Accor Live Limitless: 7 Things to Know About the Loyalty Program

Accor's loyalty program includes brands like Fairmont, Banyan Tree, Sofitel and Ibis.

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

The loyalty program of Accor Hotels is called Accor Live Limitless. Accor counts more than 40 brands within its portfolio, including luxury names like Banyan Tree, Fairmont and Raffles and midscale and economy brands like Novotel, Sofitel and Ibis.

Members earn points during eligible Accor stays that can be redeemed for a rebate on future stays. As you go up in tier, you’re also entitled to additional benefits like late check-out, welcome drinks and upgrades.

Here are seven things to know about the ALL program.

» Learn more: The best hotel credit cards right now

1. What is Accor Live Limitless?

As the loyalty program for Accor, this program works differently than many other hotel loyalty programs.

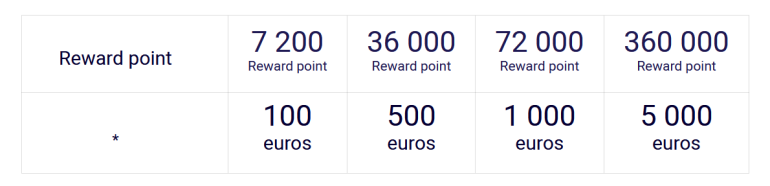

Instead of awarding points that can be redeemed later at a flat rate for free stays, it gives members a flat rebate based on the number of points they have. Every 2,000 points earned can be redeemed for hotel stays at a value of about 40 euros ($40-$44 depending on the exchange rate).

While this is easy to understand (no award charts to follow), it erases some of the outsized value you can score by redeeming points at luxury hotels. Instead, it is simply a flat rebate program.

The maximum value comes from those with top elite status since they earn more points per dollar/euro spent than a general member would.

» Learn more: New Accor Live Limitless hotels to check out

Get the 'Cheat Codes' to Cheaper Travel

Unlocking the secret to saving a ton on travel is easier than you think. 📤 Our free newsletter shows you how in 5 min. or less.

2. Is Accor Live Limitless free?

Yes, membership is free. The more you stay, the higher the elite status tier you can earn. There are five membership tiers starting with Classic membership (free when joining) and going up to Diamond, the highest tier.

Silver and Gold status come after staying 10 nights or earning 2,000 status points and 30 nights or 7,000 status points, respectively.

Earn Platinum status after staying 60 nights or earning 14,000 status points during the calendar year.

Diamond status is only available based on spending. Essentially, you can catapult your way to top status by spending a lot instead of staying many nights.

You’ll need to earn at least 26,000 status points or about 10,400 euros ($10,400-$10,440 depending on the exchange rate) in a calendar year on stays or services.

Unfortunately, these brands do not count toward elite status:

- Adagio.

- Adagio Access.

- Art Series.

- Breakfree.

- Greet.

- ibis.

- ibis Styles.

- JO&JOE.

- Mama Shelter.

- Mantra.

- Peppers.

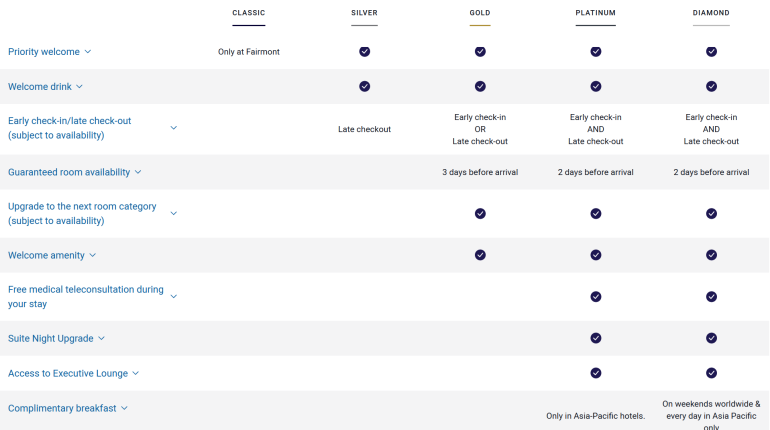

3. What benefits come with elite status?

Like other hotel elite programs, top-tier elite status members receive premium Wi-Fi. Other elite members receive certain perks at different brands.

For example, MGallery elite status guests (of any tier except classic) benefit from turndown service, and those at Fairmont can borrow BMW bikes without charge.

But tier-specific perks grow with status, including access to club lounges like Club Millésime at Sofitel properties, welcome amenities, early check-in and late checkout.

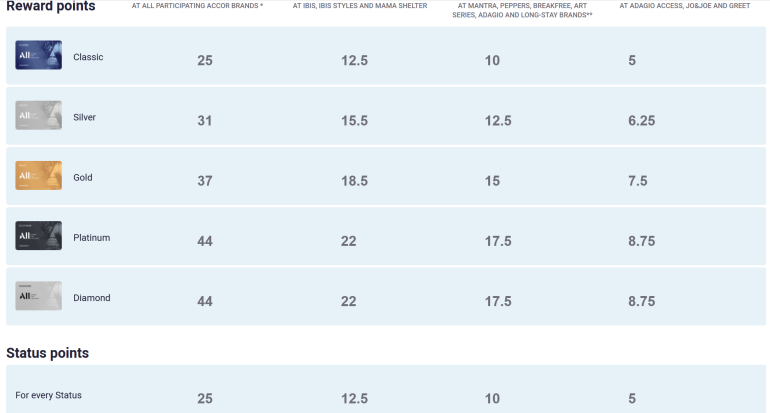

4. How many points do you earn?

The number of points you earn varies by brand and elite status tier.

For example, Classic members earn at least 5 points for every 10 euros spent. On the other end of the scale, Platinum and Diamond members can earn as many as 44 points for every 10 euros spent at certain brands.

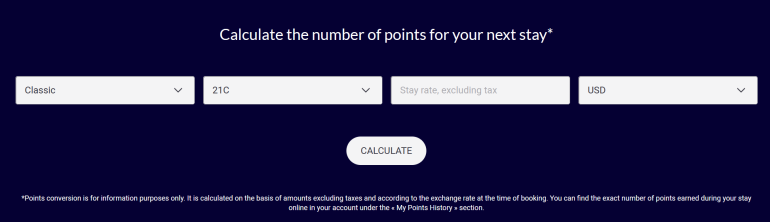

If you’re unclear on how many points you’ll earn at a particular brand, there is a nifty online calculator that can help you determine the amount. Members can also earn points for hotel spending like food and beverage purchases, even when not staying there.

When flying Air France or KLM, ALL members earn one Accor point for every 2 euros spent on either airline.

The reverse is also true: Flying Blue members (who have loyalty with Air France or KLM) earn one mile for every euro spent with Accor. ALL Members can also earn one Accor point for every $2 spent on eligible Qatar Airways flights or one Avios for every euro spent with Accor.

Accor also has a shopping portal that awards points for purchases at eligible online stores. Other travel partners include car rental brands like Avis, Hertz or Sixt, among others.

5. Can you transfer miles and points to ALL?

Yes. Capital One miles transfer to Accor’s loyalty program at a 2-to-1 ratio. This can be helpful if you’re short on points for a reward, but you can often secure greater value when using them for other redemptions.

ALL also has several airline partners, all of which are international. These include the following transfer ratios:

- Aegean Miles + Bonus: 2,000 miles = 500 Accor points.

- Flying Blue - Air France KLM: 4,000 miles = 1,000 Accor points.

- Azul TudoAzul: 10,000 TudoAzul points = 1,000 Accor points.

- Finnair Plus: 3,500 Finnair Plus points = 500 Accor points.

- Hainan Airlines - Fortune Wings Club: 2,500 Fortune Wings points = 500 Accor points.

- LATAM Pass: 5,000 LATAM Pass points = 2,000 Accor points.

- LATAM Pass Brazil: 5,680 LATAM Pass Brazil points = 1,000 Accor points.

- Qatar Airways Privilege Club: 4,500 Avios = 1,000 Accor points

- Japan Airlines: 5,000 JAL miles = 1,000 Accor points; 10,000 miles = 4,000 Accor points.

» Learn more: Credit card points programs and who they partner with

6. Where else can you redeem points?

If you’re interested in more than hotel stays, ALL offers plenty of other redemption opportunities. Here is where you can use your points:

Home rentals via Onefinestay

Accor points can be transferred to vouchers to use at Onefinestay’s homes and villas. Members can also earn Accor points for the cash portion of a stay at a rate of one point per euro spent.

Airlines

ALL members can transfer their points with 29 airline mileage programs. While this may not represent the best value for points, it can make sense if you are short of miles for an upcoming reservation. This includes airlines like Air Canada, Aeromexico, Avianca, British Airways and Delta. Among the best transfer options are:

- Delta: Convert 4,000 Accor points to 2,000 Delta SkyMiles.

- Iberia: Convert 3,000 Accor points to 3,000 Iberia Avios.

- Qantas: Convert 2,000 Accor points to 2,000 Qantas points.

- United: Convert 2,000 Accor points to 1,000 United MileagePlus miles.

- Virgin Australia: Convert 4,000 Accor points to 4,000 Velocity points.

Rental cars and train rides

Members can exchange their Accor points for loyalty points in Europcar’s car rental programs or in train programs like those with Die Bahn and Eurostar.

These may not represent the best value but provide another option.

Limitless Experiences

Accor has launched its own experiences and adventures platform known as Limitless Experiences. Members can use their points to redeem for these special activities that are not always easy to procure on your own.

Among the options have been attending an underwater ballet in Hawaii, a symphony performance in a Mexican cenote and high-end dining and cooking experiences with notable chefs and restaurants.

Others include tickets to popular music concerts and sporting events.

Dining

Members can redeem their points at participating Accor hotel restaurants listed via Accor’s map. Click on the area that shows restaurants where you can earn and redeem points.

7. Do Accor Live Limitless points expire?

Yes, ALL points expire after 365 days of inactivity. To keep the account active, be sure to stay at an eligible Accor property to earn points.

Is Accor Live Limitless worth it?

No loyalty point is worth leaving behind. You never know when you may travel with that brand again or find a way to transfer it to another program.

You can benefit from status perks after frequent stays and earn and burn points creatively. You can even donate points to charity. So yes, ALL, like other programs, is worth joining when staying at Accor hotels.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2026:

- Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

- No annual fee: Wells Fargo Autograph® Card

- Flat-rate travel rewards: Capital One Venture Rewards Credit Card

- Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

- Luxury perks: American Express Platinum Card®

- Business travelers: Ink Business Preferred® Credit Card

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

Limited Time Only: Earn $1,000 Toward Travel!

Capital One Venture Rewards Credit Card

Travel

For a limited time, the

Capital One Venture Rewards Credit Card is offering new cardholders an especially rich bonus: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel!

More like this

Related articles