How to Transfer Chase Ultimate Rewards Points Between Accounts (and Why It’s Smart)

Consolidating Chase points — whether your own or within your household — can help unlock more valuable redemptions.

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

If you have multiple cards that earn Chase Ultimate Rewards®, you can maximize the value of your points by transferring them to the card with the richest redemption options. Transfers are free and there’s no limit to how much you can move. You can also combine points with a household member who shares your address.

Points are normally worth 1 cent apiece when redeemed through Chase’s travel portal. They can be worth even more when you transfer them to select Chase cards that let you move points to airline and hotel program partners at a 1:1 ratio.

Get the 'Cheat Codes' to Cheaper Travel

Unlocking the secret to saving a ton on travel is easier than you think. 📤 Our free newsletter shows you how in 5 min. or less.

Cards that let you combine Chase points

The following Chase credit cards earn Chase Ultimate Rewards® points and are eligible for points transfers to travel partners:

Cards that let you combine points

Chase has more than a dozen airline and hotel travel partners. When you make a transfer, your Chase Ultimate Rewards® points will become points or miles in the corresponding partner’s loyalty program that can be redeemed for flights or hotel stays. However, some points are more valuable than others, so make sure you’re familiar with the best Chase transfer partners.

Full list of Chase transfer partners

Airlines

- Aer Lingus (1:1 ratio).

- Air Canada (1:1 ratio).

- Air France-KLM (1:1 ratio).

- British Airways (1:1 ratio).

- Iberia (1:1 ratio).

- JetBlue (1:1 ratio).

- Singapore (1:1 ratio).

- Southwest (1:1 ratio).

- United (1:1 ratio).

- Virgin Atlantic (1:1 ratio).

Hotels

- Hyatt (1:1 ratio).

- IHG (1:1 ratio).

- Marriott (1:1 ratio).

The following Chase cards are considered cash-back cards, but cardholders receive the rewards in the form of Chase Ultimate Rewards® points that cannot be transferred to travel partners (unless first transferred to one of the above cards):

- Chase Freedom® (no longer available to new applicants).

If you have the Ink Business Premier® Credit Card, note that you can earn Ultimate Rewards® points, but you cannot transfer them to other accounts or to any of Chase's transfer partners.

» Learn more: The best travel credit cards right now

By holding one of the cash-back Chase credit cards, you can earn more Chase Ultimate Rewards® points, particularly on bonus categories.

For example, let’s say you want to pay your phone bill and have the Ink Business Cash® Credit Card, which earns 5% cash back (or 5 Chase Ultimate Rewards® points per $1) on the first $25,000 spent on purchases at office supply stores and on internet, cable and phone services.

If you pay $200 monthly for that bill using that card, you’d earn 1,000 Chase Ultimate Rewards® points per month. But if you use a different card like the Chase Sapphire Reserve® — which earns 1 point per $1 on those purchases — you’d only earn 200 points.

To maximize the value of your points, consider moving those points from your Ink Business Cash® Credit Card to the Chase Sapphire Reserve®, Chase Sapphire Preferred® Card or Ink Business Preferred® Credit Card — cards that allow you to transfer points to a travel partner.

» Learn more: Chase trifecta: What you need to know

How to combine Chase points

The steps to transfer points between Chase cards are straightforward. If you want to merge Chase points with a family member, such as your spouse, you’ll first need to call to have them added to your account before you can go through these steps. More on that later.

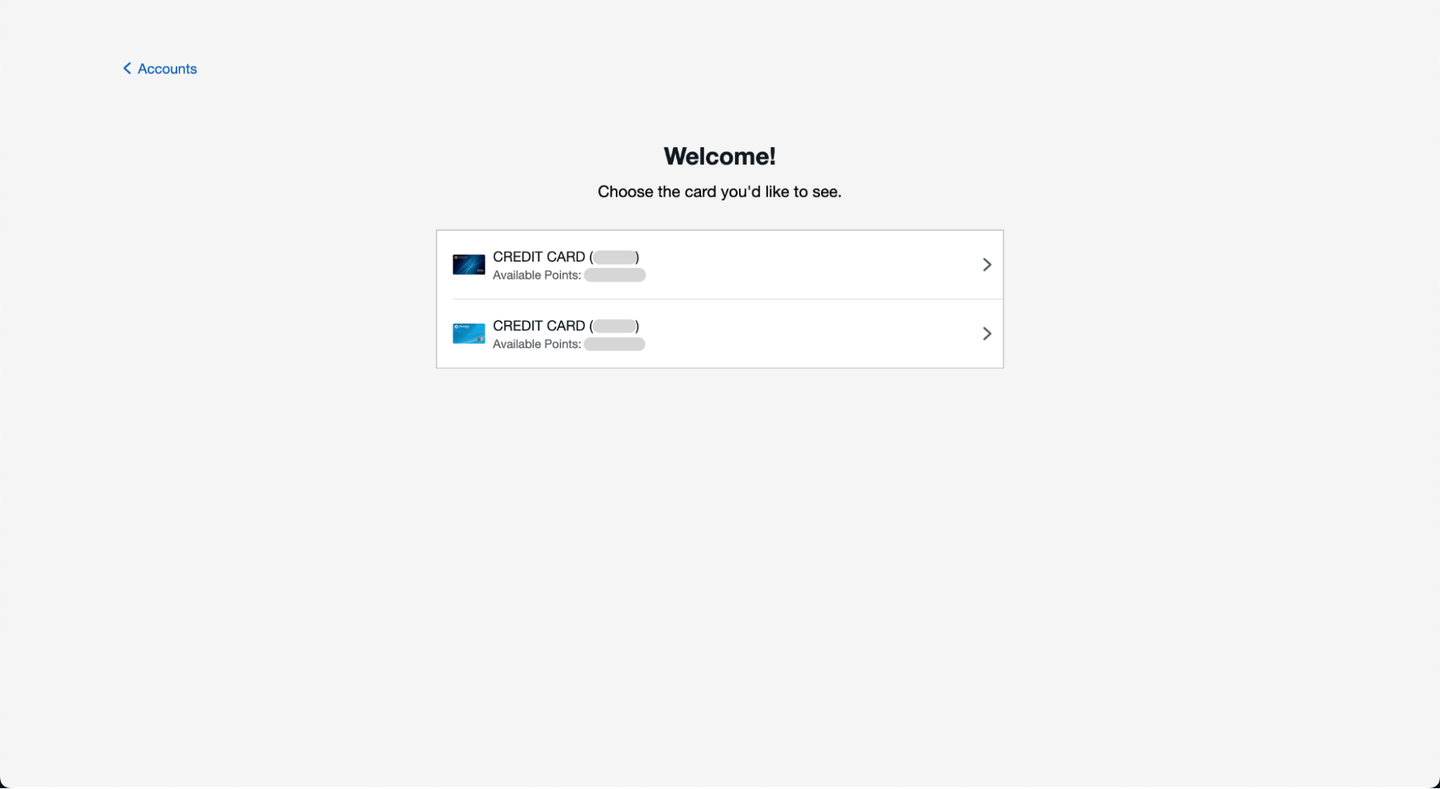

1. Go to Chase's Ultimate Rewards® portal

Visit the Chase Ultimate Rewards® website and log in to your Chase account. (While you can navigate there from the main Chase website, it’s much faster to go directly to the portal.) You can find this in the Chase mobile app by logging in and selecting the Ultimate Rewards® tile on the “Accounts” tab.

2. Choose the card that you want to transfer points from

Once in the portal, select one of your Chase cards. Here, you’ll see the total available points for each card and other important details about each card. If you’re using the mobile app, you can skip this step.

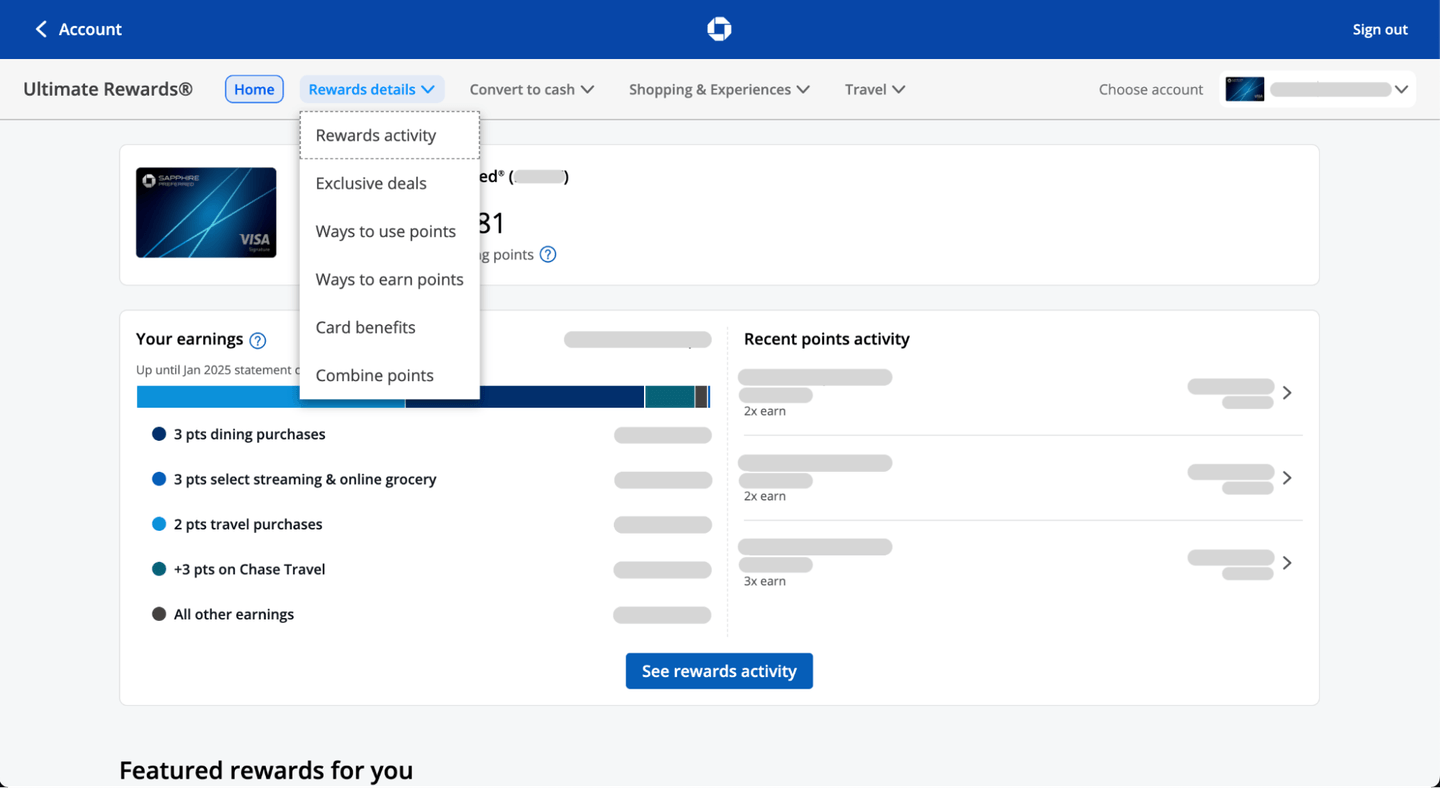

3. Find and select “Combine Points”

If you’re using a web browser, navigate to the menu bar and select “Rewards details.” A dropdown menu will appear with “Combine Points” as the last option. That step will take you to where you need to go to transfer your points between cards.

If you’re in the Chase mobile app, scroll down to the “Manage points” section and select “Combine points.” Starting from here, the browser and in-app experience is the same.

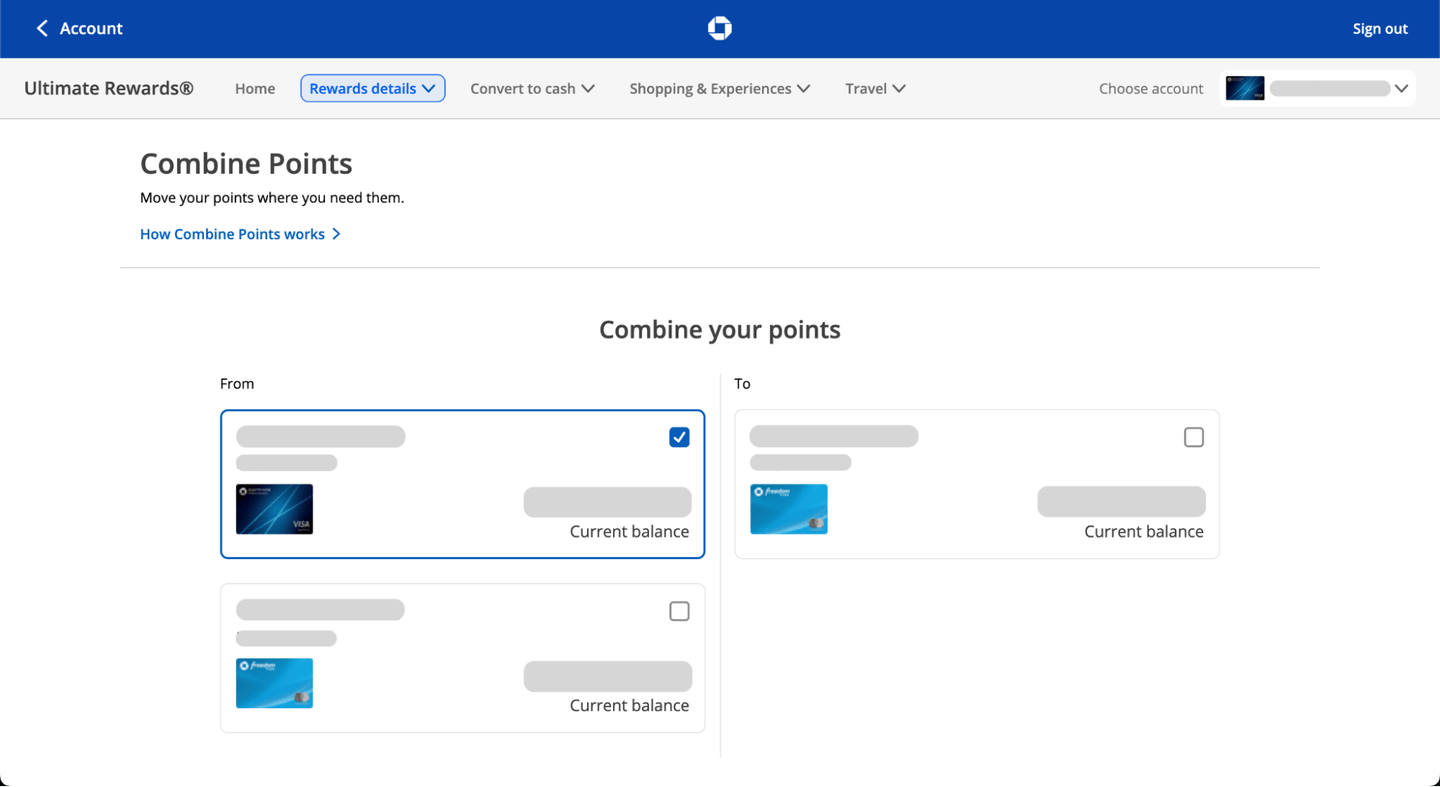

4. Select the cards you want to transfer points between

You’ll see all of your Chase cards displayed on the next screen. Select the cards you plan to transfer your points from and to so that you can begin the process of combining them.

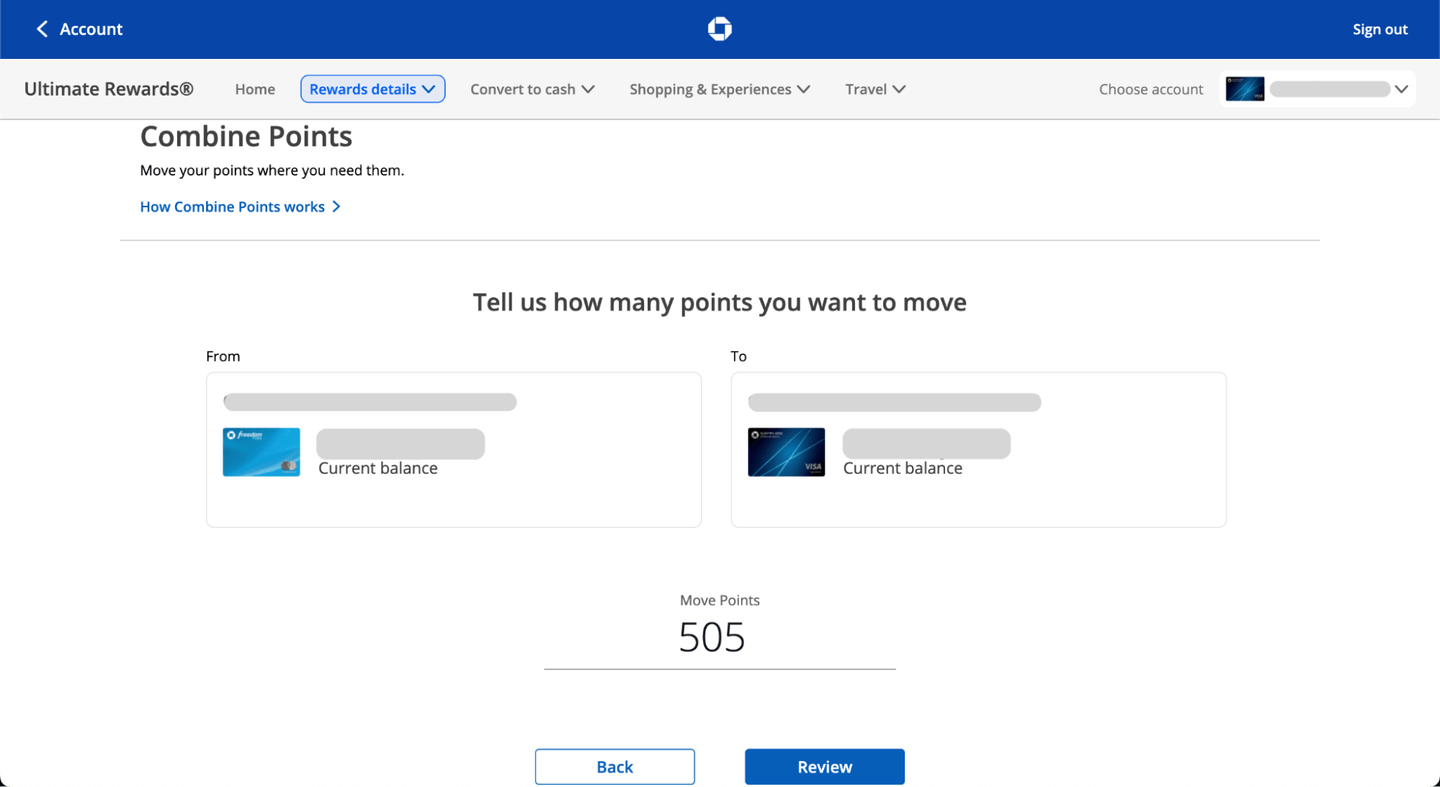

5. Choose how many points you want to transfer

You’ll need to decide how many points you want to transfer. Enter a number and select “Review.” Note that you cannot transfer more than the total amount of points in your account.

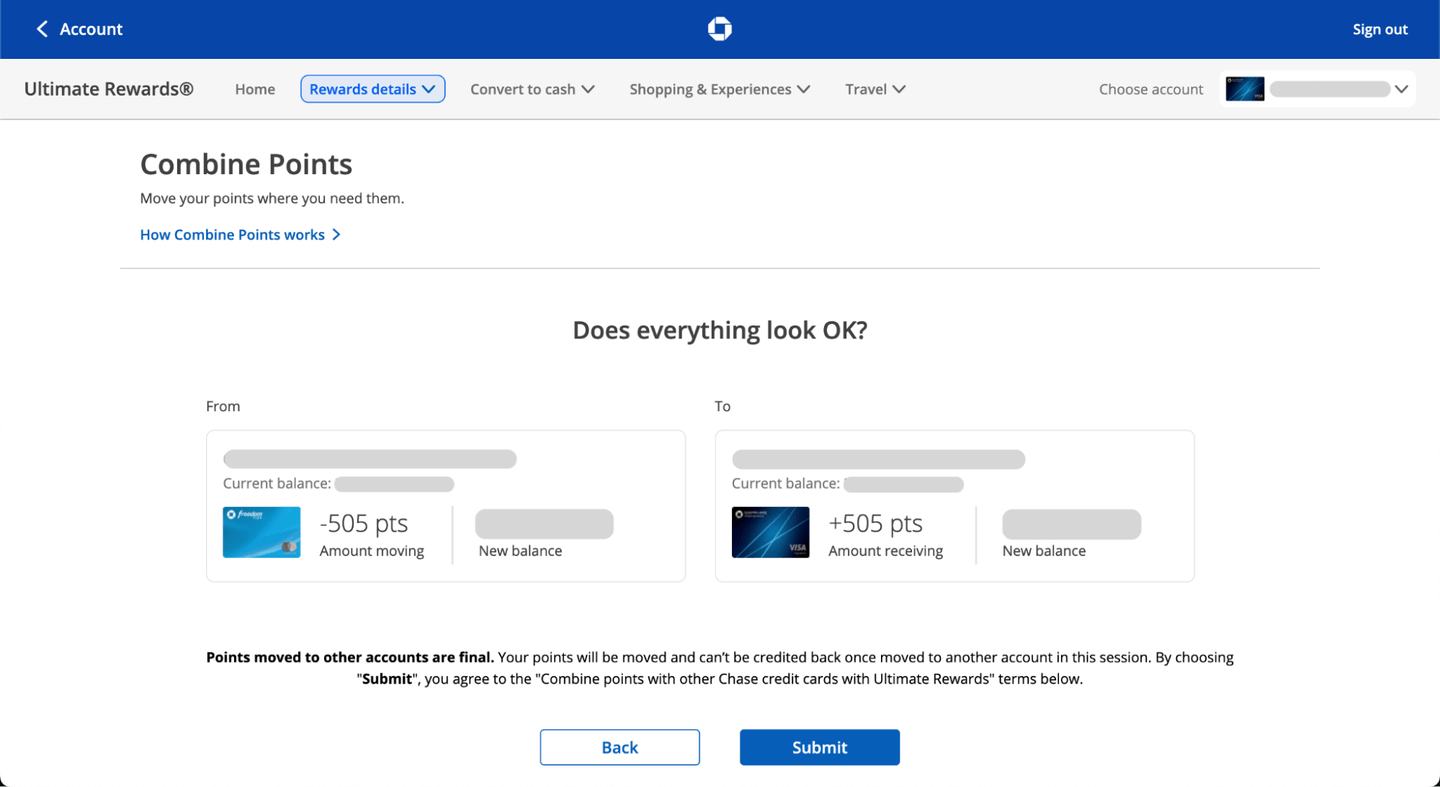

6. Review the transfer and select “Submit”

The final screen serves as a confirmation screen. Ensure all the details are correct and select the "Submit" button if everything looks accurate. Your points will be transferred over to the other card instantly.

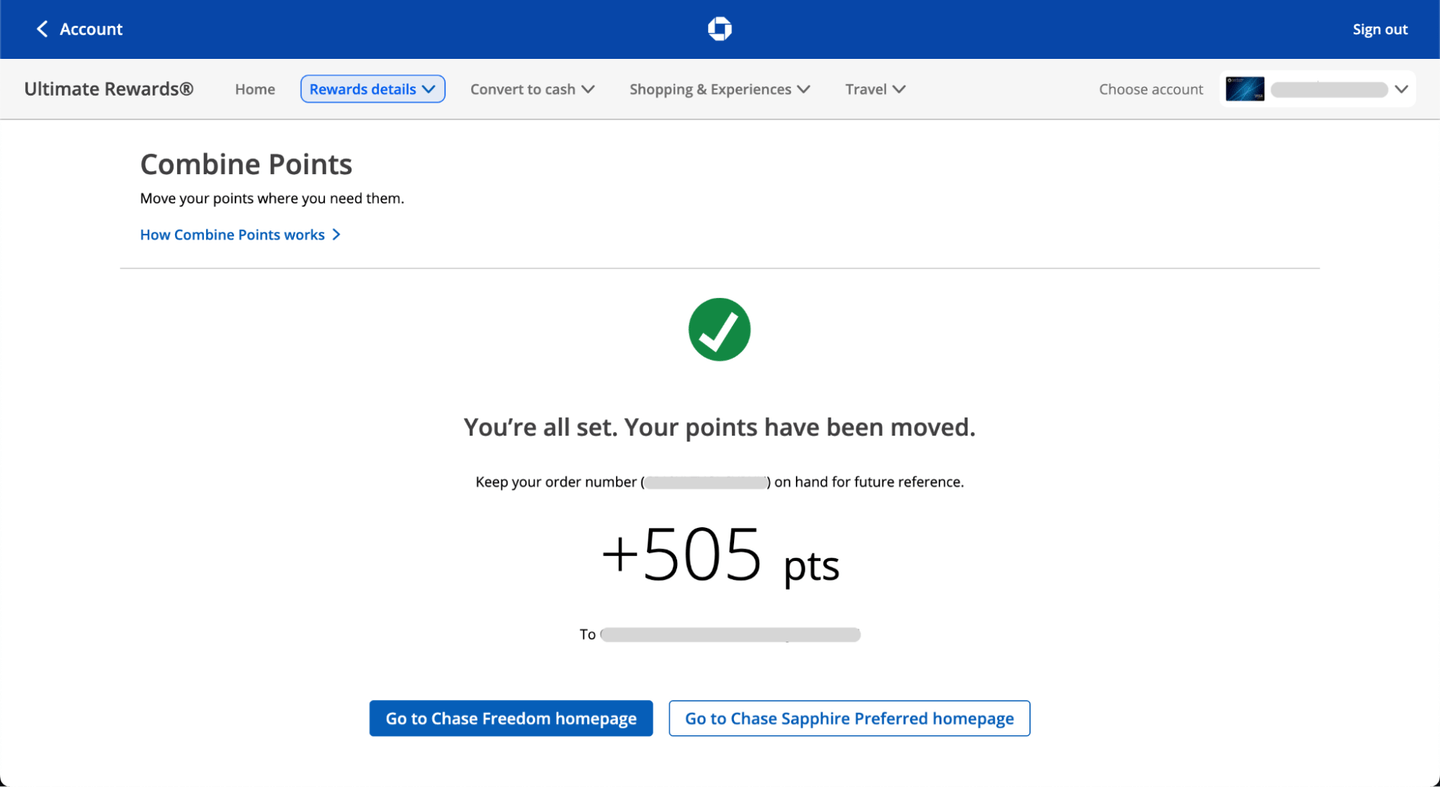

On the next page, you will see a confirmation page that verifies your points have been transferred. You’ll also find your order number in case you need to contact Chase about your points transfer transaction for any reason.

It’s that simple. Now that you know how to transfer Chase Ultimate Rewards® between accounts, you can transfer Chase points as often as you’d like.

» Learn more:Chase Ultimate Rewards® points value calculator

Can you transfer Chase points to another person?

You can transfer your Chase Ultimate Rewards® points to another person, like a family member, spouse or friend. Chase allows you to move points to another Chase card that you own or to another Chase card that belongs to a member of your household, meaning you must live at the same address. You are limited to doing this with one other person, and any other points transfers are prohibited.

How to combine Chase points with your spouse, friend or family member

If you want to transfer Chase points with a spouse, friend or family member in your household, you have to add that person’s account to your account first.

Start by calling the customer service number on the back of your Chase credit card. A representative can help you add your household member’s Chase card to your account. You’ll need to have their credit card number and last name handy to make the request.

After you link your household member’s account over the phone, you should be able to see it online for future transfer requests using the step-by-step guide from above.

» Learn more: Chase Sapphire Preferred vs. Sapphire Reserve

Why you should transfer Chase points between accounts and family members

Transferring Chase points to a spouse or family member and moving points between your own Chase accounts are two ways to get the most value out of your Chase points.

Pool points for more redemption options

You can transfer points from a Chase Sapphire Reserve®, Chase Sapphire Preferred® Card or Ink Business Preferred® Credit Card into points and miles with more than a dozen airline and hotel travel partners. These are transferred at a 1:1 ratio, meaning for each Chase Ultimate Rewards® point you transfer, you’ll get one point or mile in that partner’s loyalty program.

Using points and miles to book flights and hotel stays can be an extremely valuable tool, because they typically do not have a fixed value. For example, I transferred Chase Ultimate Rewards® points to Hyatt for a three-night stay at the Park Hyatt Milan. Instead of paying more than $4,700, I redeemed 105,000 Hyatt points — netting a value of nearly 4.5 cents per point.

While Chase’s cash-back credit cards don’t let you directly transfer to a travel partner, you can transfer those points to one of the three cards that do allow direct transfers. By pooling your points together — whether your own or with a family member — into an eligible account, you can use them to book your next trip sooner.

The information related to the Chase Freedom® has been collected by NerdWallet and has not been reviewed or provided by the issuer of this card.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2026:

- Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

- No annual fee: Wells Fargo Autograph® Card

- Flat-rate travel rewards: Capital One Venture Rewards Credit Card

- Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

- Luxury perks: American Express Platinum Card®

- Business travelers: Ink Business Preferred® Credit Card

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

Limited Time Only: Earn $1,000 Toward Travel!

Capital One Venture Rewards Credit Card

Travel

For a limited time, the

Capital One Venture Rewards Credit Card is offering new cardholders an especially rich bonus: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel!

More like this

Related articles