Should I Get a Delta or Alaska Credit Card?

We do a comparison of the airlines' credit cards and how much their miles are worth.

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

When it comes to caring for its passengers, Delta Air Lines and Alaska Airlines consistently get high marks. For the best in-flight experience, you might want to prioritize flying these customer-friendly airlines. If so, you may be wondering if you should get a Delta or Alaska credit card.

Both airlines offer valuable perks to their credit cardholders — from free checked bags to lounge access. But, it's important to consider all aspects of a credit card before you sign up. So, let's dive into the best airline cards for those considering a Delta or Alaska credit card.

Alaska Airlines vs. Delta credit cards

Although both Delta and Alaska are major domestic U.S.-based airlines, the two airlines offer quite different credit card options.

Delta credit cards

Delta offers an expansive portfolio of four personal credit card options and three business credit cards through its partnership with American Express:

- Delta SkyMiles® Blue American Express Card: $0 annual fee (see rates and fees).

- Delta SkyMiles® Gold American Express Card: $0 intro for the first year, then $150 annual fee (see rates and fees)

- Delta SkyMiles® Platinum American Express Card: $350 annual fee (see rates and fees).

- Delta SkyMiles® Reserve American Express Card: $650 annual fee (see rates and fees).

- Delta SkyMiles® Gold Business American Express Card: $0 intro for the first year, then $150 annual fee (see rates and fees).

- Delta SkyMiles® Platinum Business American Express Card: $350 annual fee (see rates and fees).

- Delta SkyMiles® Reserve Business American Express Card: $650 annual fee (see rates and fees).

- Terms apply.

» Learn more: Which Delta Air Lines credit card should you get?

Alaska Airlines credit cards

Alaska Airlines offers three Atmos-branded credit cards through Bank of America®:

- Atmos™ Rewards Ascent Visa Signature® credit card: $95 annual fee.

- Atmos™ Rewards Summit Visa Infinite® credit card: $395 annual fee.

- Atmos™ Rewards Visa Signature® Business card: $70 for the company and $25 per card annual fee.

Notable differences in these offerings

» Learn more: How to pick a premium travel credit card

Only Delta offers a card without an annual fee

Alaska doesn't offer a no-annual-fee card. So, if you're looking for a no-annual-fee airline card from either Delta or Alaska, you'll have just one option: the Delta SkyMiles® Blue American Express Card.

This card earns 2 miles per dollar spent at restaurants (including takeout and delivery) and on Delta purchases, and 1 mile per dollar on all other eligible purchases. Plus, you can earn a welcome bonus: Earn 10,000 bonus miles after you spend $1,000 in purchases on your new Card in your first 6 months. Terms Apply.

Comparing a Delta credit card vs. an Alaska credit card

When comparing Delta and Alaska credit cards, one of the most common head-to-head comparisons is between the Delta SkyMiles® Gold American Express Card and the Atmos™ Rewards Ascent Visa Signature® credit card. So, let's compare these two cards directly.

Key factors at play

Annual fee

The Delta SkyMiles® Gold American Express Card charges a $0 intro for the first year, then $150 annual fee. Meanwhile, the Atmos™ Rewards Ascent Visa Signature® credit card charges a $95 annual fee. Terms apply.

Welcome bonus

The Delta SkyMiles® Gold American Express Card is currently offering: Earn 70,000 Bonus Miles after you spend $3,000 in purchases with your new Card, and an additional 20,000 bonus miles after you make an additional $2,000 in purchases on the Card, both within your first 6 months. Ends 04/01/2026. Terms Apply.

Comparatively, the Atmos™ Rewards Ascent Visa Signature® credit card offers: Get 70,000 bonus points and a $99 Companion Fare (plus taxes and fees from $23) with this offer. To qualify, spend $3,000 or more on purchases within the first 90 days of opening your account.

» Learn more: How much are my airline miles worth?

Earning rates

The Delta SkyMiles® Gold American Express Card earns 2 miles per dollar spent at restaurants (including takeout and delivery), U.S. supermarkets and on Delta purchases. All other purchases earn 1 mile per dollar spent. Terms apply.

The Atmos™ Rewards Ascent Visa Signature® credit card offers a bonus on multiple purchases: 3 points per dollar spent on eligible Alaska Airlines purchases and 2 points per dollar spent on gas, EV charging stations, cable, streaming services and local transit, including ride share. You'll earn 1 point per dollar spent on all other purchases.

Get the 'Cheat Codes' to Cheaper Travel

Unlocking the secret to saving a ton on travel is easier than you think. 📤 Our free newsletter shows you how in 5 min. or less.

Other travel perks

Delta SkyMiles® Gold American Express Card cardmembers get a first free checked bag on Delta flights. You can also earn a $200 Delta flight credit toward future travel after spending $10,000 in purchases in a calendar year. That's like earning an additional 2 cents per dollar spent on your first $10,000 in purchases. Terms apply.

Cardholders also get 15% off award travel booked with Delta via the airline's TakeOff 15 benefit. Terms apply.

Atmos™ Rewards Ascent Visa Signature® credit card customers also get a first checked bag free and priority boarding, both for the cardholder and up to six guests on the same reservation. The free bag benefit applies to flights on Alaska Airlines and Hawaiian Airlines. You'll get 20% back on Alaska Airlines in-flight purchases. But perhaps best of all, you'll get a $99 Companion Fare each year if you spend $6,000 annually on the card. You can use this to score a round-trip flight for a companion starting at just $99 plus taxes and fees. Companion Fares can be used on any Alaska Airlines or Hawaiian Airlines flight within North America.

So, which one?

If you're debating between these two mid-tier cards, it really comes down to if you value the increased earning rate on the Delta SkyMiles® Gold American Express Card or the value of the Alaska Companion Fare, which could be worth a lot if you use it on an expensive round-trip flight.

We'd also take into account which airline offers more flights from your most frequently traveled airports. It will rarely be better to have an Alaska credit card if you live in a Delta hub.

Atmos points vs. Delta miles

Value per point

A key decision when choosing either a Delta or Alaska credit card is the value of the points or miles you earn and the ways that you can use those rewards.

NerdWallet recently analyzed the economy awards versus cash fares on Delta and Alaska. Based on this analysis, Alaska Atmos points are valued at 1.2 cents per mile. Delta's SkyMiles also a value of 1.2 cents per mile. But that's just the median value for these programs' economy awards, and your redemptions may vary.

If you want to fly up front in first or business class, Atmos Rewards comes out far ahead of Delta.

Alaska's Atmos Rewards offers some spectacular partner awards. For example, you can fly from the U.S. to Asia in Cathay Pacific business class for 50,000 points each way. Even better, Alaska allows you to stopover in Hong Kong before continuing on to India, South Asia, the Middle East or even South Africa for just 62,500 points.

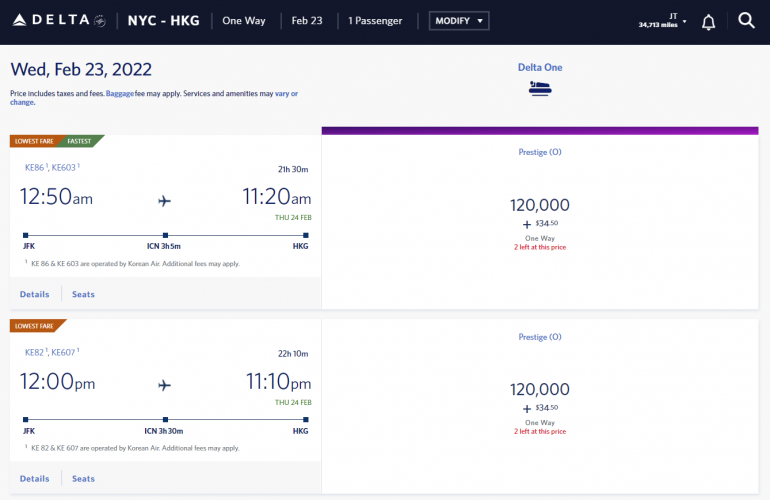

Comparatively, the cheapest Delta business class partner awards to Hong Kong cost 120,000 miles each way. And Delta now charges even higher rates within 60 days of departure.

Partner award opportunities

Alaska is part of the Oneworld alliance. It also has additional partnerships with carriers like Aer Lingus, Condor, Singapore Airlines and Starlux Airlines.

Alaska's airline partners

- Aer Lingus.

- Air Tahiti Nui.

- Aleutian Airways (earn partner only).

- American Airlines (Oneworld).

- Bahamasair (earn partner only).

- British Airways (Oneworld).

- Cape Air (earn partner only).

- Cathay Pacific (Oneworld).

- Condor.

- Contour Airlines (earn partner only).

- Fiji Airways (Oneworld).

- Finnair (Oneworld).

- Hainan Airlines.

- Iberia (Oneworld).

- Icelandair.

- Japan Airlines (Oneworld).

- Kenmore Air (earn partner only).

- Korean Air.

- LATAM Airlines.

- Malaysia Airlines (Oneworld).

- Mokulele Airlines (earn partner only).

- Oman Air (Oneworld).

- Philippine Airlines.

- Porter Airlines.

- Qantas (Oneworld).

- Qatar Airways (Oneworld).

- Royal Air Maroc (Oneworld).

- Royal Jordanian (Oneworld).

- Singapore Airlines.

- Southern Airways Express (earn partner only).

- SriLankan Airlines (Oneworld).

- STARLUX Airlines.

Delta is a founding member of the SkyTeam alliance, so you can redeem SkyMiles on any of the SkyTeam member airlines.

Delta's airline partners

- Aerolineas Argentinas.

- Aeromexico.

- Air Baltic.

- Air Europa.

- Cape Air.

- China Airlines.

- China Eastern.

- El Al.

- Garuda Indonesia.

- Kenya Airways.

- Korean Air.

- LATAM.

- MEA.

- SAS.

- Saudia.

- Scandinavian Airlines.

- Tarom.

- Vietnam Airlines.

- Westjet.

- Xiamen Air.

Either way, you’ll have access to an alliance full of partner airlines.

» Learn more: Guide to the Alaska Airlines award chart

Choose the right airline credit card for you

If you're looking for the best airline card for your situation, you can't go wrong with either a Delta or Alaska credit card. Both airlines offer credit cards with compelling benefits that can easily justify the annual fee. The best airline card is going to depend on what perks you most value, your tolerance for an annual fee and your travel habits.

To view rates and fees of the Delta SkyMiles® Platinum Business American Express Card, see this page.

To view rates and fees of the Delta SkyMiles® Reserve Business American Express Card, see this page.

To view rates and fees of the Delta SkyMiles® Gold Business American Express Card, see this page.

To view rates and fees of the Delta SkyMiles® Blue American Express Card, see this page.

To view rates and fees of the Delta SkyMiles® Platinum American Express Card, see this page.

To view rates and fees of the Delta SkyMiles® Reserve American Express Card, see this page.

To view rates and fees of the Delta SkyMiles® Gold American Express Card, see this page.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2026:

- Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

- No annual fee: Wells Fargo Autograph® Card

- Flat-rate travel rewards: Capital One Venture Rewards Credit Card

- Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

- Luxury perks: American Express Platinum Card®

- Business travelers: Ink Business Preferred® Credit Card

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

More like this

Related articles