The Guide to JetBlue TrueBlue

If you fly with JetBlue often, understanding the airline's TrueBlue loyalty program can be rewarding.

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

JetBlue TrueBlue is the frequent flyer program for JetBlue Airways, a smaller U.S. airline that has a strong presence in the Northeast, Florida and the Caribbean.

The airline has long been known for having affordable fares and highly rated in-flight entertainment, including free high-speed Wi-Fi. It's even added transatlantic routes to popular European destinations. Customers can earn TrueBlue points when they fly with the airline and its partners, which can then be redeemed for more flights with no blackout dates.

Plus, JetBlue points never expire — making it worthwhile for even infrequent flyers to join TrueBlue. (To start earning points, sign up for a free account here.)

How much are JetBlue TrueBlue points worth?

Based on our most recent analysis, NerdWallet values JetBlue TrueBlue points at 1.4 cents apiece. To determine the value of these points, we compared cash prices and reward redemptions for economy round-trip routes across several destinations and dates.

We divided the cost of the cash ticket by the cost of the reward ticket to determine a “cent per mile” value for each flight, then averaged this value across several flights and dates. Read more about how we arrived at these figures.

We consider this a baseline value for JetBlue points, based on real-world data collected from hundreds of economy routes — not a maximized value. In other words, aim for award redemptions that offer 1.4 cents or more in value from your JetBlue points.

You can use our cash vs. miles calculator to determine whether a specific redemption is worthwhile.

JetBlue does not have a published award chart. Instead, the points price usually correlates to the ticket’s cash price. That makes it harder to find JetBlue sweet spots, but that doesn't make it impossible, especially if you book a flight on one of JetBlue's partner airlines.

JetBlue TrueBlue points value over time

JetBlue TrueBlue points have increased in value since 2019, even after a slight decrease in 2020 and another in 2025.

JetBlue vs. competitors

JetBlue came in last place out of six airlines in NerdWallet’s most recent analysis of the best airlines.

It did much better in a separate analysis that looked at which airline offered the best loyalty program to its customers, with TrueBlue coming in at second place.

Here's a closer look at how JetBlue competed across subcategories:

- Second in rewards rate.

- Tied for second-to-last in operations.

- Last place in terms of lowest fees.

Get the 'Cheat Codes' to Cheaper Travel

Unlocking the secret to saving a ton on travel is easier than you think. 📤 Our free newsletter shows you how in 5 min. or less.

How to earn JetBlue TrueBlue points

JetBlue TrueBlue points never expire, and it's free to join the loyalty program. Once you're in, there are several ways to earn TrueBlue points, from flying with JetBlue and its partners to spending on its credit cards.

Earning TrueBlue points when you fly

Earning on JetBlue: The number of points you earn for JetBlue flights depends on four factors.

- The cost of the ticket. You earn JetBlue points based on your ticket's fare, not the distance flown.

- The type of ticket purchased. You earn 3 points per dollar spent on JetBlue fares, unless you booked a Blue Basic fare. Those earn 1 point per dollar.

- Where you booked your ticket. When you book your ticket directly from JetBlue, you'll earn a bonus that doubles the amount of points earned depending on your ticket type.

- Whether you have Mosaic elite status. Mosaic 1s and 2s earn an extra 3 points per dollar. Mosaic 3s earn 4 points per dollar, and Mosaic 4s earn 5 points per dollar.

| Fare class | Points earned | Free checked bags | Fare features |

|---|---|---|---|

| Blue Basic | 1 base point plus 1 bonus point per dollar spent. | 0. |

|

| Blue | 3 base points plus 3 bonus points per dollar spent. | 0 (or 1 when travel includes Europe). |

|

| Blue Plus | 3 base points plus 3 bonus points per dollar spent. | 1. |

|

| Blue Extra | 3 base points plus 3 bonus points per dollar spent. | 0 (or 1 when travel includes Europe). |

|

| Mint | 3 base points plus 3 bonus points per dollar spent. | 2. |

|

You can also earn points when you book JetBlue Vacations packages, which allow you to bundle flights with hotels, cruises, rental cars and transfers. You'll earn 6 TrueBlue points per dollar spent on airfare (9 points for Mosaics), and 1 point per dollar spent on non-airfare travel.

There are no blackout dates on flights operated by JetBlue, so you can use points for any seat at any time. If you don't have enough points, you can opt to pay with a combination of cash and points. TrueBlue members can also pool JetBlue points with family and friends.

Earning on other airlines: JetBlue is not a part of an airline alliance, but it has partnerships with other airlines, including United Airlines, Icelandair and Etihad. In general, the number of points you earn with partners is based on distance flown. (That doesn't apply to United flights, which earn 5 points per dollar spent on eligible fares via the airlines' Blue Sky partnership.)

JetBlue's partner airlines

- Cape Air.

- Condor.

- Etihad Airways.

- Icelandair.

- Japan Airlines (ending March 31, 2026).

- JSX.

- Qatar Airways.

- Singapore Airlines.

- South African Airways.

- United Airlines.

Earning TrueBlue points with a credit card

JetBlue offers several co-branded credit card options from Barclays, which can be a good option if you fly often with the airline. These cards offer an additional bonus of 3 or 6 points per dollar spent on JetBlue purchases, further boosting the total amount of JetBlue points you can earn.

How the cards compare

Annual fee

- $0

- $99

- $499

Sign-up bonus

Earn 10,000 bonus points after spending $1,000 on purchases in the first 90 days.

Earn 60,000 bonus points after spending $1,000 on purchases and paying the annual fee in full, both within the first 90 days, with the JetBlue Plus Card.

Earn 80,000 bonus points and 5 tiles after spending $5,000 on purchases in the first 90 days.

Ongoing rewards

- 3 points on JetBlue purchases.

- 2 points at restaurants and grocery stores.

- 1 point elsewhere.

- 6 points on JetBlue purchases.

- 2 points at restaurants and grocery stores.

- 1 point elsewhere.

- 6 points on JetBlue and TrueBlue Travel purchases, including JetBlue Vacations.

- 2 points at restaurants and grocery stores.

- 1 point elsewhere.

Other travel perks

50% in-flight savings on cocktails and food purchases.

- 50% in-flight savings on cocktails and food purchases.

- First checked bag free for you and up to three companions on the same reservation.

- $100 annual statement credit after you buy a JetBlue Vacations package worth $100 or more.

- 5,000-point bonus each account anniversary.

- 10% point bonus when you redeem points and travel on a JetBlue award flight.

All of the perks of the JetBlue Plus Card, and:

- Priority boarding for cardholders, authorized users and up to four eligible travel companions.

- Up to $300 in statement credits on TrueBlue Travel purchases per year; terms apply.

- $120 statement credit for TSA PreCheck or Global Entry every four years.

- Access to Priority Pass and JetBlue airport lounges.

Still not sure?

However, they're not the only options for racking up JetBlue points. In fact, other credit cards that earn transferable points can be a better option, since they tend to have more lucrative spending category bonuses. The programs that transfer to JetBlue TrueBlue at a 1:1 basis (meaning you get 1 TrueBlue point for 1 point transferred) are Chase Ultimate Rewards®, Citi ThankYou points and Wells Fargo points.

Credit cards for JetBlue points

Annual fee

- $95

- $95

Earning rates

Still not sure?

American Express Membership Rewards and Capital One miles also transfer to TrueBlue but at a worse ratio, meaning you're getting less value out of your points.

Earning TrueBlue points through partners

JetBlue has several partnerships with retailers, hotels and other merchants, allowing you to earn additional TrueBlue points. These can be a great opportunity to earn more points, especially if they're places you already shop at.

- Hotels: Earn up to 2 TrueBlue points per $1 spent on qualifying stays at most IHG properties. Earn 1 TrueBlue point per $1 spent on qualifying stays at YOTEL properties when booked through YOTEL's JetBlue booking page, JetBlue Vacations or TrueBlue Travel.

- TrueBlue Dining: Register a credit card with the airline's dining program and earn 3 points per dollar spent when you opt into TrueBlue Dining emails and use that card at participating outlets.

- TrueBlue Shopping: Earn bonus points for every dollar you spend at participating merchants when you click through from the TrueBlue shopping portal or activate card-linked offers.

- Car rentals: Earn at least 100 points per day (or 200 if you're a Mosaic member) and access special rates at Budget and Avis.

Search for partners and get details about earning here.

Purchasing additional TrueBlue points

You can buy TrueBlue points through the website, but they are expensive. If you buy 1,000 points, which NerdWallet values at $14, you will pay $37.63 — so you are paying nearly triple what they are worth.

Buying points can be good in a pinch if you’re just shy of the amount required for an award and need to top off your TrueBlue account. But in general, it’s not a good idea to purchase points.

How to redeem JetBlue TrueBlue points

One of the best ways to redeem JetBlue TrueBlue points is by booking flights with JetBlue or its partner airlines.

» Learn more: Plan your next redemption with our airline points tool

When searching for flights at JetBlue.com, toggle to see the fare displayed in either dollars or points.

JetBlue also has a “Best Fare Finder” tool, which helps you compare prices for different days in an easy-to-see calendar view. The calendar shows the lowest fares for an entire month, and you can view multiple months at once.

What if you don't have enough JetBlue TrueBlue points to book a flight?

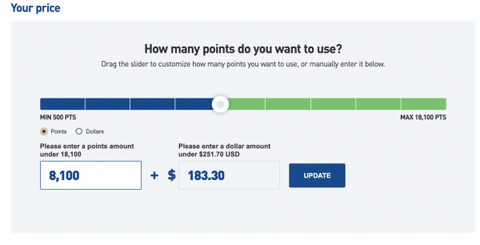

JetBlue allows you to book a flight using its Cash + Points option. To use this feature, search for a flight as usual and select “TrueBlue points” as your payment option. Upon selecting your flight, a scale will appear with a slider that you can drag to select how many points versus how much cash you want to spend.

More often than not, booking with Cash + Points ends up costing slightly more in overall value than it would had you purchased entirely in points or entirely in cash, but the difference is usually minor. If you don’t have enough TrueBlue points to cover the cost of your full itinerary — but you also don't like sitting on a small pile of points — then paying with the combo of points and miles is generally a smart idea.

JetBlue elite status

JetBlue's Mosaic elite status program uses a simple naming convention for its four loyalty tiers: Mosaic 1, Mosaic 2, Mosaic 3 and Mosaic 4.

When you enroll for your free TrueBlue account, you start off as a basic member. From there, you start earning "tiles," the metric JetBlue uses to track progress toward JetBlue Mosaic elite status. Generally, you'll earn 1 tile per eligible $100 spent on travel booked through JetBlue (including JetBlue Vacations and TrueBlue Travel) and 1 tile per $1,000 spent on JetBlue credit cards.

Parents traveling with children aged 12 and under can also earn tiles for their children's flight activity. Typically, airlines only allow you to earn elite status based on your own travel, so this will be a unique offering.

Here’s a breakdown of the four elite status tiers, how many tiles you need to reach each level and some of the best perks of each level.

| Tiles needed to earn | Spending needed to earn that many tiles | Top benefits (higher Mosaic tiers include all of the benefits of lower tiers) | |

|---|---|---|---|

| Mosaic 1 | 50. | $5,000 on JetBlue travel. |

|

| Mosaic 2 | 100. | $10,000 on JetBlue travel. |

|

| Mosaic 3 | 150. | $15,000 on JetBlue travel. |

|

| Mosaic 4 | 250. | $25,000 on JetBlue travel. |

|

Your Mosaic status is determined by the number of tiles you earn in a calendar year. Once you earn status, that status is valid for the remainder of the year in which you earned it, the entire following year and the January after. For example, if you earned Mosaic 3 on Nov. 1, 2025, your status would be valid through Jan. 31, 2027.

JetBlue also offers additional perks when you hit certain thresholds for tiles earned. For example, when you reach 10, 20, 30 and 40 tiles, you'll be able to select (and accumulate) one of the following perks:

Perks for TrueBlue members

- Group B early boarding.

- Priority security.

- One free alcoholic drink per flight.

- Earn double points on a JetBlue Vacations package (one-time use).

- 5,000 TrueBlue points.

Each time you reach a new Mosaic level, you'll be able to select a benefit from JetBlue's Mosaic Perks You Pick menu:

Perks You Pick for Mosaic members

- IHG One Rewards Platinum Elite status.

- FoundsCard Blue membership.

- Pet fee waiver (normally $125 per flight).

- $99 one-time statement credit on select JetBlue credit cards.

- 20 tile bonus for yourself or another TrueBlue member.

- 15,000 TrueBlue points.

- Priority access to Mint Suite selection on select aircraft (excluding Mint Studio).

What it’s like flying on JetBlue

The JetBlue fare classes are (in order from finest to most basic) are:

- Mint.

- Blue Plus.

JetBlue stands out for its in-flight experience, with all seats including free live TV and movies displayed on seatback screens at every seat. You can also expect free Wi-Fi and free in-flight messaging across all devices.

If you’re hungry, you’re welcome to enjoy free brand-name snacks and drinks. Complimentary drinks include Pepsi products and Dunkin' coffee, and snacks come from name brands that can vary, but have included Cheez-Its and PopCorners. Snacks also mesh well with vegan, gluten-free and nut-free diets with offerings like plantain chips, vegan butter pretzels and oat flour cookies.

On select flights, the snacks are offered "serve yourself" style through a compartment on the aircraft called the “Pantry.”

Even if you book a basic economy fare, you can still upgrade a la carte to get a bit more legroom by purchasing an EvenMore seat, which comes with free alcohol and a premium snack on eligible flights. If you have Mosaic status, you might be able to snag an EvenMore seat for free as part of your elite perks (unless you're flying in basic economy).

As you splurge on the better seats, the benefits get sweeter.

Mint, which is JetBlue’s business class product, offers the longest fully lie-flat seat (6'8") on a domestic premium flight. Other benefits of Mint include a dedicated Mint check-in queue and priority boarding.

Some aircraft offer the new front-row Mint Studio, which boasts the largest TV on a U.S. airline. JetBlue dubs this your own “apart-mint.”

JetBlue bag fees

JetBlue passengers can bring a personal item and a carry-on onboard at no cost, even if they booked a Blue Basic fare.

Fees for checked luggage on JetBlue vary depending on the fare you select, but they typically start at $35 for the first bag.

If you need to change or cancel a JetBlue flight

Refundable JetBlue tickets are always fully refundable.

For nonrefundable tickets, there’s still good news: JetBlue does not charge change and cancellation fees on Blue, Blue Extra, Blue Plus and Mint fares. Blue Basic fares incur a fee for changes or cancellations ($100 for routes in North America, Central America and the Caribbean; $200 for all other routes). Full details about what you get (or don't get) with JetBlue's fare classes are available on JetBlue's "Our Fares" page.

(Top photo courtesy of JetBlue)

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2026:

- Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

- No annual fee: Wells Fargo Autograph® Card

- Flat-rate travel rewards: Capital One Venture Rewards Credit Card

- Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

- Luxury perks: American Express Platinum Card®

- Business travelers: Ink Business Preferred® Credit Card

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

Limited Time Only: Earn $1,000 Toward Travel!

Capital One Venture Rewards Credit Card

Travel

For a limited time, the

Capital One Venture Rewards Credit Card is offering new cardholders an especially rich bonus: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel!

More like this

Related articles