What’s the Value of Capital One Miles?

Depending on how you redeem your miles, they'll net you anywhere from 1 to 1.6 cents each in value.

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

Nerdy takeaways

- Capital One miles are worth exactly 1 cent apiece when booking travel through the Capital One portal.

- More valuable redemptions are available when transferring miles to partners.

- We estimate the value of miles redeemed with Capital One transfer partners at 1.6 cents.

Why are Capital One rewards called “miles” instead of “points,” even though they’re earned by spending with Venture cards rather than by flying? Nobody knows. But we do know how much they’re worth.

Based on our analysis, Capital One miles are worth between 1 cent to 1.6 cents each, depending on how they’re used.

» Learn more: The best travel credit cards might surprise you

Why the big spread? Because these points are worth a flat value when booking travel through the Capital One Travel portal, which is how many people use them. They can be worth significantly more when transferred to Capital One’s transfer partners, but maximizing them in this way takes more work.

What’s the value when booking travel through the Capital One portal?

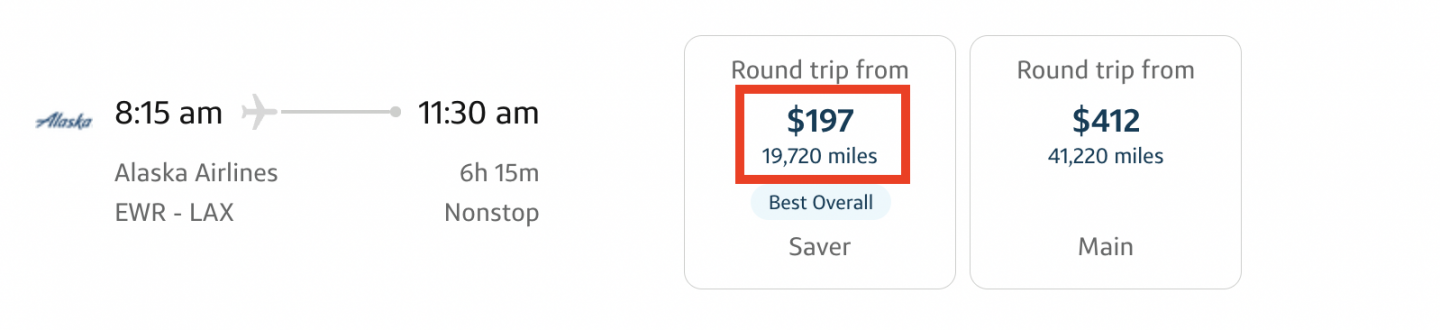

You can use Capital One miles as though they were cash by booking travel through the Capital One portal and paying with miles. They're worth exactly 1 cent apiece when used this way, and you can't squeeze more value from them. They also have the same value if you redeem miles for a statement credit against travel purchases.

» Learn more: Credit cards that earn Capital One miles

Get the 'Cheat Codes' to Cheaper Travel

Unlocking the secret to saving a ton on travel is easier than you think. 📤 Our free newsletter shows you how in 5 min. or less.

The benefit of using miles this way is simplicity. All you have to do is sign in, navigate to the travel portal and search for a flight, hotel room or rental car. Capital One will display the cost in both cash and miles, and you’ll choose how you want to pay at checkout.

The downside is value. Getting 1 cent per mile isn’t terrible, but more valuable redemptions are available when booking with partners.

» Learn more: How the Capital One Miles program works

What’s the value when transferring to Capital One partners?

Unlike in the previous section, there’s no simple answer to this question. You could get far more than 1 cent in value when transferring to partners, but you could also get far less if you’re not careful. Consider this option akin to trading in stocks rather than investing in bonds: It’s potentially more lucrative but also carries more uncertainty.

We estimate the value of miles redeemed with Capital One transfer partners at 1.6 cents based on the highest value transfer partner: Avianca LifeMiles. This figure ignores the lower-value transfer partnerships. Savvy points spenders should know which is which if they want to get the most from their miles.

| Transfer partner | NerdWallet value |

|---|---|

| Air Canada Aeroplan | 1.1 cents. |

| Air France/KLM Flying Blue | 0.8 cent. |

| Avianca LifeMiles | 1.6 cents. |

| British Airways Avios | 1.2 cents. |

| Emirates Skywards | 1 cent. |

| Singapore Airlines KrisFlyer | 1.1 cents. |

| Turkish Airlines Miles&Smiles | 0.7 cent. |

| Wyndham Rewards | 0.7 cent. |

Note: There are more Capital One transfer partnerships than what's shown above. These are the partners for which we have an estimated value.

How much are Capital One miles worth?

Use our calculator below to convert any given number of Capital One miles to dollars, based on both the baseline and NerdWallet estimated values.

Credit cards that earn Capital One miles

Capital One miles can be redeemed for a number of travel bookings. But before you start using Capital One miles, you have to earn them. The simplest way to amass a large number of Capital One miles is to earn a sign-up bonus for a credit card.

Capital One offers several credit cards that help you earn Capital One miles.

Annual fee

$95.

$0.

$395.

$0 intro for the first year, then $95.

Rewards rates

• 2 miles per dollar on purchases.

• 5 miles per dollar on hotels, vacation rentals and car rentals booked through Capital One Travel.

• 1.25 miles per dollar on purchases.

• 5 miles per dollar on hotels, vacation rentals and car rentals booked through Capital One Travel.

• 2 miles per dollar spent on purchases.

• 5 miles per dollar on flights and vacation rentals booked through Capital One Travel.

• 10 miles per dollar on hotels and car rentals booked through Capital One Travel.

• 2 miles per dollar spent on purchases.

Bonus offer

LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel.

Earn a bonus of 40,000 miles once you spend $1,000 on purchases within 3 months from account opening, equal to $400 in travel.

Earn 75,000 bonus miles when you spend $4,000 on purchases in the first 3 months from account opening, equal to $750 in travel.

Earn a one-time bonus of 50,000 miles – equal to $500 in travel – once you spend $4,500 on purchases within the first 3 months from account opening.

Learn more

How did we determine the value of Capital One miles?

NerdWallet estimates the value of Capital One miles at 1.6 cents each based on the transfer partner with the highest value rewards: Avianca LifeMiles.

» Learn more: The best Capital One credit card offers for travel

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2026:

- Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

- No annual fee: Wells Fargo Autograph® Card

- Flat-rate travel rewards: Capital One Venture Rewards Credit Card

- Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

- Luxury perks: American Express Platinum Card®

- Business travelers: Ink Business Preferred® Credit Card

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

Limited Time Only: Earn $1,000 Toward Travel!

Capital One Venture Rewards Credit Card

Travel

For a limited time, the

Capital One Venture Rewards Credit Card is offering new cardholders an especially rich bonus: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel!

More like this

Related articles