How You’ll Earn United Premier Qualifying Points On Flights

How you earn PQPs depends on whether you're booking a United, partner or preferred partner flight.

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

To earn United Airlines Premier elite status, you’ll need to collect Premier Qualifying Points (PQPs) and Premier Qualifying Flights (PQFs). These are the two metrics that United uses to calculate elite status levels.

Of these, technically only PQPs are required. Earning PQFs simply reduces the number of PQPs you need to earn elite status in United's loyalty program, MileagePlus Premier.

Let's dig into what United Premier Qualifying Points are and how you can earn them.

What are United Premier Qualifying Points?

United PQPs are a metric of how much you've spent with United. The primary way to earn PQPs is by flying on United or its Star Alliance partners. But you can also earn PQPs on the ground. Eligible United credit card holders can earn a limited number of PQPs by spending on their co-branded airline credit card.

Each method of earning Premier Qualifying Points works a bit differently. Partner flights and credit card spending have caps and limitations to keep in mind.

» Learn more: The best airline credit cards

By signing up, you will receive newsletters and promotional content and agree to our Terms of Use and acknowledge the data practices in our Privacy Policy. You may unsubscribe at any time.

Earning Premier Qualifying Points on United flights

For flights on United, you'll earn PQPs on the cost of:

- Base airfare.

- Carrier-imposed surcharges.

- Seat purchases and subscriptions.

- Co-pays on mileage upgrades and paid upgrades.

You won't earn PQPs on your entire airfare purchase; that's because airport taxes, security fees and other mandatory fees don't count toward PQP earnings. These taxes and fees can slice a decent portion of the potential PQPs.

» Learn more: Cards that can earn PQPs

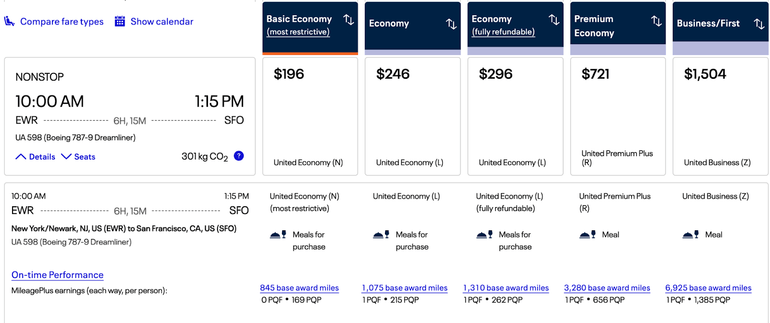

For example, on a one-way flight from Newark, New Jersey, to San Francisco, the taxes and fees range from $28 to $119:

- Basic economy: $196 (169 PQPs).

- Economy: $246 (215 PQPs).

- Refundable economy: $296 (262 PQPs).

- Premium economy: $721 (656 PQPs).

- Business class: $1,504 (1,385 PQPs).

On international routes, these taxes and fees can significantly reduce the number of PQP you earn per dollar spent.

For example, you'd earn just a fraction of the PQPs for what you pay for a flight from San Francisco to London. You'd pay $592 round-trip for a basic economy ticket but earn just 176 PQPs after subtracting $232 in taxes and fees. For premium economy, you'd pay $1,559 round-trip but earn only 581 PQPs minus $384 in taxes and fees.

United award flights

You’ll earn 1 PQP for every 100 MileagePlus miles redeemed for a United flight or seat upgrade.

PQPs go to the person who travels, not to the person who redeemed miles. If the itinerary includes a mix of United and non-United flights, you’ll only earn PQPs on the United legs.

Say, for example, you redeem 15,000 United miles for a flight. You’d earn 150 PQP toward Premier status.

How to earn United PQP on flights booked through partner airlines

In addition to flying on United, you can earn PQP toward elite status when booking flights through United's partner airlines. The redeemable miles earned are based on fare price and MileagePlus status or fare class, flight distance and where you booked the flight.

You'll earn PQP based on a fraction of the total award miles you earn on a partner flight:

- Preferred partners: Award miles divided by 5.

- Other partners: Award miles divided by 6.

There are caps on the number of PQP you can earn for these flights, which we'll discuss in the next section.

Say you earn 3,000 award miles by flying with a preferred partner. Divided by 5, you'd earn 600 PQPs for this flight. For the same 3,000-mile earnings on a nonpreferred partner, you'd earn 500 PQP.

Here’s a list of current United preferred and nonpreferred partners for earning PQPs.

United preferred partners

- Air Canada.

- Air China.

- Air Dolomiti.

- Air New Zealand.

- ANA.

- Austrian Airlines.

- Avianca.

- Azul Brazilian Airlines.

- Brussels Airlines.

- Copa Airlines.

- Edelweiss.

- Eurowings.

- Eurowings Discover.

- Lufthansa.

- SWISS International Airlines.

- Virgin Australia.

United nonpreferred partners

- Aegean Airlines.

- Air India.

- Asiana Airlines.

- Croatia Airlines.

- EgyptAir.

- Ethiopian Airlines.

- EVA Air.

- Juneyao Air.

- LOT Polish Airlines.

- Olympic Air.

- SAS.

- Shenzhen Airlines.

- Singapore Airlines.

- South African Airways.

- TAP Air Portugal.

- Thai Airways International.

- Turkish Airlines.

If earning United elite status is your goal, crunch the numbers before booking your flight. For example, if you’re flying with a preferred partner, you can maximize the number of miles flown by booking flights with a layover — rather than nonstop flights — since the number of PQPs is based on the number of miles flown.

Alternatively, if United flies the same route, check if the number of PQPs earned will be higher. Because flying with United earns you PQPs based on the cost of the flight (before taxes and fees), you may net more PQPs if the cost is higher than the number of miles flown with a partner.

Limitations on earning PQPs on preferred and nonpreferred partner flights

United limits how many PQPs you can earn on each partner flight.

| Maximum PQPs per flight | Preferred partner | Nonpreferred partner |

|---|---|---|

| First or business class | 1,500. | 1,000. |

| Economy or premium economy | 750. | 500. |

To see how this limitation can come into play, let's run the numbers. Nonpreferred partner Singapore Airlines operates the world's longest flight between New York-JFK and Singapore — which clocks in at 9,537 miles. Singapore Airlines premium economy fares earn 100% of flight miles as award miles. So you'll earn 9,537 United MileagePlus miles each way.

As a nonpreferred partner, divide these earnings by 6 to get the potential earnings of 1,589 PQPs each way. However, as a premium economy flight on a nonpreferred partner, you'll earn only the maximum of 500 PQPs on this flight. That's less than one-third of the potential earnings.

Earning PQPs with United credit cards

Some United credit cards help you earn PQPs, which could make qualifying for elite status faster:

- United℠ Explorer Card: Earn 1 PQP for every $20 in credit card spending, up to 1,000 PQPs per year.

- United Quest℠ Card: Earn 1 PQP for every $20 in credit card spending, up to 18,000 PQPs per year.

- United Club℠ Card: Earn 1 PQPs for every $15 in credit card spending, up to 28,000 PQPs per year.

- United℠ Business Card: Earn 1 PQP for every $20 in credit card spending, up to 4,000 PQPs per year.

- United Club℠ Business Card: Earn 1 PQP for every $15 in credit card spending, up to 28,000 PQPs per year.

Cards that can earn PQPs

Annual fee

- $0 intro for the first year, then $150

- $350

- $695

- $150

Learn more

So how would this actually work? Let’s say you wanted to use this strategy to help you achieve Gold status (which requires 10,000 PQPs and 30 PQFs, or 12,000 PQPs) with the least amount of flying. Because everyone must fly at least four segments with United or United Express to be eligible for elite status, let’s assume that you would earn 1,500 PQPs combined from those flights.

With only those four flights, you’d need to earn status at the higher PQP threshold of 12,000 PQPs. The remaining 10,500 PQPs that you would need to earn means that you would need to spend a whopping $210,000 on your eligible card in a calendar year.

Spending that kind of money isn’t achievable for most people, so this method isn’t ideal for achieving elite status through mostly credit card spending. However, if you’re 500 or 1,000 PQPs shy of an elite status level, and you have one of these credit cards, you could leverage this benefit to meet your goal.

Can I buy PQPs on United?

You can top off your United PQPs account balance by purchasing a Premier Accelerator from United. This option is available only when you're also buying an Award Accelerator — which is only offered when booking a United flight.

Rates and options may vary depending on the flight. For example, for a round-trip flight from San Francisco to London for a Premier Silver elite, United gives a choice between two Premier Accelerator options:

- 500 bonus PQPs for $470 (94 cents per PQP).

- 1,000 bonus PQPs for $930 (93 cents per PQP).

You should generally buy a Premier Accelerator as a last resort. Rather than simply handing your money over to United, see if you can earn PQPs by flying on United or its partners instead. That way, you'll get something for your hard-earned money.

If you're unable to take a flight, try earning PQPs by spending on eligible United credit cards. The type of United credit card you have determines how much you'll need to spend to get a PQP boost and the number of PQPs you'll earn.

» Learn more: Which United credit card should you get?

United's PQF and PQP requirements

| MileagePlus Premier level | Status requirements |

|---|---|

| Premier Silver | 15 PQF and 5,000 PQP, or 6,000 PQP. |

| Premier Gold | 30 PQF and 10,000 PQP, or 12,000 PQP. |

| Premier Platinum | 45 PQF and 15,000 PQP, or 18,000 PQP. |

| Premier 1K | 60 PQF and 22,000 PQP, or 28,000 PQP. |

You can qualify for each Premier status level through Jan. 31, 2026, based on your activity between Jan. 1 and Dec. 31, 2024. In addition to meeting these requirements, you will need to fly a minimum of four segments on United or United Express to qualify for status.

(Featured photo courtesy of United Airlines)

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2026:

- Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

- No annual fee: Wells Fargo Autograph® Card

- Flat-rate travel rewards: Capital One Venture Rewards Credit Card

- Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

- Luxury perks: American Express Platinum Card®

- Business travelers: Ink Business Preferred® Credit Card

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

Limited Time Only: Earn $1,000 Toward Travel!

Capital One Venture Rewards Credit Card

Travel

For a limited time, the

Capital One Venture Rewards Credit Card is offering new cardholders an especially rich bonus: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel!

More like this

Related articles