How to Make a Flight Payment Plan with No Credit Check

Use airlines and booking sites that offer buy now, pay later plans that don't do a hard credit check.

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

If you need to buy a plane ticket but don’t want to pay the full amount upfront, an option to consider is purchasing your flight using a flight payment plan that doesn’t require a credit check.

This can be a valuable option for travelers who can’t or don’t want to pay the total amount of the flight right away but who also don’t want to put the travel on a credit card — which may carry a sizable interest rate.

If you’re considering this option, keep reading to learn how to find a flight payment plan.

What is a flight payment plan?

A flight payment plan is a buy now, pay later option for booking flights. While the specifics vary based on your particular plan and other factors, a flight payment plan involves paying for the flight over time in equal installments. Usually, you can find these payment plans as a checkout option on the airline or online travel agency's website. Look for buy now, pay later plans from companies like Uplift, Affirm, Klarna or PayPal Credit.

Here’s an example of how a flight payment plan works:

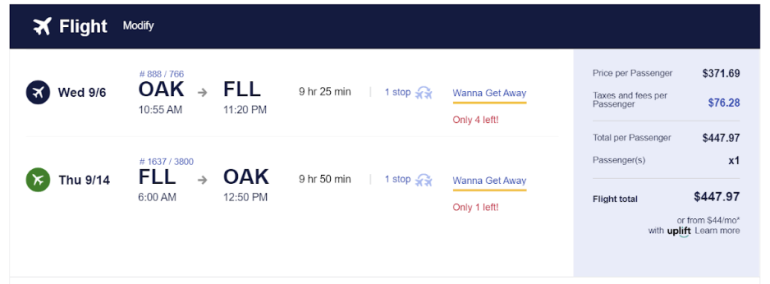

Say you want to buy a round-trip ticket on Southwest Airlines, flying from Oakland, Calif., to Fort Lauderdale, Fla. You find a ticket that departs on Sept. 6, 2023, and returns on Sept. 14 for $447.97.

Southwest allows you to pay in full or spread out your payments at checkout using Uplift. Uplift is a company that will enable qualifying customers to pay $47.34 at booking and then pay an additional $47.34 each month for the following nine months. Using the Uplift option, you’d pay $473.40 for your flight — $25.43 more than if you paid directly.

Although you’ll end up paying slightly more for the flight using Uplift than you would if you paid in full right away, this can be a great option for travelers who don’t have a credit card or who want to avoid using a credit card, especially if the card has a high interest rate.

» Learn more: 5 ways credit cards can beat buy now, pay later plans

Why look for flight payment plans with no credit checks?

Before signing up for a flight payment plan, check to see if you’ll be subject to a hard credit check for approval. Many buy now, pay later services only do a "soft credit inquiry." The main difference between a soft and a hard credit check is that a soft credit check doesn’t affect your credit score, whereas a hard credit check will.

Your credit score is essential for several reasons, including getting preferential interest rates for car loans or home mortgages, which is why you should favor flight payment plans that don’t require hard credit checks.

» Learn more: 6 tips for traveling without a credit card

Get the 'Cheat Codes' to Cheaper Travel

Unlocking the secret to saving a ton on travel is easier than you think. 📤 Our free newsletter shows you how in 5 min. or less.

Making a flight payment plan with no credit check

If you’re looking to use a flight payment plan to buy a plane ticket, the next step is to book your travel with either an airline or a booking website that offers flight payment plan options — and be sure to look for one that doesn’t require a hard credit check.

Airlines and booking websites that offer flight payment plans with no hard credit checks include:

- United Airlines.

- Southwest Airlines.

- American Airlines.

- Alaska Airlines.

- Priceline.

- CheapOair.

While the exact steps will vary based on who you’re booking with, you’ll typically take the following steps to book your flight and secure your payment plan:

- Search for and select the flight you want to book. Indicate that you’d like to use a buy now, pay later plan.

- Fill in the information required to set up your payment plan, which may include your name, birthday, Social Security number and phone number.

- If you’re approved, select the payment option you want to use.

- After you find a plan that works for you, accept the plan. You’ll usually also have to make an initial deposit.

🤓 Nerdy Tip

If you want to book a flight with an airline or booking site that doesn’t allow you to set up a flight payment plan at checkout, you may be able to set up a plan directly with a buy now, pay later company. For instance, Zip.co allows you to set up a flight payment plan with Booking.com or Delta with no hard credit check. Flight payment plans with no credit check recapped

If you’re purchasing a flight and don’t have the funds available to pay for it in full upfront — or if you’d rather spread out your payments over time — it’s worth considering a flight payment plan.

However, finding a plan that doesn’t require a hard credit check is best since that can lower your credit score.

To secure a flight payment plan with no credit check, you should first look into airlines and booking websites that offer that option, such as Alaska Airlines, United and Priceline.

After you find a flight you like, fill in the relevant information and review your payment options. If the plan looks good to you, accept the terms, including paying an initial deposit.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2026:

- Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

- No annual fee: Wells Fargo Autograph® Card

- Flat-rate travel rewards: Capital One Venture Rewards Credit Card

- Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

- Luxury perks: American Express Platinum Card®

- Business travelers: Ink Business Preferred® Credit Card

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

Limited Time Only: Earn $1,000 Toward Travel!

Capital One Venture Rewards Credit Card

Travel

For a limited time, the

Capital One Venture Rewards Credit Card is offering new cardholders an especially rich bonus: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel!

More like this

Related articles