GeoBlue Travel Insurance Review: Is it Worth the Cost?

While it is strong on medical coverage — including hazardous activities and quarantine — GeoBlue falls short in other areas.

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

at Squaremouth

GeoBlue

Long-term travelers and expats can find specialized coverage via GeoBlue.

at Squaremouth

Pros

- Flexible deductible options.

- Wide ranging medical coverage.

- Low prices for medical only needs.

Cons

- Lacks in traditional travel insurance coverage options such as trip Interruption, bag delays, etc.

- Better when paired with travel credit card insurance coverage.

If you’re going on a trip soon, you may be wondering whether to invest in travel insurance. This type of insurance can offer protection in the event that you fall ill, your plans change unexpectedly or you experience unavoidable delays.

GeoBlue is one insurance provider offering plans to travelers, with a number of plans available based on your needs. Here's a review of GeoBlue travel insurance, including the options offered and how to choose your plan.

What does GeoBlue travel insurance offer?

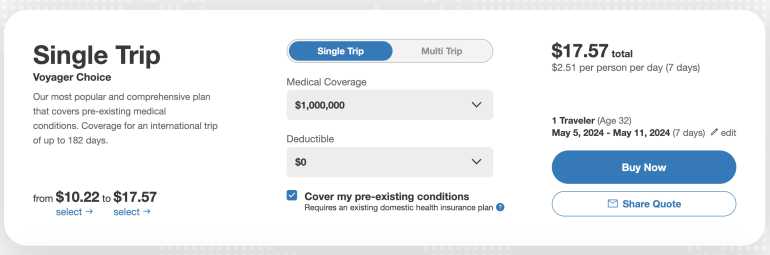

GeoBlue insurance offers two different plans for travelers, though it focuses mainly on medical coverage. These plans are called Voyager Essential and Voyager Choice. The former offers lower coverage options than the latter and is generally cheaper (though as you'll see, not always by a large amount).

The company also provides multitrip, long-term and group options for those who need them.

» Learn more: How much is travel insurance?

GeoBlue travel insurance cost and coverage

How much does GeoBlue cost? GeoBlue’s travel insurance is mostly medical-based and includes a comprehensive list of inclusions, though it also has coverage for some travel mishaps.

To get an idea of costs, we used a sample trip for a 33-year-old traveler from California with existing insurance heading out in August on a two-week trip.

Note that for this GeoBlue insurance review, we selected the highest coverage amount with no deductible. There are choices that allow you to include a higher deductible and a lower coverage limit, which may lower your plan cost.

Here’s what the two GeoBlue plans cover:

| Coverage | Voyager Essential | Voyager Choice |

|---|---|---|

| Medical limit | $1,000,000. | $1,000,000. |

| Deductible | $0. | $0. |

| Surgery, anesthesia, in-hospital doctor visits, diagnostic X-ray and lab | 100%. | 100%. |

| Office visits, including X-rays and lab work billed by the attending physician | 100%. | 100%. |

| Inpatient medical emergency | 100%. | 100%. |

| Ambulatory surgical center | 100%. | 100%. |

| Ambulance service (non-medical evacuation) | 100% up to $1,000. | 100% up to $1,000. |

| Outpatient prescription drugs (outside the U.S.) | 50% up to $5,000. | 100% up to $5,000. |

| Dental care required due to an injury | 100% up to $300. | 100% up to $500. |

| Dental care for relief of pain | 100% up to $250. | 100% up to $250. |

| Physical and occupational therapy | Up to six visits, up to $100 per visit. | Up to six visits, up to $100 per visit. |

| Accidental death and dismemberment | Up to $25,000. | Up to $50,000. |

| Repatriation of remains | Up to $25,000. | Up to $25,000. |

| Emergency medical transportation | Up to $500,000. | Up to $500,000. |

| Emergency family travel arrangements | Up to $2,500 for one round-trip economy class ticket to the hospital. | Up to $2,500 for one round-trip economy class ticket to the hospital. |

| Lost baggage and personal effects coverage | $500 per trip, $100 per bag or personal item. | $500 per trip, $100 per bag or personal item. |

| Trip interruption | Up to $1,000. | Up to $1,000. |

| Quarantine coverage | $25 per day, up to 10 days. | $50 per day, up to 10 days. |

| Hazardous activities coverage | Up to $25,000. | Up to $25,000. |

| Policy cost | $30.75. | $37.65. |

As you can see, there’s not a big difference when it comes to how much GeoBlue’s plans cost, with just about $7 between the two different offerings.

In terms of benefits, most are the same as well — the biggest difference between the Voyager Essential and Voyager Choice plans comes down to prescription medication coverage and coverage related to accidental death and dismemberment.

The less-expensive Essential plan pays 50% of your prescription costs, while the Choice plan covers the full 100%. As well, the Choice plan doubles accidental death coverage from Essential's $25,000 to $50,000.

Other than that, differences are minimal. You’ll get less coverage for emergency dental care and quarantine expenses, but otherwise, everything else is the same.

Get the 'Cheat Codes' to Cheaper Travel

Unlocking the secret to saving a ton on travel is easier than you think. 📤 Our free newsletter shows you how in 5 min. or less.

What isn’t covered

Is GeoBlue travel insurance good? Unlike many other travel insurance policies, GeoBlue’s products include coverage for hazardous activities and medical quarantine.

However, while GeoBlue shines when it comes to medical coverage, it falls short in other travel insurance aspects. Many travel insurance plans provide better options in the event that your bags are delayed, your flight is canceled or you miss nonrefundable bookings.

In GeoBlue’s case, the low levels of reimbursement for these types of issues may be problematic. However, bear in mind that many travel credit cards provide complimentary travel insurance that would pair well with a GeoBlue plan.

» Learn more: What to know before buying travel insurance

How to choose a GeoBlue plan online

To purchase a GeoBlue plan online, go to the company’s website.

You’ll see the option to generate a quote and you’ll type in your trip dates, traveler's age and ZIP code.

Once you hit "Get A Quote" the results page pops up, which will give you the option to choose your deductible amount and maximum level of coverage. You can also toggle between single trip and multi trip.

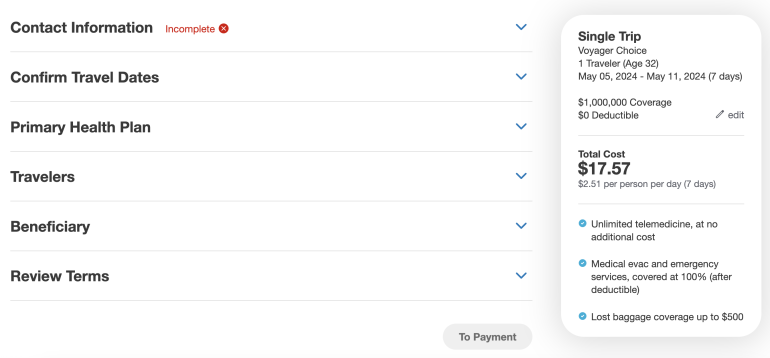

Once you’ve decided on a plan, you’ll need to fill out all pertinent information including your contact information, your health plan details and beneficiary. Once you review the terms of the plan, select to payment and input your credit or debit card information.

After that, your policy will be issued.

Is GeoBlue travel insurance worth it?

While it offers excellent medical care for low prices, GeoBlue’s policies fall short when it comes to other travel coverage. However, if you also have a travel credit card, you may be able to pair the two together for relatively strong travel insurance coverage at a low cost.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2026:

- Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

- No annual fee: Wells Fargo Autograph® Card

- Flat-rate travel rewards: Capital One Venture Rewards Credit Card

- Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

- Luxury perks: American Express Platinum Card®

- Business travelers: Ink Business Preferred® Credit Card

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

Limited Time Only: Earn $1,000 Toward Travel!

Capital One Venture Rewards Credit Card

Travel

For a limited time, the

Capital One Venture Rewards Credit Card is offering new cardholders an especially rich bonus: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel!

More like this

Related articles