Do Marriott Points Expire?

Marriott points typically expire if your account goes 24 months without a qualifying activity.

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

Just like a can of beans in your pantry, Marriott Bonvoy points have a shelf life. Your points won’t expire overnight, but they aren’t going to be in your account forever unless you keep your account active and in good standing.

Marriott points expire if your account goes 24 months without qualifying activity. If there’s been no activity on your Marriott Bonvoy account for five consecutive years, Marriott can deactivate your account entirely.

As long as you keep earning points consistently, your Marriott Bonvoy points won’t expire.

How do I find out when my Marriott points expire?

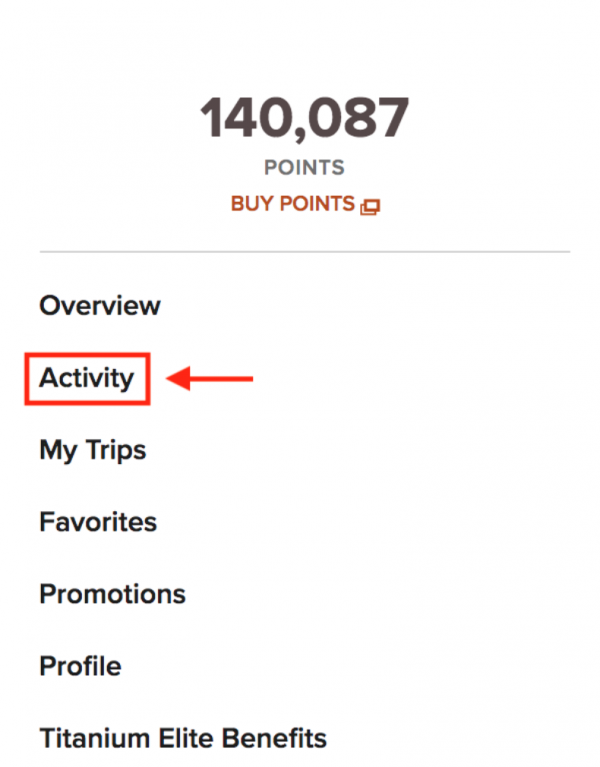

To find out when your Marriott points expire, log in to your Bonvoy account and click on your name in the top right corner. A menu will pop up displaying your elite status level, your points balance and an action list.

Click on “Activity,” and you’ll see a page with your recent points earnings and redemptions as well as the points expiration date.

» Learn more: The best ways to rack up Marriott Bonvoy points

How to keep Marriott Bonvoy points from expiring

One of the foolproof ways to ensure your Bonvoy account is active is to keep earning Marriott points. As long as you earn points, the rewards expiration date will keep pushing forward.

If you’re worried about your Bonvoy points expiring, you have several options to make sure your account remains active:

- Book and complete a paid stay or an award stay.

- Credit non-stay hotel spending to your account.

- Make a purchase with a co-branded Marriott Bonvoy credit card.

- Transfer points from a flexible program.

- Purchase Marriott Bonvoy points.

- Convert hotel points to airline miles.

- Shop with Marriott partners.

- Plan a meeting or an event at an eligible property.

Use transferable currencies

Have access to American Express Membership Rewards or Chase Ultimate Rewards® points? Both of these flexible bank currencies transfer to the Marriott Bonvoy program, and sending as few as the required 1,000 point minimum to Marriott will help extend the life of your rewards.

Here are some options for earning points with these programs:

Buying points

Another option you have is purchasing Marriott Bonvoy points starting at a rate of $12.50 per 1,000 points or 1.25 cents per point. You can purchase as few as 1,000 points and as many as 100,000 points per calendar year. NerdWallet values Marriott points at 0.8 cent apiece, which means that 1.25 cents is on the steeper end. However, purchasing 1,000 points to extend the life of a few hundred thousand points makes sense if you don’t have another way to keep your account active.

Get the 'Cheat Codes' to Cheaper Travel

Unlocking the secret to saving a ton on travel is easier than you think. 📤 Our free newsletter shows you how in 5 min. or less.

Transfer points to partner airlines

Transferring Marriott points to a partner airline will also push back their expiration date. Bonvoy members can convert their hotel points at a ratio of 3:1 (with the exception of Air New Zealand Airpoints) to more than 40 airline loyalty programs. Air New Zealand Airports converts at 200:1.

Additionally, you can also earn 5,000 extra miles for every 60,000 Marriott points transferred. You can transfer up to 240,000 points per day, meaning you can gain an extra 20,000 miles just by transferring with a partner airline. Transfers to United net an extra 5,000 bonus miles for a total of 10,000 bonus miles on every 60,000-point transfer.

Note that this transfer bonus does not apply to American, Delta, Avianca or Korean Air.

Earn points by purchasing from Marriott partners

Doing business with Marriott partners, such as Hertz or Uber, will also help you earn points and keep your account active. For example, booking a rental car with Hertz will earn you 500 Marriott points per rental.

You can also earn points by linking your Marriott Bonvoy account with Uber. Ordering a ride or food with Uber Eats will net you up to 6 Marriott points per dollar spent on eligible orders.

» Learn more: Why I love Marriott Bonvoy

Uber Eats isn’t the only way to earn points while ordering food. “Eat Around Town” is a program by Marriott that lets you earn hotel points by dining at more than 11,000 participating restaurants and paying with an eligible credit card. You’ll earn up to 6,000 Bonvoy points just for signing up for the program and eating out within the first 60 days.

You could also plan a business meeting at an eligible Marriott property. You’ll earn 2 Bonvoy points per dollar spent per event (up to 60,000 points for general members and up to 105,000 points for Titanium Elite and Ambassador Elite members).

Gifting points doesn’t count

Keep in mind that transferring or gifting points to another Marriott Bonvoy member or receiving a point transfer from someone else isn’t considered a qualifying activity and will not reset the 24-month clock.

» Learn more: The best hotel credit cards right now

If you’re worried about Marriott points expiration

If you’re worried about your Marriott points expiring, look over all the ways to perform a qualifying activity and pick the easiest one you can complete before the account is deemed no longer active. You don’t want to lose your hard-earned rewards simply because you weren’t paying attention.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2026:

- Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

- No annual fee: Wells Fargo Autograph® Card

- Flat-rate travel rewards: Capital One Venture Rewards Credit Card

- Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

- Luxury perks: American Express Platinum Card®

- Business travelers: Ink Business Preferred® Credit Card

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

Limited Time Only: Earn $1,000 Toward Travel!

Capital One Venture Rewards Credit Card

Travel

For a limited time, the

Capital One Venture Rewards Credit Card is offering new cardholders an especially rich bonus: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel!

More like this

Related articles