How to Get the Most Value From Marriott Bonvoy Points

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

The Marriott Bonvoy hotel loyalty program is a huge amalgamation of hotel brands — 30 and counting — but it’s not as complicated as you might expect. Getting the most bang for your Bonvoys doesn’t require an advanced degree in travel hacking. However, there are a few tricks and tactics with the program that can make the difference between a waste of points and a brag-worthy redemption.

Here we highlight a few tactics, along with some guidance for how to make sure you’re squeezing every bit of value from those Bonvoy points.

NerdWallet values Marriott Bonvoy points at 0.8 cent each, which offers a good starting point for determining the value of your own bookings. In other words, if you’re getting more than 0.8 cent per point, you’re doing well.

» Learn more: Which Marriott Bonvoy credit card should I choose?

Use Marriott Bonvoy points for hotel stays

There are many ways to redeem Marriott Bonvoy points, from bidding on VIP experiences to purchasing gift cards to transferring to airline partners. These redemption options occasionally offer a decent value, but in general they’re not worth the time, effort or points. Like any currency transfer, value is lost every time you convert it, and that certainly holds true if you, say, transfer Bonvoy points to United Airlines MileagePlus miles.

Some Marriott Bonvoy transfer partners are better than average, including when you transfer them to the Alaska Airlines Atmos Rewards or American Airlines AAdvantage programs. However, even that is a fairly onerous process that requires entering multiple passwords, calculating conversions and waiting.

You’ll often get the most value from Bonvoy points by using them the old-fashioned way: for hotel stays.

» Learn more: 10 great ways to use 50,000 Bonvoy points

Get the 'Cheat Codes' to Cheaper Travel

Unlocking the secret to saving a ton on travel is easier than you think. 📤 Our free newsletter shows you how in 5 min. or less.

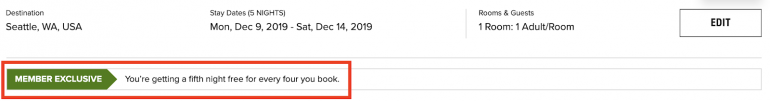

Leverage the Marriott fifth-night-free benefit

One of the most valuable (and overlooked) features of the Bonvoy program is the fifth-night-free benefit, which lets you stay an extra night at no cost, as long as your room is booked on points and your stay is four consecutive days or more. It’s overlooked for a reason: Marriott buries it on their hotel redemption page.

Because Marriott has moved to a more dynamic award chart, it’s harder to find “sweet spot” hotels that consistently offer good value for points. If a property’s paid rate is expensive, it will generally also be expensive with points (with a few exceptions; see below).

Thus, leveraging the fifth-night-free perk is one of the best ways to consistently wring more value from Bonvoy points. It effectively reduces the cost of your five-night award stay by 20%.

The best part of this perk is that it requires no extra effort at all. Just search for a five-night award stay and Marriott will automatically reduce the rate:

Of course, even four nights at a high-end property can cost a boatload of Bonvoy points, so the fifth-night-free perk is equally useful at budget properties.

» Learn more: Travel loyalty program reviews

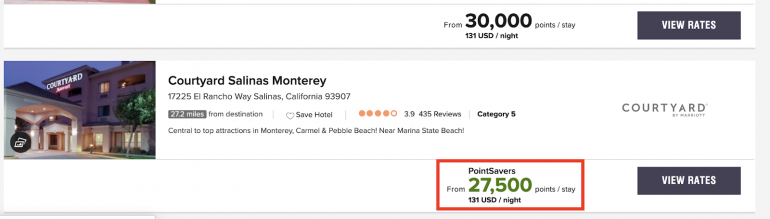

Keep an eye out for PointSavers

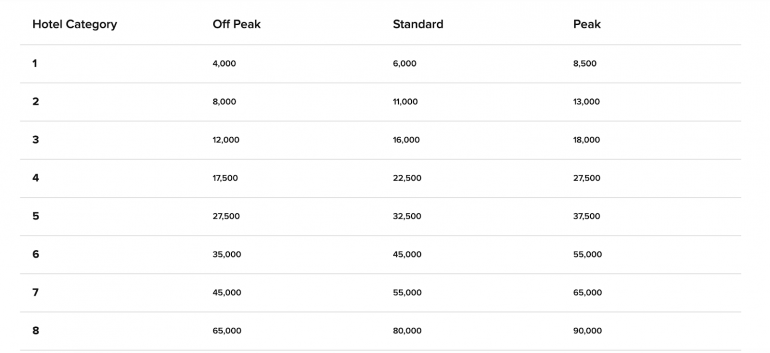

Marriott discounts the number of points needed for award nights at certain properties in a running promotion called “PointSavers.” The discounts vary by hotel category and whether the booking is peak, off-peak or standard.

Marriott publishes a list of participating hotels and dates on the PointSavers page. You might also come across PointSaver hotels by searching for award stays. PointSaver rates are displayed in green:

Aim for off-peak rates

Marriott charges reduced rates for off-peak award bookings and higher rates during peak season. This applies to both PointSaver and regular bookings.

Spread your points even further by traveling during low-demand times. Annoyingly, Marriott doesn’t currently publish the dates of each property’s off-peak season, to our knowledge, so finding does require some searching with the award tool.

If you're flexible about the exact dates you can travel (and who wants to fight with holiday or spring break crowds anyway), and you're willing to put in the work in finding those off-peak dates, you can land yourself a sweet deal.

Dodge sky-high cash rates

Prioritize your points for when cash prices are unusually high. When demand on hotel rooms is high — such as conventions, sporting events, and sometimes even no obvious reason — then cash prices for rooms go through the roof.

Although Bonvoy “dynamically” adjusts award prices for high and low seasons, they don’t do so at a more granular level. So even though you might not be able to find a room for less than $300 on a particular weekend, you might be able to score a deal with Bonvoy points.

Thus, if you find yourself in town for a big event that will undoubtedly drive up room rates, it's almost always better to pay with cash versus points. Using points when cash rates spike is a great hack for getting the most value from your Bonvoy points (or any hotel reward points) for that matter. For example, a cash room might cost $200 per night on one weekend and $500 the next. Meanwhile, the same room could cost 25,000 points per night on either weekend.

» Learn more: Marriott Rewards Program: The complete guide.

The bottom line

Mostly gone are the days when savvy points experts could hack their way to high-end Marriott properties with a predictable number of points. Marriott has tightened up its award structure to make the “cost” of booking with cash and points more equal.

That said, there are plenty of opportunities for stretching Bonvoy points further. These include ad-hoc tactics like booking award nights during peak demand, as well as more dependable strategies like leveraging the fifth-night-free perk.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2026:

- Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

- No annual fee: Wells Fargo Autograph® Card

- Flat-rate travel rewards: Capital One Venture Rewards Credit Card

- Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

- Luxury perks: American Express Platinum Card®

- Business travelers: Ink Business Preferred® Credit Card

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

Limited Time Only: Earn $1,000 Toward Travel!

Capital One Venture Rewards Credit Card

Travel

For a limited time, the

Capital One Venture Rewards Credit Card is offering new cardholders an especially rich bonus: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel!

More like this

Related articles