How to Maximize the AmEx Platinum Hotel Credit

Use the American Express Platinum Card $600 statement credit for prepaid hotel bookings on its travel portal.

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

The American Express Platinum Card® just increased its hotel credit in a big way following an annual fee hike.

Now, you’ll get $600 in statement credits per calendar year — split into two parts — when booking hotels via the Fine Hotels & Resorts (FHR) or The Hotel Collection travel portal. Terms apply. There is no enrollment required for the hotel statement credits.

You can also get this credit on The Business Platinum Card® from American Express now, too; previously, it wasn't offered.

These credits can go a long way in justifying these premium card annual fees — as long as you remember to use them. Here’s what to know.

» Learn more: Benefits of the American Express Platinum Card®

How does the $600 AmEx Platinum hotel credit work?

The $600 hotel credit is an annual benefit on the American Express Platinum Card® and The Business Platinum Card® from American Express. It appears as a statement credit after making a qualifying reservation. Terms apply.

The statement credit is split into two $300 credits: one to use in the first half of the year and the other to use in the second half of the year. This means you can’t take a $600 discount off of one stay. But if you plan your travel with these credits in mind, you can get a lot of value from them.

For a reservation to be eligible, you must prepay for the stay when booking (rather than at the hotel) and complete the transaction for the Fine Hotels and Resorts or The Hotel Collection stay using the American Express travel portal and paying with your American Express credit card. You can also make a reservation by calling American Express directly. It is possible to benefit from the statement credit, even if you pay for your reservation with points. The Pay With Points option can help you to save even more money.

One key consideration for booking a hotel from The Hotel Collection: the stay must be at least two nights.

After the reservation is made, the statement credit typically appears a few days later (although it can take as many as 90 days). If you have an additional cardholder on your account, they could take advantage of this travel credit, but the statement credit would post to the basic card member’s account.

All the perks of an FHR booking are available when using your statement credit, too.

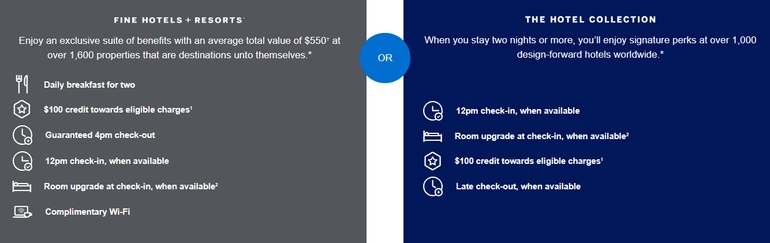

Those perks include:

- Noon check-in (when available).

- Guaranteed 4 p.m. late checkout (FHR) or late checkout when available (THC).

- Space-available room upgrade.

- Daily breakfast for two people (FHR).

- Complimentary Wi-Fi.

- $100 credit toward eligible charges (including dining, spa or bar charges, depending on the hotel).

How do you book a hotel stay through the AmEx Travel portal?

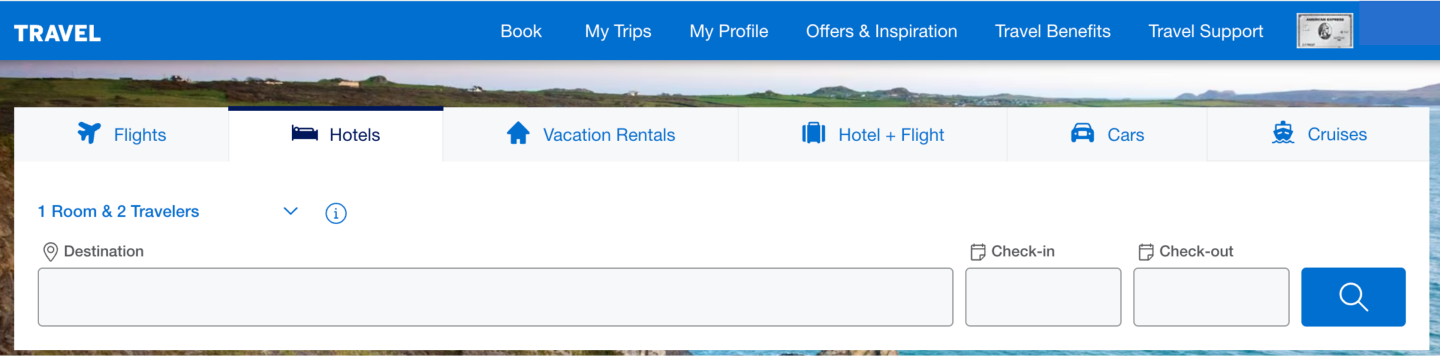

To take advantage of this credit, eligible cardholders must log into AmexTravel.com and use their associated credit card.

Search for your destination using your dates to see which hotels are available. You can pay with cash or points, but it's not the best redemption option. You can generally get more value from your points when transferring them to AmEx’s travel partners.

Full list of AmEx transfer partners

Airlines

- Aer Lingus AerClub (1:1 ratio).

- AeroMexico Club Premier (1:1.6 ratio).

- Air Canada Aeroplan (1:1 ratio).

- Air France/KLM Flying Blue (1:1 ratio).

- ANA Mileage Club (1:1 ratio).

- Avianca LifeMiles (1:1 ratio).

- British Airways Club (1:1 ratio).

- Cathay Pacific Asia Miles (5:4 ratio)

- Delta SkyMiles (1:1 ratio).

- Emirates Skywards (1:1 ratio).

- Etihad Guest (1:1 ratio).

- Iberia Plus (1:1 ratio).

- JetBlue TrueBlue (2.5:2 ratio).

- Qantas Airways Frequent Flyer(1:1 ratio).

- Singapore Airlines KrisFlyer (1:1 ratio).

- Virgin Atlantic Flying Club (1:1 ratio).

Hotels

- Choice Hotels (1:1 ratio).

- Hilton Hotels & Resorts (1:2 ratio).

- Marriott Hotels & Resorts (1:1 ratio).

For details on transfer ratios, see AmEx's website.

Since the American Express travel portal includes a wide variety of hotels, it is possible to filter down to properties eligible for the statement credit. Click the boxes in the sidebar under “Hotel Programs,” as seen in the image below.

Get the 'Cheat Codes' to Cheaper Travel

Unlocking the secret to saving a ton on travel is easier than you think. 📤 Our free newsletter shows you how in 5 min. or less.

When using the American Express Platinum Card® or The Business Platinum Card® from American Express to book a prepaid hotel on AmExTravel.com, cardholders will earn 5 Membership Rewards points per dollar spent. Terms apply.

How to get the most value

Stay at special, bucket list properties

If you belong to loyalty programs like Marriott Bonvoy, you may prefer to not use this credit on a stay at a St. Regis or Ritz-Carlton, for example, since you can redeem points for a stay there. You may prefer to use this credit instead for properties that are unaffiliated with a loyalty program. Are there any bucket list, independent hotels that may have been a splurge? Maybe this statement credit can put those more closely in reach.

Don’t forget about hotel elite status and points earning

If you're using this credit at a hotel that has a loyalty program, keep in mind there is no guarantee that you will earn points, status qualifications or elite status perks when booking a stay through AmEx Travel.

To get these benefits, most programs require you to book directly through their own channels. It is best to contact the hotel to check in advance. Some of them make an exception and provide traditional loyalty points and perks for these bookings.

» Learn more: The best hotel elite status programs this year

Compare prices — and perks

FHR and THC reservations are often more expensive than what you might find on a hotel’s own website. But when you take into account the slew of benefits (like a $100 credit or a potential room upgrade) and the ability to use your AmEx statement credits, it could be more economical.

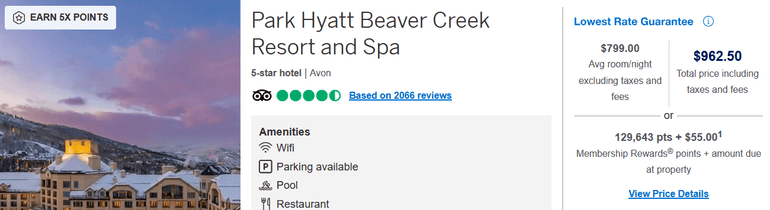

Let’s take a look at the price for the base room type on the same nights for the Park Hyatt Beaver Creek Resort & Spa. When booked via Hyatt, the rate is $879.62, including taxes and fees.

But when booked through the AmEx travel portal, the total is $962.50. While that is an $83 difference, the $100 on-property credit you’ll get more than makes up for that. Plus, you’ll get breakfast, a room upgrade (when available) and late checkout. And if you use your card’s semi-annual $300 hotel credit, the savings are even greater. (Terms apply.)

Now, if you are a World of Hyatt elite member, you may already receive some perks plus elite status credits when booking directly with Hyatt. If those are important to you, contact the hotel before making a booking through FHR to see if you would still get those perks. You just might be able to take advantage of both programs!

» Learn more: Best American Express credit cards

Use the entire credit

If your hotel stay is under $300 and you have future travel plans, don’t forget about using the remaining balance for another booking to maximize this travel credit perk. And don’t forget that you get $300 to use in the first half of the year and another $300 for the second half. You can track how much credit you have left to use by logging into your American Express account and heading to the benefits section.

You can even consider making a hotel reservation for the following year if you have not been able to use your credit before it expires. Just make sure that the transaction posts to your account before Dec. 31 of the current year so that you earn the statement credit.

🤓 Nerdy Tip

American Express will reverse the credit if you cancel a booking after the statement credit has been posted to your account. Maximize that $600 hotel credit

AmEx's new $600 hotel credit can represent significant savings. Just be sure to use your eligible credit card to make a reservation via the AmEx travel portal before it expires.

To view rates and fees of the American Express Platinum Card®, see this page.

*More from American Express

American Express relies on airlines to submit the correct information on airline transactions to identify incidental fee purchases. If you do not see a credit for a qualifying incidental purchase on your eligible Card after 8 weeks, simply call the number on the back of your Card. Qualifying airlines are subject to change. See terms & conditions for more details

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2026:

- Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

- No annual fee: Wells Fargo Autograph® Card

- Flat-rate travel rewards: Capital One Venture Rewards Credit Card

- Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

- Luxury perks: American Express Platinum Card®

- Business travelers: Ink Business Preferred® Credit Card

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

Limited Time Only: Earn $1,000 Toward Travel!

Capital One Venture Rewards Credit Card

Travel

For a limited time, the

Capital One Venture Rewards Credit Card is offering new cardholders an especially rich bonus: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel!

More like this

Related articles