generally, you’ll want to book directly — not through Chase's portal — if you’re looking to earn hotel elite status or take advantage of the benefits if you already have it. This is because most hotel chains will not give you any of your elite status perks or allow you to earn any elite-qualifying nights if you book using a third party, such as Chase's travel portal.

Consider the Manchester Grand Hyatt San Diego, which is available for a one night stay in January.

While Chase’s travel portal includes taxes and fees, it doesn’t include resort fees and taxes. Resort fees and taxes add an additional $47.25. This brings the total for your stay to $395.53. With the travel credit applied, you’ll only pay $345.53 out of pocket.

Here’s the same stay when booked directly through Hyatt’s website.

As you can see, it’s the exact same price for the booking. At first glance, then, it would seem like Chase's travel portal would be a better option.

But let’s say you have Hyatt elite status. If you're a Globalist member, you receive waived resort fees on all stays, complimentary breakfast, room upgrades when available, 4 p.m. checkout and access to the executive lounge. Waiving the resort fee drops the overall total down to $348.28 out of pocket.

Is it worth it to pay $3 more for all of those amenities? Most folks would say yes.

When it does make sense

There are definitely situations when using your travel credit is a good idea. This is especially true in cities or smaller towns where common chain hotels are not available.

Consider Split, Croatia, which features 80-plus hotels through Chase's travel portal. Of these hotels, the only major chains are Radisson and Small Luxury Hotels.

In this case, if you don’t have any loyalty to Radisson or Small Luxury Hotels, you won’t miss out on potential benefits by booking through Chase instead of directly with either brand. Both boutique hotels and non-chain options can be an excellent use of your $50 annual credit, especially in locations with limited options.

» Learn more: How to redeem Ultimate Rewards® points from Chase

If you want to use the Chase Sapphire Preferred® Card annual hotel credit

The $50 annual Ultimate Rewards® credit is a nice perk for Chase Sapphire Preferred® Card holders, helping to offset the card's $95 annual fee. Using the credit is simple — you’ll just need to book a hotel through Chase's travel portal. Before doing so, however, you’ll want to consider all your options.

Those looking to maintain or pursue elite status will want to weigh their benefits against the savings they’d receive with the credit. Otherwise, applying the $50 toward non-chain or boutique hotels can be an excellent use of this annual credit.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2026:

- Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

- No annual fee: Wells Fargo Autograph® Card

- Flat-rate travel rewards: Capital One Venture Rewards Credit Card

- Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

- Luxury perks: American Express Platinum Card®

- Business travelers: Ink Business Preferred® Credit Card

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

Limited Time Only: Earn $1,000 Toward Travel!

Capital One Venture Rewards Credit Card

Travel

For a limited time, the

Capital One Venture Rewards Credit Card is offering new cardholders an especially rich bonus: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel!

More like this

Related articles