How to Get Free Flights (Or Close to It)

Earning free flights comes down to two essential steps: Joining an airline loyalty program and opening a travel rewards card.

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

You may have seen or heard it. At the workplace water cooler, the holiday dinner table and just about every place else you go, proud travel hackers are boasting about scoring free flights to far-off destinations.

Ready to get in on the action? Here’s everything you need to know about how to get free flights, starting with a caveat: "Free flights” aren’t usually free. You often pay at least $5.60 each way for Transportation Security Administration fees on your ticket. For certain international flights, you'll also be on the hook for fuel surcharges, which can sometimes cost around $200 each way for economy class and more than $700 each way in business class.

Now that you know award travel means “mostly” free, here are the most reliable ways to get free flights.

5 ways to get free flights

With time, strategic spending and the right credit cards, you'll be well on your way to flying at deep discounts.

1. Earn miles or points by flying your preferred airline

Sign up for an airline loyalty program (joining is free). Every time you fly the airline, you will earn miles or points that can be redeemed for free flights.

» Learn more: How do airline miles work?

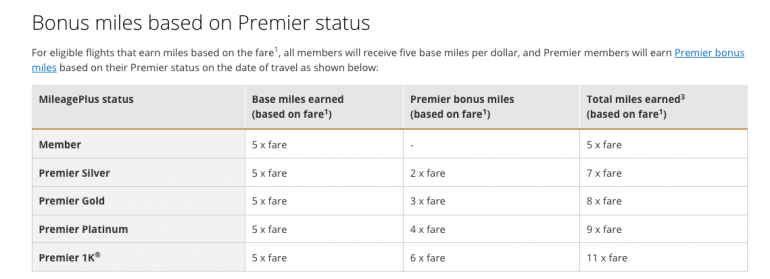

The number of miles you earn varies by airline. Most award you miles based on the cash price of your ticket. For example, United Airlines’ MileagePlus program members earn 5 MileagePlus miles per dollar spent on qualifying tickets. Premier members of the program get bonus miles on top of that.

Other airlines, such as Hawaiian Airlines, award miles based on how far you fly. A 2,397-mile flight from San Francisco to Honolulu, for example, puts 2,397 HawaiianMiles in your loyalty program account.

You can also earn miles with your preferred airline by flying on one of its partners. For example, if you fly JetBlue, you can use your HawaiianMiles member number when booking to earn miles on Hawaiian. Or, book a flight to Paris on Air France, use your Delta Air Lines SkyMiles number when booking and you’ll earn Delta miles for your trip. Determine which airlines partner with your preferred carrier to see all your options for earning miles.

» Learn more: Plan your next redemption with our airline points tool

So how many miles do you need to rack up before you have enough for a free flight? That depends on the airline miles you collect, where you’re going and when. Search your preferred airline’s website for sample award bookings for your travel dates and other dates to see how award prices can vary.

🤓 Nerdy Tip

To give you an idea of how far your miles can take you, NerdWallet keeps a regularly updated chart showing the estimated cash value of each mile or point from some major airline loyalty programs. 2. Earn miles making everyday purchases with an airline credit card

Airlines partner with financial institutions to offer airline credit cards that award your spending with miles or points deposited directly into your loyalty program account. You can earn enough points or miles for an award flight without ever buying a plane ticket with one of these credit cards.

🤓 Nerdy Tip

If you want to avoid paying out-of-pocket for a credit card, several no annual fee travel cards are worth considering. The trick is to choose an airline card that offers the most points and miles for your spending style. For example:

Popular airline cards

Annual fee

$0 intro for the first year, then $150.

$99.

$0 intro for the first year, then $150.

$99.

Earning rates

• 5 miles per $1 on prepaid hotels booked through United.

• 2 miles per $1 on United purchases.

• 2 miles per $1 at restaurants and hotels (when booked directly with hotel).

• 1 mile per $1 on all other purchases.

• 2 points per $1 on Southwest purchases.

• 2 points per $1 at gas stations and grocery stores on the first $5,000 in combined purchases per anniversary year.

• 1 point per $1 on all other purchases.

• 2 miles per $1 on purchases made directly with Delta and at U.S. supermarkets and restaurants worldwide (including takeout and delivery in the U.S.).

• 1 mile per $1 on all other eligible purchases.

Terms apply.

• 6 points per $1 with JetBlue.

• 2 points per $1 at restaurants and grocery stores.

• 1 point per $1 on other purchases.

• 1 Mosaic tile per $1,000 spent.

Still not sure?

Before you sign up for a card, think about where you spend most of your money. Then compare credit card annual fees, and find one that fits your budget and has valuable benefits.

» Learn more: The best airline credit cards right now

Get the 'Cheat Codes' to Cheaper Travel

Unlocking the secret to saving a ton on travel is easier than you think. 📤 Our free newsletter shows you how in 5 min. or less.

3. Earn thousands of miles as a credit card welcome bonus

The fastest way to get enough miles for a free flight is to snag a credit card “welcome bonus.” These offers typically include a big stack of points or miles, often in the tens of thousands. You earn this welcome bonus when you sign up as a new cardmember then hit a spending minimum in a set period — usually the first three months after opening.

Popular travel cards

Annual fee

$895.

$95.

$95.

$95.

Welcome offer

You may be eligible for as high as 175,000 Membership Rewards® Points after spending $12,000 in eligible purchases on your new Card in your first 6 months of Membership. Welcome offers vary and you may not be eligible for an offer. Terms apply.

LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel.

Earn 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening.

Earn 60,000 bonus ThankYou® Points after spending $4,000 in the first 3 months of account opening, redeemable for $600 in gift cards or travel rewards at thankyou.com.

Still not sure?

4. Earn flexible points using a non-airline credit card

Chase, American Express, Capital One, Citi and other financial institutions offer travel credit cards that pay points. You can redeem points for flights on the issuer’s travel booking site or, for some of these programs, convert your points into your favorite airline's miles. Others allow you to redeem them for a statement credit to compensate for the cost of a flight or hotel.

For example, the Bank of America® Travel Rewards credit card earns you 1.5 points per dollar on most purchases. You can use those points to book a free flight in Bank of America’s travel booking portal, or you can purchase a flight using the credit card, then apply your points for a statement credit to offset the purchase.

These flexible rewards cards give you a more comprehensive selection of airlines to choose from. But they don’t offer some perks, like free checked bags or bonus miles for buying same-brand flights with an airline's co-branded card.

🤓 Nerdy Tip

Airline-branded cards work best for travelers who favor a single airline, while broader travel rewards cards are better for those who aren’t loyal to one brand. 5. Earn an airline companion pass

Some airlines offer a chance to earn a “companion pass,” which lets a second passenger fly with you for free (not including taxes or fees). For example, you can earn the Southwest Companion Pass by flying 100 one-way flights or accumulating 135,000 qualifying points through purchasing flights or spending on a Southwest credit card. The Southwest Companion Pass lets you pick one person who can fly with you on the same itinerary for the cost of taxes and fees, which start at $5.60 each way. It’s valid for the remainder of the year in which you earned it, plus the entire following calendar year. You can even change your designated companion up to three times a year.

The Atmos™ Rewards Ascent Visa Signature® credit card also comes with a one-time-use companion fare each year, which gets your companion on a flight with you starting at just $122 ($99 fare plus taxes and fees from $23).

If you want to fly for free ...

Travelers who want to join the ranks of those who get free plane tickets, plan your strategy carefully. First, consider where you’ll travel and on what airlines. Next, sign up for loyalty programs, then look at credit card welcome bonuses and other ways to earn miles. Even if you don’t make a lot of credit card charges, you can slowly work toward low-cost or nearly free airline tickets.

To view rates and fees of the Delta SkyMiles® Gold American Express Card, see this page.

To view rates and fees of the American Express Platinum Card®, see this page.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2026:

- Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

- No annual fee: Wells Fargo Autograph® Card

- Flat-rate travel rewards: Capital One Venture Rewards Credit Card

- Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

- Luxury perks: American Express Platinum Card®

- Business travelers: Ink Business Preferred® Credit Card

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

Limited Time Only: Earn $1,000 Toward Travel!

Capital One Venture Rewards Credit Card

Travel

For a limited time, the

Capital One Venture Rewards Credit Card is offering new cardholders an especially rich bonus: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel!

More like this

Related articles