AXA Travel Insurance Review: Is it Worth The Cost?

AXA offers three policy tiers, each of which provides at least 100% trip cancellation and interruption coverage.

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

at Squaremouth

AXA

While offering multiple plans, AXA might not allow as many customizations compared to some competitors.

at Squaremouth

Pros

- Lowest-cost plan includes medical coverage.

- Pre-existing conditions waiver add-on available for higher-cost plans.

- Platinum plan includes coverage for lost ski days and golf rounds.

Cons

- No add ons available for Silver plan.

- Cancel For Any Reason upgrade available for only highest-cost plan.

AXA Assistance USA travel insurance offers three comprehensive plans with a wide variety of customizations. Although plans are on the expensive side, the benefits that they offer allow for complete peace of mind while traveling, no matter what you’re doing.

What is AXA Assistance USA travel insurance?

AXA offers travel insurance in more than 30 countries. With over 20 years of experience, AXA is well-regarded and features generally favorable reviews. It boasts an A+ Financial Strength Rating (FSR) from AM Best, which ranks companies in the insurance industry. This is the second-highest score available and marks AXA as superior.

What does AXA Assistance USA travel insurance cover?

AXA travel insurance coverage is pretty comprehensive. Although its less expensive plans offer fewer features, in general you can expect AXA travel insurance medical coverage as well as a range of travel protections.

- AXA health insurance coverage: Provides either primary or secondary emergency medical care, depending on which plan you choose.

- Trip cancellation and trip interruption: Reimburses you for nonrefundable expenses incurred when your trip is canceled or interrupted for a covered reason.

- Emergency evacuation: Covers you for costs incurred as a result of an evacuation for a medical emergency.

- Baggage protection: Reimburses you for lost luggage or the cost of buying new items in the event your luggage is delayed.

- Missed connection: Offers coverage for expenses incurred as a result of missing your connection.

Note that the more expensive your plan, the more inclusions you have. This includes unusual coverages, such as reimbursement for sports equipment rentals, lost golf rounds and pet boarding fees.

AXA Assistance USA travel insurance policies

| Silver | Gold | Platinum | |

|---|---|---|---|

| Trip Cancellation | 100% of trip cost. | 100%. | 100%. |

| Trip Interruption | 100%. | 150%. | 150%. |

| Trip Delay | $100 per day, $500 maximum. | $200 per day, $1,000 maximum. | $300 per day, $1,250 maximum. |

| Emergency Medical | $25,000. | $100,000. | $250,000. |

| Emergency Evacuation and Repatriation | $100,000. | $500,000. | $1 million. |

| Lost Luggage | $750. | $1,500. | $3,000. |

| Luggage Delay | $200. | $300. | $600. |

| Missed Connection | $500. | $1,000. | $1,500. |

Add-on options

AXA offers just two options for add-ons, and they’re pretty limited. The Gold and Platinum plans allow you to opt in to rental car insurance. The Platinum plan also includes the ability to purchase Cancel For Any Reason (CFAR) insurance.

» Learn more: The best travel credit cards right now

What’s not covered by an AXA Assistance USA travel insurance plan

AXA’s travel insurance protections are fairly broad, but there are some things that AXA won’t cover. For example, the Silver plan doesn’t cover pre-existing conditions, while the higher-tier plans do. This can be important for those with illnesses or injuries that may flare up during their vacation.

Other exemptions will generally include:

- Epidemics.

- Adventure activities (unless specifically included with your plan).

- Storms after they’ve been named.

- Anything that happens while under the influence of drugs or alcohol.

How AXA Assistance USA travel insurance compares to its competitors

On a 5-star scale, NerdWallet rated AXA 1.5 stars.

A sample trip for a 36-year old traveler from Indiana to Canada for 5 days found that the cheapest AXA plan cost $168. If you were to spring for the premium plan, which increases your coverage limits, expect to pay $235.

When looking across multiple providers, the same sample trip ranges in cost from $10-$202. Note that price isn't the only differentiating factor. Coverage is not identical across plans; each company offers various levels of scope, limits and exclusions.

| Company | Star rating | Basic plan cost | Premium plan cost | Generate a quote |

|---|---|---|---|---|

| Berkshire Hathaway Travel Protection | | $26. | $75. | |

| Tin Leg | | $36. | $188. | |

| WorldTrips Travel Insurance | | $47. | $66. | |

| World Nomads | | $63. | $115. | |

| Trawick International | | $100. | $194. | |

| AXA Assistance USA | | $114. | $159. | |

| AEGIS (GoReady) Travel Insurance | | $139. | $208. | |

| HTH Travel Insurance | | $146. | $233. | |

| Seven Corners | | $154. | $225. | |

| Travel Insured International | | $164. | $218. | |

| Allianz Global Assistance | | $166. | $291. | |

| USI Affinity Travel Insurance Services | | $169. | $297. | |

| AAA | | $183. | $222. | |

| IMG | | $183. | $252. | |

| Travel Guard | | $135. | $236. | |

| Arch RoamRight | | $202. | $225. | |

| These star ratings are based on a separate analysis of each travel insurance provider’s offerings. For more detailed scoring, see our recommendations for the best travel insurance companies, read each individual provider's NerdWallet review or view our methodology at the end of this article. Pricing is subject to change based on your specific trip details. You can verify the latest price by clicking through to Squaremouth (a NerdWallet partner). | ||||

How much is AXA Assistance USA travel insurance?

How much does AXA Assistance USA travel insurance cost? The cost is going to depend on a few factors, including where you’re going, the cost of your trip, your age, where you live and how long your vacation will be.

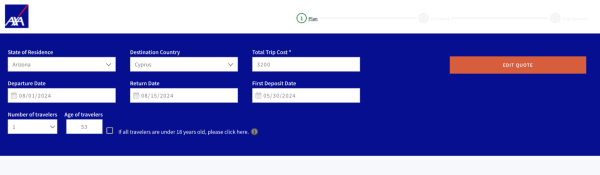

To test the waters, we created a sample trip for a 53-year-old from Arizona traveling to Cyprus for two weeks. The total trip cost was $3,200.

| Plan | Cost |

|---|---|

| Silver | $168. |

| Gold | $197. |

| Platinum | $235. |

There’s not a huge difference in cost between the Silver plan and the Platinum plan, though they’re both fairly expensive. That being said, the Platinum plan comes with all kinds of inclusions that the Silver plan is missing.

How to buy an AXA Assistance USA travel insurance policy

Purchasing an AXA policy is simple and can be done online or via the phone. To do so over the phone, call 855-327-1441.

Online, you’ll simply need to navigate to AXA’s homepage. From there, you can generate a quote using your trip information, including:

- State of residence.

- Destination.

- Departure and return dates.

- Date you made your first deposit.

- Age.

- Trip cost.

- Number of travelers.

AXA will then pop out a quote for all three of its plans. From there, you can select the one you like and go through the checkout process.

Consider comparison shopping

If you're not 100% sold on purchasing a plan from AXA, you can use a travel insurance aggregator to compare policies across multiple companies at once.

Which AXA Assistance USA travel insurance plan is best for me?

The plan that best suits your needs is going to depend on your travel habits. If you’re planning a more expensive vacation with a lot of moving parts, the higher-end Platinum plan may be a good fit. This is especially true if you’re looking to rent sports equipment, want to add on CFAR insurance or have a pet.

If you are in relatively good health and are really looking for trip protections for your vacation, the Silver plan is less expensive but still offers a broad array of coverages.

Does AXA Assistance USA travel insurance offer 24/7 travel assistance?

Yes, AXA offers 24/7 travel services:

- Within the United States: 855-327-1442.

- Outside the United States: 312-935-1719.

- Via email: [email protected].

How to file a claim with AXA Assistance USA travel insurance

You can file a claim online via the self-service site. Otherwise, you can call 888-957-5015.

Frequently Asked Questions

Does AXA Assistance USA travel insurance cover COVID?

Yes, AXA plans all cover COVID.

Does AXA Assistance USA travel insurance cover flight cancellation?

If your flight has been canceled, AXA’s travel insurance may cover the expenses incurred if you end up delayed. The limits will be decided by your plan.

How long does an AXA Assistance USA travel insurance refund take?

AXA doesn’t specify how long it will take to get a refund from a claim. However, factors that can influence the reimbursement period can include the complexity of the claim, documentation and the method in which you choose to file a claim.

Is AXA Assistance USA travel insurance primary or secondary?

The Silver plan of AXA travel insurance is entirely secondary. The Gold and Platinum plans are primary in some instances but secondary for missed connections.

Is AXA Assistance USA travel insurance worth it?

Is AXA Assistance USA travel insurance good? Overall, yes, the plans that it offers provide coverages on par with other insurance companies. Its Platinum plan in particular offers options that you won’t generally find elsewhere.

To decide whether an AXA travel insurance policy is good for you, you’ll want to crunch some numbers and generate a quote. If your peace of mind is valuable to you, purchasing a policy may be a good idea.

Be aware that many credit cards come with complimentary travel insurance, so before you purchase a plan, it’s a good idea to check if this is offered by your card.

Star rating methodology

Travel insurance rating and review methodology

Travel insurance

NerdWallet's ratings for travel insurance companies take into account the following details about each insurer:

- Scope of coverage.

- Customizability.

- Consumer experience and complaints.

- Cost.

The best travel insurers excel in all of these categories. They provide the information people need to make a purchase without any surprises along the way. They offer insurance at a fair price and allow customers to customize plans to meet their coverage preferences. They're also able to keep their customers happy throughout the relationship.

Data collection and review process

NerdWallet collects over a dozen data points for each insurer we analyze from their public-facing websites and third-party analyses. These data points are then compared against one another and against NerdWallet's standards for good travel insurance companies to determine a star rating.

Data is collected on a regular basis and reviewed by our editorial team for consistency and accuracy. Final star ratings are presented on a scale of one to five stars, where a one-star score represents "poor" and a five-star score represents "excellent."

The reviews team

The writers and editors behind NerdWallet's travel insurance reviews are insurance specialists who have had their work featured by or appear in The Associated Press, The Washington Post, The New York Times, the Chicago-Sun Times, U.S. News & World Report and the Society for Advancing Business Editing and Writing. Each writer and editor follows NerdWallet’s strict guidelines for editorial independence.

In addition to travel insurance, the team covers travel rewards programs, airlines and hotels.

Rating specifics

Our star ratings are weighted based on our editorial and professional opinions. We use the following weightings when rating travel insurers:

- Scope of coverage (25%).

- Customizability (25%).

- Consumer experience and complaints (25%).

- Cost (25%).

Scope of coverage ratings are based on assessments of a company’s standard protections, including:

- Travel medical insurance.

- Trip cancellation.

- Trip interruption.

- Trip delay.

- Baggage and personal belongings, lost luggage.

- Emergency medical assistance.

- Emergency medical evacuation.

- Emergency medical repatriation.

- Accidental death and dismemberment insurance.

- Rental car coverage.

Customizability ratings factor in whether coverage limits are fixed prices or a percentage of the trip cost (the percentage is generally better), whether a policy has customizations available, and the number of bonus features.

- 24-hour assistance.

- Pre-existing medical conditions coverage.

- Extreme sport coverage.

- CFAR add on availability.

- Travel health insurance.

- Interruption for Any Reason.

- Travel Inconvenience.

- Cancel for Work Reasons.

- Electronics coverage.

Consumer experience ratings are based on provider reviews on Squaremouth.com. If the company is not in the Squaremouth database, we default to Google reviews.

Affordability ratings are based on the percentage of total trip cost a plan costs a policyholder. Less than 4% is considered excellent, whereas over 9% is considered poor.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2026:

- Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

- No annual fee: Wells Fargo Autograph® Card

- Flat-rate travel rewards: Capital One Venture Rewards Credit Card

- Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

- Luxury perks: American Express Platinum Card®

- Business travelers: Ink Business Preferred® Credit Card

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

Limited Time Only: Earn $1,000 Toward Travel!

Capital One Venture Rewards Credit Card

Travel

For a limited time, the

Capital One Venture Rewards Credit Card is offering new cardholders an especially rich bonus: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel!

More like this

Related articles