EKTA Travel Insurance: Is It Worth the Cost?

Compare ETKA's three budget-friendly plans to ensure optimal protection.

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

Travel insurance can help you financially because of the coverage it provides when a trip goes awry. With a variety of companies and plans available to travelers, it can be difficult to choose a single travel insurance provider.

Let’s take a look at EKTA travel insurance, what its coverage looks like and whether it’s worth it for you.

What does EKTA travel insurance cover?

EKTA travel insurance has three different plan options available to travelers, with a variety of coverage levels.

Here are some of the most common types of coverage you can expect:

- Extreme sports insurance.

- Repatriation of remains.

» Learn more: The best travel insurance companies

EKTA travel insurance plans

Start

EKTA’s least expensive travel insurance plan can be had for as little as a dollar per day. Despite this, you’ll still receive a decent amount of benefits, including:

- $50,000 in emergency medical care.

- Limited coverage for COVID-19 (10% of the coverage amount).

- Reimbursement for calls for emergency transport.

- Repatriation of remains.

- Coverage for standard physical activities such as running and swimming.

🤓 Nerdy Tip

This plan specifically excludes all coverage if you’ve been drinking alcohol. It also requires a 25% deductible. Gold

EKTA’s Gold plan is more expensive and starts at just under two dollars per day. The Gold level plan features most of the same benefits as the Start option, but with higher coverage amounts and a few other key differences:

- $150,000 in emergency medical care.

- COVID-19 coverage, including inpatient treatment and no dollar limit.

- Coverage for water activities.

- Coverage after drinking alcohol.

- Option to add extreme sports coverage.

- 0% deductible.

Max+

The Max+ plan is EKTA’s most expensive plan and costs just under six dollars per day. It includes the coverage of the Gold level; however, it’s far more comprehensive than the other two options. Here’s what it covers:

- $500,000 in emergency medical care.

- Comprehensive emergency medical transport.

- Gold-level COVID-19 coverage, plus compulsory observation for up to 15 days.

- $100 reimbursement for phone calls.

- Lost or delayed luggage.

- Breakdown or damage of rented equipment.

- Coverage for legal assistance.

- Return tickets if required unexpectedly.

- Trip delay coverage for flight delays over four hours.

- 15 days of limited inpatient coverage after the trip ends.

- Coverage for family to join you if you’re ill.

- Third-party liability coverage.

- Coverage for traveling in your own vehicle, including roadside assistance.

- Coverage for search operations.

- Reimbursement for force majeur events.

» Learn more: Is there travel insurance that covers COVID quarantine?

Which EKTA plan is best for me?

As you can see, there are big differences in the coverage you’ll receive with each EKTA plan. Before choosing one, you’ll want to carefully consider your needs.

Use existing coverage

Did you know that many travel credit cards come with complimentary travel insurance? In order to qualify for coverage, you simply need to pay for your travel with the card.

Among other benefits, coverage commonly includes:

- Emergency medical insurance.

- Lost baggage insurance.

- Trip cancellation and interruption insurance.

However, it’s important to look up your card’s coverage terms and understand its limits before assuming something will be covered.

» Learn more: The best travel credit cards right now

Consider your coverage needs

There is a huge difference between the types of coverage offered by EKTA’s three plans. If you simply need health insurance and don’t plan on participating in any dangerous activities, the Start plan may suffice.

However, it’s important that you read through the plan documents to see which best suits your needs. If you’re traveling by plane or will need supplemental coverage for high-risk activities, the more expensive Max+ plan may be a better fit.

» Learn more: How much is travel insurance?

Can you buy EKTA travel insurance online?

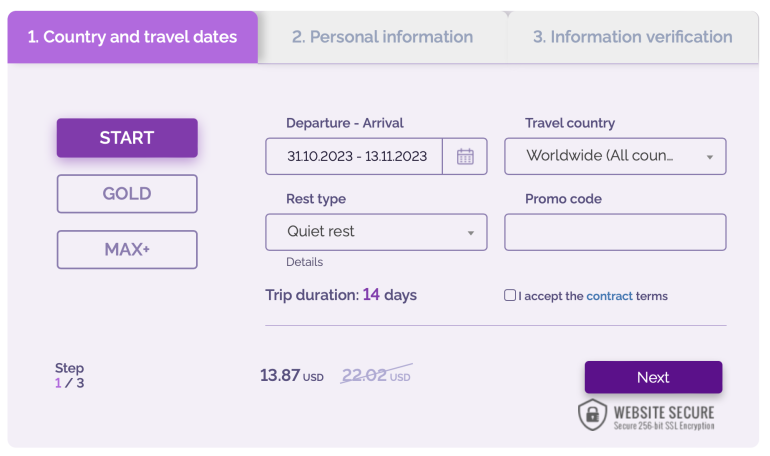

It’s easy to purchase EKTA travel insurance online. First, navigate to EKTA’s website and scroll down to the section with the form. You’ll need to choose which plan you’d like, enter your travel dates, what type of activities you plan on doing and then input some personal information. Once you’ve paid, you’re all set.

» Learn more: Common myths about travel insurance and what it covers

What isn’t covered by EKTA travel insurance?

Always read the fine print of your insurance policy so you know what is and isn’t covered. For example, the Start plan doesn’t provide coverage for inpatient treatment of COVID-19, but the higher-tiered plans do. It also excludes all coverage if you’ve been drinking alcohol.

Double-check before purchasing to find out which exclusions are a part of your policy.

» Learn more: How to find the best travel insurance

Is EKTA travel insurance worth it?

ETKA travel insurance’s three plans offer an affordable way to acquire travel insurance for your trip. However, they offer vastly different levels of coverage, so it’s best to do your homework and crunch the numbers before picking a plan.

You’ll also want to find out if you already have complimentary travel insurance coverage that’s offered by certain travel credit cards.

Frequently Asked Questions

Is EKTA travel insurance any good?

EKTA travel insurance may be a good fit for you if you like the simplicity of its policies. With just three options from which to choose, you won’t be overwhelmed by a dizzying array of coverage levels, deductibles and exclusions.

What is covered under EKTA travel insurance?

Many common travel snafus are covered under EKTA travel insurance, though your specific coverage will depend on the plan that you choose. Typical coverage for EKTA plans include emergency medical care, limited coverage for COVID-19 and repatriation of remains.

Does EKTA travel insurance cover Cancel For Any Reason?

Cancel For Any Reason insurance allows you to cancel your travel plans and recoup a portion of the nonrefundable expenses that you’ve incurred. None of EKTA’s travel insurance plans include CFAR options.

How does EKTA trip insurance work?

EKTA travel insurance becomes valid once you’ve selected a plan, generated a quote and purchased your insurance. Coverage begins on the date that you select or when you cross the border into the new country, whichever comes first.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2026:

- Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

- No annual fee: Wells Fargo Autograph® Card

- Flat-rate travel rewards: Capital One Venture Rewards Credit Card

- Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

- Luxury perks: American Express Platinum Card®

- Business travelers: Ink Business Preferred® Credit Card

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

Limited Time Only: Earn $1,000 Toward Travel!

Capital One Venture Rewards Credit Card

Travel

For a limited time, the

Capital One Venture Rewards Credit Card is offering new cardholders an especially rich bonus: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel!

More like this

Related articles