Bilt Expands Into Health Care With Walgreens Partnership

New features in the Bilt app let you apply FSA/HSA funds to eligible purchases and earn extra points at Walgreens.

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

» Update

November 2025 update: The version of the Bilt World Elite Mastercard® Credit Card issued by Wells Fargo is no longer accepting new applications. Existing cardholders can use their cards through Feb. 6, 2026, and after that point, they can transition to a new version of the card. They can choose to close their old Wells Fargo card account, but if they leave it open, it will be converted to a Wells Fargo Autograph® Card with a different card number.

April 2025 update: Bilt World Elite Mastercard® Credit Card holders can now redeem Bilt Points for up to $10 in savings during checkout at Walmart, Walgreens, CITGO, CVS, BP and Dollar General — but those redemptions don't offer much value.

Bilt Rewards, a loyalty program that offers a way to earn rewards on rent, announced a new partnership with Walgreens that’ll make it easier to use a flexible savings account (FSA) or health savings account (HSA) for eligible purchases at the pharmacy chain. You can also earn extra Bilt points when you shop at Walgreens. These new benefits, announced August 26, 2024, are already live in the updated version of the Bilt app.

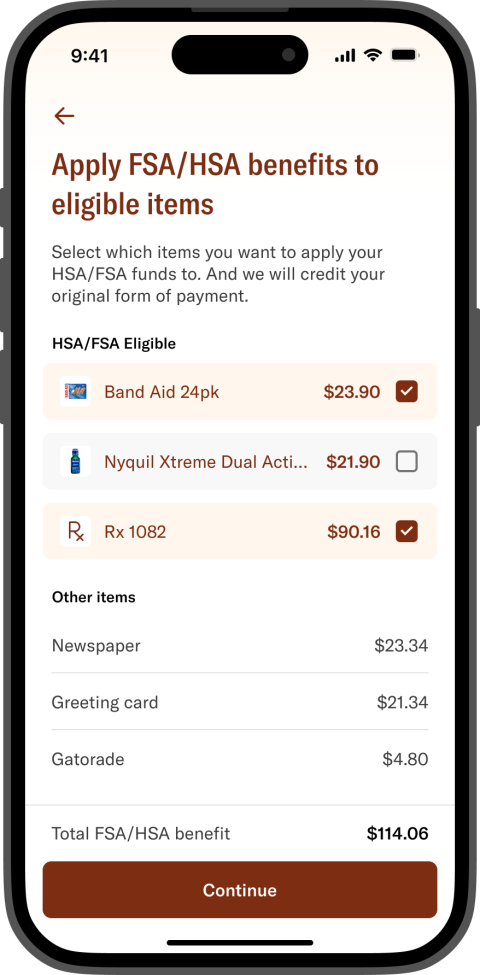

When you link your Bilt account with an FSA or HSA card, Bilt can automatically detect eligible FSA or HSA purchases at Walgreens on your other linked credit and debit cards. Through the Bilt app, you can choose to apply your FSA or HSA funds to eligible purchases, and Bilt will credit your original form of payment. You’ll also earn Bilt points for spending at Walgreens with any card linked to your Bilt account.

This partnership presents an easy way to automate applicable health care benefits and earn additional Bilt points.

How Bilt’s FSA/HSA benefit works

Bilt’s new health care benefit essentially helps people save money by using the money they’ve set aside for health care expenses in an FSA or HSA. These savings accounts can be difficult to use because people might not be aware of which purchases qualify or they forget their FSA card at the pharmacy.

In a news release announcing the Walgreens partnership, Bilt says the new feature addresses the “approximately $4 billion in FSA dollars lost annually due to non-use.” It’s also the first time this benefit has been available at a major pharmacy chain, according to Bilt.

So how does it work? First, you’ll have to link your FSA/HSA card and the debit or credit card you use for drugstore purchases. When you shop at Walgreens using any debit or credit linked to your Bilt account, Bilt will identify which items are eligible for FSA or HSA reimbursement and offer to apply benefits with a single click.

Bilt says this “eliminates the need to carry separate FSA or HSA cards and removes the guesswork in identifying eligible items.” Bilt also does not sell member data, so your health care purchases will remain private.

Get the 'Cheat Codes' to Cheaper Travel

Unlocking the secret to saving a ton on travel is easier than you think. 📤 Our free newsletter shows you how in 5 min. or less.

Earning Bilt points at Walgreens

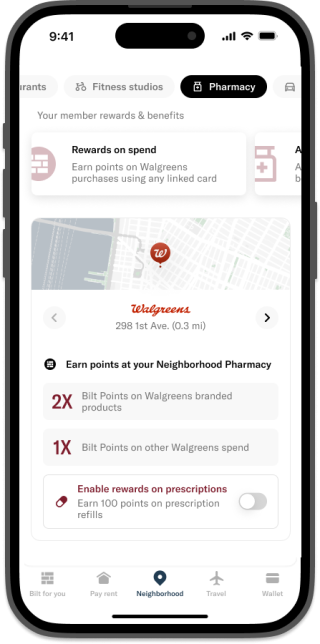

You don’t have to link your FSA or HSA card to benefit from the Walgreens partnership. If you have any credit or debit card to your Bilt Rewards account and shop at Walgreens, you’ll earn:

- 1 Bilt Rewards points per $1 spent on all Walgreens purchases.

- 2 Bilt Rewards points per $1 spent on Walgreens-branded items.

- 100 Bilt points on prescription refills (subject to exclusions).

🤓 Nerdy Tip

Check your Bilt app and turn the toggle on to enable rewards on prescriptions.

You could earn even more Bilt points by using the Bilt World Elite Mastercard® Credit Card, for an additional 1 Bilt point per $1 spent on the card, but other cards can earn more points on drugstore purchases. The card must be used five times per statement period to earn points on rent and qualifying net purchases (purchases minus returns/credits) for that statement period.

Bilt Rewards transfer to several airline and hotel partners, including Alaska Airlines' Atmos Rewards and World of Hyatt, making it a great way to earn transferable points that you can redeem for travel. Bilt Rewards is free to join, and you don’t need to be a Bilt cardholder to earn rewards. If you do any spending at Walgreens, Bilt’s new partnership with the drugstore is an easy and free way to earn extra points on your purchases.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2026:

- Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

- No annual fee: Wells Fargo Autograph® Card

- Flat-rate travel rewards: Capital One Venture Rewards Credit Card

- Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

- Luxury perks: American Express Platinum Card®

- Business travelers: Ink Business Preferred® Credit Card

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

Limited Time Only: Earn $1,000 Toward Travel!

Capital One Venture Rewards Credit Card

Travel

For a limited time, the

Capital One Venture Rewards Credit Card is offering new cardholders an especially rich bonus: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel!

More like this

Related articles