How Does the Chase Sapphire Reserve Travel Credit Work?

The annual credit is triggered by a qualifying purchase. For most cardholders, it resets every account anniversary.

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

The $300 annual travel credit is one of the key perks of the Chase Sapphire Reserve®. By taking full advantage of just this one perk, you can recoup a significant chunk of the card's $795 annual fee. Using all the benefits of the Chase Sapphire Reserve® like the travel credit can help justify paying such a massive annual fee.

So how does the Chase Sapphire Reserve® travel credit work? To maximize the travel credit, you need to make eligible travel purchases and pay attention to when the Chase Sapphire Reserve® travel credit resets. However, both of these aspects can be a little tricky.

Since many cardholders have questions about this topic, we'll cover some frequently asked questions of how the Chase Sapphire Reserve® travel credit works.

Can the Chase Sapphire Reserve® travel credit be used on any travel purchase?

Any purchase that Chase includes in its definition of a travel purchase will trigger the Chase Sapphire Reserve® annual travel credit. That makes this type of statement credit a lot simpler and easier to use than travel credits on other premium travel cards.

For comparison, one of the perks of the American Express Platinum Card® is a $200 airline fee credit.* Enrollment required. However, this credit applies to a limited set of incidental fees only, such as onboard refreshments and checked bags, for one pre-selected airline. Although it provides a long list of excluded purchases, AmEx doesn't specify which purchases qualify for this credit. Terms apply.

Chase Sapphire Reserve® cardholders don't have to wonder which travel purchases will count for the annual travel credit. Most travel purchases charged to your Chase Sapphire Reserve® will trigger the credit, leading to the obvious next question.

Get the 'Cheat Codes' to Cheaper Travel

Unlocking the secret to saving a ton on travel is easier than you think. 📤 Our free newsletter shows you how in 5 min. or less.

What counts as 'travel' for Chase

Chase specifically includes the following types of merchants in its travel category:

- Airlines.

- Timeshares.

- Cruise lines.

- Travel agencies.

- Discount travel sites.

- Campgrounds.

- Operators of passenger trains, buses, taxis, limousines, ferries, toll bridges and highways.

- Parking lots and garages.

This is a pretty expansive list of qualifying purchases. However, keep in mind that not all travel-related purchases will count as travel purchases for Chase. To help prevent confusion, Chase publishes a list of the merchants that are expressly excluded from its definition of travel:

- Educational merchants arranging travel.

- In-flight goods and services.

- Onboard cruise line goods and services.

- Sightseeing activities.

- Excursions.

- Tourist attractions.

- RV and boat rentals.

- Merchants within hotels and airports.

- Public campgrounds.

- Merchants that rent vehicles for the purpose of hauling.

- Real estate agents.

Chase also clarifies that purchases from gift card merchants or merchants that sell points or miles — like Points.com — don't qualify as travel purchases.

Now that you know the types of merchants that qualify, you might wonder what code that a specific merchant you purchase from will use. Visa used to publish a public supplier locator tool for checking Merchant Category Codes; however, Visa eliminated this tool in late 2021. Now, a good way to see how a merchant will use a code is through AwardWallet's Merchant Category Lookup Tool.

» Learn more: The best travel credit cards right now

Is the Chase Sapphire Reserve® travel credit automatic?

The annual Chase Sapphire Reserve® travel credit automatically posts when you make an eligible travel purchase. The statement credit will post to your account on the same day that the travel purchase is posted to your account. Chase notes that it may take 1-2 billing cycles for the statement credit to appear on your monthly credit card billing statement.

That sets the Chase Sapphire Reserve® annual travel credit apart from other Chase credit cards.

When does Chase Sapphire Reserve® travel credit reset?

So, when do you earn the $300 Chase Sapphire Reserve® credit?

The Chase Sapphire Reserve® $300 annual travel credit isn't based on a calendar year. Instead, the travel credit resets each year around your cardholder anniversary. More specifically, the credit resets at the close of the first statement date after your account open date anniversary, then every 12 monthly billing cycles after that.

🤓 Nerdy Tip

If you just opened a Chase Sapphire Reserve®, your credit is ready to use right away. Since these policies can be confusing to understand, let's run through an example.

Say you opened a Chase Sapphire Reserve® on June 6, and your account statement closes on the 3rd of each month. That means you'll need to use your initial $300 annual travel credit before July 3 of the following year. Your travel credit resets the next day, meaning you can start using your next $300 travel credit on July 4.

Your travel credit will continue to reset after every 12 monthly billing cycles. As long as your account statement closing date doesn't change, your travel credit will reset each year starting on July 4.

» Learn more: What should I do with my travel credit right now?

Different rules for cardholders who signed up before May 21, 2017

Chase hasn't always based the annual travel credit on the cardholder's anniversary date. Initially, Chase treated the annual credit more like a calendar-year travel credit. Longtime cardholders are still subject to these legacy rules.

If you opened your Chase Sapphire Reserve® account before May 21, 2017, your annual travel credit resets each year on the day after your December statement closes.

If, say, your December statement closes on Dec. 16, you can start using your next annual travel credit on Dec. 17. Because of this quirk, you can spend your next year's travel credit before the calendar year even begins.

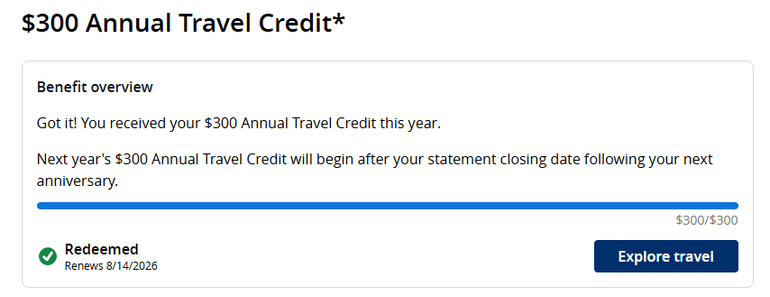

How do I check my Chase Sapphire Reserve® $300 travel credit?

Simply log into your Chase account and view your rewards activity.

Under Benefits & Redemptions Overview, one of the first sections will give you a snapshot of how much of the $300 annual travel credit you've used thus far. It will also give you information about when the credit automatically resets (your cardmember anniversary), as well as any remaining balance.

The Chase Sapphire Reserve® travel credit, recapped

The $300 annual travel credit is one of the signature benefits of the Chase Sapphire Reserve®. And thankfully, it's one of the most straightforward travel credits to use.

Unlike the airline fee credit on the American Express Platinum Card®, the Chase Sapphire Reserve® travel credit is not limited to an undisclosed list of qualifying purchases. Instead, any purchase from airlines, hotels, car rentals and cruise lines will trigger the credit. For those staying closer to home, even purchases made at toll plazas, parking lots, buses and taxis count.

Best of all, Chase automatically posts the credit on the same day the qualifying purchase posts to your account.

The tricky part can be determining when the Chase Sapphire Reserve® travel credit resets. If you opened your account after May 21, 2017, your travel credit resets for the statement after your account anniversary. If you want to be sure, you can call the number on the back of your Chase card to see when your next travel credit starts.

*More from American Express

American Express relies on airlines to submit the correct information on airline transactions to identify incidental fee purchases. If you do not see a credit for a qualifying incidental purchase on your eligible Card after 8 weeks, simply call the number on the back of your Card. Qualifying airlines are subject to change. See terms & conditions for more details

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2026:

- Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

- No annual fee: Wells Fargo Autograph® Card

- Flat-rate travel rewards: Capital One Venture Rewards Credit Card

- Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

- Luxury perks: American Express Platinum Card®

- Business travelers: Ink Business Preferred® Credit Card

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

Limited Time Only: Earn $1,000 Toward Travel!

Capital One Venture Rewards Credit Card

Travel

For a limited time, the

Capital One Venture Rewards Credit Card is offering new cardholders an especially rich bonus: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel!

More like this

Related articles