How United and Marriott Elites Can Status Match

Elite members can get reciprocal benefits with both Marriott and United through the RewardsPlus program.

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

If you have elite status with either Marriott or United, you can benefit from the RewardsPlus program, a partnership between the Marriott and United loyalty programs that gives elites reciprocal elite status in the other program.

By capitalizing on the Marriott-United status match program, you can take advantage of elite status benefits with both Marriott and United, like room upgrades, free checked bags and more.

On this page

Marriott elites become United elites and vice versa

If you have Titanium Elite or Ambassador Elite status in the Marriott Bonvoy program, you can claim Premier Silver status in United’s MileagePlus loyalty program.

On the flip side, if you have Premier Gold status with United, you can claim Gold Elite status in Marriott Bonvoy.

What you'll get with the Marriott and United status match

If you match from Marriott to United: You’ll get Premier Silver elite status in the airline loyalty program, which includes perks like:

- Complimentary access to preferred seating at booking and economy plus seats at check-in for you and a companion.

- Complimentary day-of-departure upgrades.

- One free checked bag up to 70 pounds (32 kilograms) on United economy flights or three free checked bags when flying in a premium cabin.

- Group 2 priority boarding.

- 7x award miles when flying on United.

- Expanded award availability.

Get the 'Cheat Codes' to Cheaper Travel

Unlocking the secret to saving a ton on travel is easier than you think. 📤 Our free newsletter shows you how in 5 min. or less.

If you match from United to Marriott: You’ll get Gold Elite status, Marriott’s second tier in the hotel loyalty program. Getting Marriott elite status with United comes with perks like:

- 25% bonus Marriott Bonvoy® points on stays.

- Room upgrades, based on availability.

- 2 p.m. late checkout, based on availability.

- Bonus points at check-in.

- Enhanced complimentary internet access.

» Learn more: The best travel credit cards right now

How to qualify for the necessary Marriott and United elite tiers

Here are the requirements for earning the status level needed to qualify for the reciprocal status match in both programs.

Marriott

To reach Titanium Elite, stay at least 75 nights at a participating Marriott property in one calendar year. If you have a Marriott-branded credit card, qualifying is a little easier because card perks include a 5-25 elite night credit bonus towards your status. If you have a personal and business credit card from Marriott, you can get a total of 30-40 elite night credits, putting you only 35-55 elite nights away from Titanium status.

Here are some Marriott cards along with the status they offer:

Annual fee

$0.

$95.

$250.

$650.

Rewards

• 3 Marriott Bonvoy® points per $1 at participating Marriott Bonvoy hotels.

• 2 points per $1 on grocery stores, rideshare, select food delivery, select streaming and internet, cable and phone services.

• 1 point per $1 on all other eligible purchases.

• 6 Marriott Bonvoy® points per $1 at participating Marriott Bonvoy hotels.

• 3 points per $1 on up to $6,000 a year in combined purchases on grocery stores, gas stations and dining.

• 2 points per $1 on all other eligible purchases.

• 6 Marriott Bonvoy® points per $1 at participating Marriott Bonvoy hotels.

• 4 points per $1 on up to $15,000 a year in combined purchases at grocery stores and on dining.

• 2 points per $1 on all other eligible purchases.

• 6 Marriott Bonvoy® points per $1 at participating Marriott Bonvoy hotels.

• 3 points per $1 at restaurants worldwide and on flights booked directly with airlines.

• 2 points per $1 on all other eligible purchases.

Terms apply.

Elite benefits

• 15 Elite Night Credits annually, qualifying you for Silver Elite Status.

• 15 Elite Night Credits annually, qualifying you for Silver Elite status, plus path to Gold Status when you spend $35,000 on purchases each calendar year.

• 1 Elite Night Credit toward Elite Status for every $5,000 you spend.

• Gold Elite status, plus 15 Elite Night credits each year toward Platinum Elite status.

• Platinum Elite Status and 25 Elite Night credits per year.

Terms apply.

Learn more

If you're looking to maximize credit cards on your path to Titanium status, the best way to do that is to get the Marriott Bonvoy Brilliant® American Express® Card (grants 25 elite night credits, see rates and fees) and the Marriott Bonvoy Business® American Express® Card (grants 15 elite night credits, see rates and fees ) and you'll end up with 40 elite night credits. You will then only need to earn 35 more elite nights to achieve Titanium status.

Ambassador Elite has even steeper requirements: Spend at least 100 nights a year at Marriott properties and over $23,000 in qualifying expenses at hotels.

United

Premier Gold on United requires completing four segments on United/United Express and amassing either: 10,000 Premier Qualifying Points (PQP) and 30 Premier Qualifying Flights (PQF) or 12,000 PQP. 1 PQP = $1 dollar spent on flights and other purchases (i.e. economy seats, upgrade copays and more, taxes excluded).

You can also earn PQP from holding United’s credit cards, which can make it easier to reach Gold status.

United cards

Annual fee

$0 intro for the first year, then $150.

$350.

$695.

$695.

$150.

Earning rates

• 5 miles per $1 on prepaid hotels booked through United.

• 2 miles per $1 on United purchases.

• 2 miles per $1 at restaurants and hotels (when booked directly with hotel).

• 1 mile per $1 on all other purchases.

• 5 miles per $1 on hotel stays through Renowned Hotels and Resorts.

• 3 miles per $1 on United purchases.

• 2 miles per $1 at restaurants, select streaming services and all other travel.

• 1 mile per $1 on all other purchases.

• 5 miles per $1 on hotel stays through Renowned Hotels and Resorts.

• 4 miles per $1 on United purchases.

• 2 miles per $1 at restaurants and all other travel purchases.

• 1 mile per $1 on all other purchases.

• 5 miles per $1 on hotel stays at Renowned Hotels and Resorts when you prepay and book through Chase.

• 2 miles per $1 on United purchases, at gas stations and on local transit and commuting.

• 1.5 miles per $1 on all other purchases.

• 5 miles per $1 on hotel stays booked through United.

• 2 miles per $1 on United purchases, on dining (including delivery services), at gas stations, office supply stores and on local transit and commuting.

• 1 mile per $1 on all other purchases.

PQP earning

• Up to 1,000 PQP in a calendar year.

• Earn 1 PQP for every $20 in credit card spending.

• Up to 18,000 PQP in a calendar year.

• Earn 1 PQP for every $20 in credit card spending.

• Up to 28,000 PQP in a calendar year.

• Earn 1 PQPs for every $15 in credit card spending.

• Up to 28,000 PQP in a calendar year.

• Earn 1 PQP for every $15 in credit card spending.

• Up to 4,000 PQP in a calendar year.

• Earn 1 PQP for every $20 in credit card spending.

Learn more

» Learn more: Earning United Premier Qualifying Points on flights

How Marriott elites get access to United Silver status

Marriott Titanium Elite and Ambassador Elite members can request their complimentary United Silver elite status by going to Marriott's travel partner page. Sign in to begin the process.

The confirmation page says it will take seven to 10 days for your elite benefits to be effective.

» Learn more: The 5 best ways to rack up Marriott Bonvoy points

How United elites get access to Marriott status

United Premier Gold, Platinum and 1K elite members can get Marriott Bonvoy Gold Elite status by going to United's MileagePlus portal.

Enter your MileagePlus number, password and email address, accept the terms and conditions, and click “Register for status.” Follow the instructions to link your accounts.

Get bonus United miles when you transfer Marriott points

All Marriott Bonvoy members can transfer points to 38 different airlines, including United, usually at a 3:1 ratio. However, members transferring Marriott points to United miles can get what amounts to a 2:1 ratio when transferring in blocks of 60,000 points.

For every 60,000 Marriott points transferred to United (at the base ratio of 3:1), Marriott adds on another 10,000 bonus miles for a total of 30,000 United miles (or a transfer ratio of 2:1). For transfers to most of Marriott's airline partners, you’ll only get a 5,000-point bonus for transferring 60,000 points.

Note that this transfer bonus does not apply to American Airlines, Delta Air Lines, Avianca or Air New Zealand.

It's important to keep in mind what each program’s rewards are worth. Marriott Bonvoy points are worth 0.8 cent each, while United MileagePlus miles are worth 1.2 cents each.

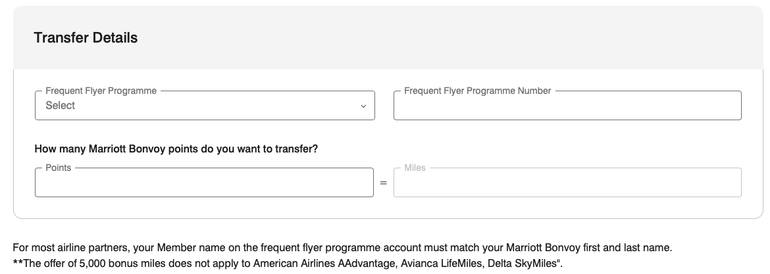

How to transfer Marriott points to United miles

Start on Marriott’s Transfer Points to Miles webpage, then click “Transfer Points.”

In the window that pops up, select the frequent flyer program you want to transfer to and enter your membership number. Enter the number of Marriott points you wish to transfer.

The transfer tool will calculate the number of airline miles you’ll receive at the standard transfer ratio. This calculation won’t reflect the 10,000-mile bonus for transferring at least 60,000 points, so you’ll need to mentally factor in both when transferring Marriott points to United miles.

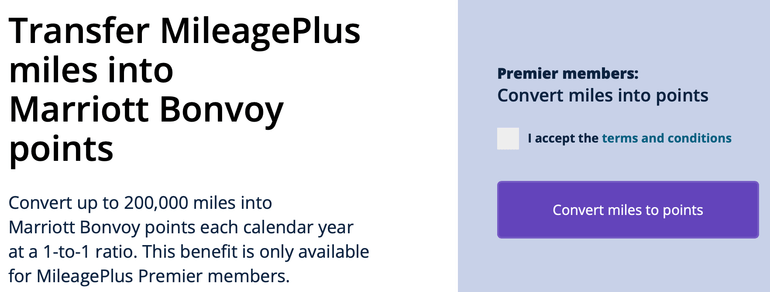

Top off your Marriott Bonvoy account with United miles

What if you need some Marriott Bonvoy points? The good news is that United MileagePlus Premier members can transfer miles to Marriott Bonvoy. The bad news? The transfer rate is only 1:1.

United miles are generally more valuable than Marriott Bonvoy points. That’s why it can be a good deal to transfer Marriott points to United at a 3:1 transfer ratio (or 2:1 if transferring in blocks of 60,000). However, transferring points from United to Marriott at a 1:1 ratio is harder to justify.

So convert your United miles to Marriott points only when you’re within striking distance of a Marriott hotel stay. You’re limited to transferring 200,000 United miles to Marriott points each calendar year.

How to transfer United miles to Marriott points

To transfer United miles to Marriott Bonvoy points, start on this United webpage.

Enter your MileagePlus number and password, then agree to the terms and conditions. Next, you’ll be prompted to enter your Marriott Bonvoy account number. Then enter the number of miles you want to transfer.

Final thoughts on the United-Marriott status match

Reciprocal elite status and earning bonus points on transfers are nice perks of the RewardsPlus partnership. If you’re eligible, go ahead and enroll. It’s free. Then you can enjoy status in both programs instead of just one. And keep the point-transfer options in mind for the next time you need to top off your United MileagePlus or Marriott Bonvoy account.

To view rates and fees of the Marriott Bonvoy Business® American Express® Card, see this page.

To view rates and fees of the Marriott Bonvoy Brilliant® American Express® Card, see this page.

The information related to Marriott Bonvoy Bountiful™ Card credit card has been collected by NerdWallet and has not been reviewed or provided by the issuer of this card.

The information related to United Club℠ Business Card credit card has been collected by NerdWallet and has not been reviewed or provided by the issuer of this card.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2026:

- Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

- No annual fee: Wells Fargo Autograph® Card

- Flat-rate travel rewards: Capital One Venture Rewards Credit Card

- Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

- Luxury perks: American Express Platinum Card®

- Business travelers: Ink Business Preferred® Credit Card

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

Limited Time Only: Earn $1,000 Toward Travel!

Capital One Venture Rewards Credit Card

Travel

For a limited time, the

Capital One Venture Rewards Credit Card is offering new cardholders an especially rich bonus: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel!

More like this

Related articles