How to Check In to a Hotel Without a Credit Card

There are a couple of ways to book without a credit card, but you will need a debit card or cash to check in.

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

Traveling with a credit card has enormous benefits. Perhaps most importantly, credit cards are typically safer to carry and use than cash. If your wallet gets stolen, you can contact your bank to lock your credit card, but any cash you were carrying is likely gone forever. If your credit card is used fraudulently, you generally won't be responsible for paying back those purchases.

And of course there are the spending rewards and perks of using a credit card. Many no-annual-fee travel credit cards offer not just bonus points for spending, but also benefits like no foreign transaction fees.

But credit cards aren’t for everyone, especially if you struggle to pay your bills on time. Even if you are in a better place with money now but have a poor credit history (or are credit invisible), you might struggle to get approved for a no-annual-fee credit card. In that case, traveling without a credit card might be inevitable.

And the reality is, many Americans don’t have a credit card. More than 175 million Americans hold at least one credit card, according to the 2021 Consumer Credit Card Market Report from the Consumer Financial Protection Bureau. But when you factor in 2020 population data from the U.S. Census Bureau, that’s an estimated 83 million adults who likely don’t have a credit card.

Thankfully, it’s entirely possible to travel without a credit card. Payment options vary by business, but commonly accepted methods include:

- Cash.

- PayPal.

- Third-party payment services like "buy now, pay later" companies.

- Gift cards.

- Debit cards.

Yet every once in a while, traveling without a credit card can still feel impossible, particularly at hotels. So, do you need a credit card for a hotel? Not always — but often. Let’s dig in.

Get the 'Cheat Codes' to Cheaper Travel

Unlocking the secret to saving a ton on travel is easier than you think. 📤 Our free newsletter shows you how in 5 min. or less.

Why do some hotels require credit cards?

While many hotels accept debit cards, gift cards and hotel points as payment, some will still require you to present a credit card at check-in or upon making the reservation, no matter what method you’ll actually use to pay.

There are two primary reasons why hotels require your credit card information:

- Charging cancellation fees. Most hotels have policies where — if you back out of your reservation past the cancellation window — the hotel will charge you anyway. With a credit card on file, the hotel is able to charge cancellation fees.

- Covering damage, theft or other incidental charges. Most hotels require a security deposit to ensure you won't damage the room or walk off with the TV. Many hotels require your credit card on file to keep you on the hook for theft or damage.

During your stay, many hotels also make it easy for you to make purchases without actually handing over payment on the spot — such as when you enjoy a drink from the in-room minibar. Those charges typically are billed to your credit card upon checkout.

What hotels do not require a credit card?

Some major hotel brands will accept a debit card for reservations, and some will accept alternate forms of payment like personal checks or wire transfers. But in general, most major hotel brands require either a credit or debit card in order to make a reservation. While most typically don’t require that same card be used to fund the actual payment, most require a card on file in some capacity to ensure sufficient funds are available to settle your final bill.

When you put that card on file, money typically isn’t actually taken from the credit card. Instead, you’ll likely see a “hold” line on your account indicating a charge has been initiated but not completed. Assuming you pay off your bill using another form of payment (and don’t incur any extra charges during your stay), that charge will never end up being processed.

Here are some examples of hotels that don’t require a credit card:

- Best Western: While credit cards are required for online reservations, you can make a reservation by phone at 800-564-2515. Exact rules vary by property, but you can usually make a phone reservation without a credit card and also pay by alternate (non-credit card) method in person at check-in.

- Hilton: You can provide a debit card number as a guarantee when booking directly through Hilton's website. Payment can be made via debit or credit.

- Marriott: At check-in, you have the option of using a debit card instead of a credit card. No matter which type of plastic you use, your card-issuing bank will place a hold for room and tax charges, any applicable resort fees, plus an amount for incidentals per day for the entire stay (amount varies by location). Payment can be made via debit or credit.

- Motel 6: Some (though not all) properties require some sort of plastic upon check-in, but debit or bank card is accepted as well as credit. Payments are accepted by those methods as well as by cash or traveler’s check. However, advance payment deposits through a credit card guarantee, check or wire transfer are required for reservations with 10 or more rooms.

Meanwhile, these hotels typically won’t allow you to book if you don’t have a credit card:

- Hyatt: A credit card is required for all reservations made through Hyatt’s website.

- Radisson: Radisson Americas and Radisson Hotels only accept credit cards; debit won’t work.

- Wyndham: Credit cards are required for reservations made online.

Note that some card holds might not be released until you’re long gone from the property. For example, both Radisson and Marriott — among other brands — warn that holds may not be released for up to five business days after you’ve left, meaning your money will be inaccessible to you for at least a few days post-checkout.

How to book a hotel without a credit card

If you have your heart set on a hotel that typically requires a credit card for reservations, there may still be a way for you to book that room. Here are a couple of things to try:

Book over the phone: Just because the fine print on a hotel website says one thing doesn’t mean a sympathetic property manager at your destination won't be willing to work with you. Policies can vary by property. Sometimes when an automated booking system requires a credit card, a human might provide a workaround.

Consider booking through online travel agencies: Marriott might demand a credit card when booking direct, but third-party travel agencies like Expedia or Orbitz might let you book that same Marriott room through them using a different payment method.

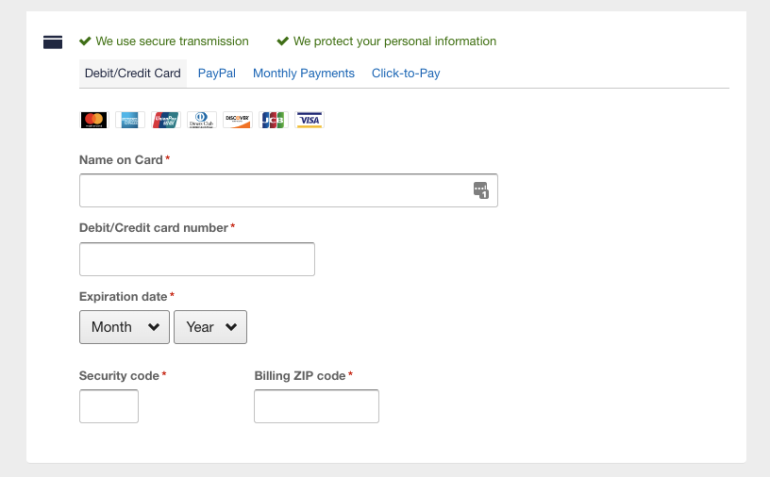

For example, aside from credit cards, Orbitz payment options include debit cards, PayPal, and Affirm — a service that lets you make recurring, partial payments by debit card, checking account or check sent by snail mail.

Just understand the tradeoffs when you book through a third party, which can include higher rates and worse cancellation policies.

How to check in to a hotel without a credit card

While the above strategies might help you book a room, the hotel may not let you check in without a credit card on file. Many hotels require a credit card at check-in as a deposit for incidentals or damage.

If you’ve gone through the reservation process and paid using an alternate method, it can be frustrating to arrive on the first day of your trip, only to find the hotel won’t hand over the keys without a credit card.

Thankfully, it’s not uncommon for hotels to accept an alternate payment method as financial security that you won’t steal its TV or take candy from the minibar without paying. Even some properties within major hotel chains might make an exception if you ask.

Here are some alternatives to credit card deposits:

Pay the security deposit upfront in cash

Rather than putting a hold on your credit card, some hotels might allow you to put down a cash security deposit, returned to you upon checkout.

This could be challenging though, given that it’s common for security deposits to run north of $200 (and sometimes well north). High-end properties can even have a $1,000 security deposit and — while they may accept cash — you might not want to travel with that much cash in your wallet. You might not have that much cash, period.

Then again, paying with cash has one main benefit: Your funds will be released immediately upon checkout (as opposed to the multiple days it can take for holds to be released on a credit or debit card).

Place a debit card hold

Similar to a credit card hold, the hotel might be willing to place a debit card hold. Just be aware that some debit cards have daily or monthly spending limits (especially prepaid debit cards). Even if you can afford the room rate, the additional hotel security deposit could cause you to exceed your spending limit. Have a plan (such as calling your bank) in case the deposit exceeds it.

Also, determine how much money is in your account, as the debit card hold might cause you to incur overdraft fees if you have insufficient funds.

Look at nonchain hotels

A major hotel chain might have a fixed policy that’s impossible to skirt, but a locally-owned motel or small bed-and-breakfast likely doesn’t have such bureaucracy and might be more willing to work with you.

Consider vacation rentals

Many vacation rentals won’t require credit cards — for payment or for deposit. In addition to credit and debit cards, Airbnb accepts Apple Pay, Google Pay and PayPal in most countries.

Airbnb explicitly prohibits hosts from charging security deposits. Instead, Airbnb informs guests at the time of booking that their payment method may be charged if they cause damage during a stay. If a dispute arises, Airbnb works with both parties through its Resolution Center.

However, don’t try paying in cash for your Airbnb. Cash payments are a violation of Airbnb’s terms and conditions.

Call and ask

If you don’t have a credit card, the best thing you can do is call your hotel as early as possible and ask what your credit card–free options are. If the hotel provides none, then take your business elsewhere.

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

Limited Time Only: Earn $1,000 Toward Travel!

Capital One Venture Rewards Credit Card

Travel

For a limited time, the

Capital One Venture Rewards Credit Card is offering new cardholders an especially rich bonus: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel!

More like this

Related articles