How to Save Money Flying on American Airlines

Earning miles through the AAdvantage program or a co-branded card is key, but there are many ways to save.

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

If you’re planning to fly with American Airlines soon, you may be wondering how to save some money. Airfare costs can take up a significant portion of your travel budget, but with the right strategy, you can lessen the cost of your next flight.

Here are 9 ways to save money flying on American Airlines.

9 ways to fly American cheaper

1. Join the AAdvantage loyalty program to earn rewards

It pays to be loyal to an airline. Whether you fly with American Airlines occasionally or often, you'll want to become an AAdvantage member. This airline loyalty program is free to join and offers member benefits that could improve your flight experience. As an AAdvantage member, you can earn miles and redeem them for nearly-free flights.

Here are some ways you can earn AAdvantage miles:

- Flying with American Airlines and its airline partners.

- Booking travel with travel partners.

- Dining at participating restaurants.

- Shopping through the American Airlines Advantage eShopping portal.

🤓 Nerdy Tip

If you fly or spend enough to earn elite status on American Airlines, you will be able to get complimentary Main Cabin Extra or Preferred seats and check a bag at no extra cost. » Learn more: Guide to the American Airlines AAdvantage program

2. Book basic economy fare tickets for the lowest rate

American has several ticket fare types. For the most affordable fare option, consider booking a basic economy ticket, which are often sold at the lowest price.

Though cheaper, there are some restrictions for this ticket type to keep in mind. For instance, your ticket doesn’t include a checked bag for most routes, it isn't eligible for any changes or cancellation, and you'll be the last to board the plane.

If you can deal with these limitations, buying a basic economy on American Airlines to save money may be a good idea.

Get the 'Cheat Codes' to Cheaper Travel

Unlocking the secret to saving a ton on travel is easier than you think. 📤 Our free newsletter shows you how in 5 min. or less.

3. Book American Airlines deals

American Airlines publishes travel deals on its website. You can view current low fares for select domestic and international destinations. You can also browse available travel deals and discounts for savings on vacation packages and bonus mile offers.

Bookmark these pages, as the deals offer an easy way to save money on flights.

4. Use an American Airlines credit card to earn miles faster

With an American Airlines credit card, you can earn miles as you spend with the card. Plus, you may get additional perks like free checked bags, early boarding and discounts on in-flight purchases.

Here are some options:

Annual fee

$0.

$99, waived for the first 12 months.

$350.

$595.

Welcome offer

Earn 15,000 American Airlines AAdvantage® bonus miles after making $1,000 in purchases within the first 3 months of account opening.

Earn 50,000 American Airlines AAdvantage® bonus miles after spending $2,500 in purchases within the first 3 months of account opening.

For a limited time, earn 90,000 American Airlines AAdvantage® bonus miles after $5,000 in purchases within the first 4 months of account opening.

For a limited time, earn 100,000 American Airlines AAdvantage® bonus miles after spending $10,000 within the first 3 months of account opening.

Earn rate

• 2 miles per $1 at grocery stores, including grocery delivery services, and on eligible American Airlines purchases.

• 1 mile per $1 spent on other purchases.

• 1 Loyalty Point per 1 eligible AAdvantage® mile earned from purchases.

• 2 miles per $1 at gas stations and restaurants, and on eligible American Airlines purchases.

• 1 mile per $1 spent on other purchases.

• 1 Loyalty Point per 1 eligible AAdvantage® mile earned from purchases.

• 6 miles per $1 on eligible AAdvantage Hotels bookings.

• 3 miles per $1 on eligible American Airlines purchases.

• 2 miles per $1 at restaurants, including takeout and delivery, and on eligible Rides and Rails purchases, including taxis, rideshares and public transit.

• 1 mile per $1 on everything else.

• 1 Loyalty Point per 1 eligible AAdvantage® mile earned from purchases.

• 10 miles per $1 on eligible car rentals and hotels booked through AA.

• 4 miles per $1 on eligible American Airlines purchases (5 miles per $1 after spending $150,000 total on the card in a calendar year).

• 1 mile per $1 on everything else.

• 1 Loyalty Point per 1 eligible AAdvantage® mile earned from purchases.

Learn more

Having an American Airlines credit card can speed up the number of miles you earn — especially if you are able to earn a lump sum of points from a welcome offer. With award flights available for as few as 10,000 miles round trip, getting an airline credit card could be a smart move.

» Learn more: Which American Airlines credit card should I get?

5. Book discounted award flights

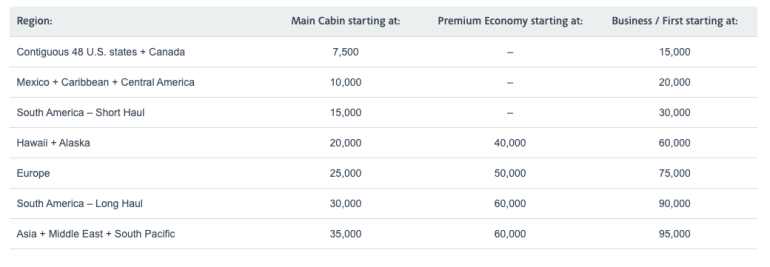

If you have AAdvantage miles that you need to use, you may be able to save yourself some money by booking an award flight. Unfortunately, in its shift to dynamic award pricing, American has discontinued MileSAAver, AAnytime and Web Special fares, which offered discounted redemptions when available.

While award pricing will vary based on demand, American has published an "award chart" showing what you can roughly expect to pay. However, there are no guarantees:

6. Take advantage of no change fees on eligible fares

Many American bookings qualify for no change fees. All domestic, short-haul international, and select long-haul international main cabin, premium economy and premium cabin tickets qualify for no change fees. Travelers only need to pay the difference in fare if the new ticket is a higher price.

This policy can give you the confidence to book a ticket sooner and cancel and rebook later if the ticket price becomes more affordable.

» Learn more: Is the American Airlines AirPass worth it?

7. Veterans and their families can save 10% on airfare

You can save money on American Airlines flights if you're a veteran. American Airlines offers a 10% discount for veterans and their families through the VetRewards program, made available through Veterans Advantage.

You'll need to book your flight with Veterans Advantage, but if you're a VetRewards member, this can be a great way to save money.

» Learn more: 3 ways to score military travel discounts

8. Download the app for free inflight entertainment

Take advantage of this little-known American Airlines Wi-Fi hack: If you download the airline's app ahead of travel, you'll be able to access movies, TV shows and music free of charge for the duration of your flight. This can save you $10 or more per flight.

9. Browse flights on the low fare calendar

Search the AA Fare Finder Map to find deals from your home airport and plan future redemptions. Input your dates, interests and budget, and the tool will recommend popular destinations from your airport of choice.

Note that the prices listed may be for basic economy fares.

The bottom line

Flying on American Airlines doesn't have to be overly expensive. There are ways to save money on your next airfare purchase. If you're planning to purchase a flight ticket with American, consider using the tips above to keep more money in your wallet.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2026:

- Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

- No annual fee: Wells Fargo Autograph® Card

- Flat-rate travel rewards: Capital One Venture Rewards Credit Card

- Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

- Luxury perks: American Express Platinum Card®

- Business travelers: Ink Business Preferred® Credit Card

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

Limited Time Only: Earn $1,000 Toward Travel!

Capital One Venture Rewards Credit Card

Travel

For a limited time, the

Capital One Venture Rewards Credit Card is offering new cardholders an especially rich bonus: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel!

More like this

Related articles