AEGIS (Formerly GoReady) Travel Insurance Review: Is it Worth the Cost?

GoReady offers plans tailored for different kinds of travel, including cruises and vacation rentals.

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

AEGIS (GoReady)

AEGIS plans are highly customizable, each offering various ancillary coverages.

Pros

- Offers specialty plans for pandemic-related coverages, those staying at vacation rentals and cruise coverage.

- Can customize protection for work-related trip interruption.

Cons

- Maximum trip length is 60 days.

- Some ancillary coverages available on only the basic plan but not more premium ones.

Purchasing travel insurance can provide peace of mind on your trips, especially when you opt for a policy that covers trip delays and includes emergency medical benefits.

AEGIS insurance is a travel insurance provider with a variety of options to suit travelers. Here's a look at the company's different plans, what’s covered and how to choose a plan that works for you.

What does AEGIS travel insurance cover?

AEGIS travel insurance provides six different policies to customers with varying levels of coverage. These are called:

- Choice.

- Pandemic Plus.

- Vacation Rental.

- Cruise.

- Trip Cancellation.

- VIP.

Depending on your itinerary, one plan may be superior; this is especially true if you opt for something specialized like a Vacation Rental policy or Cruise policy.

Otherwise, you can expect a fairly standard coverage from AEGIS, such as:

- Accidental death insurance.

» Learn more: How much is travel insurance?

AEGIS insurance plans

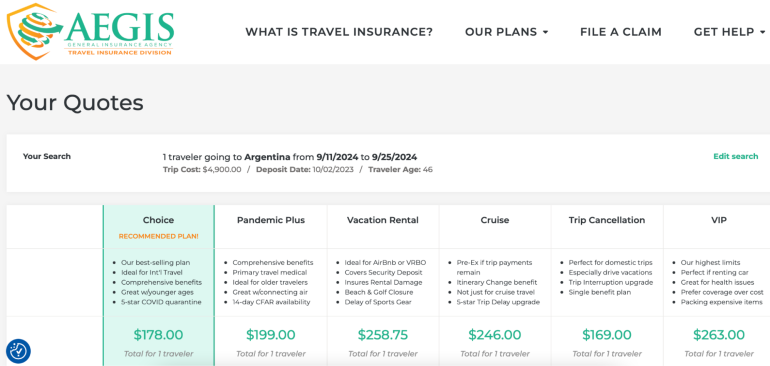

To generate quotes, we created a sample trip for one 46-year-old traveler from Colorado heading on a two-week trip to Argentina.

AEGIS offers three more "standard" travel insurance plans: Choice, Trip Cancellation and VIP. Here’s how the costs and coverage vary across these plan options.

AEGIS standard plans

| Coverage | Choice | Trip Cancellation | VIP |

|---|---|---|---|

| Maximum trip length | 60 days. | 60 days. | 60 days. |

| Trip cancellation | 100% of trip cost. | 100% of trip cost. | 100% of trip cost. |

| Trip interruption | 150% of trip cost. | Add-on available. | 175% of trip cost. |

| Trip delay | $2,000 ($200 per day starting at six hours). | Coverage not included. | $1,500 ($250 per day starting at six hours). |

| Missed connection | $500 starting at three hours. | Coverage not included. | $1,000 starting at three hours. |

| Baggage delay | $200 starting at 24 hours. | Coverage not included. | $750 starting at 24 hours. |

| Lost luggage | $500. | Coverage not included. | $2,500. |

| Emergency medical expense | $50,000. | Coverage not included. | $250,000. |

| Emergency evacuation and repatriation | $250,000. | Coverage not included. | $1 million. |

| Accidental death and dismemberment | $10,000. | Coverage not included. | $50,000 ($100,000 air only). |

| Rental car coverage | Add-on available. | Coverage not included. | $50,000. |

| Pre-existing medical condition exclusion waiver | Add-on available. | Included if policy purchased within 14 days of initial trip deposit. | Included if policy purchased within 14 days of initial trip deposit. |

The cost for our Argentina-bound traveler for the Choice plan is $178, while for Trip Cancellation and VIP, the price is $169 and $263, respectively.

AEGIS specialty plans

AEGIS also offers three travel insurance plans oriented toward specialty experiences, including for those staying in a vacation rental or going on a cruise.

| Coverage | Pandemic Plus | Vacation Rental | Cruise |

|---|---|---|---|

| Maximum trip length | 90 days. | 30 days. | 90 days. |

| Trip cancellation | 100% of trip cost. | 100% of trip cost. | 100% of trip cost. |

| Trip interruption | 150% of trip cost. | 100% of trip cost. | 150% of trip cost. |

| Trip delay | $1,000 ($200 per day starting at six hours). | $1,000 ($200 per day starting at six hours). | $1,000 ($250 per day starting at six hours). |

| Missed connection | $250 starting at three hours. | Coverage not included. | $750 starting at three hours. |

| Baggage delay | $500 starting at 12 hours. | $200 starting at 24 hours. | $750 starting at 24 hours. |

| Airline ticket change fee | $200. | Coverage not included. | Coverage not included. |

| Itinerary change | Coverage note included. | Coverage not included. | $250. |

| Lost luggage | $500. | Coverage not included. | $2,500. |

| Sporting equipment delay | Coverage not included. | $250 starting at 24 hours. | Coverage not included. |

| Vacation rental damage | Coverage not included. | $1,000. | Coverage not included. |

| Security deposit waiver | Coverage not included. | $1,000. | Coverage not included. |

| Emergency medical expense | $50,000. | $50,000. | $100,000. |

| Emergency evacuation and repatriation | $500,000. | $250,000. | $250,000. |

| Travel inconvenience beach and golf closure | Coverage not included. | $100. | Coverage not included. |

| Early-purchase benefit: Pre-existing medical condition exclusion waiver | Included if policy purchased within 14 days of initial trip deposit. | Included if policy purchased within 14 days of initial trip deposit. | Included if policy purchased within 24 hours of final payment. |

Specialty plans don't always mean higher costs. The Pandemic Plus coverage will cost the sample trip traveler $199, while Vacation Rental coverage is $258.75 and Cruise coverage is $246.

What isn’t covered by AEGIS

An AEGIS insurance review wouldn't be complete without considering what types of situations aren’t covered. While these aren't included in the base package, you can consider adding this coverage by purchasing it as an add-on.

- Baggage delay for sports equipment.

- Trip cancellation for work reasons.

There will be other situations that are excluded from your policy. To find these, review the full benefits schedule of the plan that you’re considering.

» Learn more: What to know before buying travel insurance

How to choose a AEGIS plan online

Is AEGIS insurance legitimate? It is, and purchasing a plan online is simple. To do so, go to AEGIS’s website. On the homepage, you’ll input your information to generate a quote. This includes travel destination, age and state of residence.

Once you’ve tapped “Get My Quote,” you’ll be presented with all six of AEGIS's available options, including costs and a breakdown of inclusions.

From here, you’ll be able to select the plan that suits your needs and pick any optional add-ons. Then, you’ll go through the checkout process. After you’ve paid, your plan becomes active.

Which AEGIS plan is best for me?

Choosing the right plan for your trip involves understanding what type of coverage you need.

- For cruises. The Cruise plan has the ability to include pre-existing conditions long after this option disappears with other policies. It also covers you in the event you miss prepaid events if your travel provider changes your itinerary.

- For the best service. The VIP plan offers the most comprehensive suite of benefits and the highest payouts, including rental car coverage.

- For vacation rental stays. The Vacation Rental plan is a superior option for those in short term rentals because of its coverage for damage, which includes up to $1,000 for security deposit loss.

- For those with their own medical insurance. The Trip Cancellation plan is the least expensive option but still provides trip protections in the event that your travel is canceled.

AEGIS's travel insurance plans may make sense for you, but before purchasing a policy, check to see whether a travel credit card you hold offers its own complimentary travel insurance.

Is AEGIS travel insurance worth it?

AEGIS offers several travel insurance plans to choose from, with some levels of customization to help you get the exact coverage you're looking for.

Overall, travel insurance is worth it, but AEGIS might not give you the best deal. Shop around with other travel insurance companies to make sure you're getting the lowest price for the protections you need.

If you have a travel credit card, look at what travel insurance benefits are included to avoid duplicating your coverage.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2026:

- Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

- No annual fee: Wells Fargo Autograph® Card

- Flat-rate travel rewards: Capital One Venture Rewards Credit Card

- Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

- Luxury perks: American Express Platinum Card®

- Business travelers: Ink Business Preferred® Credit Card

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

Cards for Travel Insurance from our Partners

Chase Sapphire Reserve®

Rewards rate 1x-8x Points

Intro offer 125,000 Points

Chase Sapphire Preferred® Card

Rewards rate 1x-5x Points

Intro offer 75,000 Points

Southwest Rapid Rewards® Plus Credit Card

Rewards rate 1x-2x Points

Intro offer 50,000 Points

More like this

Related articles